JPM Prime Brokerage Global Hedge Fund Trends March 2013

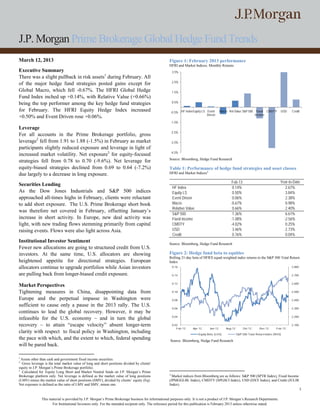

- 1. J.P. Morgan Prime Brokerage Global Hedge Fund Trends March 12, 2013 Figure 1: February 2013 performance HFRI and Market Indices. Monthly Returns Executive Summary 3.5% There was a slight pullback in risk assets1 during February. All 2.5% of the major hedge fund strategies posted gains except for Global Macro, which fell -0.67%. The HFRI Global Hedge 1.5% Fund Index inched up +0.14%, with Relative Value (+0.66%) being the top performer among the key hedge fund strategies 0.5% for February. The HFRI Equity Hedge Index increased -0.5% HF Index Equity LS Event Macro Rel Value S&P 500 Fixed CMDTY USD Credit Driven Income +0.50% and Event Driven rose +0.06%. -1.5% Leverage -2.5% For all accounts in the Prime Brokerage portfolio, gross leverage2 fell from 1.91 to 1.88 (-1.5%) in February as market -3.5% participants slightly reduced exposure and leverage in light of -4.5% increased market volatility. Net exposure3 for equity-focused Source: Bloomberg, Hedge Fund Research strategies fell from 0.78 to 0.70 (-9.6%). Net leverage for equity-biased strategies declined from 0.69 to 0.64 (-7.2%) Table 1: Performance of hedge fund strategies and asset classes due largely to a decrease in long exposure. HFRI and Market Indices4 Feb-13 Year-to-Date Securities Lending HF Index 0.14% 2.67% As the Dow Jones Industrials and S&P 500 indices Equity LS 0.50% 3.84% approached all-times highs in February, clients were reluctant Event Driven 0.06% 2.38% to add short exposure. The U.S. Prime Brokerage short book Macro -0.67% 0.98% Relative Value 0.66% 2.40% was therefore net covered in February, offsetting January’s S&P 500 1.36% 6.61% increase in short activity. In Europe, new deal activity was Fixed Income -1.08% -2.56% light, with new trading flows stemming primarily from capital CMDTY -4.02% 0.25% raising events. Flows were also light across Asia. USD 3.46% 2.73% Credit 0.76% 0.04% Institutional Investor Sentiment Source: Bloomberg, Hedge Fund Research Fewer new allocations are going to structured credit from U.S. investors. At the same time, U.S. allocators are showing Figure 2: Hedge fund beta to equities Rolling 21-day beta of HFRX equal-weighted index returns to the S&P 500 Total Return heightened appetite for directional strategies. European Index allocators continue to upgrade portfolios while Asian investors 0.16 2,800 are pulling back from longer-biased credit exposure. 0.14 2,700 0.12 2,600 Market Perspectives Tightening measures in China, disappointing data from 0.10 2,500 Europe and the perpetual impasse in Washington were 0.08 2,400 sufficient to cause only a pause in the 2013 rally. The U.S. 0.06 2,300 continues to lead the global recovery. However, it may be 0.04 2,200 infeasible for the U.S. economy – and in turn the global recovery – to attain “escape velocity” absent longer-term 0.02 2,100 Feb-12 Apr-12 Jun-12 Aug-12 Oct-12 Dec-12 Feb-13 clarity with respect to fiscal policy in Washington, including Equity Beta (LHS) S&P 500 Total Return Index (RHS) the pace with which, and the extent to which, federal spending Source: Bloomberg, Hedge Fund Research will be pared back. 1 Assets other than cash and government fixed income securities. 2 Gross leverage is the total market value of long and short positions divided by clients' equity in J.P. Morgan’s Prime Brokerage portfolio. 3 Calculated for Equity Long Short and Market Neutral funds on J.P. Morgan’s Prime 4 Brokerage platform only. Net leverage is defined as the market value of long positions Market indices from Bloomberg are as follows: S&P 500 (SPTR Index), Fixed Income (LMV) minus the market value of short positions (SMV), divided by clients’ equity (Eq). (JPMGGLBL Index), CMDTY (SPGSCI Index), USD (DXY Index), and Credit (JULIR Net exposure is defined as the ratio of LMV and SMV, minus one. Index). 1 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 2. Prime Brokerage Global Hedge Fund Trends – Performance, Leverage, and Risk Exposures This section presents a summary of the changes that we have observed in leverage and sector exposures across the range of hedge funds that we work with. The confidentiality of our clients’ positions is important to us and as such this information has been aggregated and displayed in an anonymous manner in an effort to mitigate the risk of revealing or alluding to any one fund’s exposures. Information may be excluded due to the perceived risk of revealing sensitive information. The information discussed is specific to activities on J.P. Morgan’s books, and may not represent total client activity. These numbers should only be viewed as representative observations. Market Overview Equity Hedge There was a slight pullback in risk assets during February. Equity Hedge strategies returned +0.50% in February Although the S&P 500 Index increased +1.1%,5 the MSCI according to the HFRI Equity Hedge Index. Overall, AC World Index declined -0.2%. European markets exerted a defensives led other sectors. The MSCI World Consumer drag, with the Euro Stoxx Index down -6.2%. Emerging Staples Index was up +2.4% in February compared to +0.5% markets equities also underperformed, with the MSCI EM for the MSCI World Consumer Discretionary Index and a Index falling -1.3% through month-end. Year to date, decline of -2.9% for the MSCI Market Materials Index. however, equities continue to rally. The S&P 500 is up Market neutral managers benefitted from small cap and pair +6.46% and the Russell 2000 has risen +7.70%. Additionally, trading strategies while fundamental growth strategies the S&P 500 / 10-Year Treasury return differential stands at capitalized on gains in the U.S. Small Cap, Cyclical and +6.54%. Alongside February’s slight pullback in risk assets, Financial sectors. the HFRI Global Hedge Fund Index inched up +0.14%. All of the major hedge fund strategies posted gains except for Event Driven Macro, which reversed two consecutive months of positive The HFRI Event Driven Index was largely flat in February, performance. inching up +0.06% month-over-month amidst robust strategic, financial and distressed M&A activity. LBO On the macro economic front, inconclusive election results in activity was particularly strong in February, accounting for Italy captured news headlines but the impact was primarily $51 billion out of $200 billion in total M&A globally localized, as demonstrated by declining yields on Spanish according to J.P. Morgan Global Asset Allocation. February and Portugese debt (though Italian yields rose). The Yen thus marked the strongest month for LBO activity since July continued to weaken in February pursuant to “Abenomics,” 2007, when volumes reached $55 billion (See Figure 3). further bolstering Japanese equities. Year to date, the Nikkei February’s heightened LBO activity was spurred by low remains one of the world’s strongest markets, having surged yields, record levels of cash on corporate balance sheets and +11.65%. High expectations surrounding new leadership for robust demand for high yield loans, as evidenced, for the Bank of Japan have helped drive yields on 10-year JGBs example, by record new issuance of loans and high yield to a decade-long nadir. bonds in February (See Figure 4). Relative Value Figure 3: LBO transactions as a percentage of total M&A Relative Value was the best performer among the major 40% hedge fund strategies in February, with the HFRI Relative Value Index increasing +0.66%. Multi-strategy relative value 35% managers profited from active commodity spread trading. 30% Gains among multi-strategy fixed income arbitrage and 25% convertible arbitrage strategies also contributed to February’s positive returns. Multi-strategy fixed income arbitrage 20% managers benefitted from global credit exposures as the 15% HFRI Relative Value Multi-Strategy Index rose +1.49%. 10% Convertible arbitrage funds with directional exposures to Asia Pacific convertible securities performed well, with the 5% HFRI Fixed Income-Convertible Arbitrage Index up +0.45% 0% month-over-month. Jan-00 Apr-02 Jul-04 Oct-06 Jan-09 Apr-11 Source: J.P. Morgan Global Asset Allocation 5 References are to SPX Index vs. SPTR Index as in Table 1. 2 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 3. Prime Brokerage Global Hedge Fund Trends – Performance, Leverage, and Risk Exposures Figure 4: Loan and HY bond new issuance ($ billions) USD. Several factors underpinned this trend, including a 140 Institutional loans further decline in the Yen (-0.9%) due to anticipated easing High‐yield bonds measures by the Bank of Japan, Moody’s UK downgrade, 120 and renewed pressure on the Euro (-3.8%) as a result of 100 113 disappointing fourth quarter GDP. 80 60 38 34 52 32 44 27 50 19 24 30 33 40 7 14 22 26 14 18 16 10 6 20 46 40 42 13 47 43 48 33 34 27 8 24 32 31 31 30 22 20 17 8 6 10 26 22 19 13 23 0 1 7 10 4 May‐… May‐… Mar‐… Mar‐… Nov‐… Nov‐… Jul‐11 Oct‐11 Jul‐12 Oct‐12 Jan‐11 Dec‐11 Jan‐12 Dec‐12 Jan‐13 Apr‐11 Apr‐12 Feb‐11 Aug‐11 Feb‐12 Aug‐12 Feb‐13 Jun‐11 Sep‐11 Jun‐12 Sep‐12 Source: J.P. Morgan High Yield and Leveraged Loan Research While the HFRI Event Driven Index was more or less flat in February, managers with exposures to active target companies in pending mergers have benefitted from robust year to date corporate activity (See Figure 5). If conditions such as low interest rates and high levels of cash on corporate balance sheets persist, the auspicious M&A climate is likely to continue, especially as companies seek to grow through acquisition rather than organically. Merger arbitrage managers should in turn benefit, assuming that completion rates follow the same trajectory. Figure 5: S&P Long-Only Merger Arbitrage Index year to date performance 1910 1900 1890 1880 1870 1860 1850 1840 2-Jan 9-Jan 16-Jan 23-Jan 30-Jan 6-Feb 13-Feb 20-Feb 27-Feb S&P Long-Only Merger Arbitrage Index Source: Bloomberg Global Macro Global Macro strategies declined in February, blunting the gains of the prior two months. The HFRI Macro Index fell – 0.67% as negative performance among systematic CTAs (-1.11%)6 partially offset gains among currency and fixed income discretionary managers. Discretionary managers with long USD and short JPY exposures posted gains as most currencies sold off against the 6 HFRI Macro: Systematic Diversified Index, February 2013. 3 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 4. Prime Brokerage Global Hedge Fund Trends – Performance, Leverage, and Risk Exposures Leverage and Risk Exposures Figure 8: Z-score of gross leverage and the S&P 500 Index The Z-score measures how many standard deviations an observation is above or below the mean Gross Leverage Gross leverage and net exposure for clients in the Prime 1.3 Brokerage Portfolio were stable in the first half of February but trailed off towards month-end as market participants reduced exposure and leverage slightly because of increased market volatility. For all accounts in the Prime Brokerage 0.0 portfolio, gross leverage fell from 1.91 to 1.88 (-1.5%) (See Figure 6). By contrast, gross leverage of levered accounts in the Prime Brokerage portfolio increased from 2.50 to 2.59 (+3.8%) (See Figure 7). This dichotomy was a reversal from -1.3 the pattern in January. As fewer clients deployed leverage in Feb-11 Aug-11 Feb-12 Aug-12 Feb-13 February, gross leverage among levered accounts was Difference between gross leverage and S&P 500 Index Z-scores skewed higher since clients that retained debits did so at higher levels. Month-over-month, leverage in the Prime Source: Bloomberg, J.P. Morgan Prime Brokerage Brokerage portfolio was subdued relative to the gain in the Gross Leverage by Strategy S&P 500 (See Figure 8). Gross leverage rose for High Yield Fixed Income from 1.26 Figure 6: Daily gross leverage and the S&P 500 Index to 1.42 (+12.4%). Gross leverage for Market Neutral also increased in February from 4.26 to 4.47 (+4.9%). By 1,550 1.95 contrast, gross leverage fell for High Grade Fixed Income, 1,500 which declined from 2.41 to 2.06 (-14.3%). All strategies are 1.90 running leverage above their average 2-year levels except for 1,450 High Grade Fixed Income. 1,400 1.85 Figure 9: Gross leverage by strategy 1,350 1.80 5 1,300 4 1,250 1.75 Feb-12 Apr-12 Jun-12 Aug-12 Oct-12 Dec-12 Feb-13 S&P 500 Index (LHS) Gross Leverage (RHS) 3 Source: Bloomberg, J.P. Morgan Prime Brokerage 2 Figure 7: Gross leverage (levered accounts) 5-day moving average and the S&P 500 Index 1 1,550 2.7 1,500 0 Market Neutral Equity Long Multi-Strategy Convertible High Grade High Yield Short Arbitrage Fixed Income Fixed Income 1,450 2.6 Dec-12 Jan-13 Feb-13 1,400 Source: J.P. Morgan Prime Brokerage 1,350 2.5 1,300 1,250 2.4 Feb-12 Apr-12 Jun-12 Aug-12 Oct-12 Dec-12 Feb-13 S&P 500 Index (LHS) Gross Leverage (Levered Accounts - RHS) Source: Bloomberg, J.P. Morgan Prime Brokerage 4 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 5. Prime Brokerage Global Hedge Fund Trends – Performance, Leverage, and Risk Exposures Table 2: Gross leverage by strategy Table 3: Long and short exposures by sector Average and first quartile calculated for the period of February 2011 to February 2013 Long (Short) exposure by sector as a percentage of total client long (short) exposure in Prime Brokerage portfolio First Dec-12 Jan-13 Feb-13 Average % Change Quartile Long exposure Short exposure M arket Neutral 4.36 4.26 4.47 3.84 3.54 4.9% Feb-12 Jan-13 Feb-13 Feb-12 Jan-13 Feb-13 Equity Long Short 1.86 1.97 1.94 1.83 1.72 -1.0% M ulti-Strategy 1.76 1.77 1.79 1.77 1.74 1.2% Basic Materials 6.2% 5.6% 5.4% 4.2% 5.2% 4.8% Convertible Arbitrage 3.65 4.17 4.29 3.61 3.44 2.7% Communications 11.6% 13.5% 14.4% 6.5% 6.6% 7.2% High Grade Fixed Income 2.39 2.41 2.06 2.61 2.38 -14.3% Consumer, Cyclical 11.3% 11.0% 11.0% 8.5% 8.6% 7.9% High Yield Fixed Income 1.17 1.26 1.42 1.21 1.16 12.4% Consumer, Non- 14.2% 15.1% 14.9% 10.2% 11.8% 10.8% PB Portfolio (Levered Accounts) 2.54 2.50 2.59 2.53 2.48 3.8% cyclical Diversified 0.3% 0.3% 0.3% 0.0% 0.0% 0.0% Source: J.P. Morgan Prime Brokerage Energy 8.7% 8.6% 8.7% 7.5% 5.9% 6.2% Non sector-specific 3.3% 4.1% 4.2% 14.9% 16.0% 18.4% Net Exposure and Net Leverage ETF Net exposure for equity-biased funds fell from 0.78 to 0.70 (- Financial 20.4% 18.1% 17.9% 11.6% 11.8% 10.8% 9.6%) in February and net leverage declined from 0.69 to Industrial 6.3% 5.9% 5.8% 6.2% 6.7% 6.7% 0.64 (-7.2%). These decreases reflected the overall pullback Technology 5.2% 4.0% 4.1% 5.4% 7.1% 6.6% in February as managers reduced their net long exposure. Utilities 1.9% 1.3% 1.1% 1.9% 1.9% 1.9% Other 5.5% 6.3% 6.1% 9.2% 10.1% 11.8% Figure 10: Net exposure and net leverage Equity Long Short and Market Neutral funds on the Prime Brokerage platform only. Source: J.P. Morgan Prime Brokerage LMV: Market value of long positions. SMV: Market value of short positions. Eq: Equity in the clients’ accounts 1.3 1.0 0.7 0.4 Feb-11 Jun-11 Oct-11 Feb-12 Jun-12 Oct-12 Feb-13 Net Exposure (LMV/SMV)-1 Net Leverage (LMV-SMV)/Eq Source: J.P. Morgan Prime Brokerage Sector Exposures The most sizeable increase in the long Prime Brokerage portfolio month-over-month once again was in the Communications sector (+0.9%). The largest declines occurred in the Basic Materials, Consumer, Non-cyclical, Financial and Utilities sectors, each of which fell -0.2%. The largest increases in the Prime Brokerage short portfolio were in the Non sector-specific ETF (+2.4%) and Communications (+0.6%) sectors. (The increase in long and short exposure for the Communications sector was attributable largely to heightened M&A activity.) The most substantial decreases in short exposure occurred with respect to the Financial (-1.0%) and Consumer, Non-cyclical (-1.0%) sectors. 5 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 6. Prime Brokerage Global Hedge Fund Trends – Securities Lending U.S. Securities Lending Liberty Global agreed to acquire Virgin Media (VMED) in a stock and cash deal valued at over $23 billion. Equities Shareholders of VMED will receive a combination of As the equities market approached all-time highs in February, cash and shares of Liberty series A & C shares. Liberty clients were reluctant to add short exposure, with the U.S. expects to realize synergies from the scale of the short book net covered for the month. As of month-end, the combined business once the acquisition is completed by short sale/buy to cover ratio by market value for 2013 was mid-year. LBTYA and LBTYK borrows remain liquid flat, with shorting in ETFs offset by single name covering. despite increased demand. Most sectors were net covered in February led by Consumer, Non-cyclical, Consumer, Cyclical and Technology. The lone LinnCo. LLC (LNCO) announced its acquisition of all of outlier was the Communications sector, which was net the Berry Petroleum (BRY) shares in an all-stock shorted. That anomaly resulted from heightened demand for transaction. The transaction represents the first Liberty Global shares (LBTYA and LBTYK), which spiked acquisition of a publicly held company by an upstream after the planned acquisition of Virgin Media (VMED) was LLC/MLP. The transaction has already been approved announced. by the boards of directors of each of Linn Energy ETFs (LinnCo.’s parent), LinnCo, and Berry, and is expected February was the second consecutive month during which to close in the second quarter. Arbitrage funds have not ETFs were net shorted. SPY (SPDR S&P 500 ETF Trust), been very active with this transaction due to scarce IYR (iShares Dow Jones US Real Estate) and HYG (iShares borrow in LNCO. iBoxx High Yield Corp Bond) were the key drivers. Clients OfficeMax (OMX) and Office Depot (ODP) announced increased short exposure in other broad based ETFs such as an all-stock merger, which has already been approved by QQQ (PowerShares QQQ Trust) and MDY (SPDR S&P the board of both companies. OMX stockholders will Midcap 400 ETF). There was reduced exposure to small-cap receive 2.69 shares of ODP for every share held, and the ETFs led by IWM (iShares Russell 2000). transaction is expected to close by year-end. Borrow for HYG was the most active ETF in February from a stock loan ODP remains liquid despite increased demand. standpoint. Creating to lend HYG is unattractive and PPG Industries (PPG) completed the spinoff of its expensive due to the difference between the creation basket chemicals and commodities business to Axiall Corp and the high-yield index that it tracks. When demand (AXLL – formerly Georgia Gulf (GGC)). Overall, just increases, as it did in February, borrow cost spikes and the under 15% of PPG shareholders elected to take part in ETF trades like a hard-to-borrow security. FXI (iShares the voluntary exchange offer. FTSE XinhuaChina 25 Index) also was active in February, skewed towards buys-to-cover. The fund saw large outflows Fixed Income as demand decreased, in turn causing the cost to borrow to There was a marked decrease in fixed income shorting for ease. both investment grade and high yield corporate debt in February. Financials and technology were the only sectors Event Driven for which there were net increases in shorts. Basic Materials, M&A activity was again robust in February, continuing the trend that commenced in January: Communications, Consumer, Non-cyclical and Utilities were the leading sectors for short covering. February witnessed Kinder Morgan Energy Partners (KMP) agreed to strong flows in the following names, partly in response to acquire Copano Energy (CPNO) in a transaction valued potential LBO activity: Dell, Inc., (DELL), HJ Heinz Co. at approximately $5 billion. Owners of CPNO will (HNZ) and JC Penny (JCP). receive 0.4563 shares of KMP for each Copano share they own. The transaction is expected to close in the In contrast to February’s corporate debt activity, there was a third quarter of this year subject to regulatory and net increase in short balances with respect to convertible shareholder approvals. We are approving limited bonds. Several issues experienced a sudden tightening of quantities of KMP. However, supply across the street liquidity along with headline-driven rate volatility. The U.S. remains constrained. Prime Brokerage book continues to see heavy flows around 6 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 7. Prime Brokerage Global Hedge Fund Trends – Securities Lending Lam Research (LAM), Newmont Mining (NEM), Peabody Table 4: U.S. securities lending trends by sector For the month of February 2013 (BTU), Priceline (PCLN) and RadioShack (RSH). 5 Day 30 Day 90 Day Figure 11: Cumulative net activity Position Position Position Market value change of activity across equities, ETFs, and fixed income Price Change Price Change Price Change $4.0 Change (shares) Change (shares) Change (shares) Consumer, Non-cyclical 1.2% -2.4% 1.6% -4.9% 9.0% 1.0% $2.0 Financial 0.8% -1.8% 1.2% -3.5% 12.1% -3.8% Technology 0.9% 0.0% -2.0% -3.2% 14.0% -11.5% $0.0 Energy 0.5% -3.4% 1.6% 2.8% 10.4% -4.0% Communications 1.5% -0.3% -0.1% 7.0% 14.1% 3.4% ‐$2.0 Industrial 1.3% 0.3% 0.9% -1.3% 14.7% -6.2% ‐$4.0 Consumer, Cyclical 0.7% -0.5% -0.4% -1.6% 9.8% -7.2% Basic Materials 0.7% 2.6% -6.0% 0.7% 1.8% 24.4% ‐$6.0 Utilities 1.2% -0.1% 2.0% -0.8% 9.8% 11.3% ‐$8.0 Source: J.P. Morgan Securities Lending Equity ETF Fixed Income Net Activity ‐$10.0 3-Jan 17-Feb 2-Apr 17-May 1-Jul 15-Aug 29-Sep 13-Nov 28-Dec 11-Feb Table 5: U.S. securities lending trends by ETFs Source: J.P. Morgan Securities Lending For the month of February 2013 5 Day 30 Day 90 Day Figure 12: Rolling 1-month daily short flow Position Position Position Daily Activity Relative to 30-Day Average (LHS) and S&P 500 Index (RHS) Price Change Price Change Price Change Change (shares) Change (shares) Change (shares) 350% 1,550 SPDR S&P 500 ETF TRUST 0.9% 32.6% 1.1% 34.7% 8.9% 27.1% ISHARES RUSSELL 2000 0.6% -1.8% 0.5% -4.4% 13.5% 3.7% 250% SPDR S&P MIDCAP 400 ETF 0.7% 0.0% 0.6% 17.0% 12.0% -11.2% 150% ENERGY SELECT SECTOR 1,500 0.8% 12.0% 1.3% -8.0% 10.0% -25.9% SPDR ISHARES IBOXX H/Y CORP 50% 0.7% 14.4% -0.8% 41.3% 2.2% 81.9% BOND POWERSHARES QQQ 0.9% 9.3% 0.0% 37.4% 5.0% -15.0% -50% NASDAQ 100 INDUSTRIAL SELECT 1.2% -2.9% 1.5% 47.0% 12.3% 23.2% 1,450 SECTOR SPDR -150% MATERIALS SELECT 1.9% 25.9% -2.4% 57.4% 7.2% 89.7% SECTOR SPDR SPDR BARCLAYS HIGH -250% 0.3% -15.3% -1.6% 87.4% 1.6% 46.8% YIELD BOND ETF CONSUMER STAPLES 0.1% -21.4% 3.5% -15.7% 8.3% -8.4% -350% 1,400 SPDR 01-Feb 08-Feb 15-Feb 22-Feb Source: J.P. Morgan Securities Lending Net Cover Activity (LHS) Net Short Activity (LHS) S&P 500 Index (RHS) Source: Bloomberg, J.P. Morgan Securities Lending 7 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 8. Prime Brokerage Global Hedge Fund Trends – Securities Lending International Securities Lending general meetings in March. There was heavy activity around MediaTek Inc. (2454 TW) as market participants trimmed Europe New deal activity was light in February with most of the long positions and put on new shorts in anticipation of trading flows stemming from capital raising events. antitrust approval for the company’s merger with MStar Koninklijke KPN N.V., Citycon OYJ and Royal Imtech N.V. Semiconductor, Inc. (3697 YW). each announced rights issues. Borrow demand was most substantial for Koninklijke KPN as funds sought shares prior Hong Kong to the general shareholders meeting in March. Borrow for As in January, fees on Evergrande (3333 HK) and Zoomlion Citycon was limited, with aggressive bidding by arbitrage (1157 HK) declined during February as liquidity for those funds. Utilization of Royal Imtech borrow was high in names increased. Demand was heavy for company names advance of its rights issue announcement. The only other that are under review as a result of the MSCI’s rebalancing. trade of note was Exor S.p.A., which is planning a mandatory Japan conversion of preferred shares. Although the Nikkei was up +3.8% in February, activity was generally light as was the case in the rest of the region. Directional trades remained a primary focus for many hedge Hedge funds sought locates in names such as Gree Inc. (3632 funds in February. Nokia, which has been heavily shorted JP), Dena Co. Ltd. (2432 JP) and Start Today Co Ltd (3092 over the last 12 months, experienced heightened demand in JP). The Prime Brokerage book experienced recalls for Bic advance of its deletion from the Euro Stoxx 50. Index tracker Camera, Inc. (3048 JP) in anticipation of the company’s funds re-balanced, which in turn catalyzed recalls. Demand is record date. still robust for Banca Monte dei Paschi, with many funds increasing short positions. The borrow level for Alcatel- Australia Lucent continued to ease as a number of funds covered short February was earnings season in Australia. There was strong positions. February saw heightened recalls on PagesJaunes demand for borrow in Monadelphous Group Limited (MND Groupe, for which utilization is still heavy. AU), as investors remain bearish on the mining services sector. Borrow for Tatts Group Ltd. (TTS AU) also was in In Spain, the Prime Brokerage book continued to see strong demand ahead of the company’s earnings statement. Tatts demand from directionally-oriented hedge funds for Bankia, Group continues to trade at expensive multiples relative to its Caixabank, Banco Popular and Fomento de Construc Y peers, a fact that also helped spur demand. Additionally, there Contra, with recall pressure in Bankia pushing borrow rates was increased short interest in Ansell Ltd. (ANN AU) on the to 70%. heels of disappointing net profits. With respect to the Glencore/Xstrata merger, the completion date moved to mid-April. Risk arbitrage funds therefore added to their positions, which created upward pressure on borrow costs. Asia ex-Japan Korea Overall, flows were light in February. Brokers used the opportunity to refinance existing shorts. Activity declined for OCI Co. Ltd. (010060 KS), which has been a popular name among short sellers. Demand remains strong for LG Electronics (056670 KS). Taiwan Flows were generally muted in February, with activity driven largely by investors exercising calls in anticipation of annual 8 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 9. Prime Brokerage Global Hedge Fund Trends – Institutional Investor Sentiment Institutional Investor Sentiment Asia Asian investors are pulling back from long-biased credit Americas exposure and instead are showing renewed interest in low We are approaching an inflection point in the market for directional, relative value and long short credit. Among institutional investor capital, as flows into structured credit investors who do not already have exposure to structured are slowing while allocators are showing heightened appetite credit, there is strong interest in the strategy. As ever, “good” for directional strategies with higher betas. Given the strong discretionary macro managers are in demand but Asian returns and corresponding inflows that structured credit investors are generally disillusioned with underperformance generated from 2009 through 2012 – a period during which among macro funds. However, there has been a slight uptick the HFRX Fixed Income-Asset Backed Index averaged in interest in emerging markets macro. +19.63% annually – fewer investors are making new allocations since (1) the strategy now comprises part of many Equity long short remains a “bread and butter” strategy U.S. investors’ portfolios and (2) some investors who have among Asian investors and there is renewed interest in the not yet made allocations are concerned about the current region in capturing risk-on equity upside. However, only opportunity set. There has been a palpable uptick in interest investors who are currently underweight equities are making in equity long short and event driven managers. Interest in such allocations. Asian investors are generally saturated with systematic strategies and CTAs remains muted. New respect to multi-strategy funds, as most of the major multi- launches continue to garner interest. strategy managers already account for core allocations in The Capital Introduction Group (CIG) spent time with investors’ portfolios. Finally, interest in CTAs has waned. institutional investors in and around Boston in February. Only groups that view CTAs as a tail to their portfolios Fund of hedge funds (FoFs) continue to grow their advisory remain committed to the strategy. and customized businesses while their comingled vehicles Table 6: Investor strategies of interest by region7 contract. Notably, Boston-area consultants were interested in learning about new launches, which have not been a Americas Europe Asia Direction of Level of Direction of Level of Direction of Level of traditional focus for them. Interest Interest Interest Interest Interest Interest Convertible CIG also hosted a heavily attended event on convertible Neutral Neutral Neutral Arbitrage arbitrage managers in February. While it is too early to say Distressed Neutral Neutral Neutral that a trend is underway, we have seen an uptick in interest in convertible arbitrage, especially given heavy 2013 issuance. Equity Long Increasing Increasing Neutral Short Europe Event Increasing Neutral Neutral Driven To the extent that any clear themes have emerged among European allocators, it is the continual upgrading of Macro Neutral Neutral Decreasing portfolios as investors rotate away from managers who have CTA Neutral Neutral Decreasing underperformed. As in the U.S., there is interest among European investors in new managers across the strategy Market Neutral Neutral Increasing Neutral spectrum. Structured Neutral Neutral Increasing Credit CIG met with an array of investors in Switzerland. Zurich- based family offices continue to reduce their hedge fund Legend Low Interest holdings, with private equity and direct market investments Medium Interest benefitting from this reallocation. Swiss corporate pensions continue to disintermediate FoFs in lieu of direct High Interest investments, albeit not without the services of consultants. Source: J.P. Morgan Capital Introduction Group Overall, there is rising interest in directional equity long short strategies and, in a few instances, long-only equity as investors try to increase the volatility in their portfolios. 7 Institutional investors in Switzerland also expressed interest This information comes from CIG conference calls and meetings with global hedge fund managers and institutional investors. This table represents views of the CIG team in global macro and European structured credit. and may not be completely exhaustive. 9 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 10. Prime Brokerage Global Hedge Fund Trends – Market Perspectives February Commentary The following sections are excerpts from J.P. Morgan Research publications. The full publications can be The rally that commenced with vigor in January took a pause accessed via the sources provided in the footnotes below. in February. Headwinds emerged as a result of tightening measures in China, disappointing data from Europe and the Bernanke Stays the Course on Asset Purchases 8 perpetual impasse among Washington policymakers over the federal budget. As expected, Fed Chair Bernanke's semiannual monetary policy testimony sounded a little more dovish than the most Those obstacles, however, were sufficient only to cause a recent FOMC minutes. In particular, while noting the costs to pause in, rather than a reversal of, the global recovery, which balance sheet expansion, he concluded that these costs were continued in February but at a lower pace. The J.P. Morgan either small or nonexistent, and more than easily offset by the Global Manufacturing PMI was 50.8 in February, still in beneficial effects of asset purchases. These benefits were expansion territory but down from 51.4 in January. characterized as "clear" whereas the "potential" costs were Significantly, data from China also blunted momentum as the methodically discussed and minimized. We believe today's country’s manufacturing PMI declined from 50.4 in January testimony supports the view that the Fed remains comfortable to 50.1 last month. February was therefore the fifth continuing with its asset purchase program. consecutive month during which China’s PMI signaled The first cost that the Chairman dismissed was worries that expansion. However, the month-over-month decline is the eventual exit would un-anchor inflation expectations. To indicative of a decrease in the rate of that expansion. this he noted that measures of inflation expectations remain low and that the Committee was "confident" in their exit The U.S., by contrast, continues to be a key driver behind the tools. The second cost was excessive risk-taking, in the form global recovery. Even as across-the-board federal spending of, for example, reach-for-yield behavior. Bernanke observed cuts took hold, the U.S. PMI rose to 54.2 in February from that some risk-taking, such as that by entrepreneurs, is part of 53.1 in January, the highest reading since June 2011. a healthy recovery. He also echoed Governor Stein's point Additionally, the U.S. economy added 236,000 jobs in that low rates encourage longer-term funding, which should February as unemployment fell to 7.7%, the lowest level reduce systemic risk. He concluded that the Fed's regulatory since December 2008. Furthermore, new factory orders – a tools should help to head off brewing financial imbalances. key leading indicator – climbed to 57.8 in February from Finally, on the topic of potential losses on the Fed balance January’s 53.3, the largest such increase since March 2010. sheet, he made that the point that on a through-the-cycle Accordingly, the U.S. expansion continues to gain steam in basis, any future decline in remittances should be more than spite of the ongoing paralysis in Washington. offset by the outsized remittances that the Fed has paid to Treasury over the past few years. In sum, Bernanke brushed Expiration of the continuing resolution for the federal budget off the costs and risks attending to asset purchase, while and the debt ceiling loom next on the horizon. Yet markets noting that the benefit has been an important support to the now appear to view a refusal by Congress to renew its recovery. continuing resolution on March 27, or to lift the debt limit in May, as low probability outcomes. Bernanke's remarks on the economy were quite limited and focused on the labor market and the costs of high and Such resilience notwithstanding, the pullback in federal extended unemployment. His testimony also commented on spending, even if incremental, is likely to extract a toll. U.S. fiscal policy, repeating the usual advice to put in place long- GDP slowed from 3.1% in the third quarter to 0.1% in the run reforms in lieu of short-run fiscal austerity. The Monetary fourth quarter partly as a consequence of declining federal Policy Report did not add too much to the discussion, other outlays, which fell at an annualized rate of 14.8% over that than to more thoroughly examine the benefits of asset period. It may therefore be infeasible for the U.S. economy – purchases, to which "a balanced reading of the evidence and in turn the global recovery – to attain “escape velocity” supports the conclusion that LSAPs have provided a absent longer-term clarity with respect to fiscal policy, including the pace at which, and the extent to which, U.S. federal spending will be pared back. 8 J.P. Morgan Chase North America Economic Research, Bernanke Stays the Course on Asset Purchases, February 26, 2013, J.P. Morgan Markets, https://na- markets.jpmorgan.com/research/content/GPS-1062584-0. 10 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 11. Prime Brokerage Global Hedge Fund Trends – Market Perspectives meaningful support to the economic recovery while across households, banks, and sovereigns. In the event, the mitigating deflationary risks." rebound in spending on durables was modest overall and focused on machinery, transport equipment, and autos. The The Next Wiggle is a Weaker US Consumer9 recovery relied heavily on the ending of an inventory adjustment and the recovery of global trade. The region Global activity indicators lifted as we turned into the New moved back into recession in late 2011, as these exceptional Year with the latest three-month gains in global industrial supports faded, financial stress increased, and the region production and retail sales volumes each tracking close to a turned to substantial fiscal consolidation. 4% pace of increase. We believe that this news points to a broad positive turn in global growth, but we recognize that As we look to the coming few quarters, we expect the region the underlying pace of global growth is not as rapid as the to exit recession and start growing again. The initial impulse latest activity readings suggest. Drags that weighed heavily for growth is coming from a return of confidence in the on global growth early last quarter—notably the Japan-China integrity of the Euro area, a fading of fiscal austerity, and an dispute, Hurricane Sandy, and a temporary drop in global improvement in the global backdrop. But, for growth in the auto production—have faded, boosting industrial activity region to be sustained, cyclical forces need to be at work. The around year-end. Meanwhile, household spending was lifted scope for a cyclical recovery, as seen in 2009-10, is clearly last quarter by falling inflation. In the coming months, this there: cash balances are high, levels of spending on durables boost will be replaced by large headwinds concentrated in the are low, and monetary policy remains very easy. But, on the US, resulting from rising energy prices and a tax hike. other hand, inventory positions are less lean than in 2009, global trade will not be bouncing back from depressed levels, We have sent a message that there is upside risk to our and the same deleveraging headwinds remain in place. Thus, current quarter 2.4% global GDP forecast because the lift in the recovery over the coming 18 months is unlikely to be as global activity into the New Year has proved stronger than solid as during the period from the middle of 2009 to the anticipated. However, the stage is now set for moderation in middle of 2011. the monthly data flow. Global retail sales volumes are expected to flatten during February and March as US spending contracts. Meanwhile, global production gains are expected to slow to a roughly 2.5% annualized pace over the next three months. If we are right, this softening will prove temporary and a rebound into midyear will leave 2Q13 global growth roughly in line with this quarter’s outcome. Cyclical Lift in the Euro Area: Let’s Have Another Go10 In our view, the Euro area is moving toward exiting recession and will start to grow again from the second quarter. The last time the region made a transition from recession to expansion was in the middle of 2009. After a 5.6% drop in the level of GDP from early 2008 to the spring of 2009, the economy began to expand again from the third quarter of 2009 and enjoyed eight quarters of growth averaging 2% ar. Despite very depressed levels of spending on durables, low inventory positions, and very low interest rates, it was always clear that the recovery from the 2008-09 recession was going to be hard work. There was significant pressure to delever 9 J.P. Morgan Economic Research, Global Data Watch: The Next Wiggle is a Weaker US Consumer, February 22, 2013, J.P. Morgan Markets, https://na- markets.jpmorgan.com/research/content/GPS-1060551-0. 10 J.P. Morgan Economic Research, Economic Research Note: Cyclical Lift in the Euro Area: Let’s Have Another Go, February 22, 2013, J.P. Morgan Markets, https://na- markets.jpmorgan.com/research/content/GPS-1060083-0. 11 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.

- 12. Important Information and Disclaimers Contact Us: JPMorgan. Under all applicable laws, including, but not limited to, the US Employee Retirement Income Security Act of 1974, as Alessandra Tocco amended, or the US Internal Revenue Code of 1986 or the Financial Alessandra.Tocco@jpmorgan.com Services and Markets Act 2000 (Regulated Activities) Order 2001, 212-272-9132 as amended, no portion of this Material shall constitute, or be construed as constituting or be deemed to constitute “investment Kenny King, CFA advice” for any purpose, and JPMorgan shall not be considered as a Kenny.King@jpmorgan.com 212-622-5043 fiduciary of any person or institution for any purpose in relation to Material. This Material shall not be construed as constituting or be Christopher M. Evans deemed to constitute an invitation to treat in respect of, an offer or a c.m.evans@jpmorgan.com solicitation of an offer to buy or sell any securities or constitute 212-622-5693 advice to buy or sell any security. This Material is not intended as tax, legal, financial or equivalent advice and should not be regarded Stacy Bartolomeo or used as such. The Material should not be relied upon for Stacy.Bartolomeo@jpmorgan.com compliance. 212-272-3471 Elizabeth Drumm An investment in a hedge fund is speculative and involves a high Elizabeth.H.Drumm@jpmorgan.com degree of risk, which each investor must carefully consider. Returns 212-272-2642 generated from an investment in a hedge fund may not adequately compensate investors for the business and financial risks assumed. This material (“Material”) is provided by J.P. Morgan’s Prime An investor in hedge funds could lose all or a substantial amount of Brokerage business for informational purposes only. It is not a its investment. While hedge funds are subject to market risks product of J.P. Morgan’s Research Departments. This Material common to other types of investments, including market volatility, includes data and viewpoints from various departments and hedge funds employ certain trading techniques, such as the use of businesses within JPMorgan Chase & Co., as well as from third leveraging and other speculative investment practices that may parties unaffiliated with JPMorgan Chase & Co. and its subsidiaries. increase the risk of investment loss. Other risks associated with The generalized hedge fund and institutional investor information hedge fund investments include, but are not limited to, the fact that presented in this Material, including trends referred to herein, are hedge funds: can be highly illiquid; are not required to provide not intended to be representative of the hedge fund and institutional periodic pricing or valuation information to investors; may involve investor communities at large. This Material is provided directly to complex tax structures and delays in distributing important tax professional and institutional investors and is not intended for nor information; are not subject to the same regulatory requirements as may it be provided to retail clients. mutual funds; often charge higher fees and the high fees may offset the fund’s trading profits; may have a limited operating history; can This Material has not been verified for accuracy or completeness by have performance that is volatile; may have a fund manager who has JPMorgan Chase & Co. or by any of its subsidiaries, affiliates, total trading authority over the fund and the use of a single adviser successors, assigns, agents, or by any of their respective officers, applying generally similar trading programs could mean a lack of directors, employees, agents or advisers (collectively, “JPMorgan”), diversification, and consequentially, higher risk; may not have a and JPMorgan does not guarantee this Material in any respect, secondary market for an investor’s interest in the fund and none may including but not limited to, its accuracy, completeness or be expected to develop; may have restrictions on transferring timeliness. Information for this Material was collected and compiled interests in the fund; and may affect a substantial portion of its during the stated timeframe, if applicable. Past performance is not a trades on foreign exchanges. guarantee of future results. JPMorgan has no obligation to update any portion of this Material. This Material may not be relied upon as JPMorgan may (as agent or principal) have positions (long or short), definitive, and shall not form the basis of any decisions. It is the effect transactions or make markets in securities or financial user’s responsibility to independently confirm the information instruments mentioned herein (or derivatives with respect thereto), presented in this Material, and to obtain any other information or provide advice or loans to, or participate in the underwriting or deemed relevant to any decision made in connection with the restructuring of the obligations of, issuers mentioned herein. subject matter contained in this Material. Users of this Material are JPMorgan may engage in transactions in a manner inconsistent with encouraged to seek their own professional experts as they deem the views discussed herein. appropriate including, but not limited to, tax, financial, legal, investment or equivalent advisers, in relation to the subject matter © 2013 JPMorgan Chase & Co. All rights reserved. All product covered by this Material. JPMorgan makes no representations (and names, company names and logos mentioned herein are trademarks to the extent permitted by law, all implied warranties and or registered trademarks of their respective owners. Access to representations are hereby excluded), and JPMorgan takes no financial products and execution services is offered through J.P. responsibility for the information presented in this Material. This Morgan Securities LLC (“JPMS”) and J.P. Morgan Securities plc Material is provided for informational purposes only and for the (“JPMS plc”). Clearing, prime brokerage and custody services are intended users’ use only, and no portion of this Material may be provided by J.P. Morgan Clearing Corp. (“JPMCC”) in the US and reproduced or distributed for any purpose without the express JPMS plc in the UK. JPMS and JPMCC are separately registered written permission of JPMorgan. The provision of this Material does US broker dealer affiliates of JPMorgan Chase & Co., and are each not constitute, and shall not be construed as constituting or be members of FINRA, NYSE and SIPC. JPMS plc is authorized and deemed to constitute, a solicitation of, or offer or inducement to regulated by the FSA and is a member of the LSE. J.P. Morgan provide or carry on, any type of investment service or activity by Securities (Asia Pacific) Limited is regulated by the HKMA. 12 This material is provided by J.P. Morgan’s Prime Brokerage business for informational purposes only. It is not a product of J.P. Morgan’s Research Departments. For Institutional Investors only. For the intended recipient only. The reference period for this publication is February 2013 unless otherwise stated.