Responsibility accounting and transfer pricing

- 1. RESPONSIBILITY ACCOUNTING AND TRANSFER PRICING

- 2. Decentralization: A decentralized organization is one which decision making is not confined to a few top executives but are rather spread out throughout the organization. • In segment reporting, costs and revenue are assigned to segments to enable management to see where responsibility lies for control purposes and to measure the performance of segment managers.

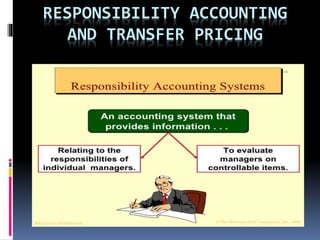

- 3. BASIC CONCEPTS: •Responsibility Center: Specific unit of an organization assigned to a manager who is held accountable for its operations and resources. Each manager’s performance is judged by how well he or she manages those items under his or her control. •Budgeting Program: Each manager is assigned responsibility for those items of revenues and costs in the budget that he or she is able to control. •Responsibility Accounting: Is the system that recognizes various decision centers throughout an organization and traces costs ( and revenues, assets, and liabilities where pertinent) by areas of responsibility. It is central to any effective profit planning and control system. Also known as: *Activity Accounting *Profitability Accounting

- 4. OBJECTIVE: • Set managerial targets and formulate strategies to attain the firm’s overall objectives. ADVANTAGES: • Facilitates delegation of decision making. • Helps management promote the concept of management by objective. • It aids in establishing standards of performance which are used in evaluating the efficiency and effectiveness of the different units in the organization. • It permits effective use of management by exception.

- 5. • Helps management promote the concept of management by objective. - A management model that aims to improve performance of an organization by clearly defining objectives that are agreed to by both management and employees. • It permits effective use of management by exception. - A practice where only significant deviations from a budget or plan are brought to the attention of management. The idea behind it is that management's attention will be focused only on those areas in need of.

- 6. PREREQUISITES TO THE INITIATION AND MAINTENANCE OF AN EFFECTIVE RESPONSIBILITY ACCOUNTING SYSTEM: 1. WELL DEFINED ORGANIZATION STRUCTURE: Requires that the spheres of jurisdiction which are set forth in the organization chart must be clearly established and understood and that a manager’s financial responsibilities are defined in advance. 2. WELL DEFINED AND ESTABLISHED STANDARDS OF PERFORMANCE IN REVENUES, COSTS, AND INVESTMENTS: Requires that an integrated plan for the control of operations which would provide for cost standards, expense, budget, sales forecasts, profit planning and programs for capital investment and financing as well as the necessary procedures to affectuate the plan should be established and maintained.

- 7. PREREQUISITES TO THE INITIATION AND MAINTENANCE OF AN EFFECTIVE RESPONSIBILITY ACCOUNTING SYSTEM: 3. SYSTEM OF ACCOUNTING THAT IDENTIFIES ANY REVENUES, EXPENSES AND ASSETS TO SPECIFIC UNITS IN THE ORGANIZATION. 4. SYSTEM THAT PROVIDES FOR THE PREPARATION OF REGULAR PERFORMANCE REPORTS: Requires that a system of preparing regular reports showing the planned results, actual results and the variances should be established.

- 8. RESPONSIBILTY CENTERS AND THEIR EVALUATION: TYPES: 1. COST CENTER: Manager is only responsible for controlling costs.

- 9. Pro-forma Responsibility Cost Report: Costs Actual Budget Variance (F/U) Direct costs Xx xx Xx Controllable Xx Xx Xx Total Xx Xx Xx Non controllable Xx Xx Xx Total Xx Xx Xx Indirect costs Xx Xx Xx Total Costs Pxx PXx Pxx

- 10. Formula guide/s: •Budgeted Cost per Unit: Total budgeted cost / Total no. of units produced •Actual Cost per unit: Total Actual cost / Total no. of units produced

- 11. RESPONSIBILTY CENTERS AND THEIR EVALUATION: TYPES: 2. PROFIT CENTER: The manager is only responsible for generating revenue.

- 12. Pro-forma Income Statement of a Profit Center: Actual Budget Variance Sales in units xx xx Xx Sales Revenues Pxx Pxx PXx Direct Variable Costs Cost of Goods Sold xx xx Xx Sales Commissions Xx xx xx Total Direct Variable costs xx xx xx Contribution Margin xx xx Xx Direct fixed costs Manufacturing Xx xx xx Selling and Administrative xx xx Xx Total Direct Fixed Costs Xx xx xx Segment Margin xx xx xx

- 13. Pro-forma costs by division that can be directly attributable to that division: A B C Total Revenue xx xx xx Xx Less: Direct costs xx xx xx Xx Contribution to indirect cost xx xx xx Xx Less: Allocated company costs xx xx xx Xx Net income (Loss) Pxx Pxx Pxx Pxx

- 14. RESPONSIBILTY CENTERS AND THEIR EVALUATION: TYPES: 3. INVESTMENT CENTER: Manager is responsible for generating revenues and controlling costs.

- 15. OBJECTIVE OF AN INVESTMENT CENTER OR BUSINESS UNIT: A. Motivate managers to exert a high level of effort to achieve the goals of the firm. B. Provide right incentive for managers to make decisions that are consistent with the goals of top management. C. Determine fairly the rewards earned by managers for their effort and skills.

- 16. Return on Investment Formula: •Net operating income / Average Operating Assets •(Net operating income / Sales) x (Sales / Average operating asset) •Operating profit margin x Asset turnover or return on Sales Notes: *Net operating income (EBIT) is generally used because it’s consistent with the base to which it is applied and that is operating assets. *Operating assets include cash, A/R, inventory, net PPE, and all other assets held for productive use in the organization. Land held for future use as an investment in another company or factory building rented to someone else are not included. *ROI can be improved by either increasing sales, by reducing expenses or by reducing assets.

- 17. Advantages of ROI: 1. Easily understood and has gained wide usage. 2. Comparable to interest rates of returns of alternative investments. Limitation of ROI: 1. Subject to some criticisms such as: a.) Tends to emphasize short-run performance rather than long-run profitability. b.) ROI may not be fully controllable by the division manager due to the presence of committed costs. 2. It results to disincentive for high ROI units to invest in projects with ROI greater than the minimum rate of return but less than unit’s current ROI. Other criteria/s used to evaluate performance: 1. Growth in market share 2. Increase in productivity 3. Product innovation 4. Peso profit 5. Receivable and inventory turnover 6. Ability to venture into new and profitable areas.

- 18. Other approaches to measure performance in an investment center: •Residual income: The net operating income that an investment center is able to earn above some minimum return on operating assets. •Economic Value Added (EVA): A business unit’s income after taxes and after deducting the cost of capital. The cost of capital is usually obtained by calculating a weighted average of the cost of the firm’s two sources of funds: *Borrowing and Selling Stocks

- 19. RESPONSIBILTY CENTERS AND THEIR EVALUATION: TYPES: 4. REVENUE CENTER: Manager is responsible for the center’s invested capital.

- 20. 3 TYPES OF VARIANCES AND THEIR FORMULA/S USEFUL TO REVENUE CENTERS: •Sales Price Variance: Shows how much difference between the actual and budgeted contribution margin is caused by the difference between actual and budgeted sales prices. =(Actual sales price – Master budget sales price) x Actual unit sales •Sales Volume Variance: Measures the difference between actual unit sales and budgeted unit sales. =(Actual unit sales – Master budget unit sales) x Master budget average contribution per margin • Sales Mix Variance: Measure of the change in contribution margin caused by selling products in proportion (mix) different from those that were budgeted. =(Flexible budget average contribution margin per unit – Master budget average contribution margin per unit) x Actual unit sales

- 21. TRANSFER PRICING: Rationale: The problem revolve around the question of what transfer price to charge between the segments. •Transfer Price: It is the value assigned to goods and services transferred between segments within the company. THE NEED FOR TRANSFER PRICE: -Corporate managers should set transfer pricing policies ensuring that divisions don’t purchase outside when internal facilities to be idle is detrimental to the overall company. A. Excellent tool for motivating division managers B. Excellent tool for establishing and maintaining cost control systems and measuring internal performance.

- 22. ALTERNATIVE TRANSFER PRICING SCHEMES: 1. Minimum Transfer Price: =(Differential costs per unit) + (Lost contribution margin per unit on outside sales) •Represents lower limit since the selling division must receive at least the amount shown by the formula in order to be as well of as if it’s sold only to outside customers. •If the selling division has sufficient idle capacity to met the demand of another division without cutting into its sales of its regular customers, then it does not have any opportunity costs.

- 23. ALTERNATIVE TRANSFER PRICING SCHEMES: 2. Market-based Transfer Price: •Designed for situations in which there is an outside market for the transferred product or service. •If the selling division has no idle capacity, the market price in the outside market is the perfect choice for the transfer price. •As a general rule, this policy should contain the ff: 1. Buying division must purchase internally so long as the selling division meets all the bona fide outside prices and want to sell internally. 2. The selling division must be free to reject internal business if it prefers to sell outside. 3. If the selling division does not meet all bona fide outside prices, then the buying division id fee to purchase outside. 4. As independent and impartial body must be established to settle disagreements between divisions over transfer prices.

- 24. ALTERNATIVE TRANSFER PRICING SCHEMES: 3. Cost-based Transfer Price a. Variable Cost Transfer Price: Transfer price is based only on variable or differential costs. b. Full Cost Transfer Price: Full costs includes actual manufacturing costs (variable and fixed) plus potions of marketing and administrative costs. c. Alternative Cost Measures: i. Full absorption cost-based transfer price: Used because of the difficulty in determining the opportunity cost to the company making internal transfer. ii. Cost-Plus transfer: Used based on either variable costs or full absorption cost.

- 25. ALTERNATIVE TRANSFER PRICING SCHEMES: 4. Negotiated Transfer Price: Managers are permitted to negotiate the price for internally transferred goods or services. •A negotiated price is an attempt to stimulate an arm’s length transaction between supplying and buying segment. •The major advantage of this is that they preserve the autonomy of the division manager. However, negotiation may be very time consuming and require frequent re- examination and revision of prices. As a result, it may distort segment financial statement and mislead top management in its attempt to evaluate performance and make decisions.

- 26. DISTRESS PRICES: When a firm chooses to mark down the price of an item or service instead of discontinuing the product or service altogether. A distress price usually comes about in tough market conditions when the sale of a particular product or service has slowed down dramatically and the company is unable to sell enough of it to cover the fixed costs associated with doing business.

- 27. TRANSFER PRICE FOR SERVICES: The department performing the services to a second department generates revenues from such activity. The same transfer is the second department’s purchase of services. Ff. Steps to be followed: 1. Identify the different departments contributing various services. 2. Evaluate the corresponding skills and experience of personnel involved in delivering services. 3. Estimate the cost involved in providing the services. 4. Adopt one or any of the principles applied to transfer of products discussed.

- 28. MULTINATIONAL TRANSFER PRICING: Used worldwide to control flow of goods and services between segments of corporation. OBJECTIVES: Minimizing taxes, duties, and tariffs, foreign exchange risks along with enhancing a company’s competitive position and improving its relation with foreign government.