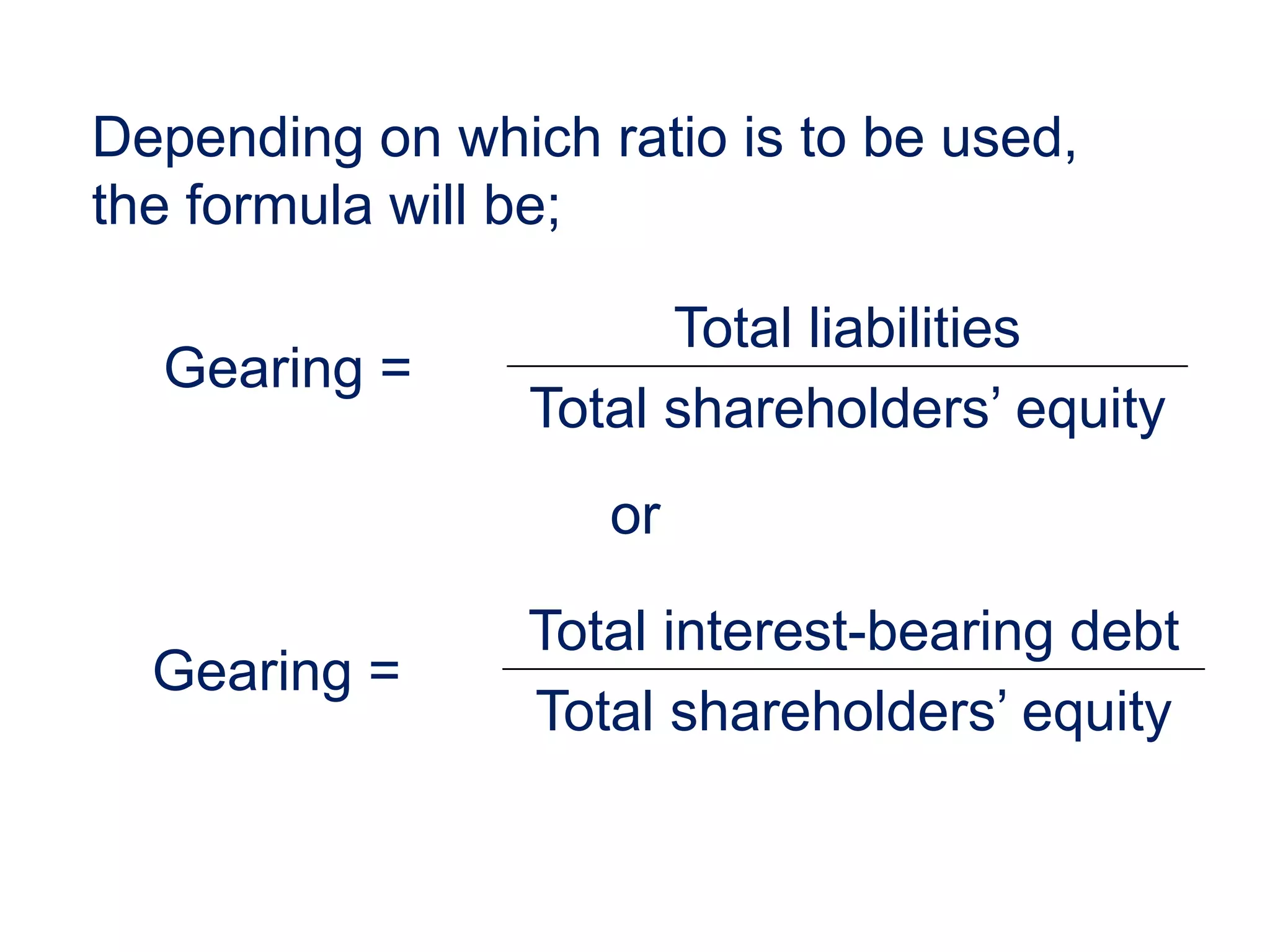

The document explains the concept of gearing ratio, which measures a business's reliance on debt versus equity for funding its assets. It discusses various definitions of debt used by lenders for calculating this ratio, their implications on risk assessment, and the importance of understanding the nature of the debt (long-term vs. short-term). Additionally, it highlights that the optimal gearing ratio varies by industry and provides guidance on interpreting these ratios and considering preference shares and shareholder loans in calculations.