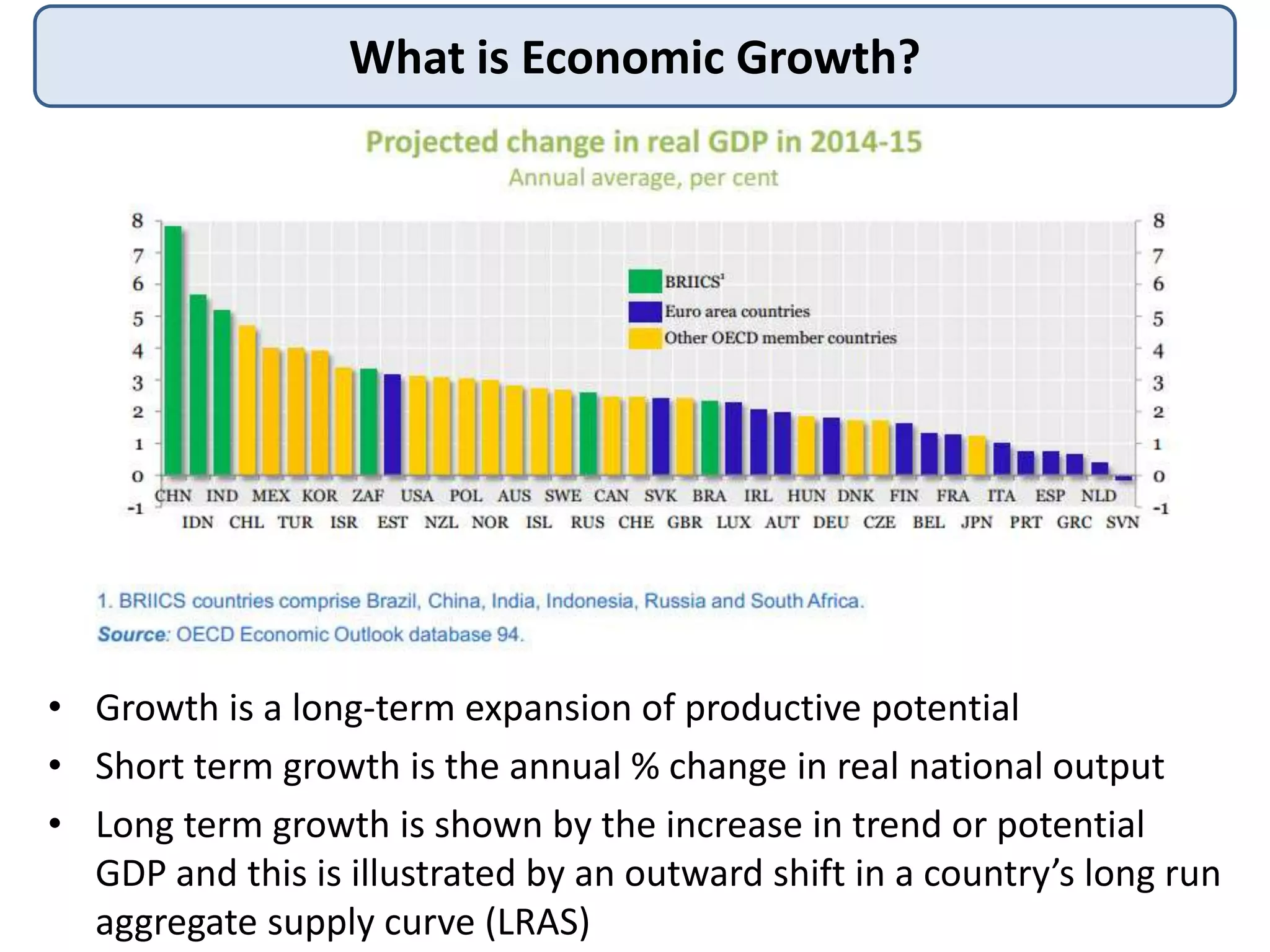

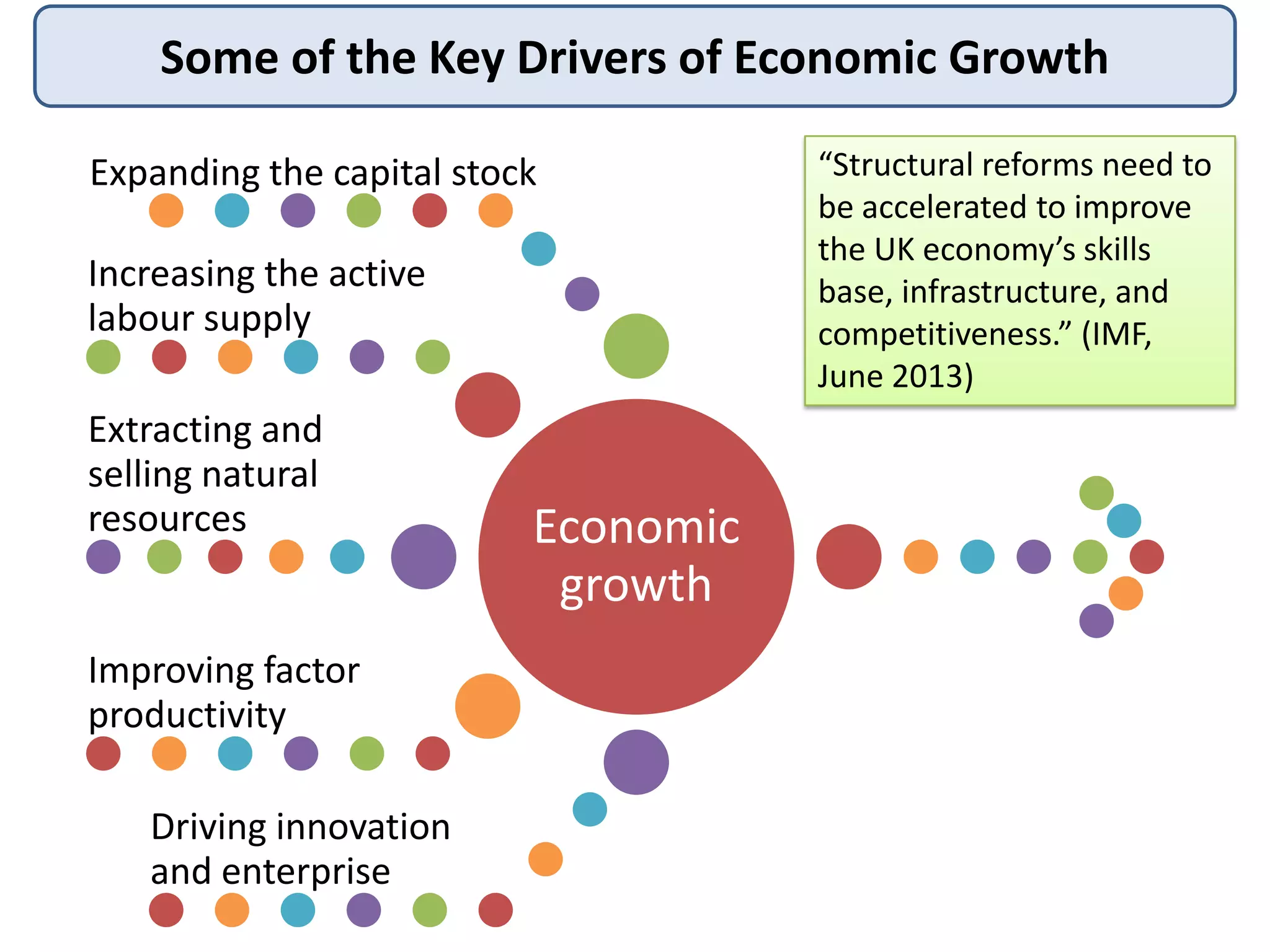

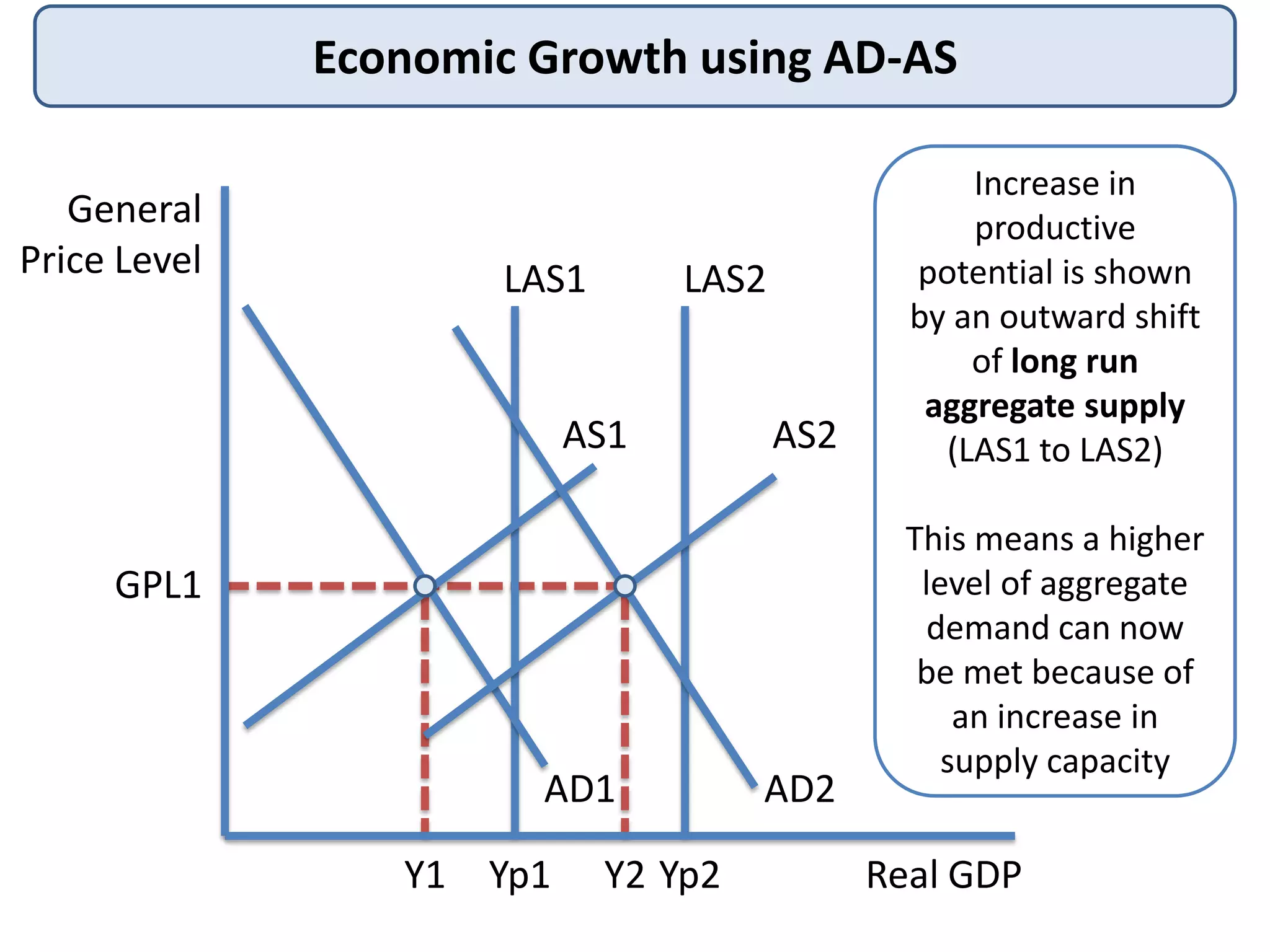

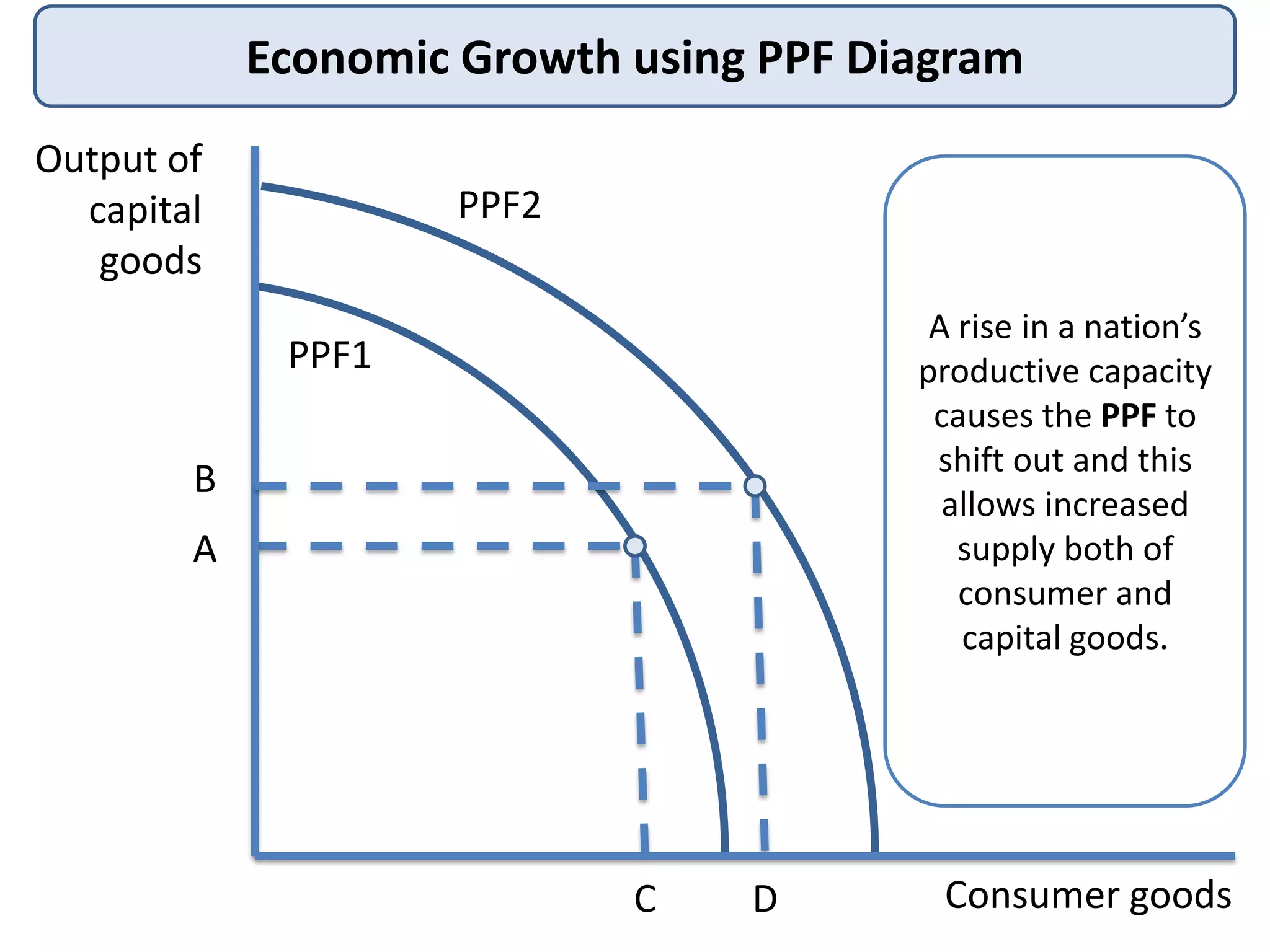

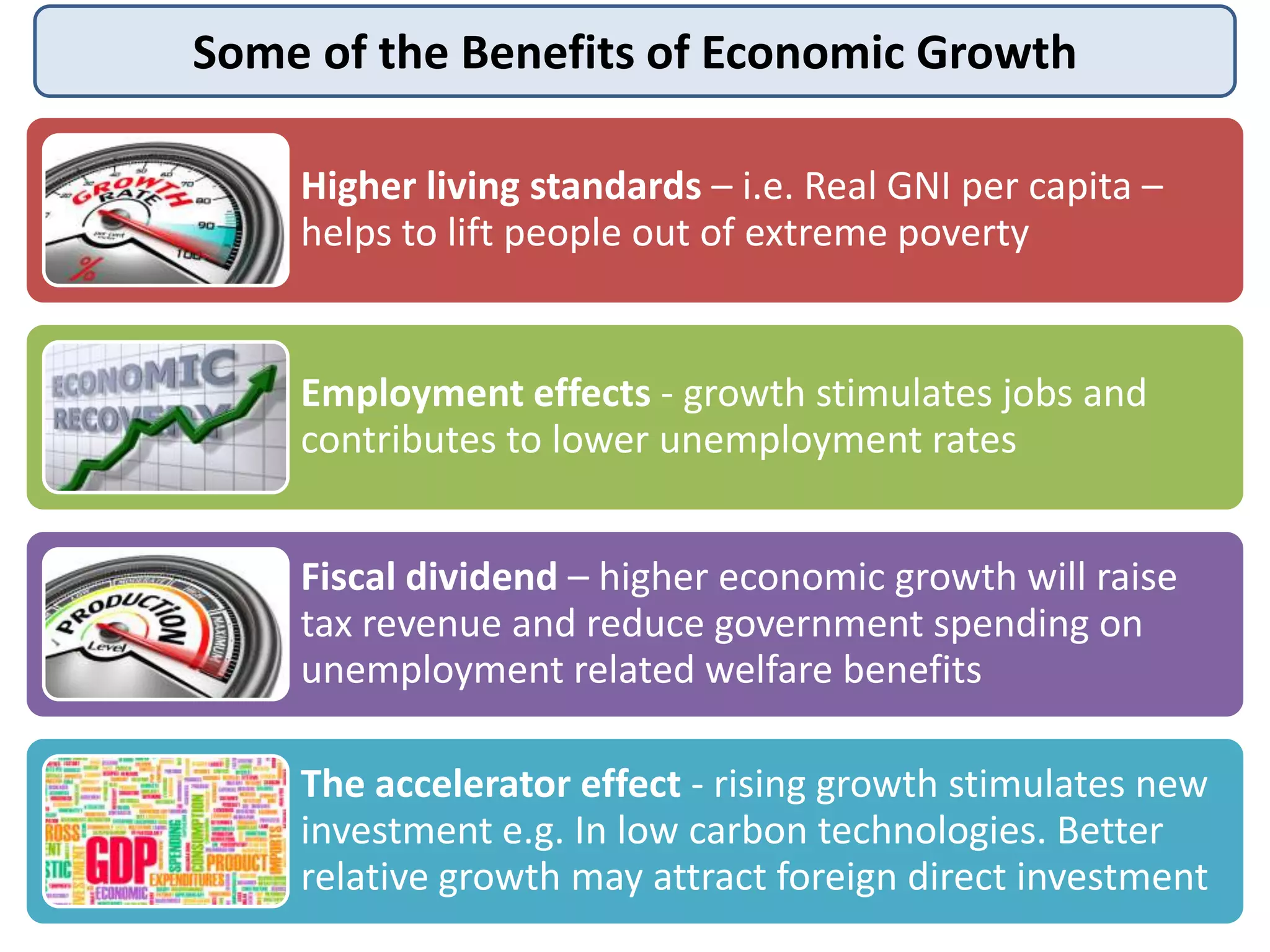

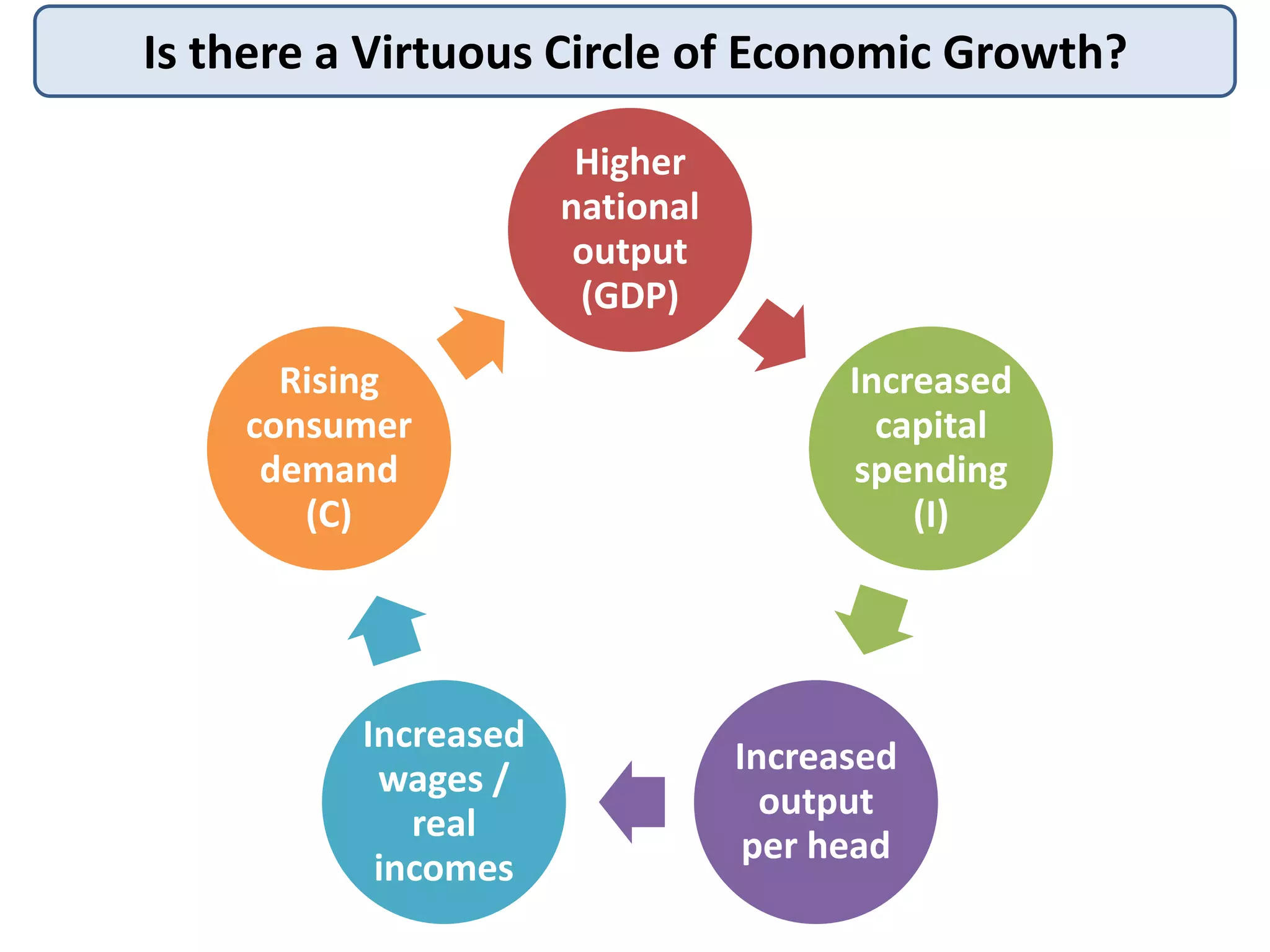

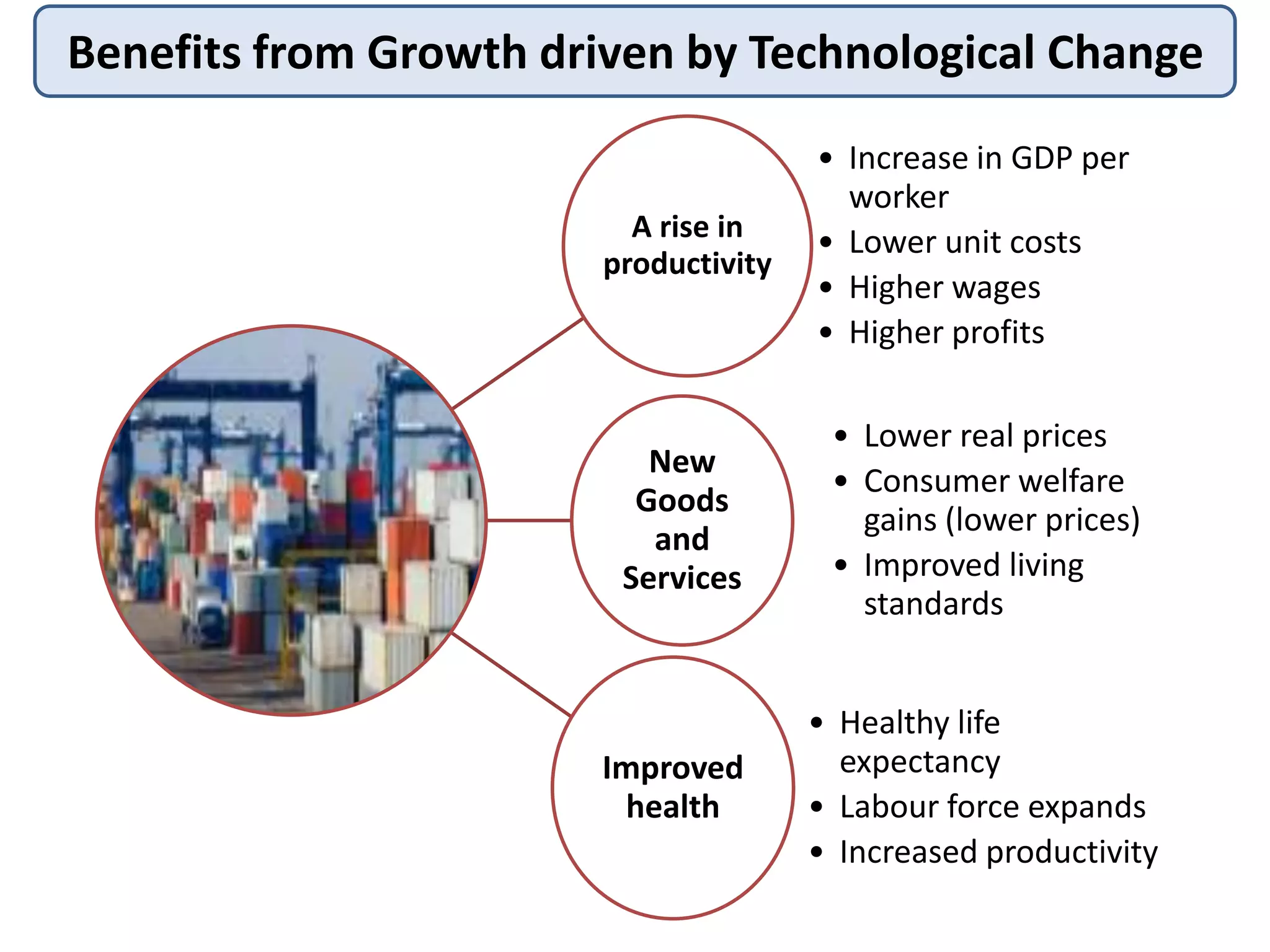

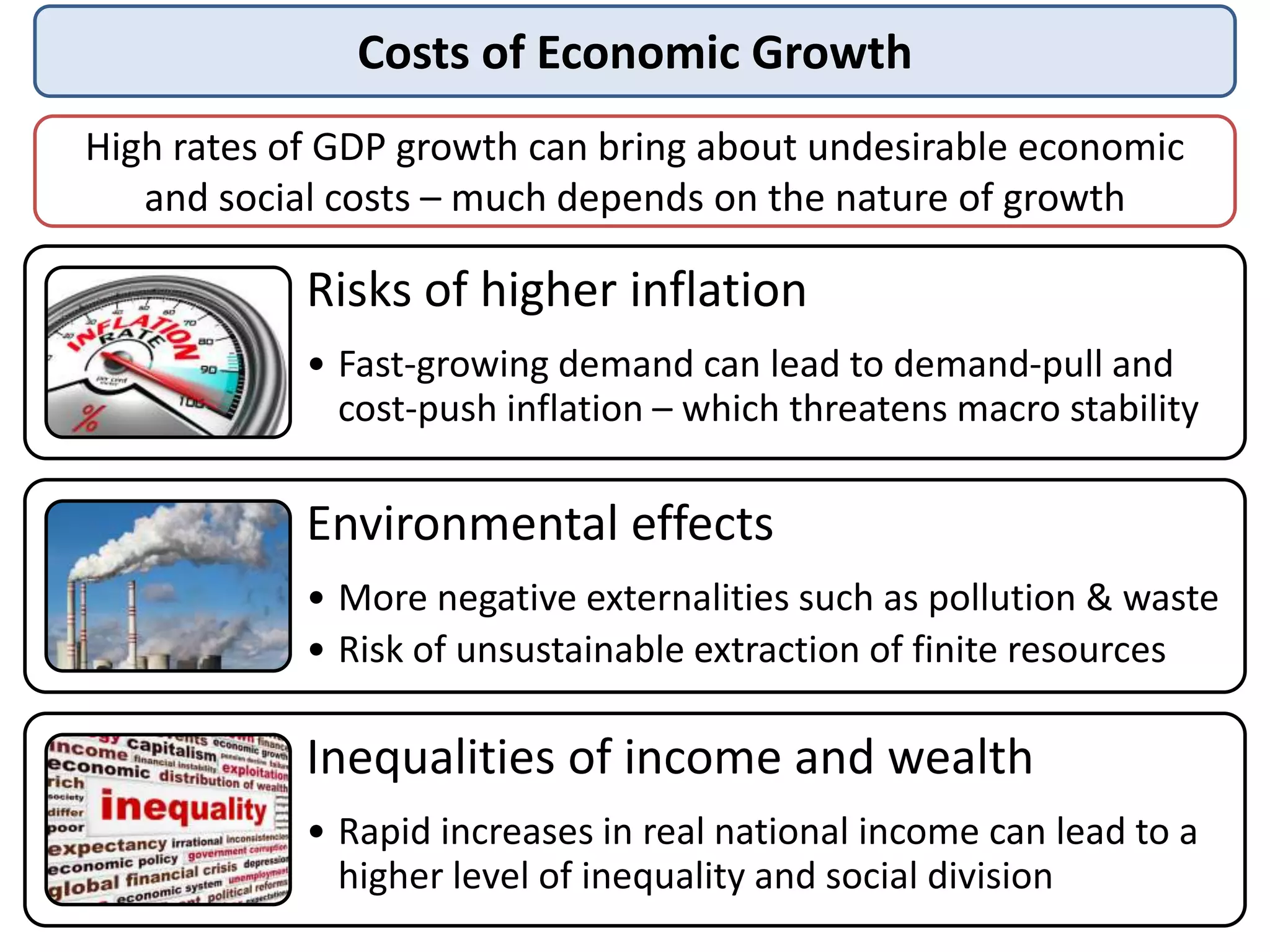

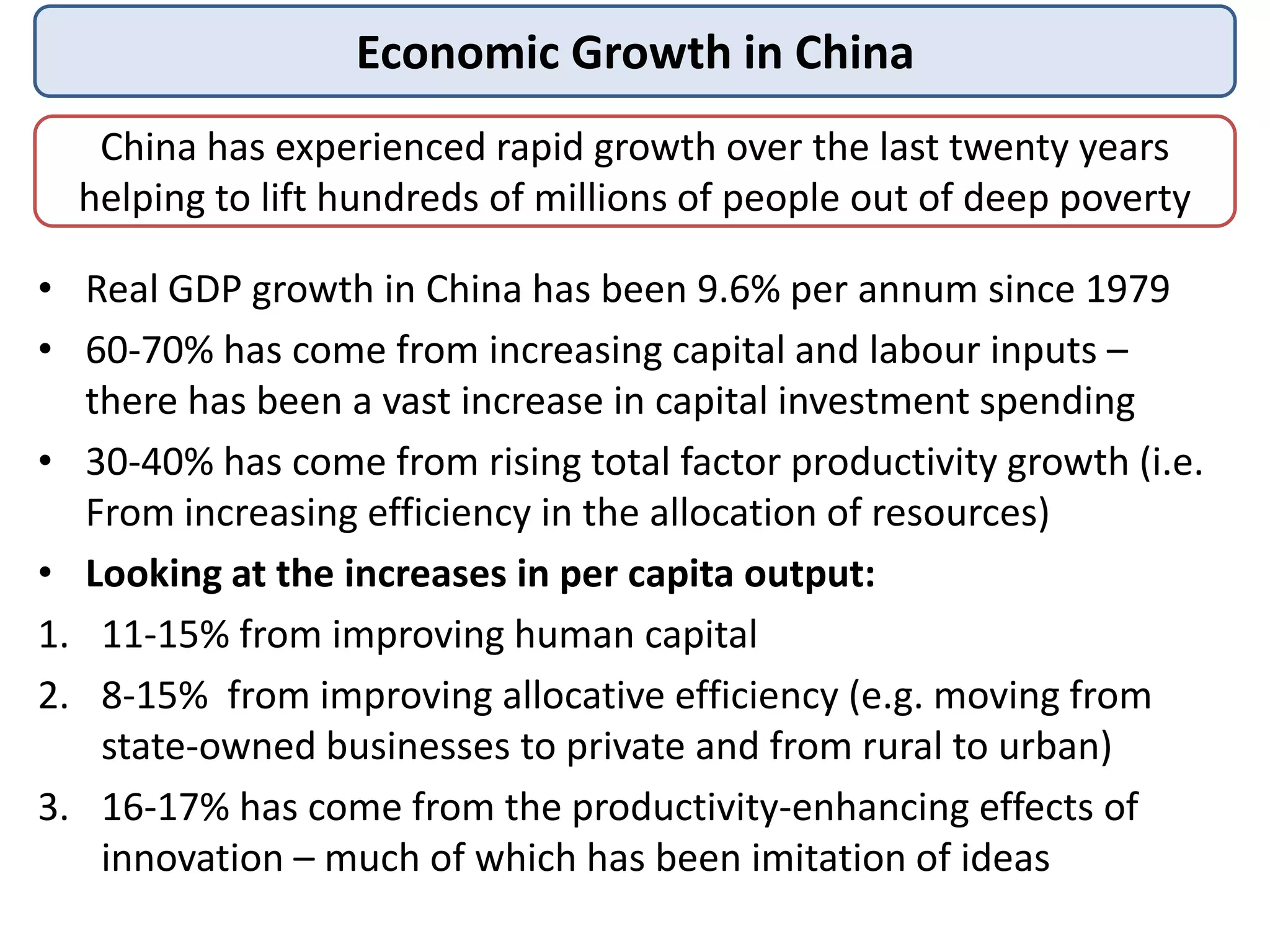

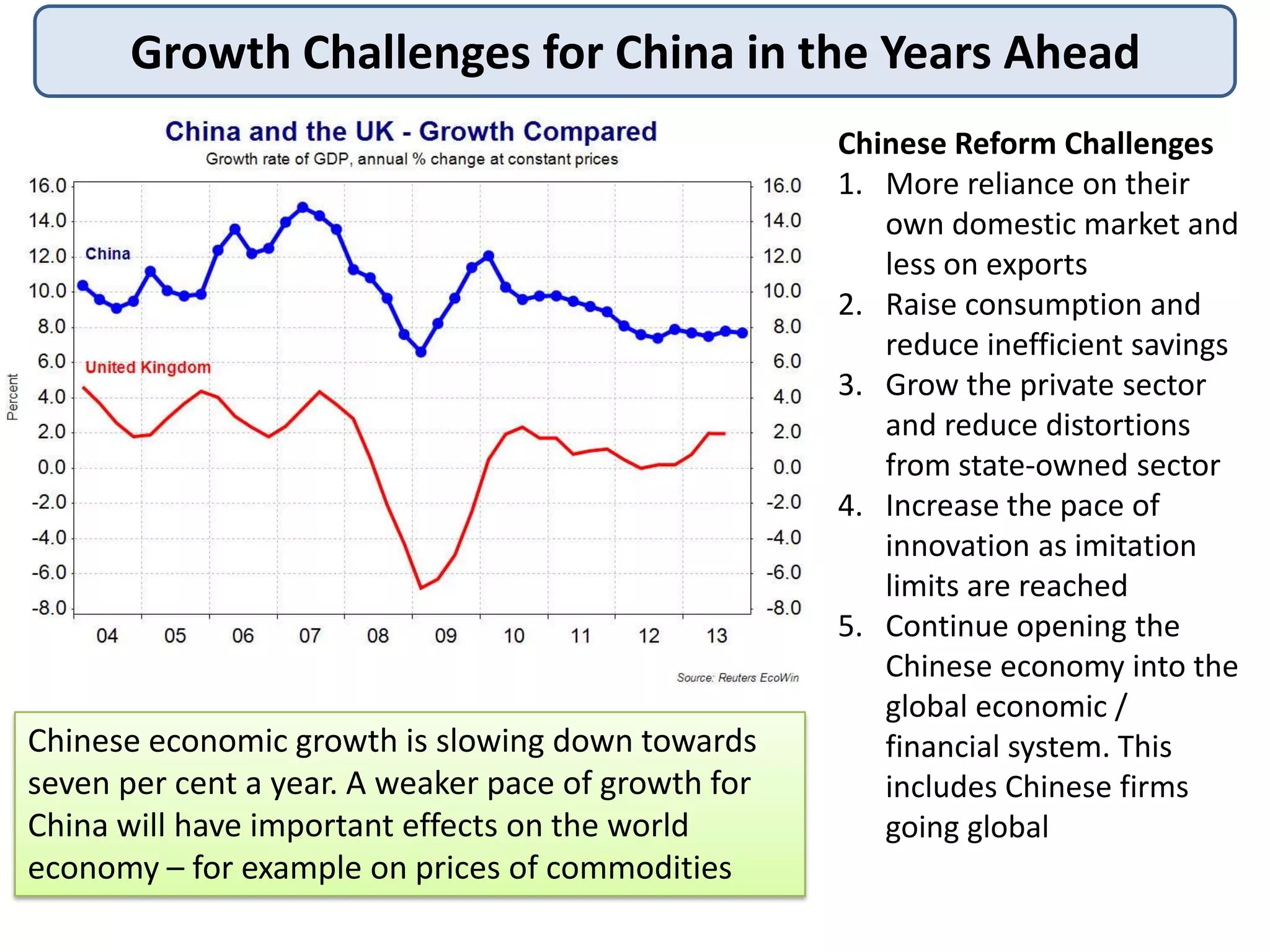

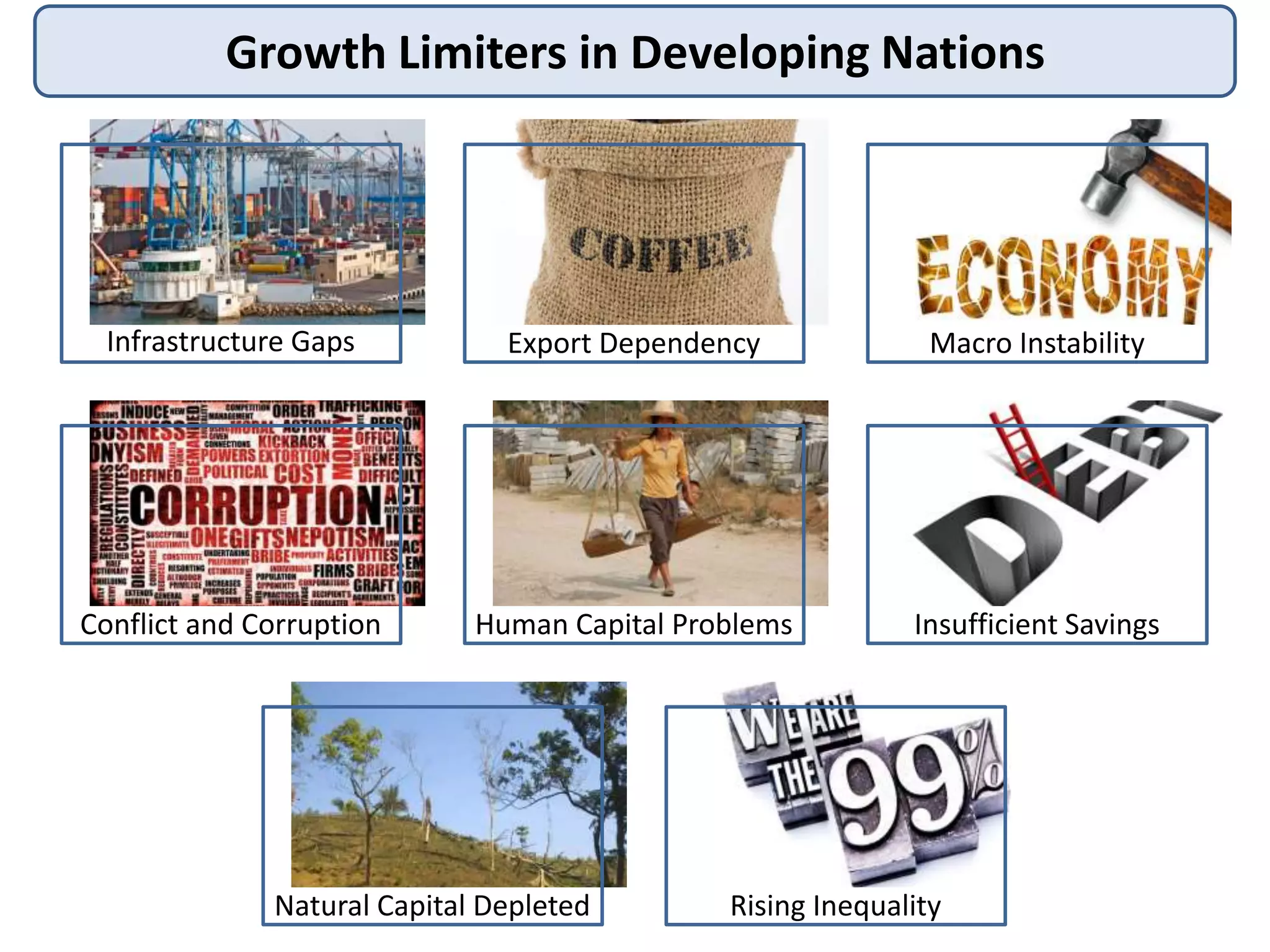

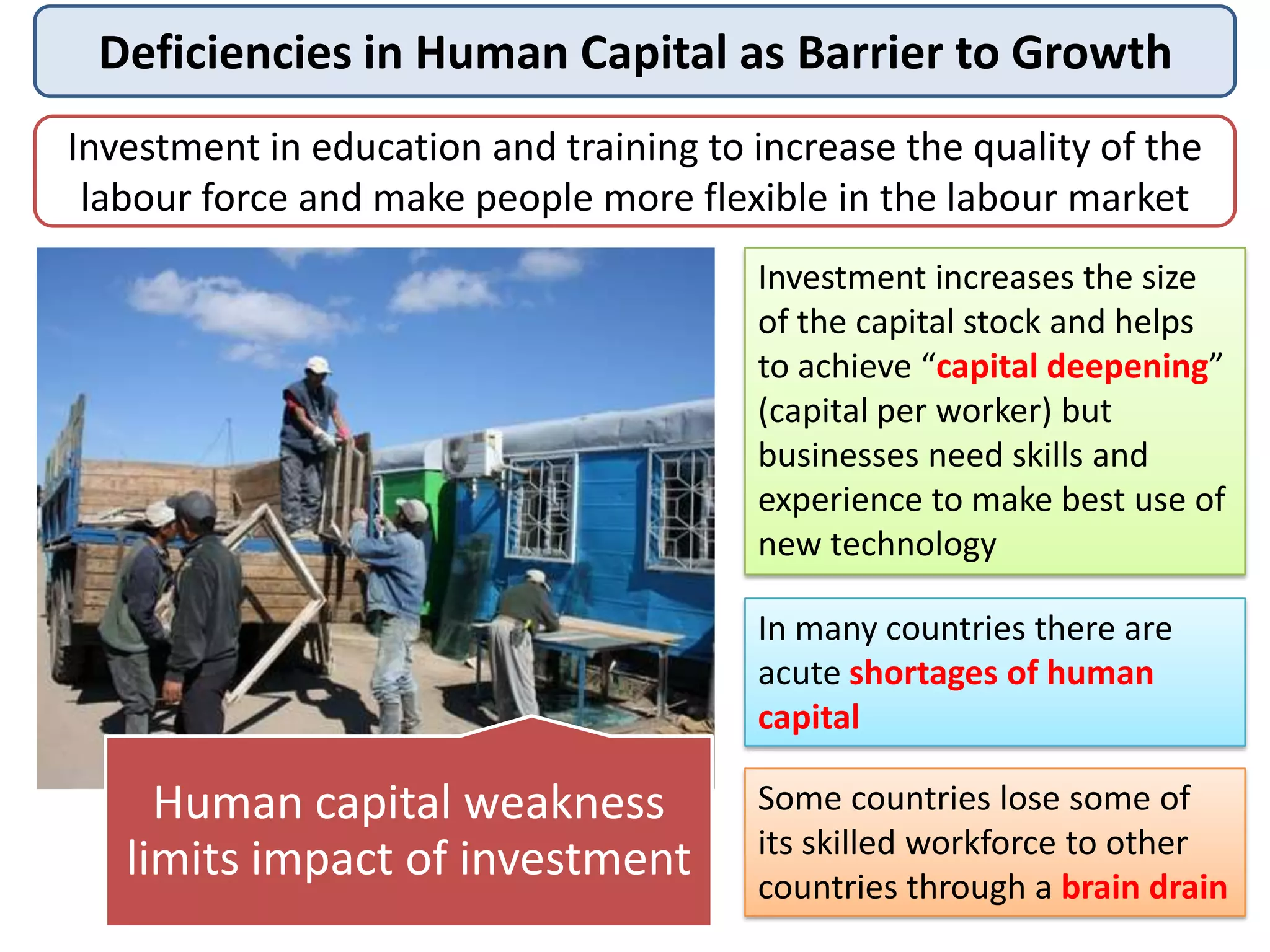

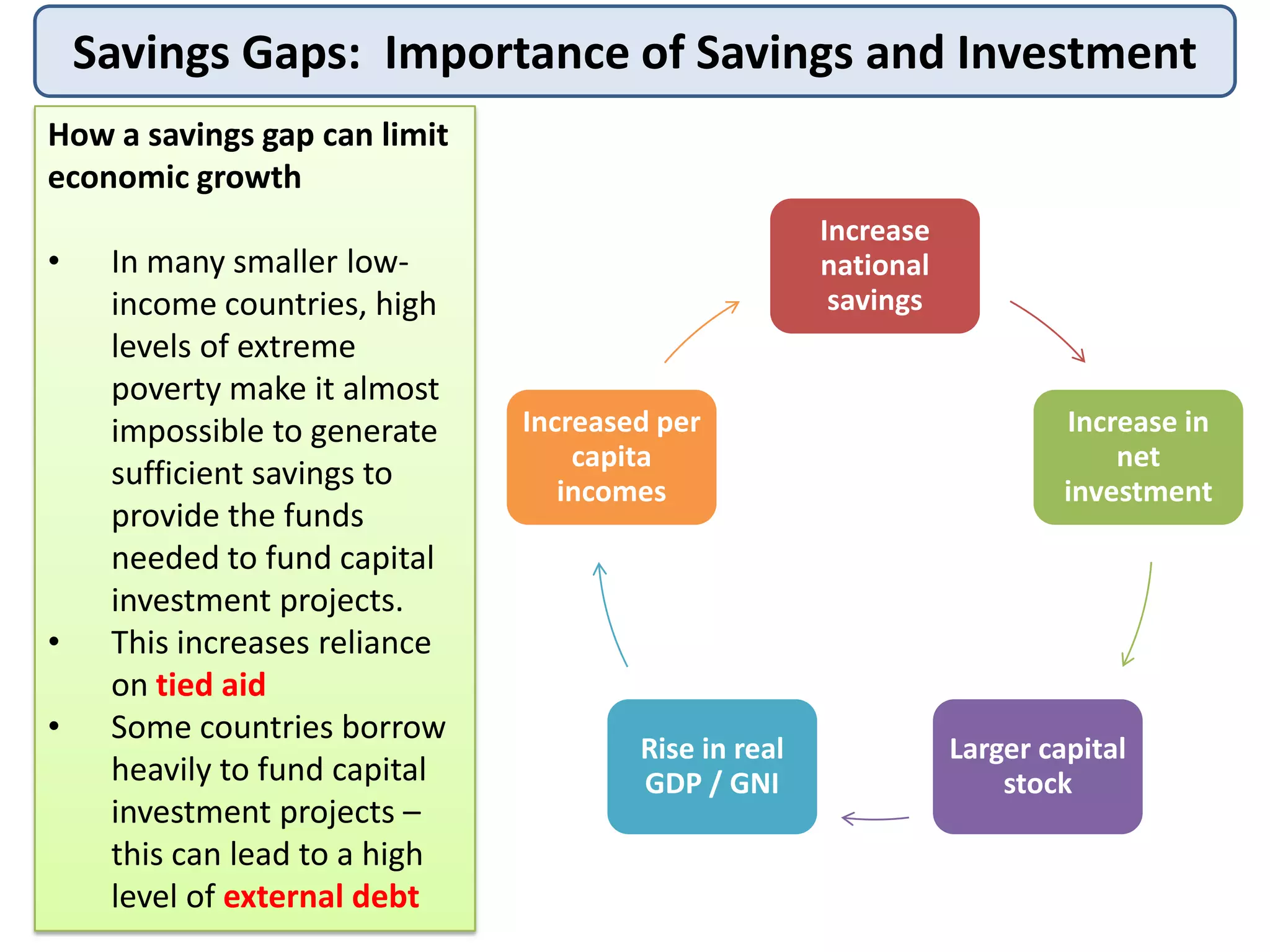

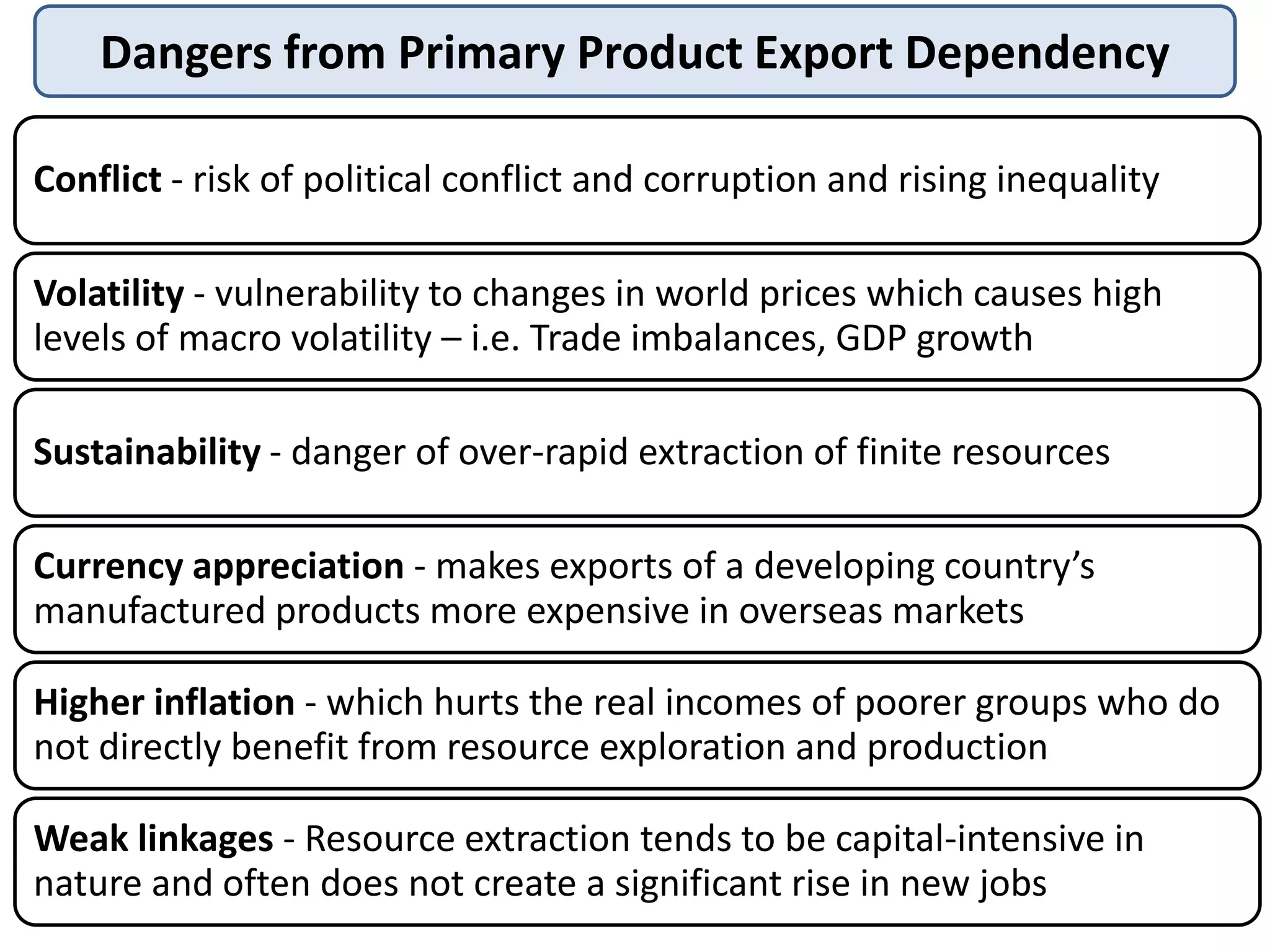

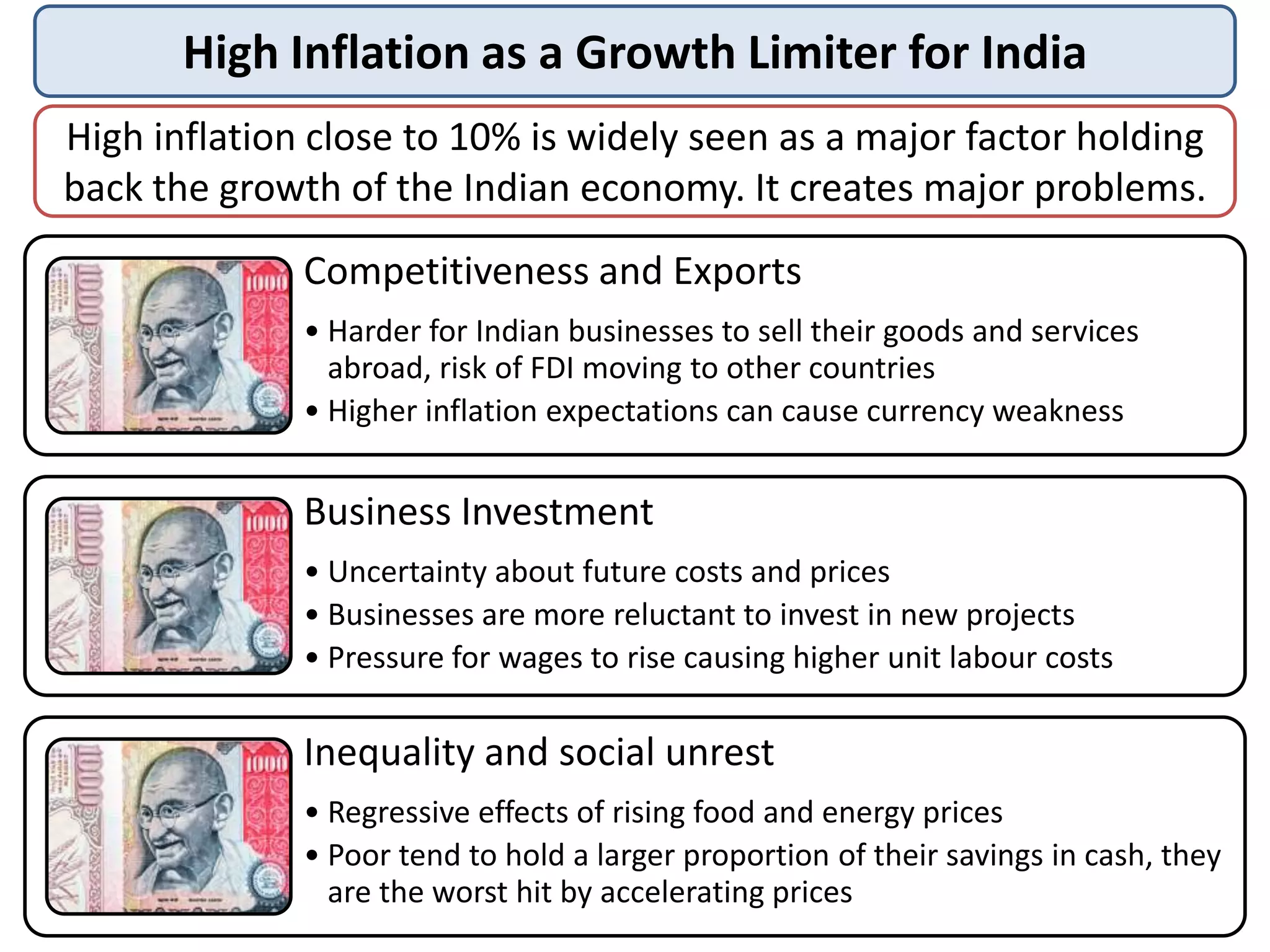

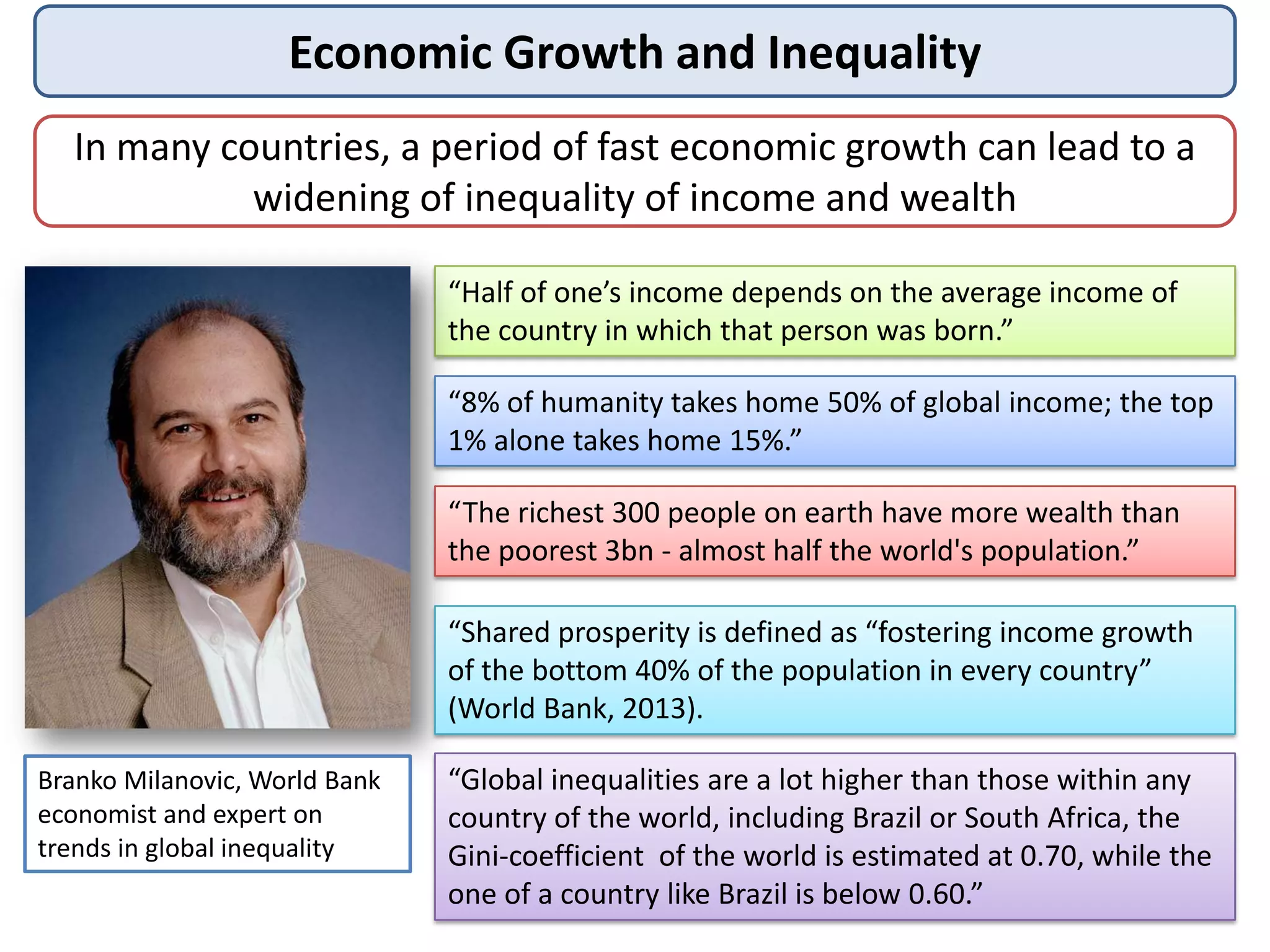

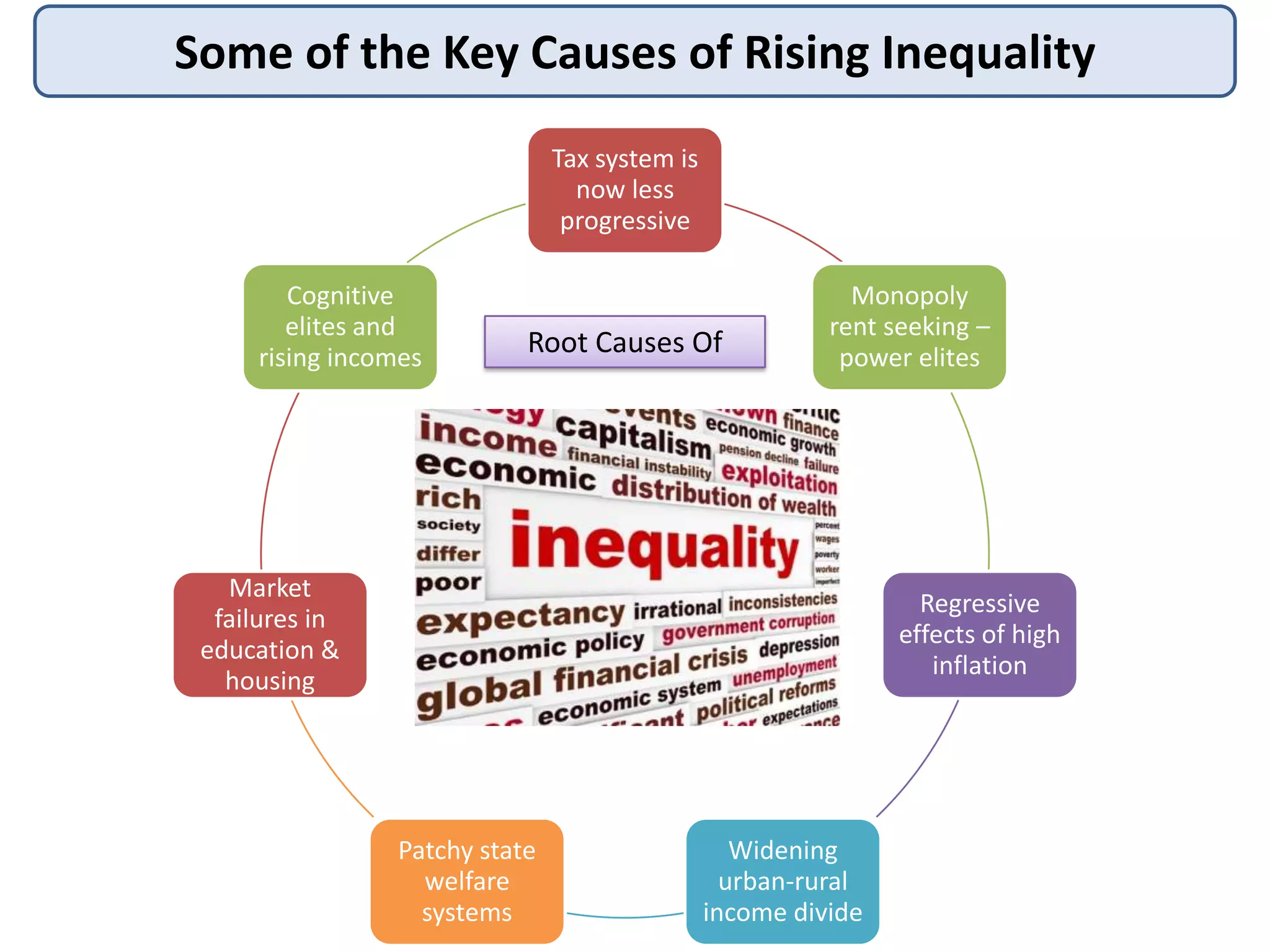

The document discusses economic growth and its key drivers. It defines economic growth as a long-term expansion of a country's productive potential. The main drivers of growth include increasing capital stock, labor supply, productivity, and innovation. However, growth also faces limitations such as infrastructure gaps, export dependency, human capital problems, and rising inequality within countries. Rapid growth can increase a nation's income but also widen inequality, posing challenges for maintaining balanced and sustainable development.