Capital and revenue concept

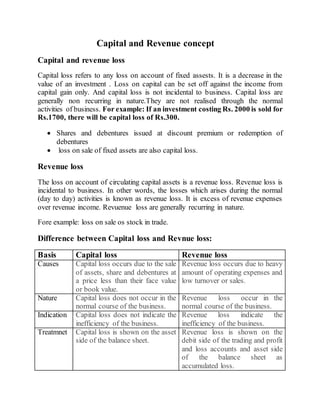

- 1. Capital and Revenue concept Capital and revenue loss Capital loss refers to any loss on account of fixed assests. It is a decrease in the value of an investment . Loss on capital can be set off against the income from capital gain only. And capital loss is not incidental to business. Capital loss are generally non recurring in nature.They are not realised through the normal activities of business. For example: If an investment costing Rs. 2000 is sold for Rs.1700, there will be capital loss of Rs.300. Shares and debentures issued at discount premium or redemption of debentures loss on sale of fixed assets are also capital loss. Revenue loss The loss on account of circulating capital assets is a revenue loss. Revenue loss is incidental to business. In other words, the losses which arises during the normal (day to day) activities is known as revenue loss. It is excess of revenue expenses over revenue income. Revuenue loss are generally recurring in nature. Fore example: loss on sale os stock in trade. Difference between Capital loss and Revnue loss: Basis Capital loss Revenue loss Causes Capital loss occurs due to the sale of assets, share and debentures at a price less than their face value or book value. Revenue loss occurs due to heavy amount of operating expenses and low turnover or sales. Nature Capital loss does not occur in the normal course of the business. Revenue loss occur in the normal course of the business. Indication Capital loss does not indicate the inefficiency of the business. Revenue loss indicate the inefficiency of the business. Treatmnet Capital loss is shown on the asset side of the balance sheet. Revenue loss is shown on the debit side of the trading and profit and loss accounts and asset side of the balance sheet as accumulated loss.

- 2. Capital and Revenue expenditure When the benefit of expenditure is available over a number of years , it is a capital expenditure. Capital expenditure has physical existence except intangible assets. Expenditure in the acquisition of fixed assets Other expenses inccured in connection with their acquisition Any expenses which results as expansion and increase in life substantially of fixed asset Expenses on development of mine and land plantation till they become operation Cost of experiment which ultimately result in acquisition of a patent Legal charges incurred in connection with acquiring or defending suits for protecting fixed assets , rights , etc Revuenue expemditure When the benefit of expenditure is likely to affect for less than a period of one year, it is considered as revenue expenditure. So all expenses incurred during the regular course of business are treated revenue expenditure. Depreciation on fixed assets Expenses incured in the day to day conduct of business Expenses incured im buying goods for resale on raw materials for manufacturing Interest on loans borrowed for running the business Deferred revenue expenditure The benefits of certain expenditure are available for more than a year. It should be spread over number of accounting years, Expenses incurred on adverstising campaigns to introduce new product in the market Expenses incurred in the fornation of a new company Brokerage charge, underwriting comission and other expenses incurred in connection with the issue of shares and debentures.

- 3. Difference between Capital expenditure and Revenue expenditure Basis Capital expenditure Revenue expenditure Meaning Expenses incurred in acquiring of a capital asset or improving the capacity of an existence one. Expenses incurred in regulating th day to day activities of bueinss Term It has long term effect It has short term effect Captalisation Yes No Show in It is shown in the income statement and balance sheet It is shown in income statement Outlay It is non recurring in nature It is recurring in nature Benefit Benefit more than a year Only in the current accounting year Earning capacity It seeks to improve earning capacity It maintains earning capacity Matching concept It is not matched with capital receipts It is matched with revenue receipts Capital and Revenue receipts Capital receipts Capital receipts are the amounts receibed from the owner as capital, loan from outsiders and proceeds from the sale of fixed assets, they are non recurring in nature. In other words, capital receipts are the receipts which do not results from the regular course of business. Capital reecived from owner Loan from outsiders Sale of fixed assets Revenue receipts Revenue receipts are the receipts which results from the regular course of business activities. The revenue receivd from the sale of product and services are revenue receipts. Revenue receipts are shown in income statemnt as income.

- 4. Difference between Capital receipts and Revenue receipts Basis Capital receipts Revenue receipts Meaning Capital receipts are the income generated from the incvesting or financing activities of a firm Revenue receipts are the income generated from the operating activites of a business firm Nature It is non recurring in nature It is recurring in nature Term It has long term effect It has short term effect Show in It is shown in Balance sheet It is shown in Income ststement Received in exchange of Source of income Income Value of asses or liability It either decrases the value of assets or increases the vlue of liability It increase or decrease the value of assets or liability