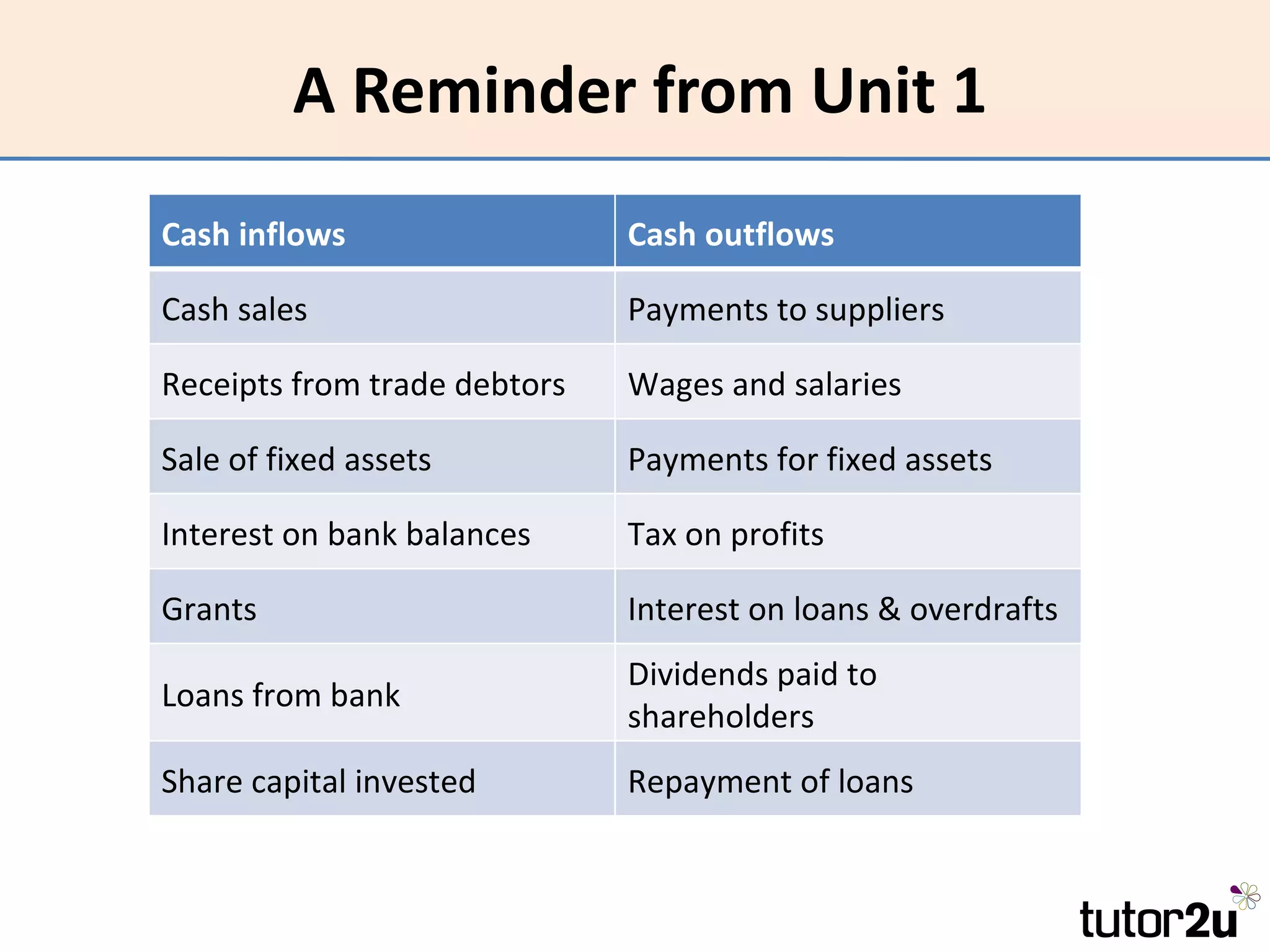

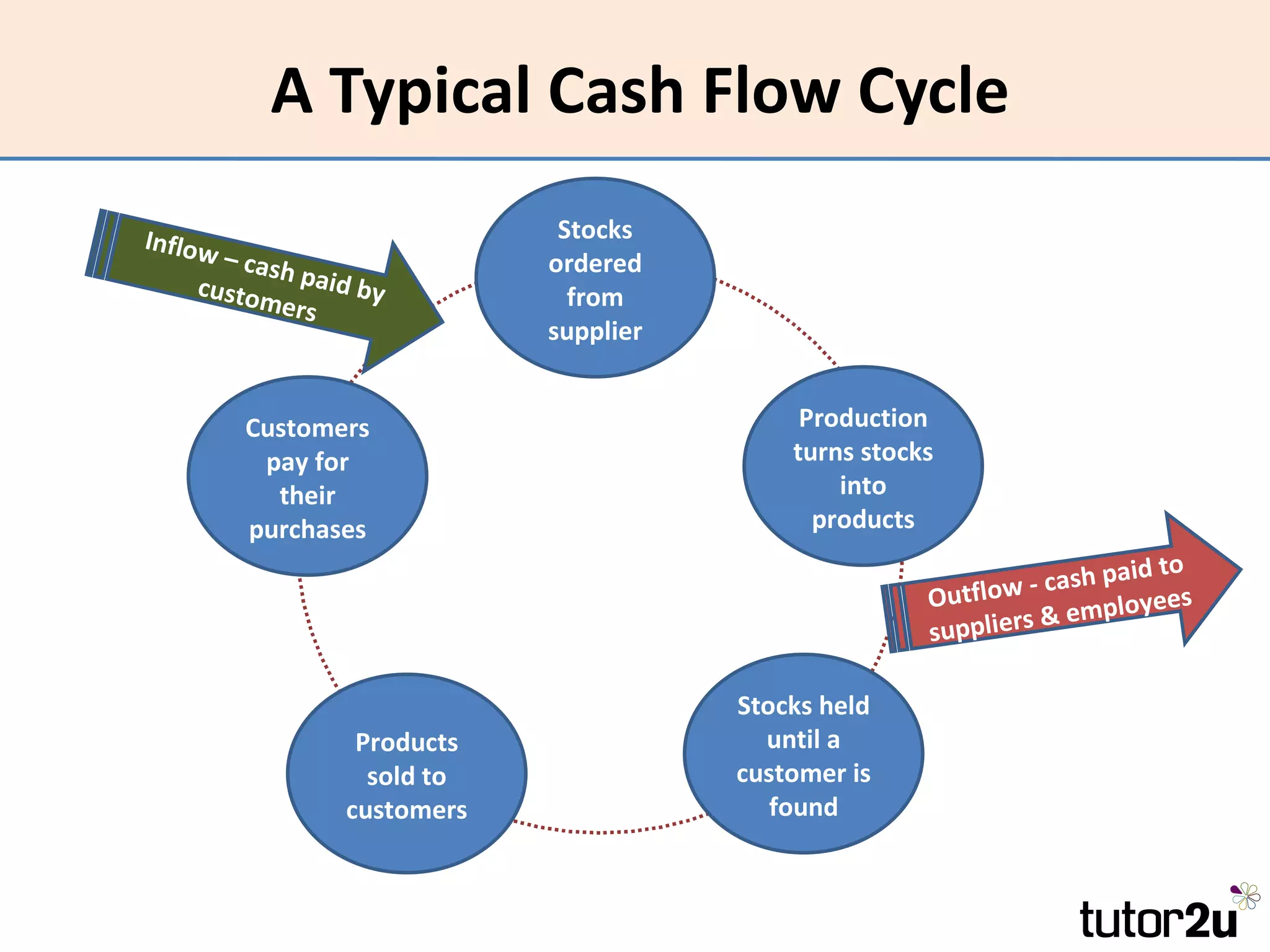

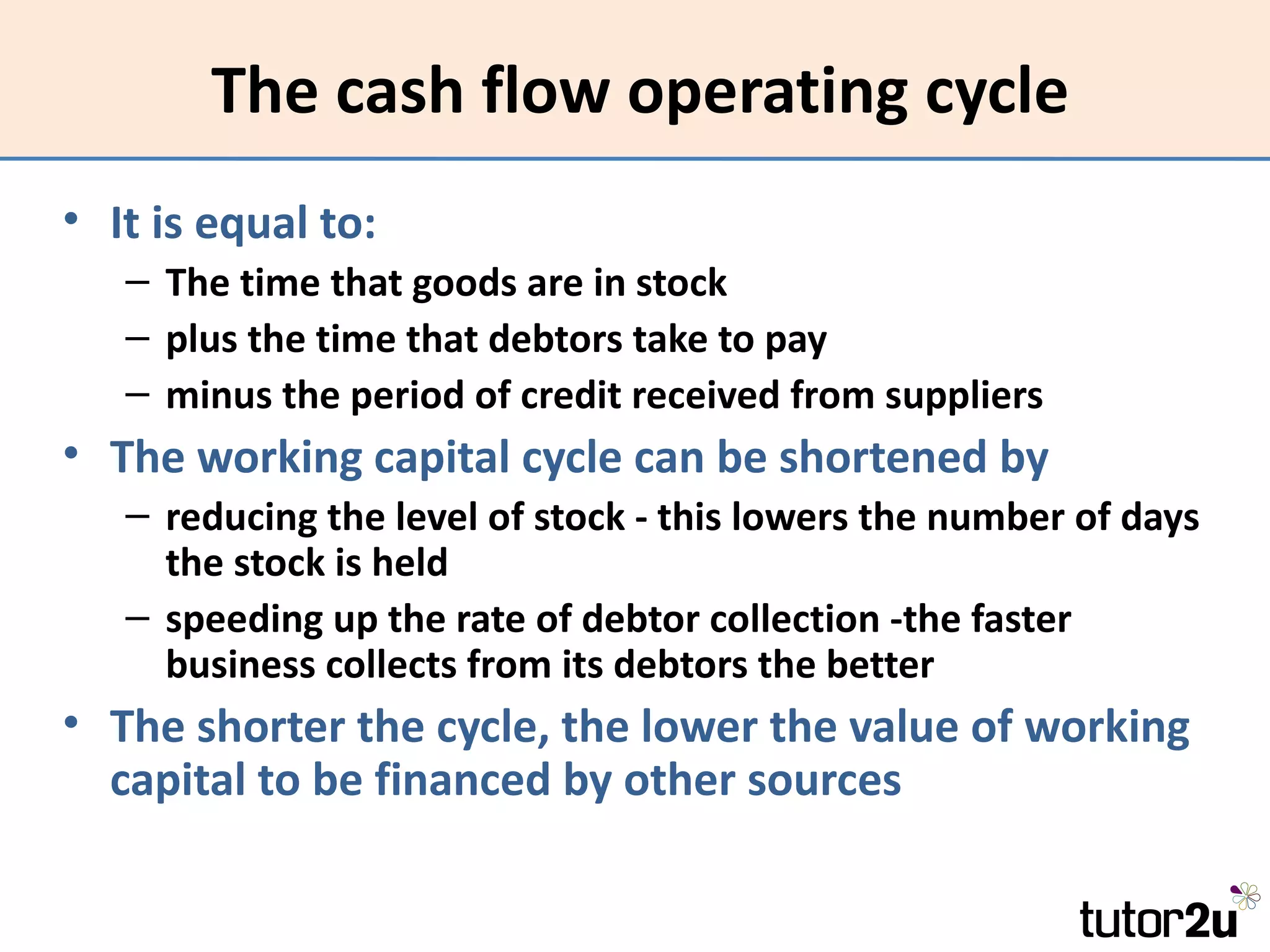

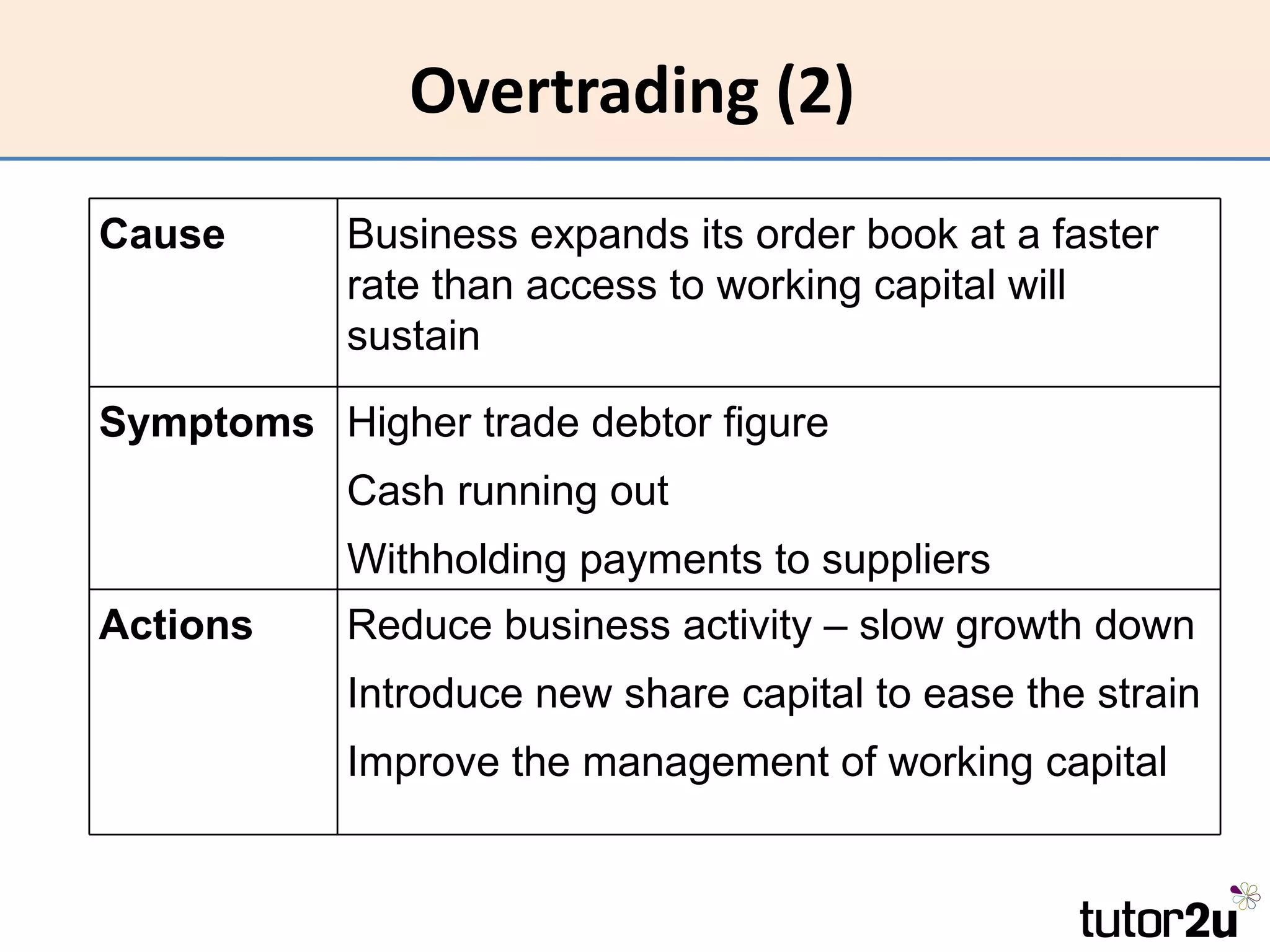

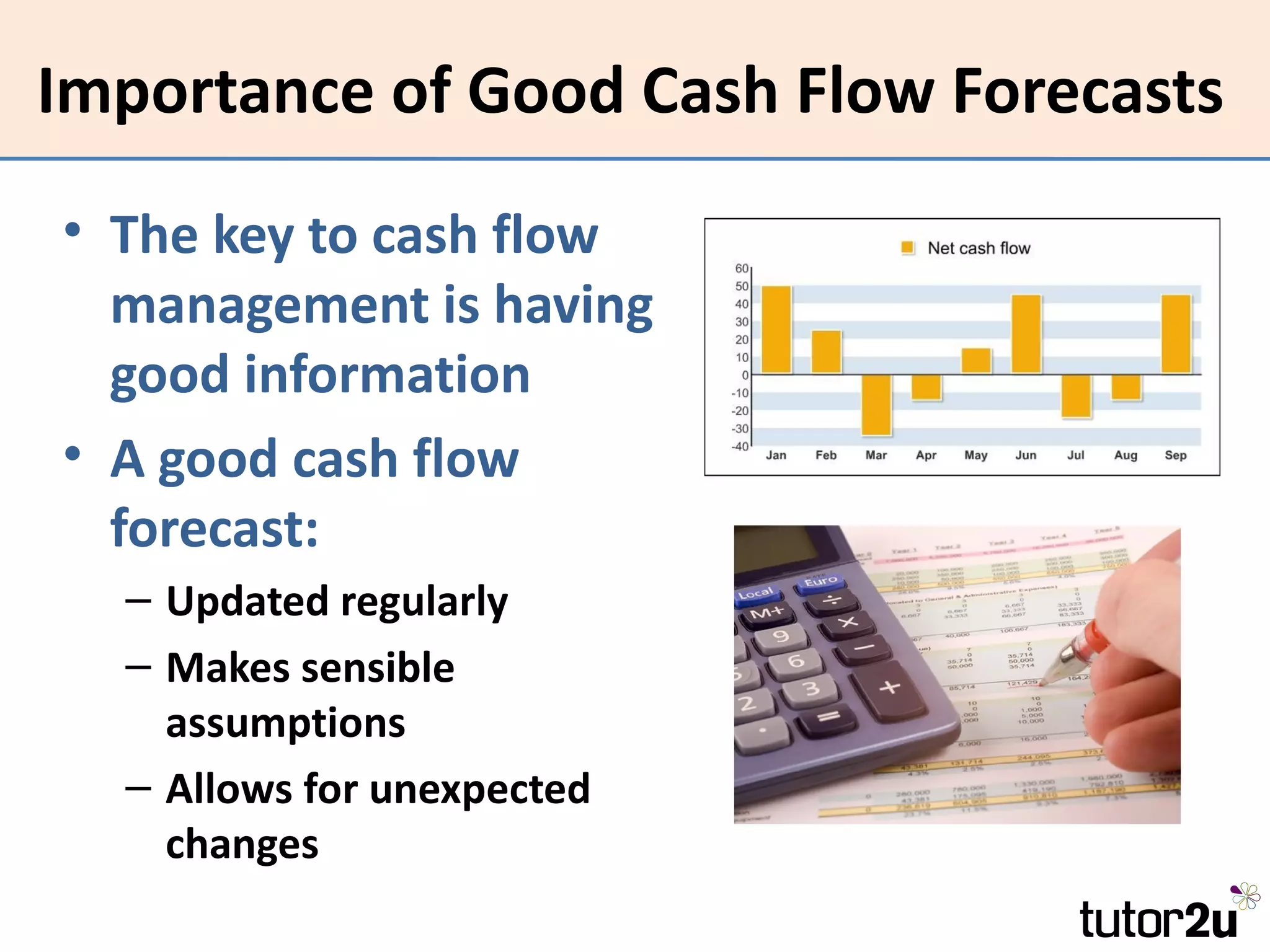

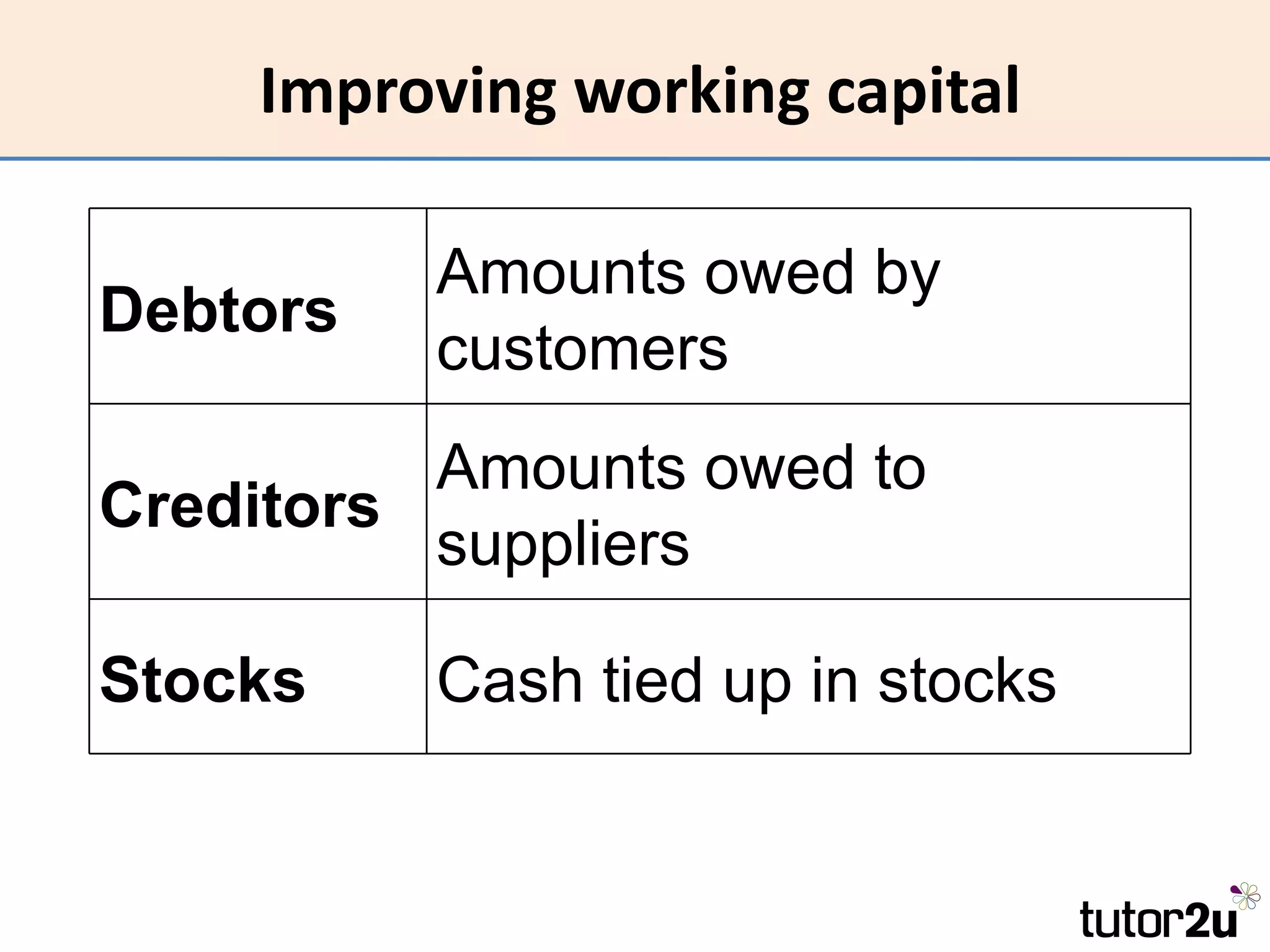

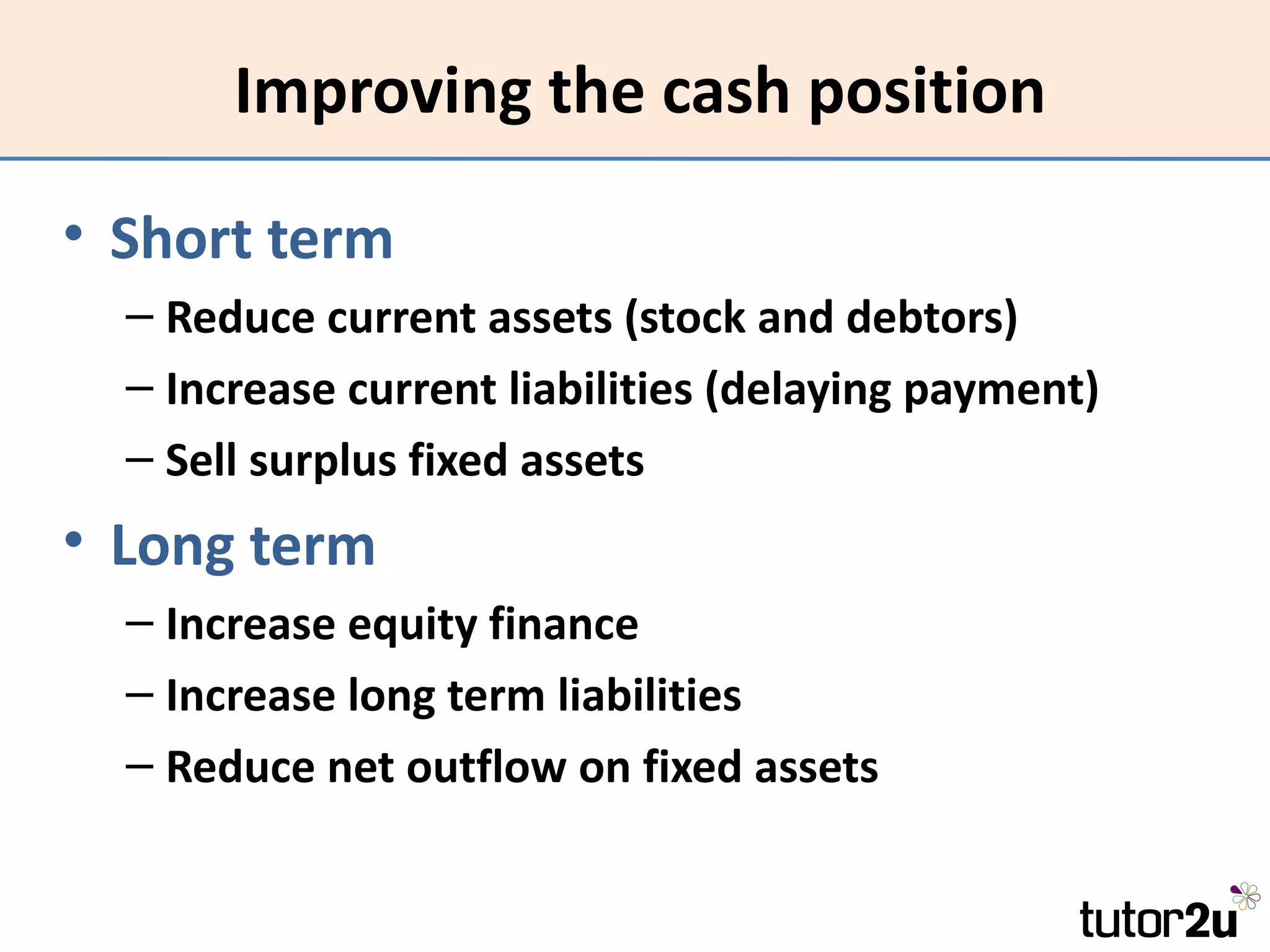

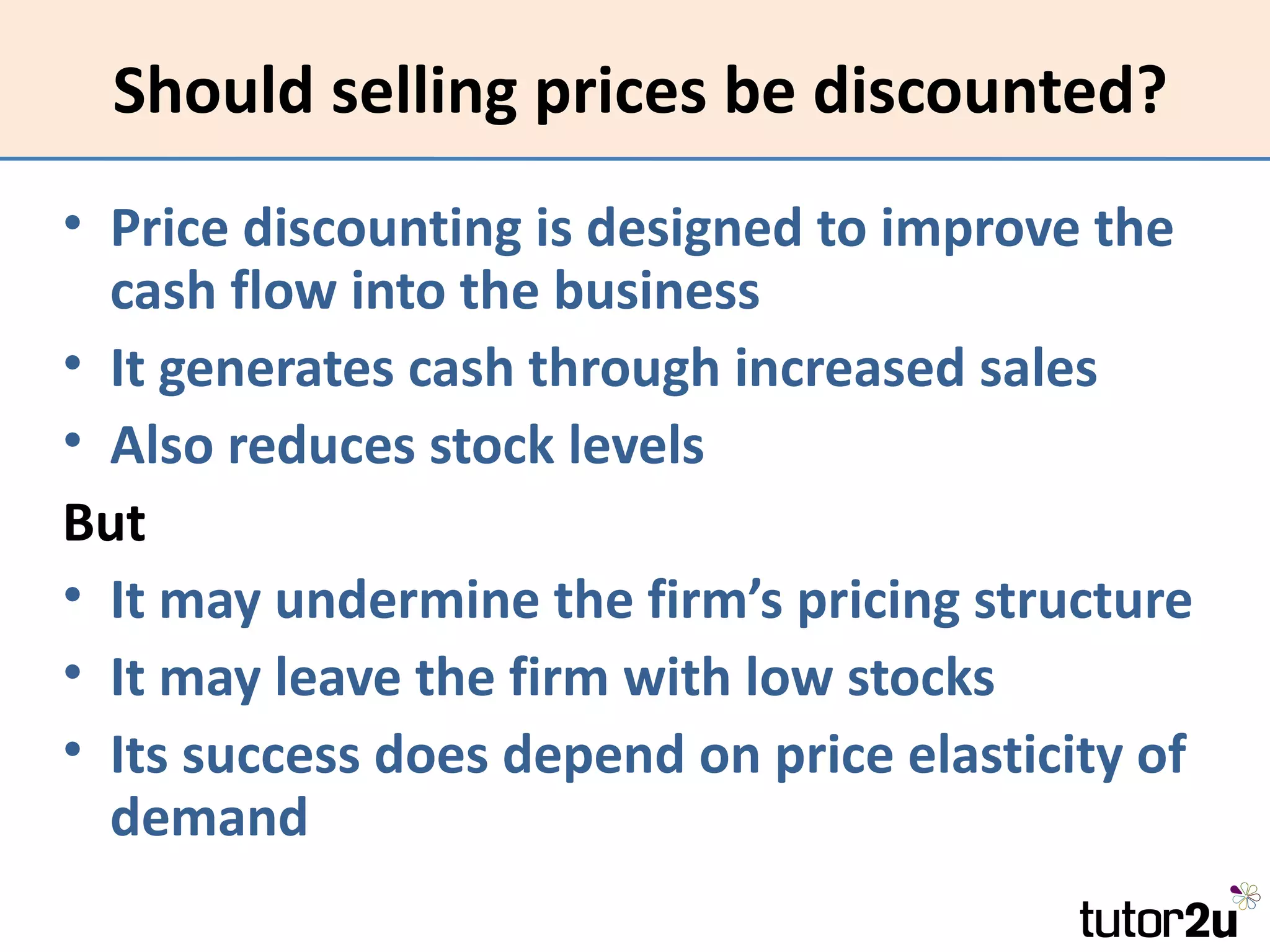

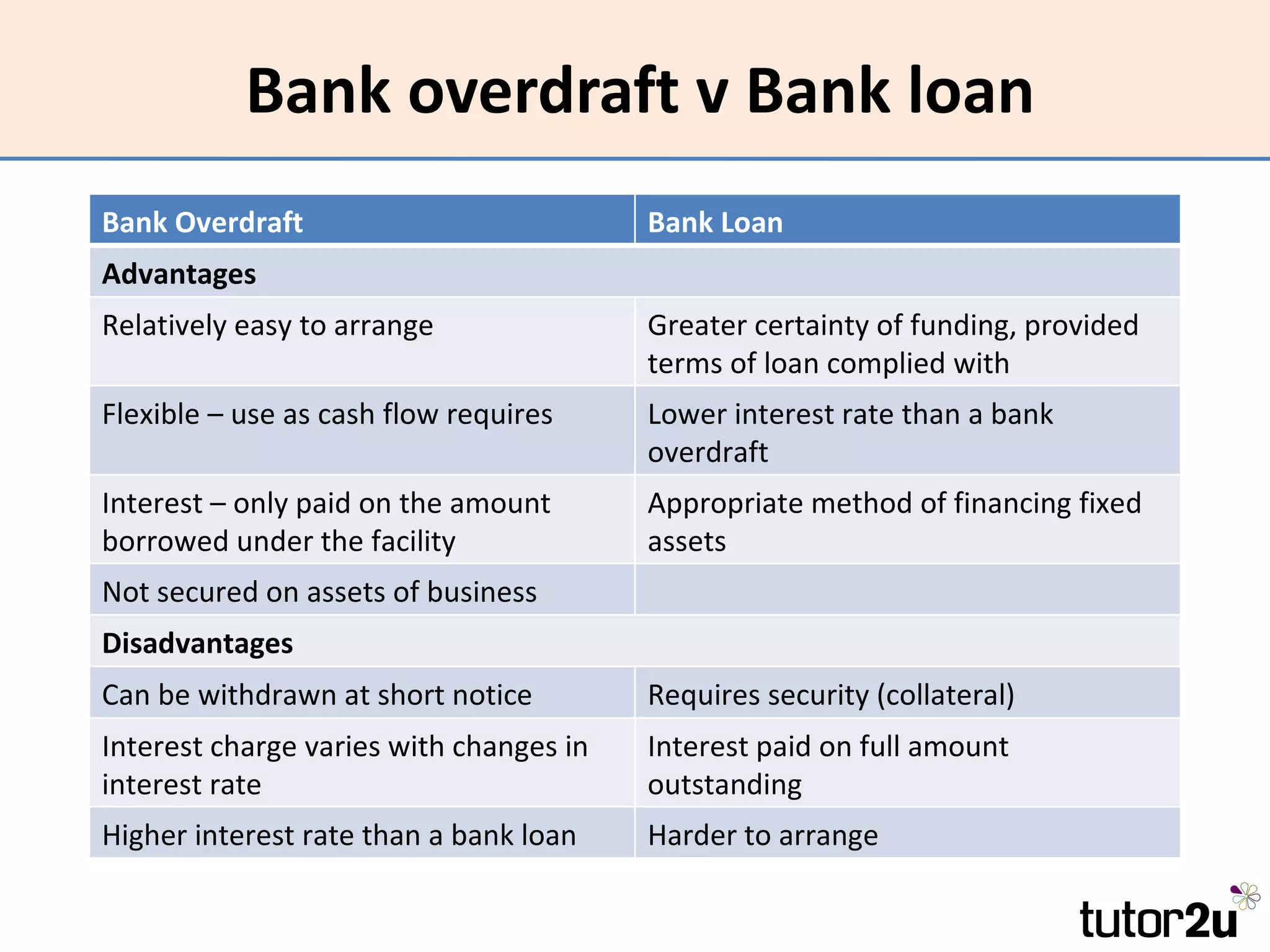

A business may experience cash flow problems if it does not have enough cash to pay its liabilities. Common causes include low profits, overinvestment, too much stock, allowing too much customer credit, or unexpected changes. To improve cash flow, a business should manage working capital effectively by focusing on reducing debtors, creditors, and stock levels. It can also choose appropriate short-term financing like a bank overdraft or bank loan to meet temporary cash shortfalls. Maintaining a good cash flow forecast helps identify risks so problems can be addressed early.