2Women with a Parasol-Madame Monet and Her SonClau.docx

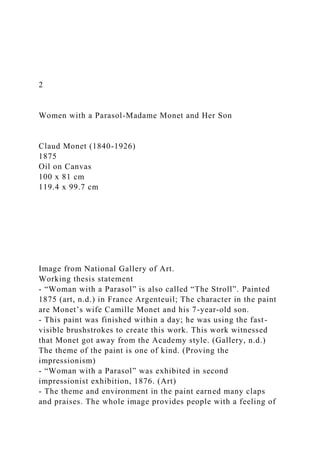

- 1. 2 Women with a Parasol-Madame Monet and Her Son Claud Monet (1840-1926) 1875 Oil on Canvas 100 x 81 cm 119.4 x 99.7 cm Image from National Gallery of Art. Working thesis statement - “Woman with a Parasol” is also called “The Stroll”. Painted 1875 (art, n.d.) in France Argenteuil; The character in the paint are Monet’s wife Camille Monet and his 7-year-old son. - This paint was finished within a day; he was using the fast- visible brushstrokes to create this work. This work witnessed that Monet got away from the Academy style. (Gallery, n.d.) The theme of the paint is one of kind. (Proving the impressionism) - “Woman with a Parasol” was exhibited in second impressionist exhibition, 1876. (Art) - The theme and environment in the paint earned many claps and praises. The whole image provides people with a feeling of

- 2. freedom and kind. (Art, nga.gov, n.d.) The controversy parts. · How much contribution that this paint did to the modern art world. · The affections about the theme in this paint. · The viewer nowadays is judging the art value of this paint. Those controversy parts about the paint were making a progress in modern art and improve the development of art. Bibliography: 1. “Woman with a Parasol - Madame Monet and Her Son.” Modern Painters 29, no. 1 (March 2017): 45. https://search.ebscohost.com/login.aspx?direct=true&db=edb&A N=121204182&site=eds-live. 2. Goldwater, Robert. "The Glory that was France." Art News 65 (March 1966):42, repro. cover. 1966 3. Hand, John Oliver. National Gallery of Art: Master Paintings from the Collection. Washington and New York, 2004: 382-383, no. 317, color repro. 2004 4. C. Monet Gallery “Woman with a Parasol”. https://www.cmonetgallery.com/woman-with-a-parasol.aspx 5. Woman with a Parasol, 1875 by Claude Monet, Claude Monet Paintings, biography, and Quotes. https://www.claude- monet.com/woman-with-a-parasol.jsp#prettyPhoto 6. Eelco Kappe. “Woman with a Parasol - Madame Monet and Her Son by Claude onet.” TripImprover, (2019/10/16) https://www.tripimprover.com/blog/woman-with-a-parasol- madame-monet-and-her-son-by-claude-monet#comments 7. Google Art and Culture, National Gallery of Art, Washington

- 3. DC. https://artsandculture.google.com/asset/woman-with-a- parasol-madame-monet-and-her-son/EwHxeymQQnprMg 8. Charles Saatchi. “Charles Saatchi's Great Masterpieces: when a family scene was an act of rebellion.”19 March 2018. 7:00AMhttps://www.telegraph.co.uk/art/artists/charles-saatchis- great-masterpieces-family-scene-act-rebellion/ 9. TotallyHistory. “Woman with a Parasol”. http://totallyhistory.com/woman-with-a-parasol/ 10.Peter C. Baker. “THE REAl WORLD OF MONET”, The New York. January 10,2013. https://www.newyorker.com/books/page-turner/the-real-world- of-monet Improving financial literacy in college of business students: modernizing delivery tools Ronald Kuntze College of Business, University of New Haven, West Haven, Connecticut, USA Chen (Ken) Wu and Barbara Ross Wooldridge Soules College of Business, The University of Texas at Tyler, Tyler, Texas, USA, and Yun-Oh Whang Joseph M. Katz Graduate School of Business, University of Pittsburgh, Pittsburgh, Pennsylvania, USA

- 4. Abstract Purpose – The purpose of this paper is to develop and test through an experiment, an innovative online video teaching module that significantly improves financial literacy in college of business students. Specific business major financial literacy levels are also tested. Design/methodology/approach – A total of 244 college of business students were given a financial literacy test. Half of the students were exposed to the “treatment” (watched a video module), while other half were not. The videos comprised 67 min of micro-lectures that students could download, free of charge, at their own convenience. The researchers analyzed the impact of a previous personal finance course on students’ financial literacy levels and tested across four business majors. Findings – The video intervention was the most successful at increasing financial literacy, surprisingly more so than having taken a past personal finance course. Interaction effects were not significant. Four college majors were tested with a shorter, improved financial literacy measure – finding, to our surprise that non-quantitative business majors (particularly marketing students) are not less financially literate than other majors. Supporting past research, the authors found that female and African-American college students performed significantly lower on the test. Originality/value – The research adds value to the literature by developing and testing a modern, novel teaching innovation to improve financial literacy in young adults. Using an experimental setting, the authors showed that the innovation was more effective than the commonly proscribed personal finance course. This is one of the few studies to measure financial literacy levels for specific college of business majors. Keywords Experiment, Video, College of business students, Financial literacy improvement

- 5. Paper type Research paper Introduction: financial literacy – a significant individual and societal problem Since the late 1990s, the study of “Financial Literacy” has been a hot-button issue in the popular press as well as in education, economics, management, finance and marketing journals. Politicians, pundits, educators, economists and the media fervently express trepidation that Americans, particularly younger ones, appear unable to save money, invest appropriately, handle credit, solve basic math and financial problems as well as comprehend both personal and national financial matters (Hamilton, 2013; Henager and Cude, 2016; Huhmann, 2017; Mandell, 2008; Marcolin and Abraham, 2006). Researchers have identified alarmingly lower levels of financial literacy in certain at-risk demographic groups potentially leading to negative financial behaviors (Bucher- Koenen et al., 2017; Nejad and O’Connor, 2016). Recent studies have also shown that consumers may be over-confident in their perceived financial literacy (subjective vs objective financial literacy – see Hadar et al., 2013) and as a result may take part in riskier financial behaviors (Nejad and Javid, 2018; Porto and Xiao, 2016). International Journal of Bank Marketing Vol. 37 No. 4, 2019 pp. 976-990 © Emerald Publishing Limited 0265-2323

- 6. DOI 10.1108/IJBM-03-2018-0080 Received 31 March 2018 Revised 17 August 2018 29 October 2018 Accepted 30 October 2018 The current issue and full text archive of this journal is available on Emerald Insight at: www.emeraldinsight.com/0265-2323.htm 976 IJBM 37,4 Millennials are particularly challenged by financial illiteracy due to the unprecedented burden of credit cards and student loans (de Bassa Scheresberg and Lusardi, 2014; Xiao et al., 2011), making US college students a surprisingly vulnerable population. This extends to recent college graduates. Several studies find mean college financial literacy scores not much higher than K-12, even among business majors (Hamilton, 2013), with post-secondary US students having “inadequate knowledge” of personal finance (Hanna et al., 2010; Mandell, 2008; Xiao et al., 2014). As a result, even educated and affluent younger Americans may find themselves unable to navigate the financial world, prone to make uninformed decisions and misled about financial matters (Marcolin and Abraham, 2006). Williams and

- 7. Oumlil (2005) have called for an “intervention strategy” to improve young college adults’ ability to make informed financial decisions. From a macro- economic perspective, if the highest educated and financially secure cohort (college graduates) in a nation are crippled by poor financial skills and knowledge, we risk an “uncompetitive and unattractive workforce that by necessity will lean more on social programs,” according to Ted Beck, CEO of the National Endowment for Financial Education (Malcolm, 2012). Although a generalized lack of objective financial knowledge among younger Americans has been documented for decades at both the high school and college level (Chen and Volpe, 1998; Danes and Hira, 1987; Lusardi et al., 2010), there appears to be little research focused on the financial literacy of specific college majors. As marketing and finance professors, several of the researchers on this project were interested in whether the poor financial literacy scores found in college of business studies extend equally across all majors. There is a concern that poor financial literacy may be amplified in marketing, where there is a long documented history of students experiencing difficulty with math, statistics and numeracy (Aggarwal et al., 2007; Budden, 1985; Ganesh et al., 2010). As marketing researchers and scale developers, we also hoped to find more research exploring financial literacy scale development, refinement and validation (as called for by Hastings et al., 2013; Hung et al., 2009). Researchers disagree

- 8. upon construct definitions for financial literacy, ways to measure it and direct links to behavior (Huhmann and McQuitty, 2009). There are additional ongoing disagreements about related constructs such as financial capability, objective financial knowledge and financial self-efficacy (Hung et al., 2009; Taylor, 2011; Shim et al., 2013; Xiao and O’Neill, 2016). Finally, it appears that the major thrust, in terms of efforts to improve financial literacy in millennials, is often relegated to a mandated personal finance course “unevenly applied” in K-12 grade (Harrington and Smith, 2016). We would like to see the rich tapestry of modern marketing educational tools such as mixed media, online video workshops and seminars, and exploratory teaching methods available to marketing educators expand to include the improvement of financial literacy across the college curriculum. Study purpose The purpose of this study is to extend the conceptual and theoretical literature related to financial literacy improvement in young people, particularly in college of business students. We analyzed the effectiveness of short videos vs taking a more traditional finance course and evaluated the impact on the participants’ performance on a financial literacy test. Working with online media sources already in place, the researchers utilized video self-tutorials, and an experiment was conducted with 244 college of business students to explore if these online tutorials would significantly improve financial literacy in business

- 9. majors. Specific business school major, GPA, demographics and exposure to a personal finance course were each analyzed, as well as more appropriate measures of college student literacy proposed. The study more deeply explores marketing and management majors, potentially at risk for poor financial literacy demographic groups, and calls for marketing researchers to assist in scale development and improvement. This study also extends 977 Improving financial literacy research in utilizing greater diversity in teaching perspectives (Xiao and O’Neill, 2016), and simplifying and modernizing information/content learning and delivery (Huhmann and McQuitty, 2009) using online web tools and systems (Alwehaibi, 2015; Wankel, 2010). Financial literacy and students The GAO (2012) defined financial literacy as: “the ability to make informed judgments and to take effective actions regarding the current and future use and management of money. It includes the ability to understand financial choices, plan for the future, spend wisely, and manage the challenges associated with life events such as a job loss, saving for retirement, or paying for a child’s education” (p. 3). The origins of

- 10. academic research and measurement of financial literacy began with US high school seniors and the development of a lengthy measurement instrument in the late 1990s with the “Jump$tart, Baseline Survey 1997–1998 of 12th Graders” (Mandell, 2008). Scores on the measure were problematic at best, with high schoolers in the “failing ranges” of 48–57 percent (Jump$tart, 2014). American university students performed poorly displaying a “dismal knowledge” of personal finance (Chen and Volpe, 1998; Volpe et al., 1996) with a mean score of 53 percent on the instrument in the early years of survey (Hanna et al., 2010). Although the performance of a sub-segment including both college-bound and college students improved in the late 2000s, the annual nationwide high school and college student averages were by most measures still “not passing” (OECD, 2005). Jump$tart survey results support a litany of research indicating American consumers, particularly younger ones, are financially illiterate and this is causing serious issues at home as well as in business and society (Fernandes, 2014; Malcolm, 2012; Mandell, 2008; Marcolin and Abraham, 2006). Lack of financial literacy in college students continues to resonate in the popular business press as this cohort struggles with repaying soaring student debt (Lachance, 2012; Xiao et al., 2014). The average college student now accrues over $35,000 in student debt (Ellis, 2013), and poor financial literacy skills in college graduates magnify the problem. “It comes back to a financial literacy issue and making sure

- 11. students understand what they’re getting into, how much they’re borrowing and an understanding that there are different options for them at the end,” says Megan McClean, Director of Policy and Federal Relations at the National Association of Student Financial Aid Administrators (Bidwell, 2013). More recent research has focused on parsing out and measuring important objective and subjective or “perceived” knowledge elements of the financial literacy construct (Hadar et al., 2013; Nejad and Javid, 2018). It is presumed that overly confident college students and graduates who lack true objective financial literacy will make uninformed personal decisions in their everyday financial lives (Perry, 2008; Porto and Xiao, 2016) and may even negatively impact significant financial decisions at work after graduation. Fernandes (2014) worried that financial illiteracy runs rampant in corporate America and that business executives and managers without basic financial skills make key strategic decisions daily. Numerous studies and measures indicate that American college students score poorly when it comes to financial literacy and performance is deteriorating for most groups. Of particular concern are minority student populations (Harnisch, 2010) and women (Bucher- Koenen et al., 2017) who continue to test at lower financial literacy levels. Experts further warn that a lack of financial literacy and basic financial skills in graduated business majors is costing our economy through entrepreneurial failure (Hannaher, 2011), consumer debt (Collins et al., 2011; Ellis, 2013;

- 12. Lusardi and Tufano, 2009), risky decision making (Mouna and Jarboui, 2015; Blankson et al., 2012) and poor corporate decision making (Fernandes, 2014; Gruca, 2000). Relatedly, there has been great concern over marketing students’ apparent weaknesses in math, statistics and quantitative skills. First diagnosed nearly 30 years ago by Budden (1985), researchers since have called for educators to enhance financial and analytical skills in the classroom (Brennan and Vos, 2013; Ganesh et al., 2010; Gruca, 2000) and have warned 978 IJBM 37,4 that math and quantitative skills have become even more important for marketers post-graduation (Davis et al., 2002). Undergraduate marketing majors have been found to lack mathematical and quantitative skills in general (Aggarwal et al., 2007), and may even gravitate to the major because of perceived lower quantitative skills requirements when compared with other business majors (Ganesh et al., 2010). According to Tarasi et al. (2012), marketing students are less likely to have an affinity for the crucial quantitative aspects of the discipline and statistical anxiety is especially strong for marketing majors relative to other business majors. This has become a significant concern

- 13. for marketers with the contemporary emphasis on “Big Data” analysis and marketing metrics in the workforce (Schlee and Harich, 2010). This is extremely important for marketing faculty, since weaknesses in marketing math and elementary financial understandings weaken employability of marketing graduates (Brennan and Vos, 2013). “Poor mathematical fluency” appears to continue even after four years of marketing curricula (Saber and Foster, 2011). Degreed marketing managers exhibit poor financial planning skills (Abernethy and Gray, 2000) and their lack of financial literacy, numeracy and problem-solving skills can significantly handicap a marketer’s business career as well as hurt his or her ability to advance in an organization (Ganesh et al., 2010). Aggarwal et al. (2007) warned that particularly quantitatively challenged marketing undergraduates may find difficulty both on the job front and in their hopes of gaining an MBA with poor and declining GMAT scores. After graduation, marketing majors are increasingly called upon to be accountable for their financial decisions within the firm (Brennan and Vos, 2013; Ganesh et al., 2010; Saber and Foster, 2011). The marketing major has a significantly higher percentage of female graduates compared to higher paying numerical majors such as engineering and computer science (50 percent vs below 20 percent – Perry, 2016), supporting the argument that women marketing majors comprise a vulnerable group in terms of

- 14. financial well-being. Mahdavi and Horton (2014) found college-educated women particularly at risk for lower levels of financial knowledge and call for action to enhance financial literacy in this population as well as vulnerable ethnic groups (Bucher-Koenen et al., 2017; Nejad and O’Connor, 2016). On the positive side, poor quantitative, statistics and numeracy skills (and apparent interest) among marketing majors (Tarasi et al., 2012) have resulted in a myriad of cross-departmental creative teaching innovations for undergraduates and MBA students (Brennan and Vos, 2013; Gruca, 2000; Saber and Foster, 2011). Innovative pedagogical tools and methods to improve the “less quantitative minded” business student’ have resulted in whiteboards in the classroom (Greene and Kirpalani, 2013), stand-alone self-study tutorials (Chen et al., 2012) and innovative class modules to improve numeracy (Ganesh et al., 2010). The financial literacy literature appears to have a gap in cutting edge pedagogical tools (see Lusardi et al., 2017 for an exception), and researchers have called for more creative methods in the classroom (Goetz et al., 2011; Huhmann and McQuitty, 2009). Researchers have also suggested greater financial skills development and exposure to basic finance concepts be integrated into the marketing curriculum (Brennan and Vos, 2013; Gruca, 2000). A personal finance course and financial literacy itself is often ignored after high school, and neither is a part of the majority of university

- 15. business programs. Bianco and Bosco (2011) examined the curricula of 100 AACSB accredited schools and found that only 54 percent offered a personal finance course, and that these were mostly (44 percent) only offered (not required) to business majors. Only 10 percent of these offerings were available to non-business majors (Lafond and Leaubie, 2014). These numbers indicate that many marketing majors and graduating marketing professionals from the social sciences and more practice-based backgrounds miss out on personal finance and financial literacy education after high school. The majority of advertising-, sales-, web-development- and branding-focused students are not exposed to the basic concepts of financial literacy. 979 Improving financial literacy Since financial literacy is “the ability to make informed judgments and to make effective decisions regarding the use and management of money” (Marcolin and Abraham, 2006), it should be a concern to marketing faculty that financial literacy is not more adequately addressed in or adjacent to the marketing curriculum. Study rationale and measure development In order to ascertain basic financial literacy levels in business

- 16. majors and explore whether there might be problems and/or differences among majors, several researchers at different universities collaborated in an experiment. The idea began with a finance professor who had taught personal finance in the past, and was interested in analyzing financial literacy in different majors. This professor had been developing a shorter version of the lengthy Jump $tart Instrument (2009) that would be more concise (length of time to complete: 15 vs 45 min) and had more age appropriate measures. Researchers have often used abbreviated instruments to measure financial literacy (Hanna et al., 2010; Mitchell and Lusardi, 2015). Through collaborating with several marketing professors, a 16- item financial literacy instrument was developed and pre-tested across three universities and scores of students. The shorter instrument maintained similar “means” to the larger, ungainly Jump$tart measure that had been used over decades primarily to study high school students. This research tested several new questions specifically developed to measure financially informed and effective judgments, vs more commonly measured financial knowledge (Jump $tart questionnaire). We also sought to update the context of the questions to better suit the age bracket of our subjects (college students). These two sample questions (among others) delve deeper into behavioral intentions: (1) You just received the following offers from credit card companies. It came in a good time because you needed $1,000 for a new laptop to replace the

- 17. old one that just broke down. You expect to be able to pay it back in full in two years. Which of the following would be the best offer?: • $0 signup fee and 10 percent annual percentage rate (APR) interest for two years. • $200 signup fee, 0 percent APR interest for the first year and 12 percent APR interest for the second year. • $0 signup fee, 0 percent APR interest for the first year and 18 percent APR interest for the second year. (2) Which of the following scenarios would you choose for books for next semester? The on-campus bookstore price of these books is $400. If you buy from the bookstore at full price, they will give you $100 back if you sell back all the books at end of the semester (one quarter of your purchase). Assume you cannot sell back books from online, or if purchased at a discount from the bookstore. Choose the best priced option: • You buy the books full price from the bookstore, you only sell back 80 percent of the books. • Bookstore has a sale at 25 percent off. • Online store rents them for 50 percent full price; you must pay shipping and

- 18. handling (receiving and returning) of approximately $45 each way. Although these are two of the longest, most complex (and time consuming) questions, they clearly resonate with a younger subject pool and represent complex decision making with real financial outcomes. 980 IJBM 37,4 The next step was to use the instrument to test and compare and contrast financial literacy levels of college of business majors. The marketing professors were interested in whether marketing majors would score poorly – particularly in comparison to more “quantitative” business majors such as accounting and finance. After canvassing the financial literacy literature, two marketing professors suggested adding an experimental teaching component to the testing of business majors. The marketing professors had developed innovative pedagogical tools to improve numeracy and statistical knowledge in marketing students using online training videos in the past. Armed with the understanding that these kinds of tools were not being commonly used to improve financial literacy with college students, the co-authors set out to find or produce a

- 19. more personalized, online video that could be easily accessed by students on their own time. The video would be short in time (shorter than a single class period), cost effective (utilizing extant videos on YouTube – or easily produced videos by a professor) and effective in terms of increasing financial literacy measures. The goal of this study then expanded beyond simply measuring financial literacy in college of business majors, to include a teaching innovation to improve students’ financial literacy knowledge. Collaborating researchers across different disciplines added to the richness of the scale development and teaching innovation. Students at the private southeast school in three different business courses participated in the experiment. Students in introductory business (4 sections for a total of 116 students), introductory finance (2 sections for a total of 36 students) and introductory marketing (3 sections of 92 students) course took part so that the researchers could maximize students from multiple majors. Video treatment development In order to quickly roll out a video tool easily accessible to students, previously developed financial literacy videos on YouTube were chosen. It should be recognized, however, that instructors could create and develop their own videos for this or related pedagogical purposes. Researchers hoped the learning module could be integrated later into an introduction to business course – or a principles of marketing

- 20. course (perhaps during “break-even analysis” or “marketing math”) without having to add any significant class time to the curriculum. Dowell and Small (2011) found that college students’ incorporating online resources into their self-regulated learning strategies can significantly improve engagement and outcomes. Lusardi and Mitchell (2014) indicated that videos can be particularly compelling at improving financial literacy and Henager and Cude (2016) suggested that young people specifically respond to new and creative self-directed learning options. We hope this research contributes to the growing literature on packaging learning modules for millennials and delivering them online through YouTube and social media (Alwehaibi, 2015; Phillips and Trainor, 2014). Two private university professors were tasked with finding approximately one hour of video micro-lectures that could be easily aggregated into a module that students could download, free of charge, at their own convenience. This specific time length coupled with a short, financial literacy measurement tool would equate to the time of a single class period in a three or four credit-hour course. College students were expected to have a shortened attention span, one that is echoed by nearly all consumers who “spend very little time processing financial information” (Huhmann, 2017, p. 757). To test the efficacy of the module, financial literacy levels were assessed across cohorts receiving the treatment (module) vs those not receiving the

- 21. treatment. Financial literacy scores were also compared across several majors and several other classes (introduction to business), something not done in previous research. Finally, the researchers analyzed the impact of a previous personal finance course on their students’ financial literacy. 981 Improving financial literacy To minimize demand effects and not “teach to the test,” the researchers at the private institution were not given the measurement tool. They were given the GAO (2012) definition, several “popular press” articles on financial literacy and its decline among US students, and two other construct definitions as a guide for selecting the micro lectures to be included in the module (Jump$tart, 2014; Marcolin and Abraham, 2006). The total module length ended up at 67:36 – and the links can be accessed at: https://youtu.be/7cvDExdTKsw. The module was pre-tested with over a dozen undergraduate and MBA students to get feedback in terms of optimal length, concept clarity and the “level of boredom” as it was assumed (correctly, unfortunately, etc.) that undergraduate business students would have a limited attention span for some of these concepts. The pre-testing helped to inform the final length and video choices.

- 22. Experimental protocol and composition The use of several introductory courses with multiple sections allowed the researchers to reach a wider variety of majors than otherwise possible. The researchers included a question allowing them to assess if a student had previously taken personal finance. We were agnostic as to how differing majors and previous exposure to personal finance might impact the experimental results, although it was expected that those students that had taken such a course in the past would score higher on measures of financial literacy. Students in the experimental group were given the link to the video and asked to view it within a two-week period before Spring break. Both the control and experimental groups were asked immediately after spring break to fill out a questionnaire in class for extra credit – providing an interval of time between viewing the module and measuring financial literacy. There were no discussions of financial literacy in any of the classes. No details about the study were provided until after all students had completed the survey. A total of 244 students were involved in the research, all were given a financial literacy test. Of these, 122 were asked to watch the video, while 122 were not. The viewing data provided by the YouTube video indicated that there were 107 unique views of the video. Approximately 50 percent watched the entire video or most of it, while 13 percent watched less than 2 min of the video. The remaining 37 percent were

- 23. exposed to varying amounts of viewing. We were unable to parse out performance on the test based upon viewing time. Of the 244 students, 12 declined to provide their major, the remaining 183 identified business majors were as follows: marketing 23.4 percent, management 45.4 percent, accounting 22.9 percent and finance 8.3 percent. The majority of respondents had not taken a personal finance course (72 percent), while 28 percent had, ten of the students declined to answer the question. The majority of students were male (63 percent), had a GPA between 2.5 and 3.5 (62 percent) and were mostly juniors (54 percent) and seniors (33 percent). The 49 percent of the students had $1,000 or less of credit card debt, 29 percent had $1,000 to $3,000 and 22 percent had over $3,000. In total, 62 percent of the students anticipated having less than $5,000 in student loans, while 28 percent anticipated loans between $5,000 and $30,000, and 22 percentage anticipated loans over $30,000 with 5 percent of these students estimating loans of more than $50,000. The majority of the students were white (70 percent), with 13 percent African-American, 11 percent Hispanic and 6 percent other (including Asian and Native American). Experimental findings The primary research finding was that the relatively short (just over one hour) video treatment had a significant positive effect upon financial literacy scores for the students – across all majors (see Table I). The video treatment had a stronger positive effect

- 24. than a previously taken personal finance course (since most of these students are juniors, many of them would have recently taken the personal finance course – or even taking it concurrently). The most important finding is that those students exposed to the video 982 IJBM 37,4 https://youtu.be/7cvDExdTKsw module scored significantly higher than those who did not receive the treatment (po0.001; F-statistic ¼ 20.03). Having had a personal finance course also had a stronger positive effect (po0.03, F-statistic ¼ 4.64) but curiously there was not a significant interaction effect (p ¼ 0.21). A two-factor ANOVA model with fixed effects for the two main variables of interest (video treatment and personal finance course) and their interaction was used to analyze results. To explore student/major effects, marketing … follow exact paper format below BUS 300 1 Title of Paper Here

- 25. (type your introduction here) [~1/2 page] - statistics (recent: 2018, 2019, or 2020) (1 sentence, use in-text citations) - background information (~3 sentences, use in-text citations) - definition(s) (1 sentence, use in-text citations) Background on Financial Literacy [~2 pages] - summarize your topic with peer-reviewed articles from the last 5 years (2015-2020) and/or .gov sources from the last 5 years (2015-2020) - include definitions, if appropriate - Note: use in-text citations Current Research (summary of current research here) [~½ - 1 page] - include a summary of the main points from the first and second peer-reviewed articles below Title of the First Peer-Reviewed Article [~2 pages] [type the exact title of your peer-reviewed article above] - summarize the empirical peer-reviewed article (look for “n” in the abstract) - after you have completed your summary, you should be able to identify the who, what, when, where, why, and how in your summary Title of the Second Peer-Reviewed Article [~2 pages]

- 26. [type the exact title of your peer-reviewed article above] - summarize the empirical peer-reviewed article (look for “n” in the abstract) - after you have completed your summary, you should be able to identify the who, what, when, where, why, and how in your summary Conclusion [~1/2 page] - overall summary of your paper - Note: there should be no new information here, so there is no need to use in-text citations KnE Social Sciences 1st IRCEB The First International Research Conference on Economics and Business Volume 2018 Conference Paper Mitigating Consumptive Behavior By Enhancing Student’s Financial Literacy: Experiments Using Video Learning Suparti, Dodik Juliardi, Hendry Praherdhiono, Mohamad Arief Rafsanjani Accounting, Faculty of Economy, State University of Malang

- 27. Abstract In Indonesia, low level of financial literacy, which is reflected through consumptive behavior, has reached a point of concern. This study attempts to increase financial literacy among accounting students by using learning video. Learning video was used to increase financial literacy and decrease the consumptive behavior among students. This research used quasi experiment method in two classes (experiment class and control class). The findings indicate that video, as learning media, has a significant positive effect and can increase students’ financial literacy as well as decrease the consumptive behavior of students. Keywords: Financial Literacy, Consumptive Behavior, Video Learning. 1. Background Nowadays, financial literacy becomes a concern of many people. Some studies have shown that more and more people have low financial literacy in some countries in Europe, America, Australian and other countries, including developing countries [2, 10]. The same thing also occurs in Indonesia, in which the results of a survey which was conducted by the Financial Services Authority (OJK) show low level of financial literacy of Indonesians in 2016, which is only 29.66% [14]. Low financial literacy will affect many things, one of which is a person’s financial

- 28. behavior, reflected through consumptive behavior [3, 5, 10]. Therefore, this needs a serious attention and concern of all parties, including academicians. This is because in developing countries, college has a significant contribution to national development [12, 16]. The learning process in college is one of the important factors in forming of student financial literacy. Financial learning in college has a significant influence on knowledge and financial skills of students [9]. Various methods, media, and learning resources How to cite this article: Suparti, Dodik Juliardi, Hendry Praherdhiono, Mohamad Arief Rafsanjani, (2018), “Mitigating Consumptive Behavior By Enhancing Student’s Financial Literacy: Experiments Using Video Learning” in The First International Research Conference on Economics and Business, KnE Social Sciences, pages 433–441. DOI 10.18502/kss.v3i3.1901 Page 433 Corresponding Author: Suparti [email protected] Received: 23 January 2018 Accepted: 5 April 2018 Published: 23 April 2018

- 29. Publishing services provided by Knowledge E Suparti et al. This article is distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use and redistribution provided that the original author and source are credited. Selection and Peer-review under the responsibility of the 1st IRCEB Conference Committee. http://www.knowledgee.com mailto:[email protected] https://creativecommons.org/licenses/by/4.0/ https://creativecommons.org/licenses/by/4.0/ KnE Social Sciences 1st IRCEB are expected to give students knowledge and understanding in

- 30. the field of finance or often referred to as financial literacy [11]. Therefore, college need to design an effective learning to improve financial literacy so as to reduce the consumptive behavior of students. In order to achieve the purpose of personal finance learning effectively, the learning media used should be appropriate. The rapid development of technology encourages educators (lecturers) to utilize technology in classroom learning activities to support the achievement of learning objectives [17]. One of the technological developments that can be used in the learning process is video. The use of video in the learning process has many benefits, namely developing a student’s knowledge base, improving students’ understanding and dis- cussion, accommodating diverse learning styles of students, as well as improving stu- dents’ motivation and enthusiasm [4, 15]. Another study has shown that learning videos can be stored and reused at any time, which can be used as learning materials for independent learners and can be used for distance learning [13]. Well packaged learning videos can convey more real information; provide a new style of education, encourage curiosity and can be adjusted to the ability of learners; help view the topic with a broader perspective [1, 6, 8, 15]. Based on the background above, the research questions of this research are as

- 31. follows: 1. Is there any effect of using instructional video media on students’ financial liter- acy and consumptive behavior? 2. Can the use of learning video media improve students’ financial literacy and consumptive behavior? 2. Method Quasi experiment method is used in this research to see the effect of using video learning media on students’ financial literacy and its impact on students’ consumptive behavior. Financial literacy and consumptive behavior were measured by using an instrument which was developed by Danes & Haberman, (2007). The constructs for financial literacy are understanding the cost of buying on credit, knowing key questions to ask when shopping for auto insurance, knowing about investments (stocks, mutual funds, bonds, etc), and knowing the difference between needs and wants. While the constructs for consumptive behavior are tracking the expenses, comparing the prices, DOI 10.18502/kss.v3i3.1901 Page 434 KnE Social Sciences 1st IRCEB set aside money for future, using a budget, repay the money

- 32. owed on time, writing financial goals, achieving financial goals, and discussing money with family. This research uses two groups of accounting students at Universitas Negeri Malang with the same characteristics (ability, knowledge level/ financial literacy, location of learning, and qualification of teaching staff). The first group is experimental group. This group used a lecture model with learning video as the media, which have been prepared before and guided by a lecturer. The other group is a control group that was taught by using the conventional discussion model with Microsoft Office Power point as the learning media, which is also guided by a lecturer. At the beginning of the study, those two groups would be given a pre-test. Next, the experimental group is given treatment of personal finance video (as the learning media) and control group was taught by using Microsoft Office Power point as the learning media. At the end of the study, both groups would be given a post-test. Pre- test and post-test is used to determine the level of financial literacy and consumptive behavior of students. Group Pre-test Treatment Post-test Experimental O1 X O2 Control O1 - O2

- 33. Figure 1: Research Design. The pre-test and post-test results of these two groups would then be analyzed by using t-test to see the effect of using video as the learning media on financial literacy and its impact on students’ consumptive behavior. Analysis conducted in this study include several stages: First, the pre-test score in difference test (t-test) was used to ensure that students from both classes (experimental and control class) have the same level (equivalent) of students’ financial literacy and consumptive behavior. Second, we compared the mean of pre-test and post-test scores of each class to see whether there was an increase in the level of financial literacy and consumptive behavior after the treatment was given, followed by a t-test to see the significance of the increase in pre-test score to the post-test score. Third, we compared the mean of post-test scores of experimental class and control class to see which class having the higher post-test score. Furthermore, a difference test (t-test) was conducted on the gain score to see whether there were significant dif- ferences from those two classes, which would be used as a basis to conclude whether there is influence of treatment given. DOI 10.18502/kss.v3i3.1901 Page 435

- 34. KnE Social Sciences 1st IRCEB 3. Findings Researchers performed the analysis in several stages. First, we analyzed the pre-test results of experimental class and control class by using difference test (t-test) to see if there were differences in the level of financial literacy and consumptive behavior of the students in those two classes (subject of our study). The results can be seen in table 1 below: Table 1: T-test results of pre-test score of financial literacy and consumptive behavior variable. Variable t-test for Equality of Means sig. (2-tailed) Financial Literacy Equal variance assumed 0,893 Consumptive Behavior Equal variance assumed

- 35. 0,279 The results of difference test on pre-test score before the treatment was given (in table 1) show that there was no significant difference in the level of financial literacy and consumptive behavior among the students in both classes (experimental class and control class) who became the subject of our study (sig> 0.05). Second, after giving treatment in each class, lecturers in the experimental class provided personal finance material by using video as the learning media, while in con- trol class, teaching and learning activity was conducted conventionally (lectures and discussions) with Microsoft Office Power point as the learning media. The researchers conducted post-test to determine the level of financial literacy and consumptive behavior of students. The researchers then compared the mean of the pre-test and post-test scores of each class to see whether there was an increase in students’ level of financial literacy and consumptive behavior after the treatment was given. The results can be seen in table 2 and table 3 below: Table 2: Comparison of the mean of pre-test and post-test scores. Score of Pretest Score of Pretest Financial Literacy

- 36. Consumptive Behavior Financial Literacy Consumptive Behavior Experimental Class 26,85 61,9 30,54 68,96 Control Class 26,93 64,84 28,31 66,22 Table 2 above shows that the post-test score is higher than the pre-test score. To more convince us, a follow-up test namely difference test (t- test) was conducted to DOI 10.18502/kss.v3i3.1901 Page 436 KnE Social Sciences 1st IRCEB see if the post-test score is significantly different from the pre- test score. The results are shown in table 3 below: Table 3: Pre-test and post-test t test results in the experimental class and control class. Sig. (2-tailed) Experimental Class

- 37. Control Class Pair 1 Pretest FL-Posttest FL 0,000 0,000 Pair 2 Pretest CB-Posttest CB 0,000 0,000 Difference test results in table 3 above shows that the pre-test scores are different from post-test scores significantly (sig <.05). This indicates that learning by using video as learning media which was conducted in the experimental class increases students’ level of literacy and decrease students’ consumptive behavior. Third, the researchers compared the mean of post-test scores of the experimental class and control class to see which grade obtaining the higher post-test score. The results can be seen in table 4 below: Table 4: Comparison of mean of post-test score of the experimental class and control class. Experimental Class Control Class Financial Literacy Consumptive Behavior Financial Literacy Consumptive

- 38. Behavior Mean 30,54 68,96 28,31 66,22 Minimum 25,00 49,00 21,00 39,00 Maximum 36,00 102,00 37,00 93,00 The result of table 3 above can show that the mean of post-test scores achieved by experimental class is higher than the mean of post-test scores achieved by control class. Furthermore, a t-test was performed on the gain score to see whether there is a significant difference from the second post-test scores of both classes. The results can be seen in table 5 below: Table 5: Results of difference test on the gain score of experimental class and control class. Variable t-test for Equality of Means sig. (2-tailed) Financial Literacy Equal variance assumed 0,000 Consumptive Behavior

- 39. Equal variance assumed 0,000 DOI 10.18502/kss.v3i3.1901 Page 437 KnE Social Sciences 1st IRCEB The results of difference test on the gain score in table 5 above shows that both variables have sig value <0,05 which shows that statistically there is a significant difference of gain score obtained by experiment class and control class both at stu- dents’ financial literacy level and consumptive behavior. This indicates that there is influence of the use of video as the learning media on the level on financial literacy and consumptive behavior of students. The existence of this influence can be seen from the existence of significant difference of score between class which was taught by using video as the learning media (experimental class) and class which was taught by using Microsoft Office Power point as learning media (control class). 4. Discussion After treatment was given in each class, the researchers compared the mean of the pre-test and post-test scores of the two classes. Table 2 above

- 40. shows that there is an increase in the score of financial literacy and consumptive behavior. Results of t-test (table 3) also confirm that there is a significant difference between pre-test and post- test score. Then, we compared the mean of post-test score achieved by students of the experimental class and the mean of post-test score achieved by students of control class (table 4), showing that the mean of post-test scores achieved by students of the experimental class is higher than the mean of post-test scores achieved by students of control class, followed by t-test on the gain score (table 5), showing that there is statistically significant difference in gain scores achieved by the experimental class and control class, both at the level of financial literacy and consumptive behavior of students. This shows that there is a positive influence of the use of video as learning media on the level of financial literacy and consumptive behavior of students. The existence of this influence can be seen from the significant difference of gain scores between class which was taught by using video as the learning media (experimental class) with class which was taught by using Microsoft Office Power point as the learning media (control class). These results support the previous findings that financial learning in college is one of the important factors in forming the financial literacy of

- 41. students. Financial learning in college has a significant influence on students’ financial knowledge and skills [9]. The findings also show us that the use of certain strategies, such as the use of video as the learning media, can improve the knowledge of students, which in this case is financial literacy. This is in line with some of the previous findings [11, 17]. DOI 10.18502/kss.v3i3.1901 Page 438 KnE Social Sciences 1st IRCEB This study also supports the previous findings that the use of video as the learning media can convey more tangible information; provide new educational styles and encourage learners’ curiosity [1, 6, 8, 15]. It is proven in this research that the achieve- ment level of experiment class is better and significantly different from the control class. In the experimental class, the lecturer taught by using the video as the learning media, while in the control class the lecturer taught by using conventional method, lectures and discussions, without using any media. Low financial literacy in many countries, both developed countries and developing countries, including in Indonesia [2, 10, 14] will affect many things, one of which is the financial behavior of a person, which is reflected through consumptive behavior

- 42. [3, 10]. It needs to be taken seriously by us, academicians in college. This is because college has a significant contribution to national development [12, 16]. The findings of this study show that if we have concerns to improve students’ knowledge, especially in financial literacy and consumptive behavior, we need to design an effective learning; therefore, the purpose of learning can be achieved effectively. This study shows that the use of video as learning media can achieve the learning objectives. 5. Conclusion The use of learning video media has a significant positive effect on the level of financial literacy, and ultimately can decrease the consumptive behavior of students. It empha- sizes to us as teachers that effective learning can be designed by using certain strategy or media, so that the purpose of learning can be achieved well. 6. Limitation This study was conducted on accounting students, so for the purposes of generalization in other majors, further study is needed due to differences in students’ characteristics and level of financial literacy owned. References [1] Aloraini, S. (2012). The impact of using multimedia on students’ academic achievement in the College of Education at King Saud

- 43. University. Journal of King Saud University - Languages and Translation, 24(2), 75–82. https://doi.org/10.1016/j. jksult.2012.05.002 DOI 10.18502/kss.v3i3.1901 Page 439 https://doi.org/10.1016/j.jksult.2012.05.002 https://doi.org/10.1016/j.jksult.2012.05.002 KnE Social Sciences 1st IRCEB [2] Atkinson, A. & F. Messy. (2012). Measuring Financial Literacy: Results of the OECD / International Network on Financial Education (INFE) Pilot Study. OECD Working Papers on Finance, Insurance and Private Pensions, No. 15. https://doi.org/http://dx. doi.org/10.1787/5k9csfs90fr4-en [3] Chinen, K., & Endo, H. (2014). Observation of Financial Literacy among the Selected Students in the U.S. and Japan. International Journal of Economics and Finance, 6(9), 95. https://doi.org/10.5539/ijef.v6n9p95 [4] Cruse, Emily. (2006). Using Educational Video in the Classroom: Theory, Research and Practice |Media and Learning. Retrieved August 30, 2017, from http://www. libraryvideo.com/articles/article26.asp [5] Danes, S. M., & Haberman, H. R. (2007). Teen financial knowledge, self-efficacy, and behavior: A gendered view. Journal of Financial Counseling

- 44. and Planning, 18(2), 48–60. [6] Holsinger, Erik. (1995). How do multimedia works (Vol. 1). Riyadh: Arab Scientific Publishers. [7] Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial management: the connection between knowledge and behavior. Federal Reserve Bulletin, (Jul), 309–322. [8] Alfar, Ibrahim. (2009). Preparation and production of interactive multimedia software (1st ed.). Egypt: Delta Computer Technology. [9] Johnson, E., & Sherraden, M. (2007). From Financial Literacy to Financial Capability Among Youth. The Journal of Sociology & Social Welfare, 34(3). Retrieved from http: //scholarworks.wmich.edu/jssw/vol34/iss3/7 [10] Lusardi, A & Mitchell, OS. (2014). The Economic Importance of Financial Liter- acy:Theory and Evidence. Journal of Economic Literature, 52(1), 5–44. https://doi. org/http://dx.doi.org/10.1257/jel.52.1.5 [11] Lutfi, & Iramani. (2008). Financial Literacy Among University Students And Its Implications To The Teaching Method. Presented at the SEAAIR Conference, STIE Perbanas Surabaya. [12] Aligaweesa, Millicent A.k. (1987). The role of a university

- 45. in national development: a case study of makerere university. Journal of Educational Administration, 25(2), 294–307. https://doi.org/10.1108/eb009937 [13] Mohamad, Rossafri, Yahaya, Wan Ahmad Jaafar Wan, & Muninday, Balakrishnan. (2008). USING VIDEO MATERIALS IN FORMAL EDUCATION: A METHODOLOGICAL APPROACH. Retrieved August 30, 2017, from https://www.researchgate.net/ DOI 10.18502/kss.v3i3.1901 Page 440 https://doi.org/http://dx.doi.org/10.1787/5k9csfs90fr4-en https://doi.org/http://dx.doi.org/10.1787/5k9csfs90fr4-en http://www.libraryvideo.com/articles/article26.asp http://www.libraryvideo.com/articles/article26.asp http://scholarworks.wmich.edu/jssw/vol34/iss3/7 http://scholarworks.wmich.edu/jssw/vol34/iss3/7 https://doi.org/http://dx.doi.org/10.1257/jel.52.1.5 https://doi.org/http://dx.doi.org/10.1257/jel.52.1.5 https://www.researchgate.net/publication/265466001_ USING_VIDEO_MATERIALS_IN_FORMAL_EDUCATION_A _METHODOLOGICAL_APPROACH https://www.researchgate.net/publication/265466001_ USING_VIDEO_MATERIALS_IN_FORMAL_EDUCATION_A _METHODOLOGICAL_APPROACH KnE Social Sciences 1st IRCEB publication/265466001_USING_VIDEO_MATERIALS_IN_FOR MAL_EDUCATION_A_ METHODOLOGICAL_APPROACH

- 46. [14] OJK. (2017). Survei Nasional Literasi dan Inklusi Keuangan. Kemeterian Keuangan Republik Indonesia. Retrieved from http://www.ojk. go.id/id/berita-dan-kegiatan/siaran-pers/Documents/Pages/ Siaran-Pers-OJK-Indeks-Literasi-dan-Inklusi-Keuangan- Meningkat/17. 01.23%20Tayangan%20%20Presscon%20%20nett.compressed.p df [15] Qandeel, Abdul Rahman Yasin. (1998). Educational Methods and Technology Educa- tion (Vol. 1). Riyadh: Riyadh Publishing House. [16] Ross, A. M. (1973). The Role of Higher Education Institutions in National Develop- ment. Higher Education, 2(1), 103–108. https://doi.org/10.2307/3445764 [17] Smaldino, Sharon E., Lowther, Deborah L., & Russel, James D. (2015). Intructional technology & Media For Learning. USA: Pearson. DOI 10.18502/kss.v3i3.1901 Page 441 https://www.researchgate.net/publication/265466001_ USING_VIDEO_MATERIALS_IN_FORMAL_EDUCATION_A _METHODOLOGICAL_APPROACH https://www.researchgate.net/publication/265466001_ USING_VIDEO_MATERIALS_IN_FORMAL_EDUCATION_A _METHODOLOGICAL_APPROACH https://www.researchgate.net/publication/265466001_ USING_VIDEO_MATERIALS_IN_FORMAL_EDUCATION_A _METHODOLOGICAL_APPROACH