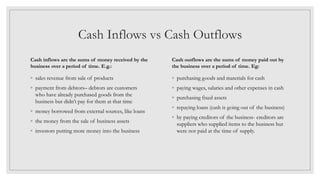

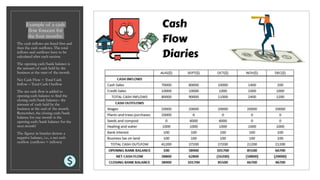

The document discusses cash flow forecasting and working capital for businesses. It defines cash inflows and outflows, and explains that a cash flow forecast estimates future monthly cash balances based on expected inflows and outflows. The forecast can help businesses determine cash needs, how much to borrow, and whether there is excess cash. When a forecast shows negative cash flow, businesses can take steps like increasing loans, delaying payments, or collecting debts sooner to correct the problem. Working capital refers to liquid assets needed to cover short-term expenses, such as cash, amounts owed by debtors, and inventory that can be converted to cash.