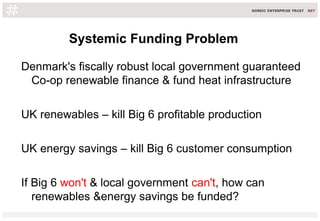

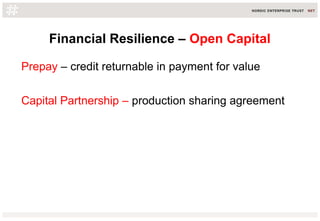

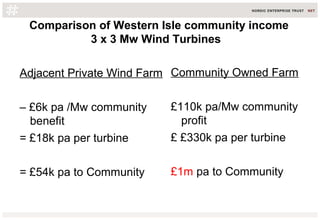

The document proposes a "Natural Grid" approach and "Open Capital" model to fund renewable energy and energy efficiency projects. It involves:

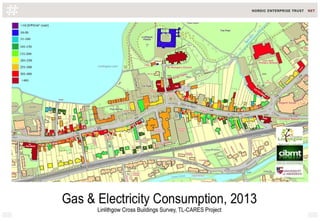

1) Applying a "Least Carbon Fuel Cost" principle to prioritize investments that minimize carbon inputs for a given energy output.

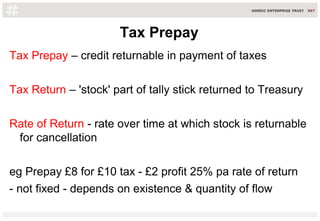

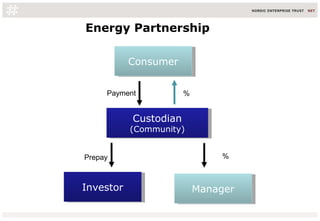

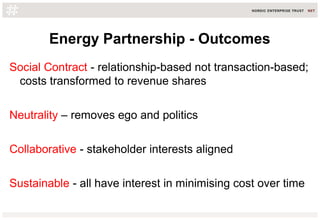

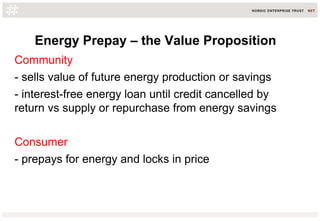

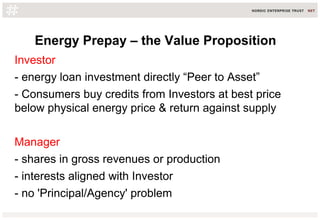

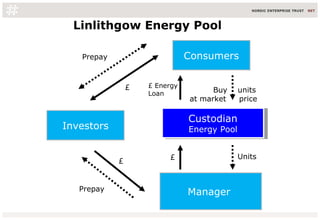

2) Creating an "Energy Partnership" where investors prepay for future energy production/savings, earning a return as energy credits are used to offset consumer bills.

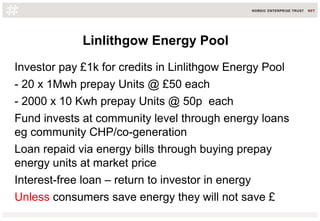

3) Establishing an "Energy Pool" where investors fund community-level energy loans that are repaid through residents buying prepaid energy units, creating an interest-free financing structure.