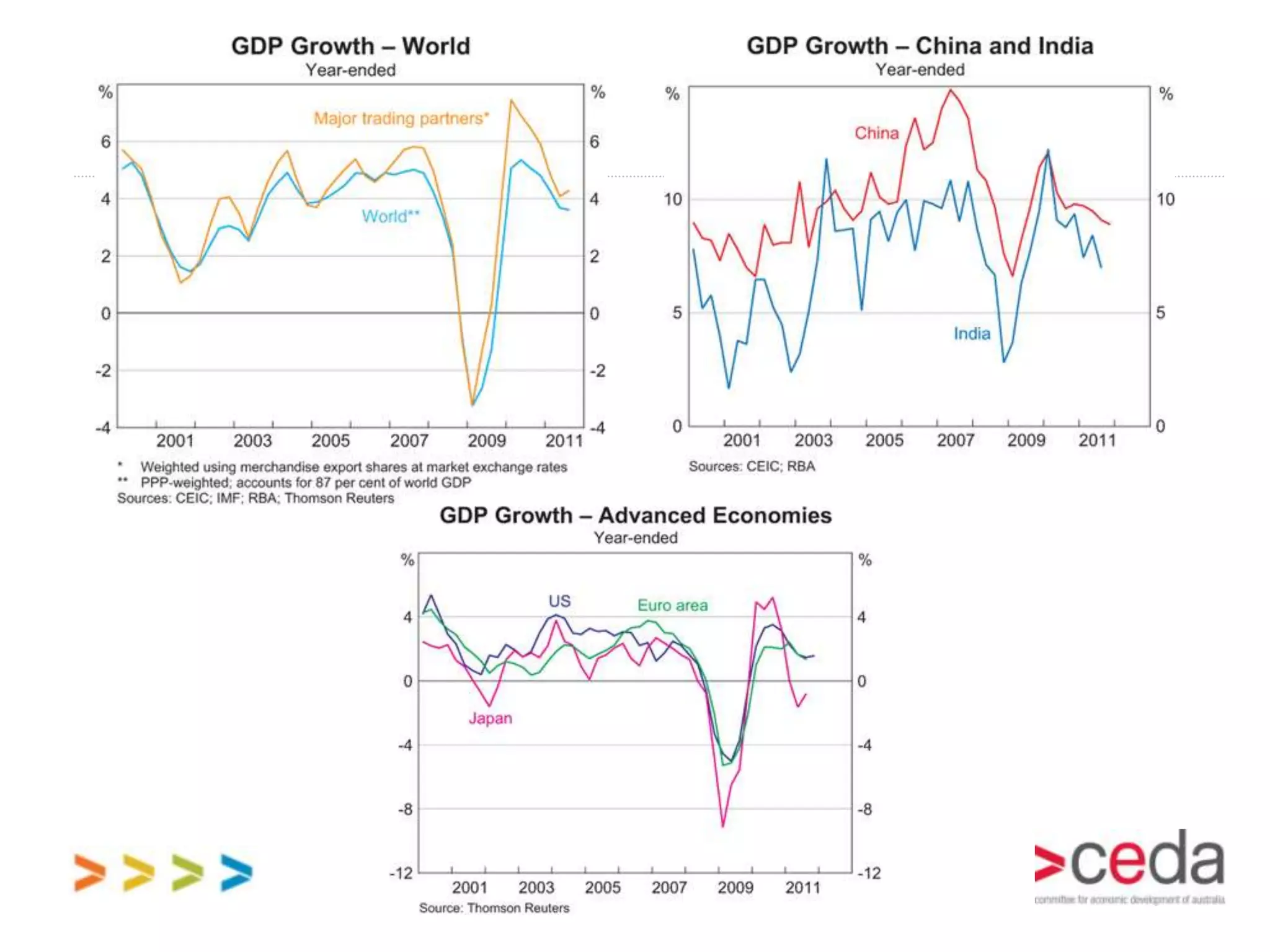

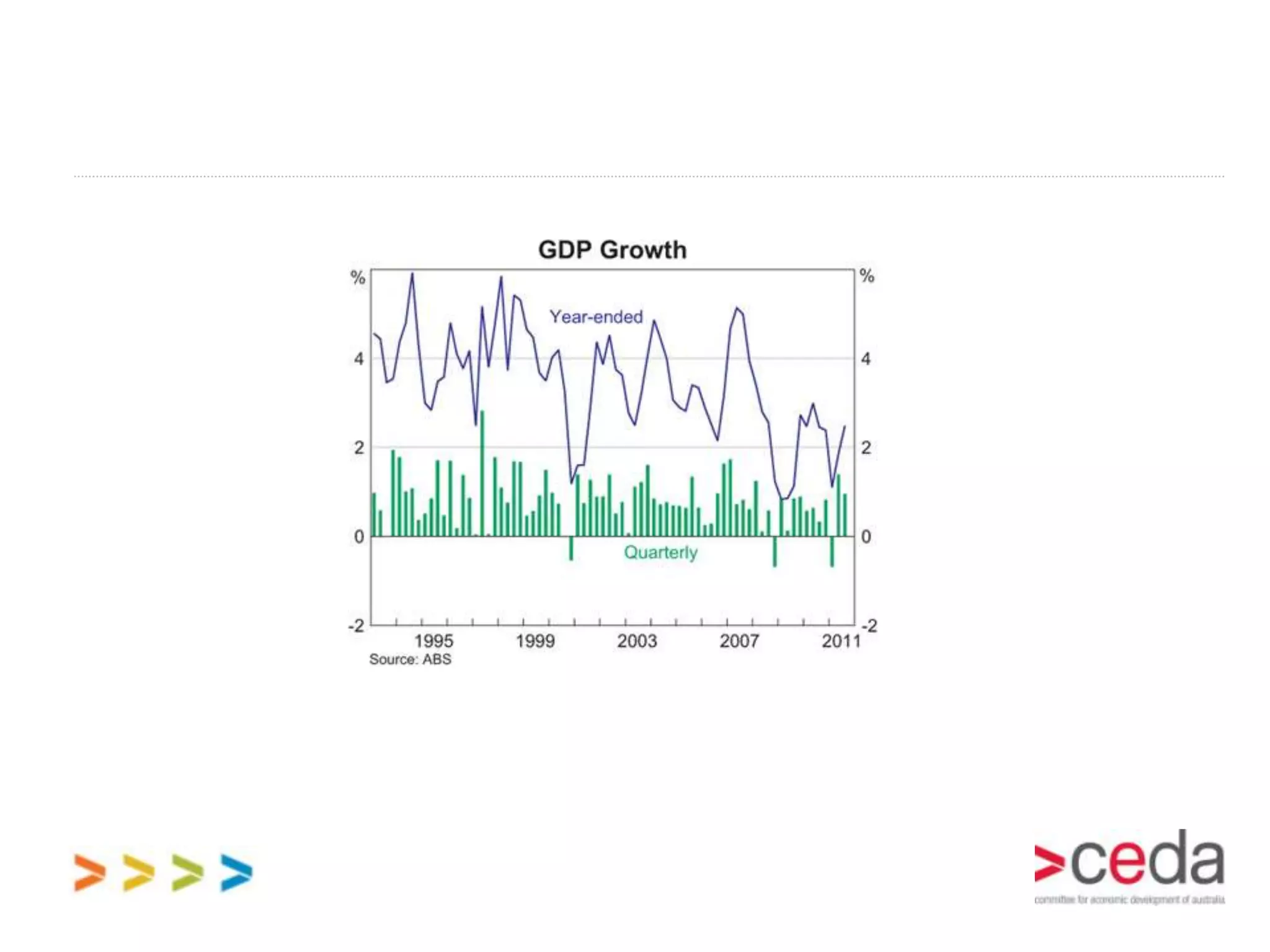

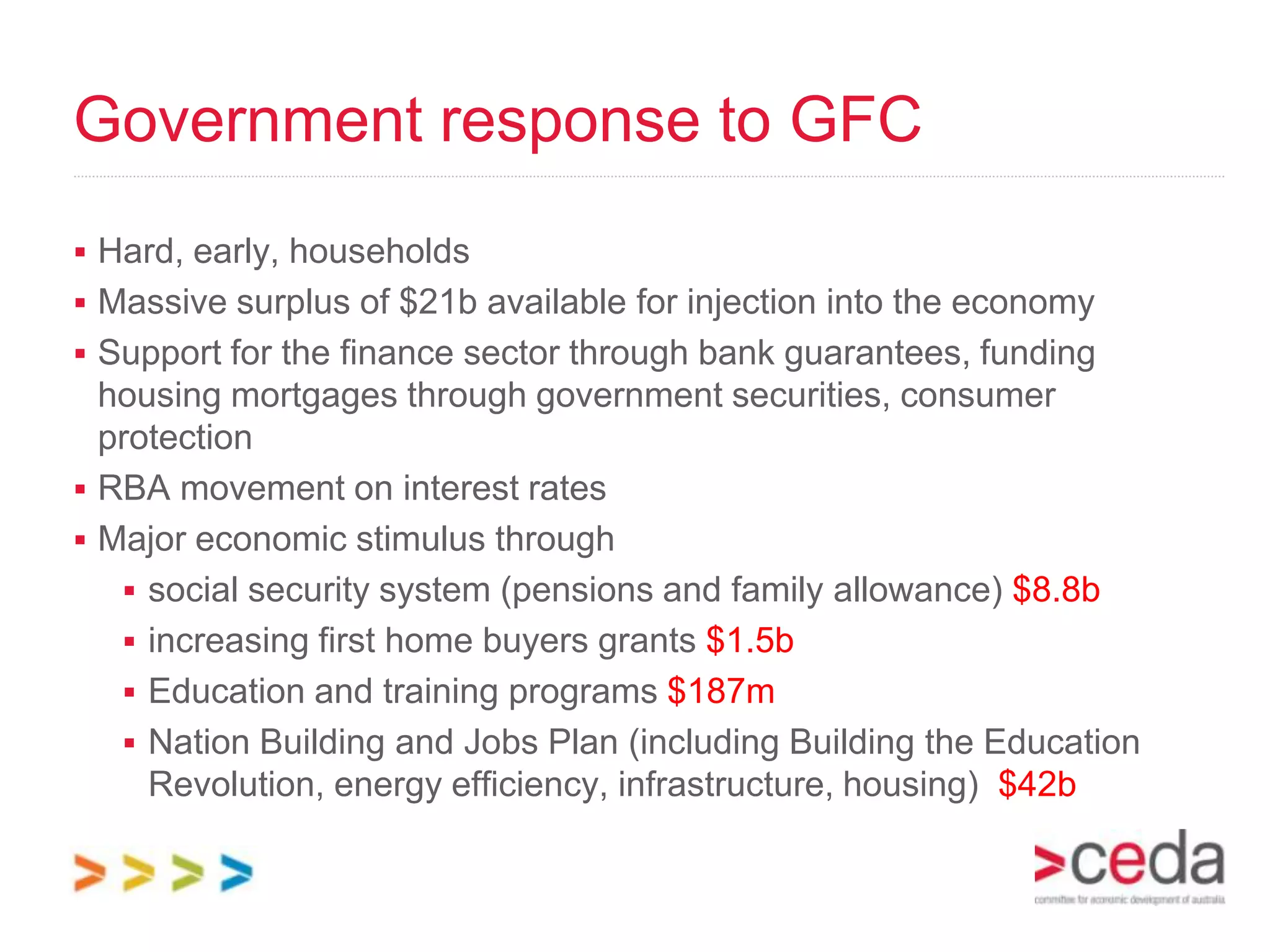

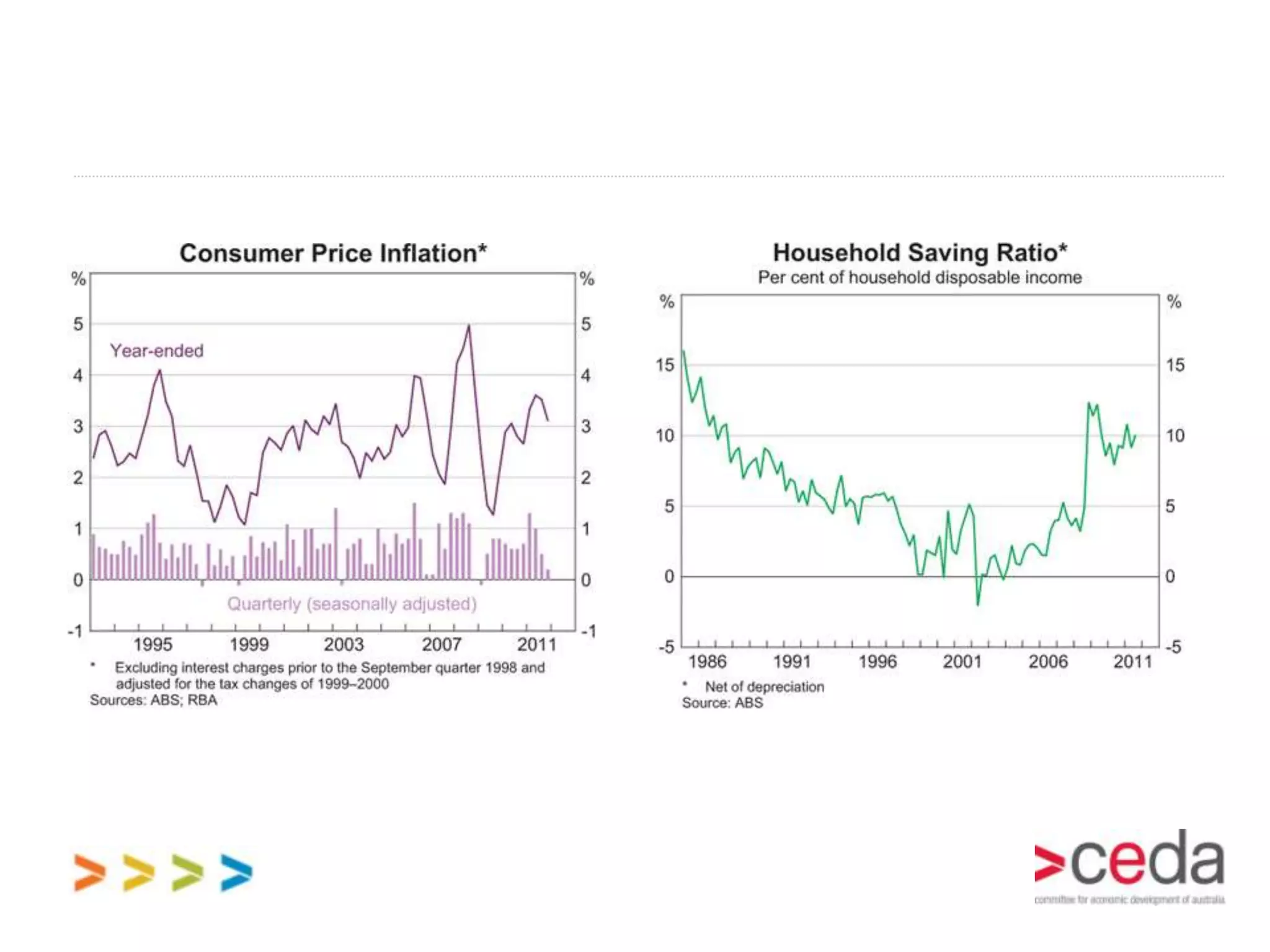

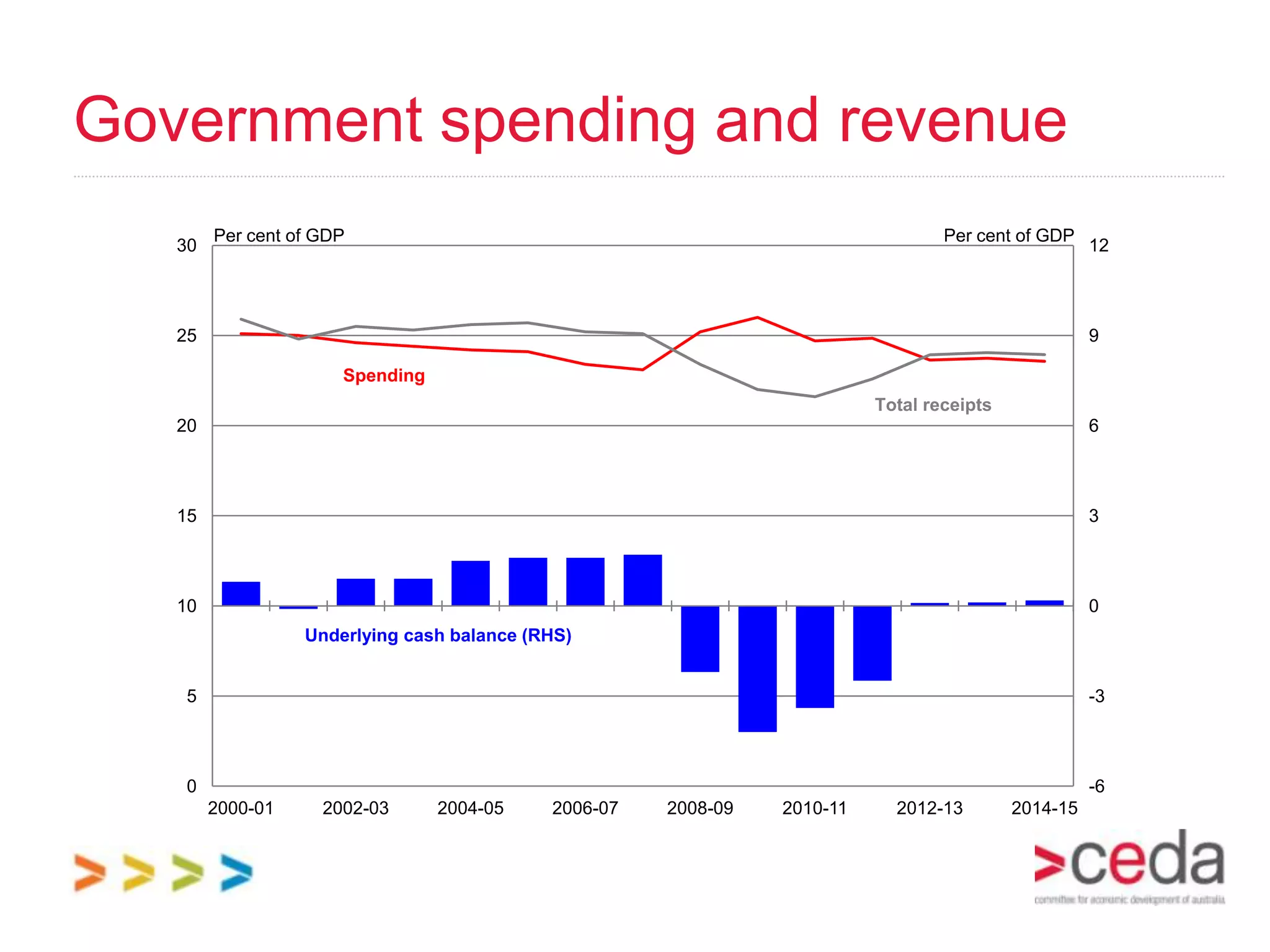

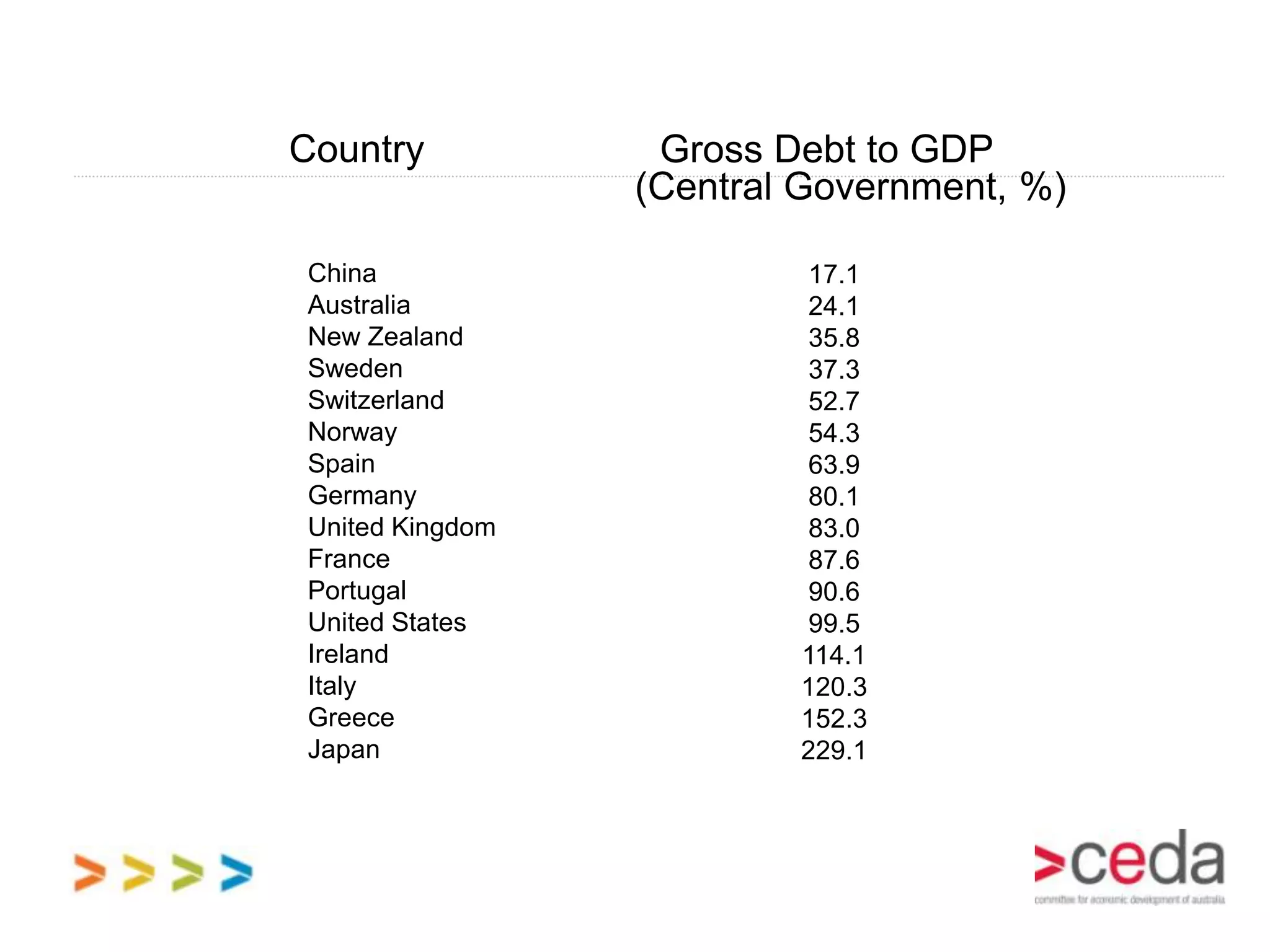

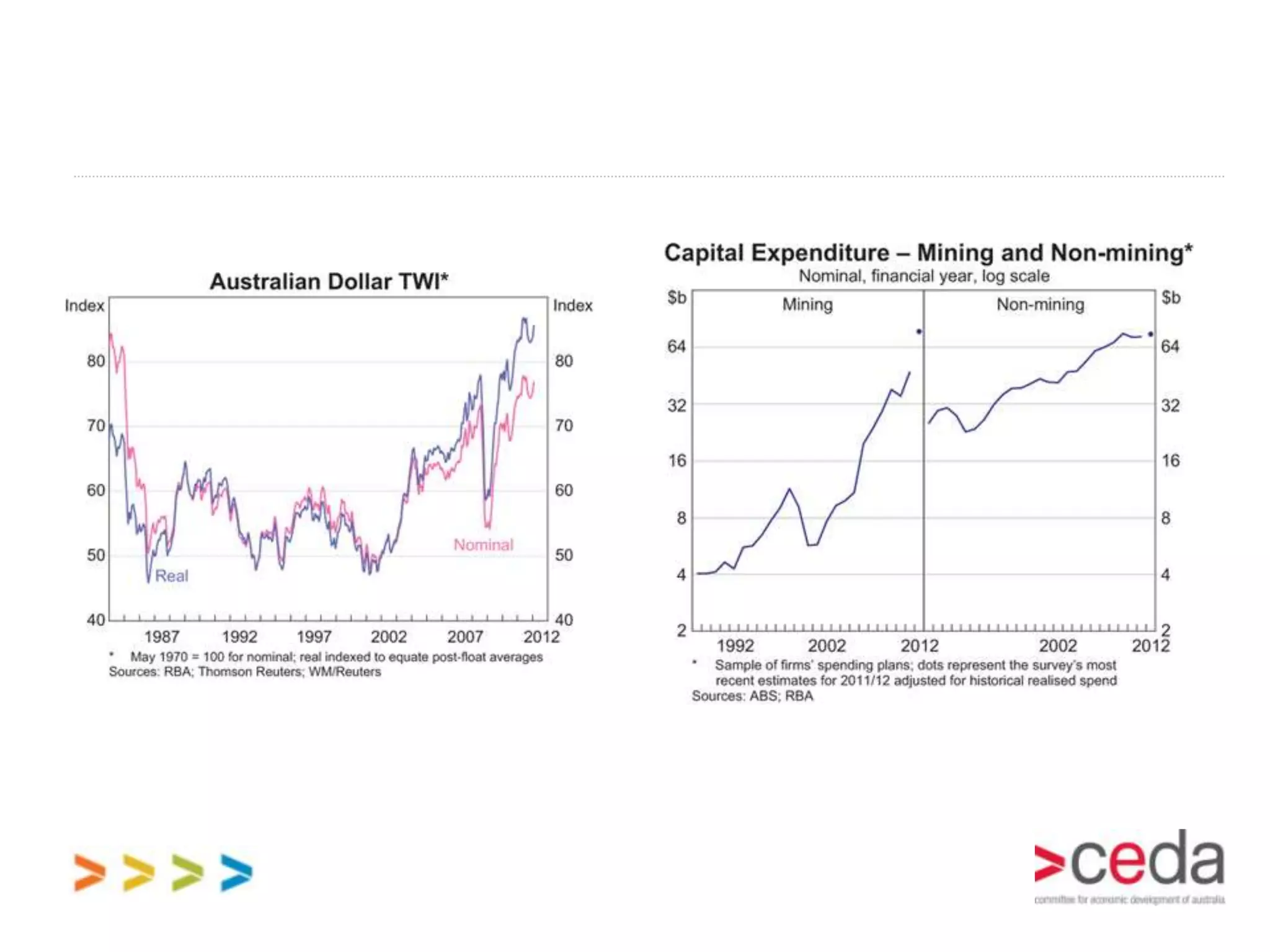

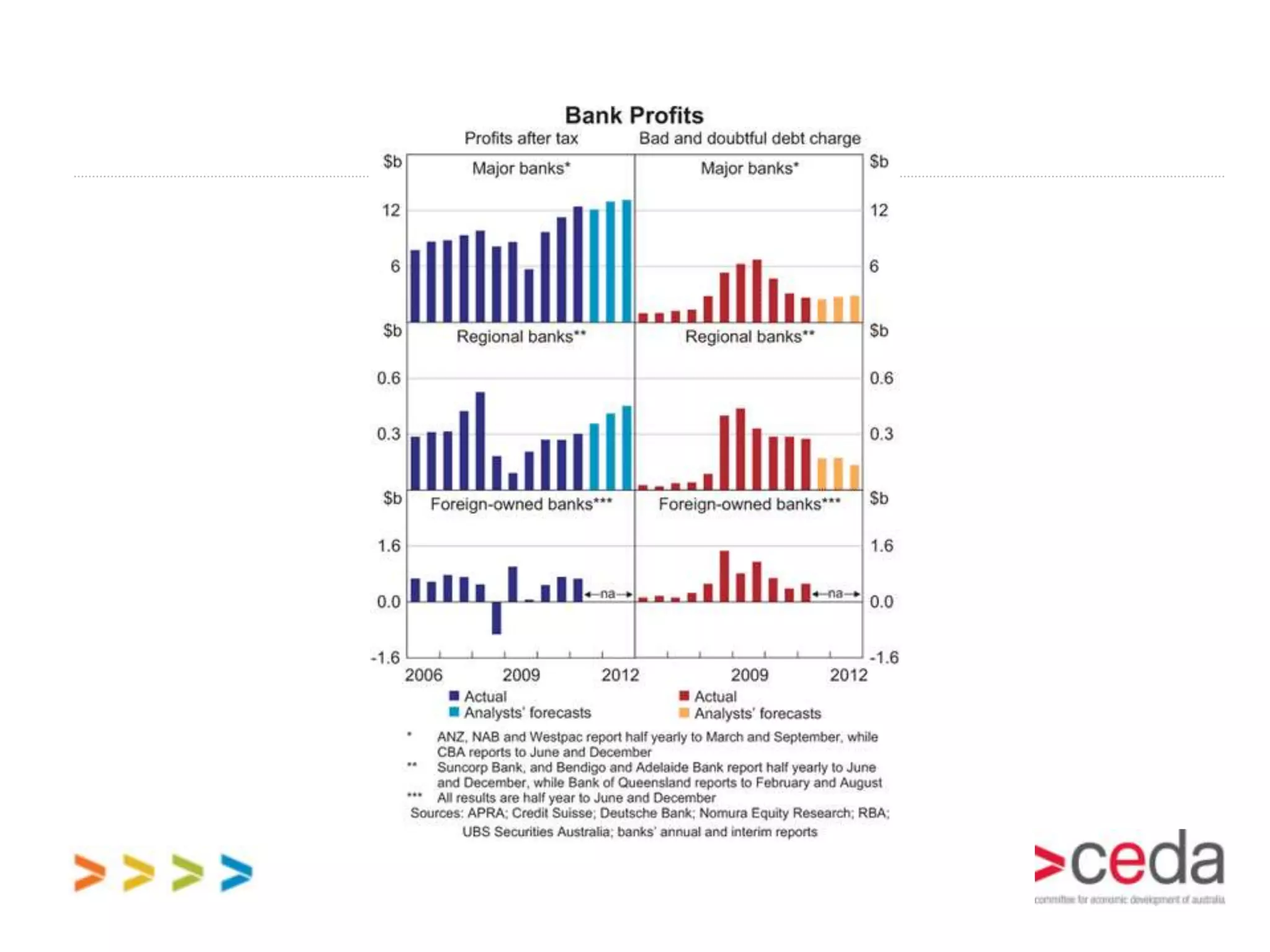

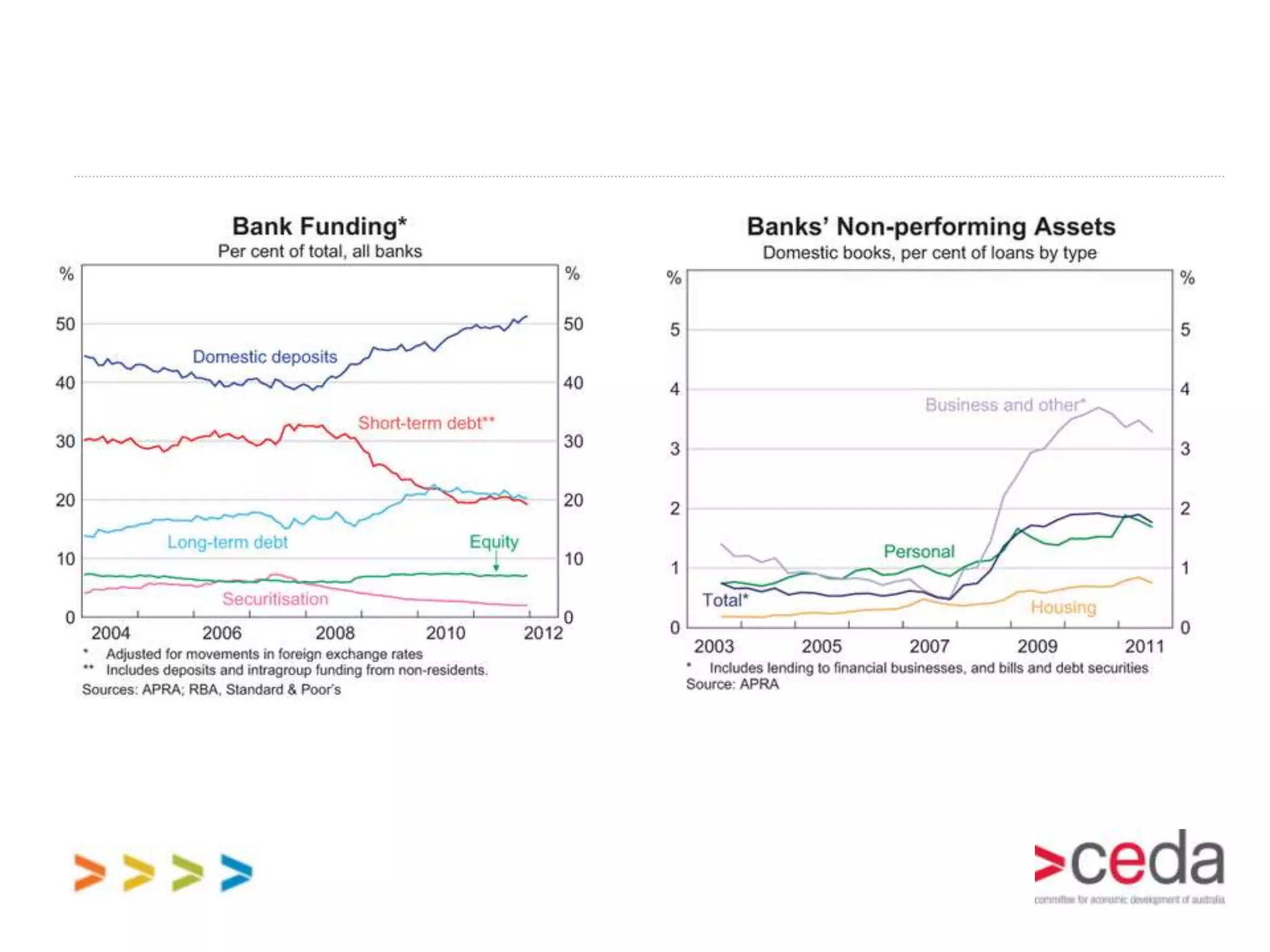

The document discusses the global financial crisis (GFC) and the European sovereign debt crisis, focusing on causes, impacts, and Australia's comparatively stable economic position. It highlights Australia's governmental responses, including stimulus measures and financial sector support, and outlines the lessons learned regarding fiscal policies and economic fundamentals. The document emphasizes the importance of regulatory oversight and the challenges posed by global economic interconnectivity.