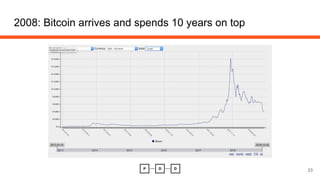

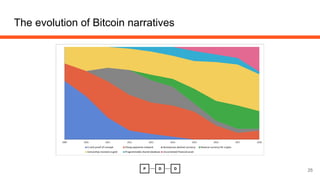

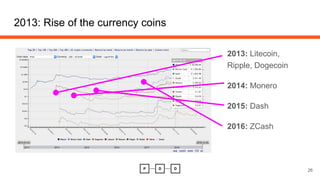

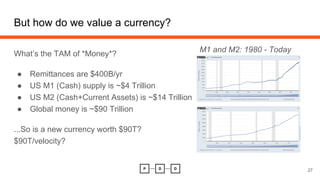

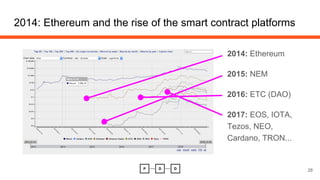

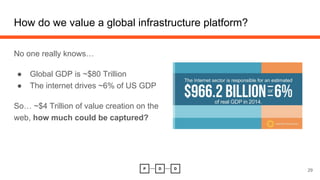

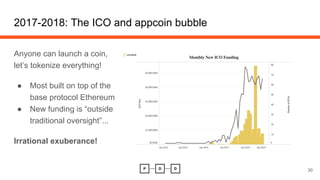

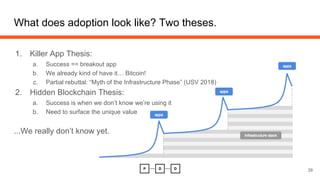

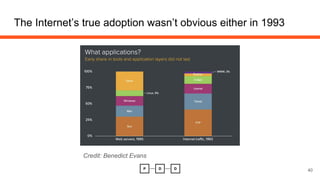

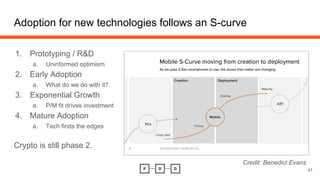

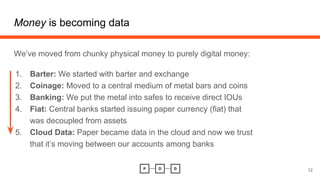

The document elaborates on the complexities and evolution of the blockchain ecosystem, highlighting various stages of public perception and technological adaptation from skepticism to acceptance. It outlines key trends such as the transition from physical to digital assets, the significance of data ownership, and the challenges of adoption for decentralized applications. Additionally, it discusses the historical context of blockchain narratives and future possibilities in areas like finance, web 3, and user control.

![For example: open/closed cycles

Early 1990s [CLOSED]: Private networks, gatekeeping… the AOL days

Late 1990s [OPEN]: We have a new distributed, decentralized, permissionless

network where anyone can build applications. The future is ours!

Late 2000s [CLOSED]: Gatekeepers and aggregators (Google, Facebook)

become the toll takers and smartphones created walled gardens (Apple store)

20?? [OPEN]: We AGAIN have a new distributed, decentralized, permissionless

network where anyone can create applications.

Credit: Benedict Evans for the verbiage 22](https://image.slidesharecdn.com/meetupdeconstructingtheblockchainecosystem20181205-181214174455/85/Start-here-Deconstructing-the-Blockchain-Ecosystem-22-320.jpg)