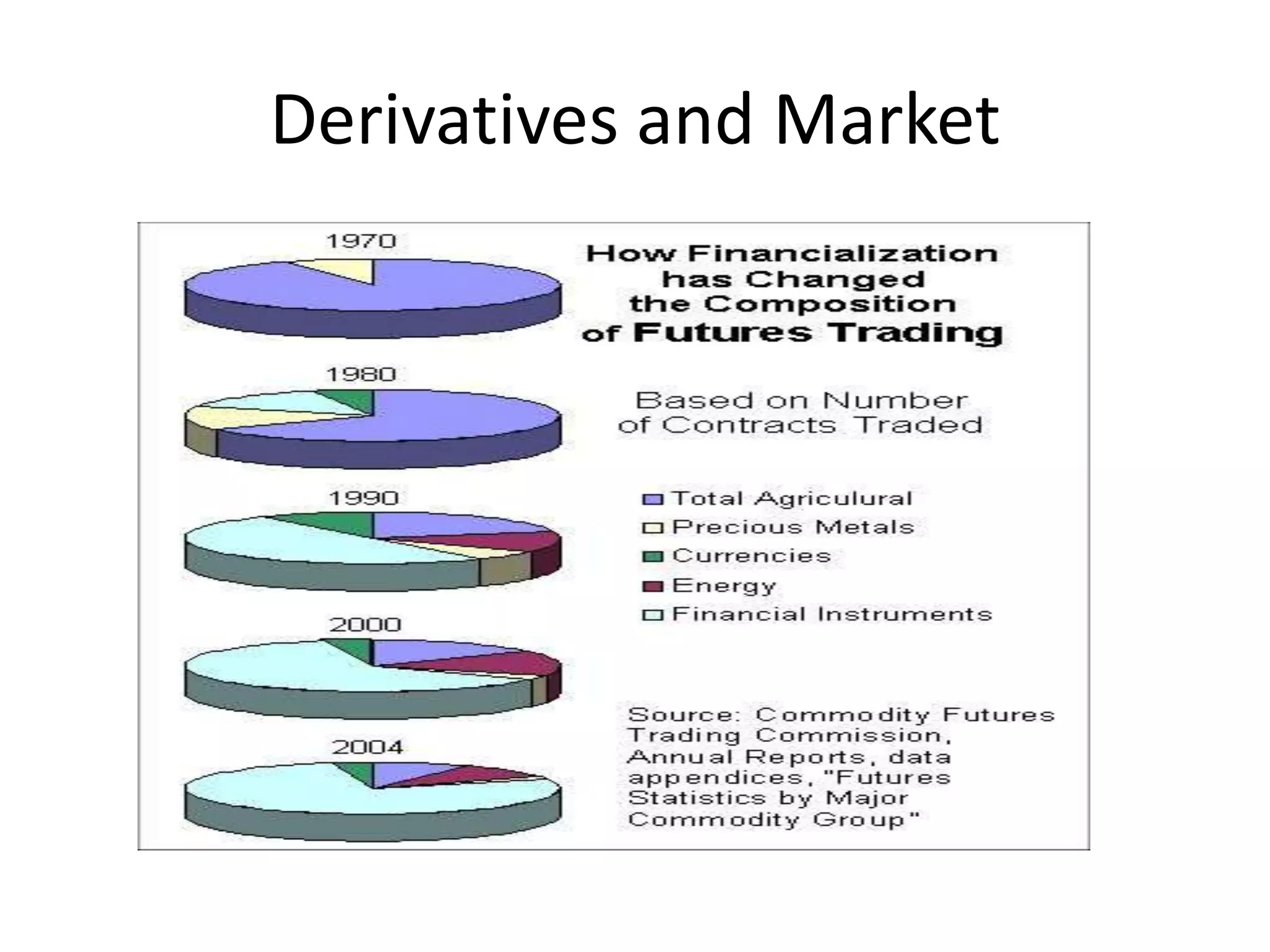

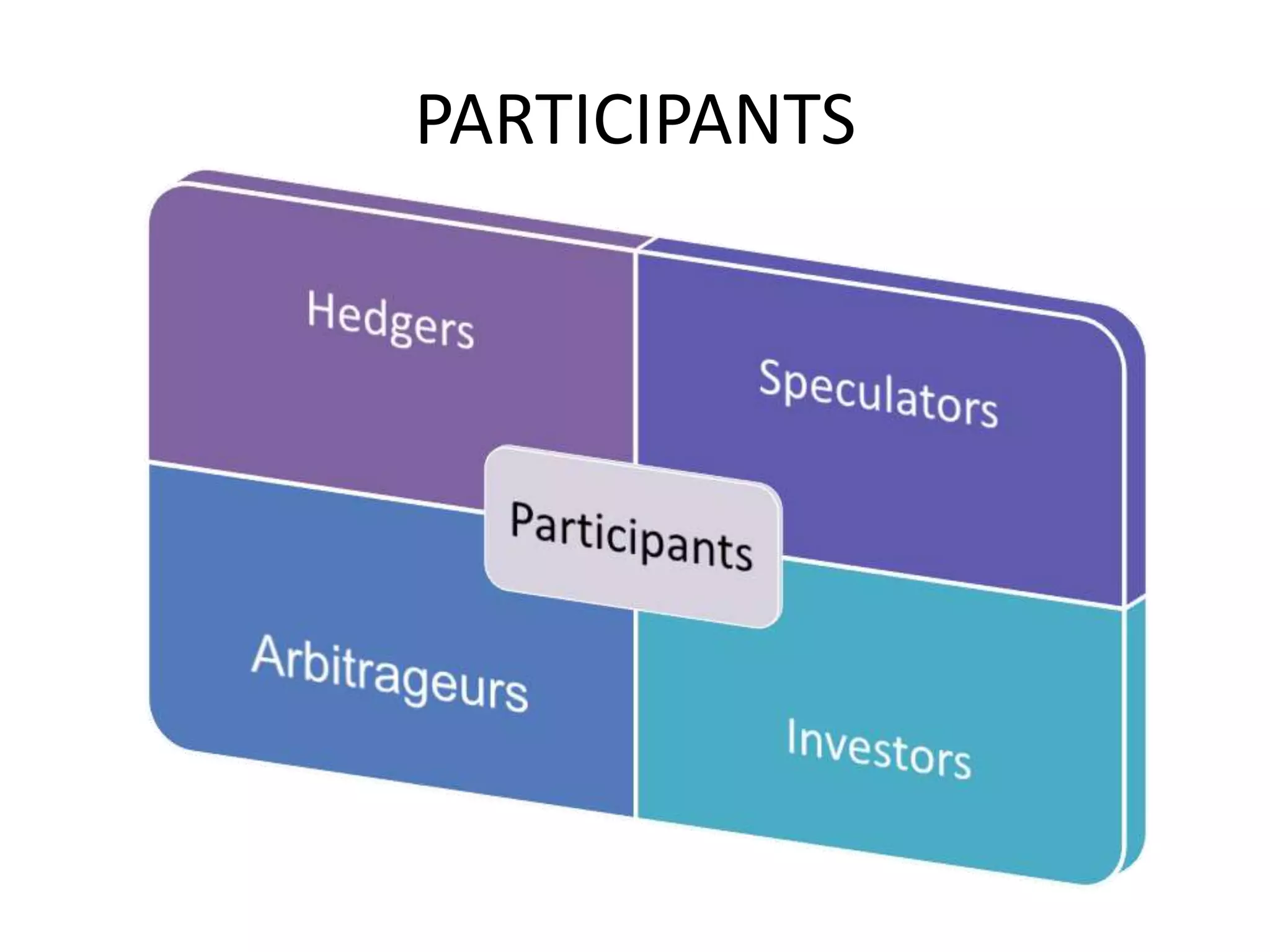

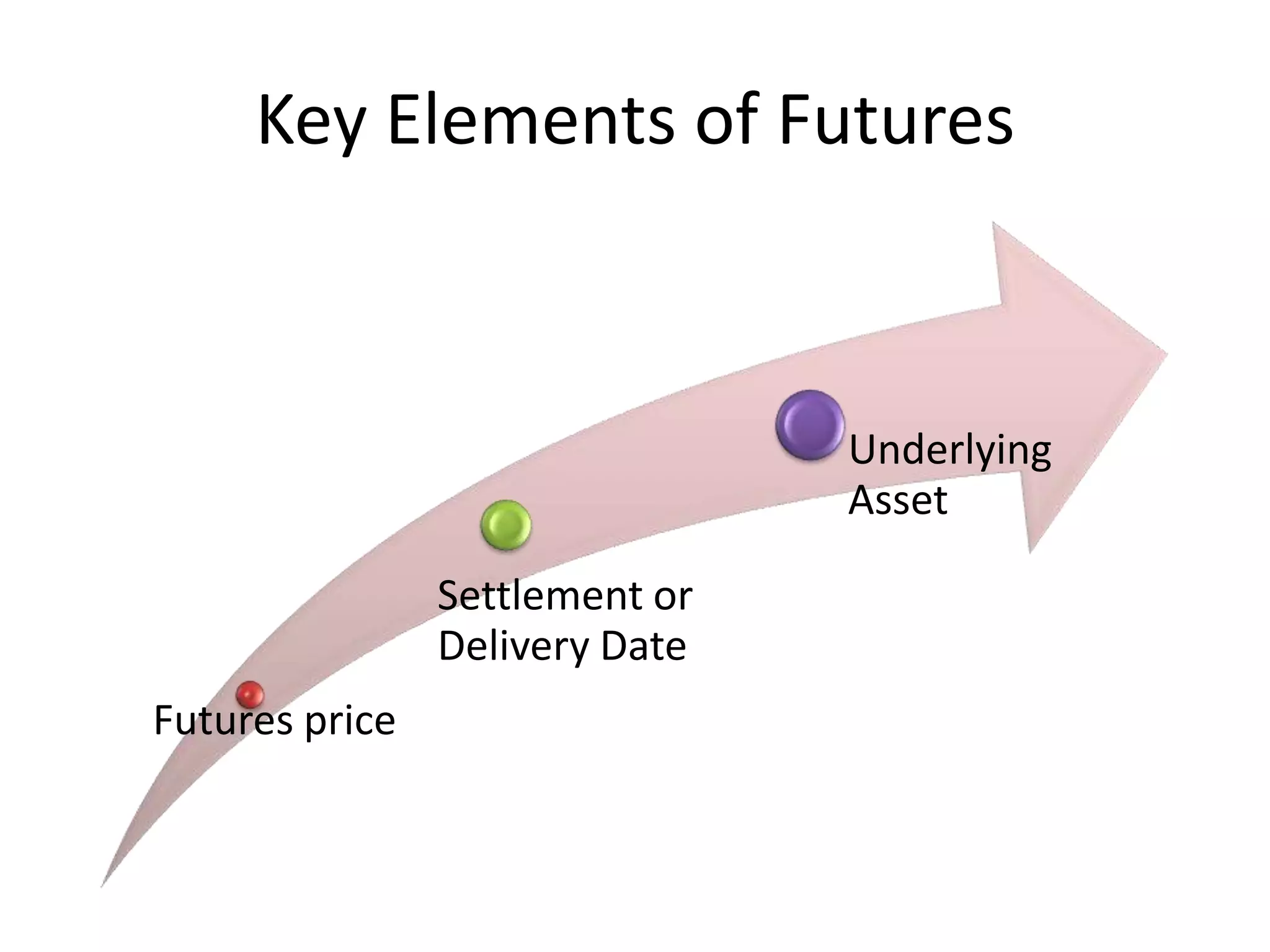

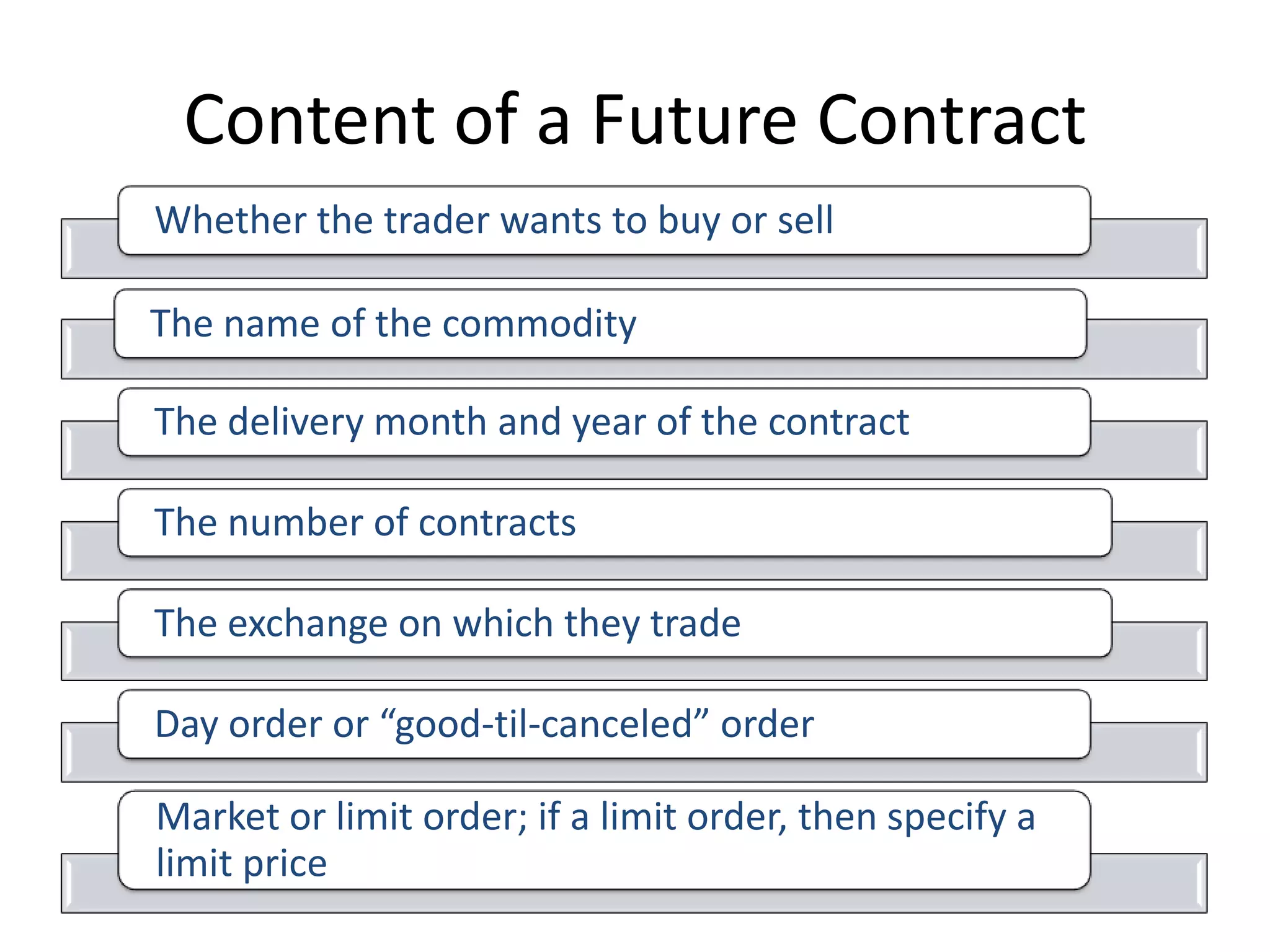

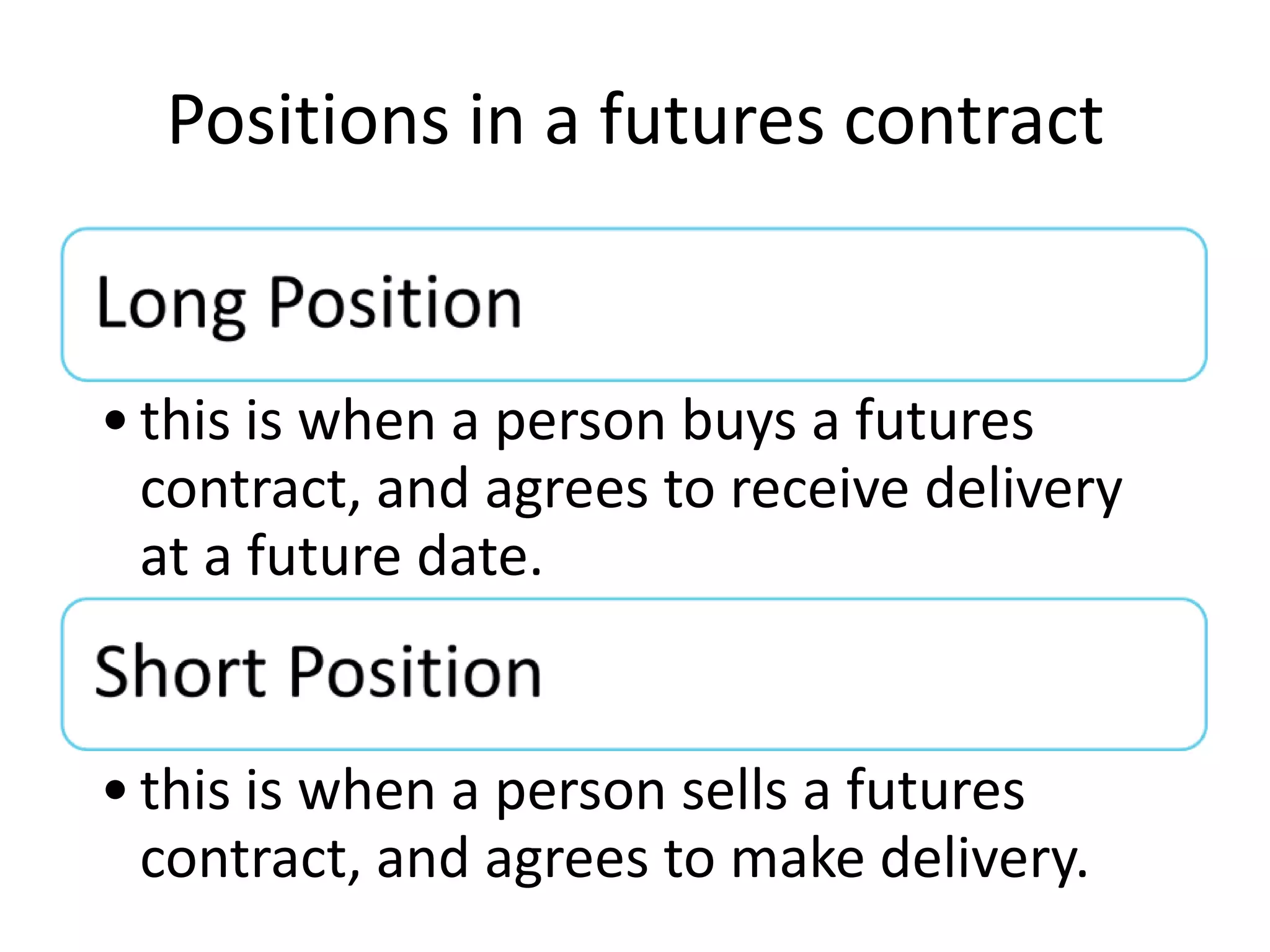

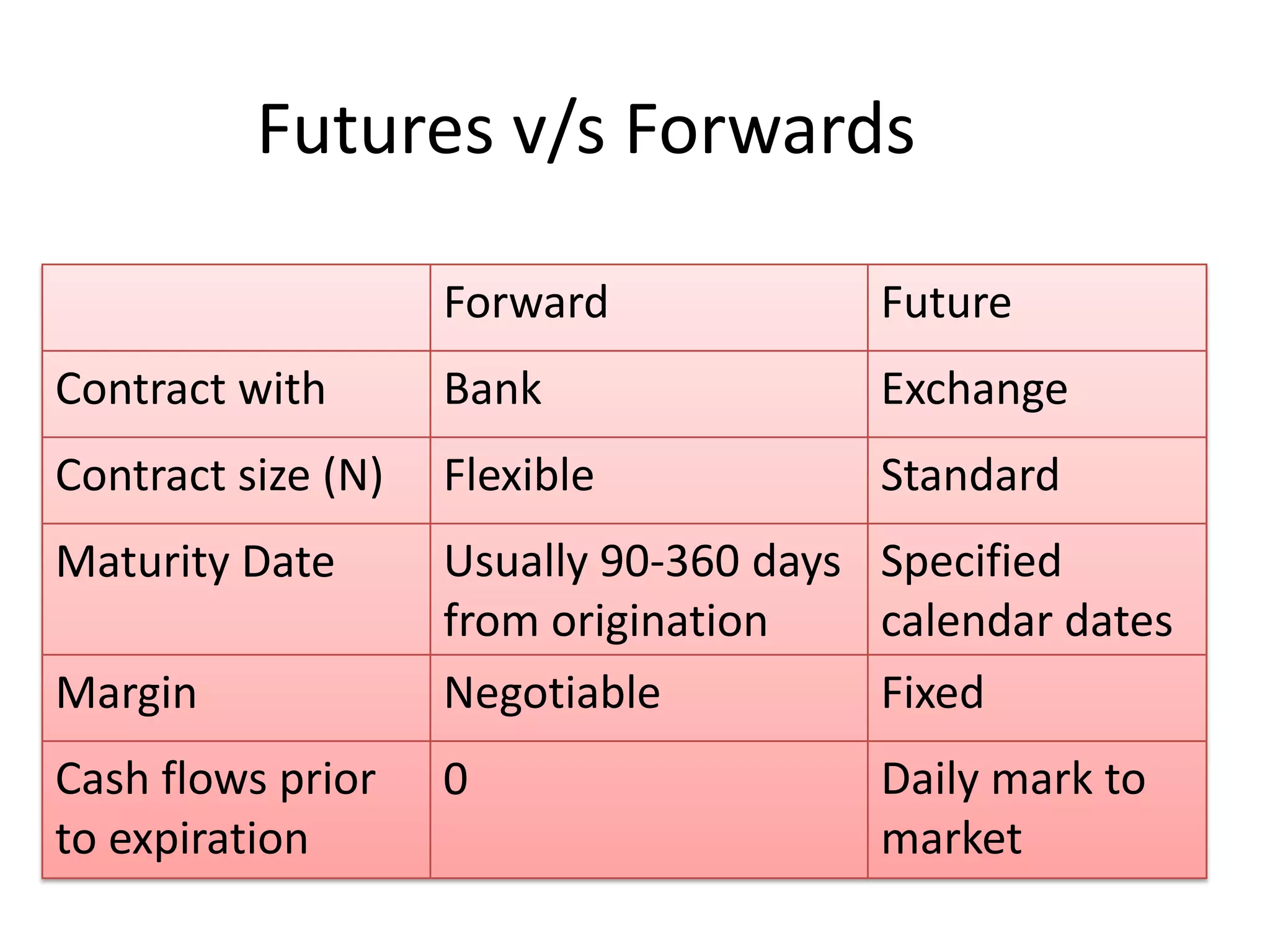

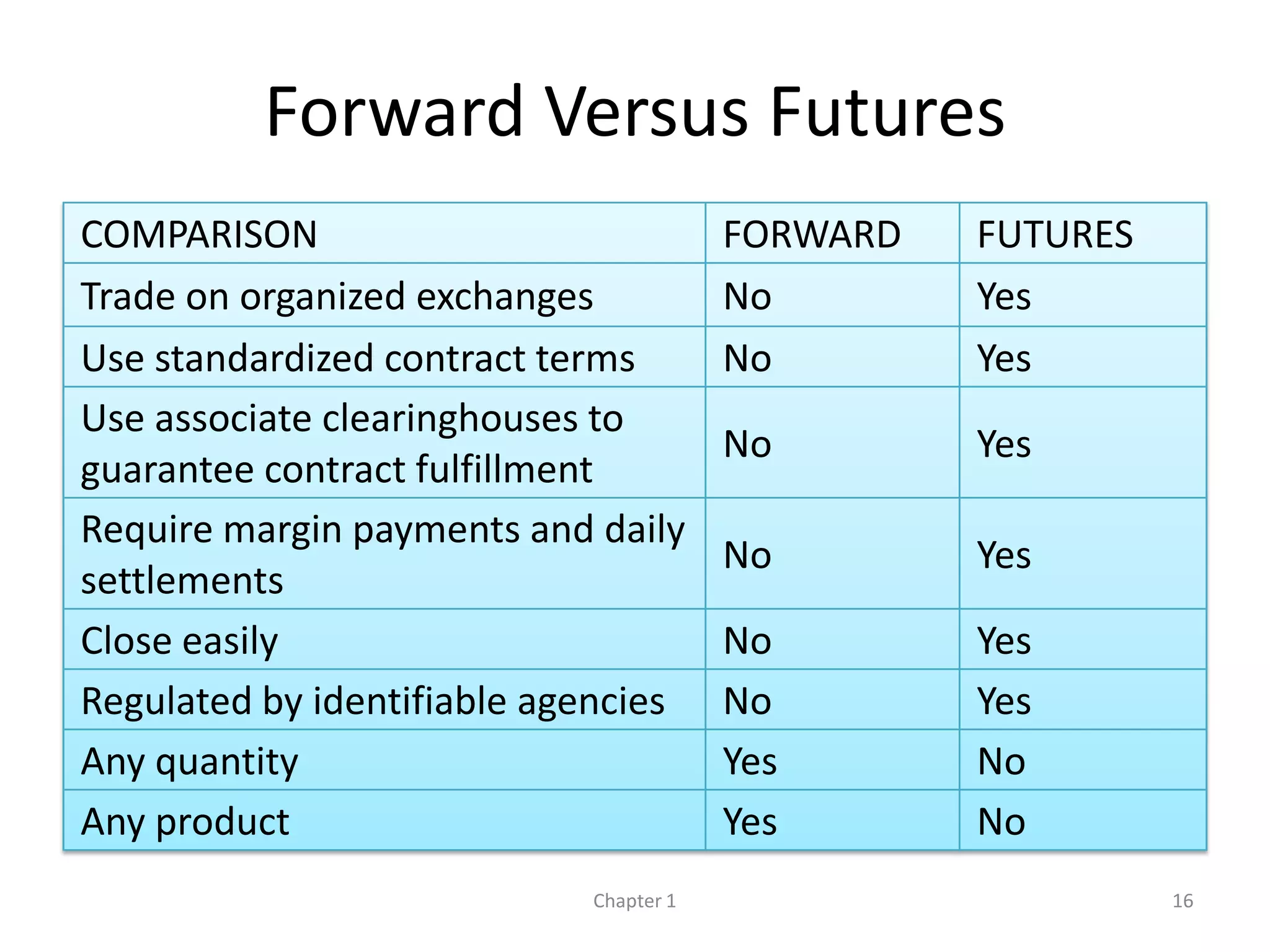

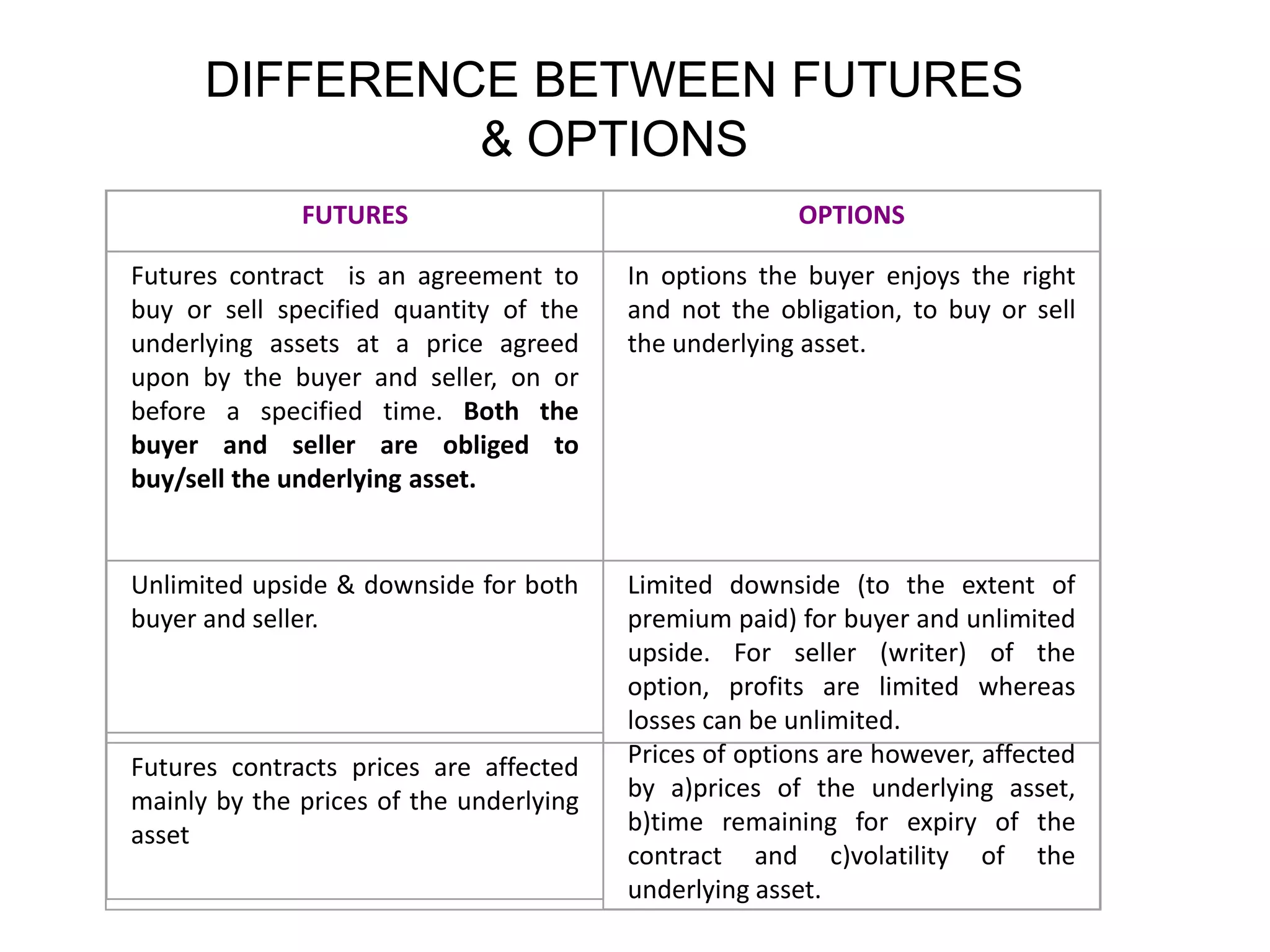

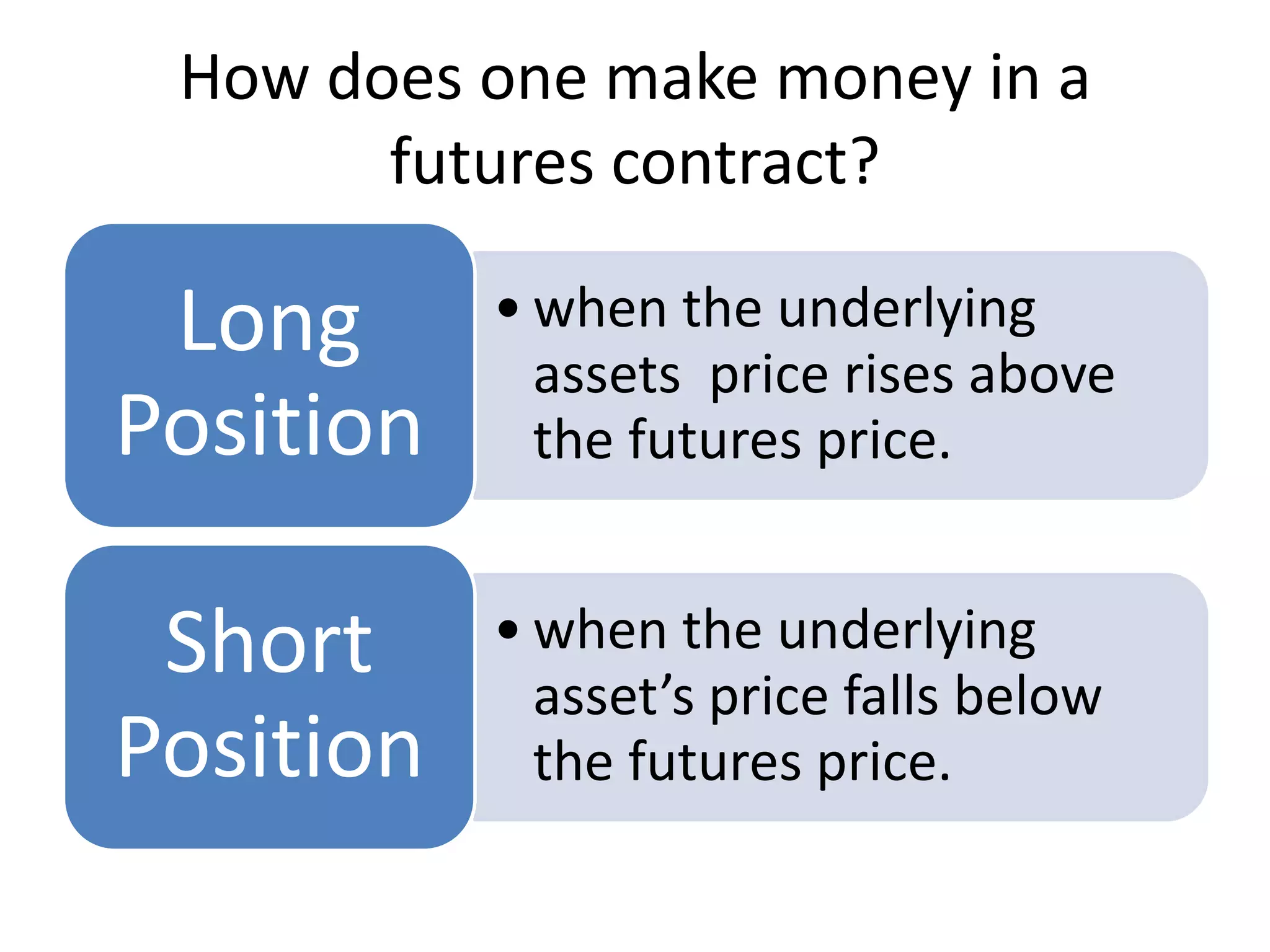

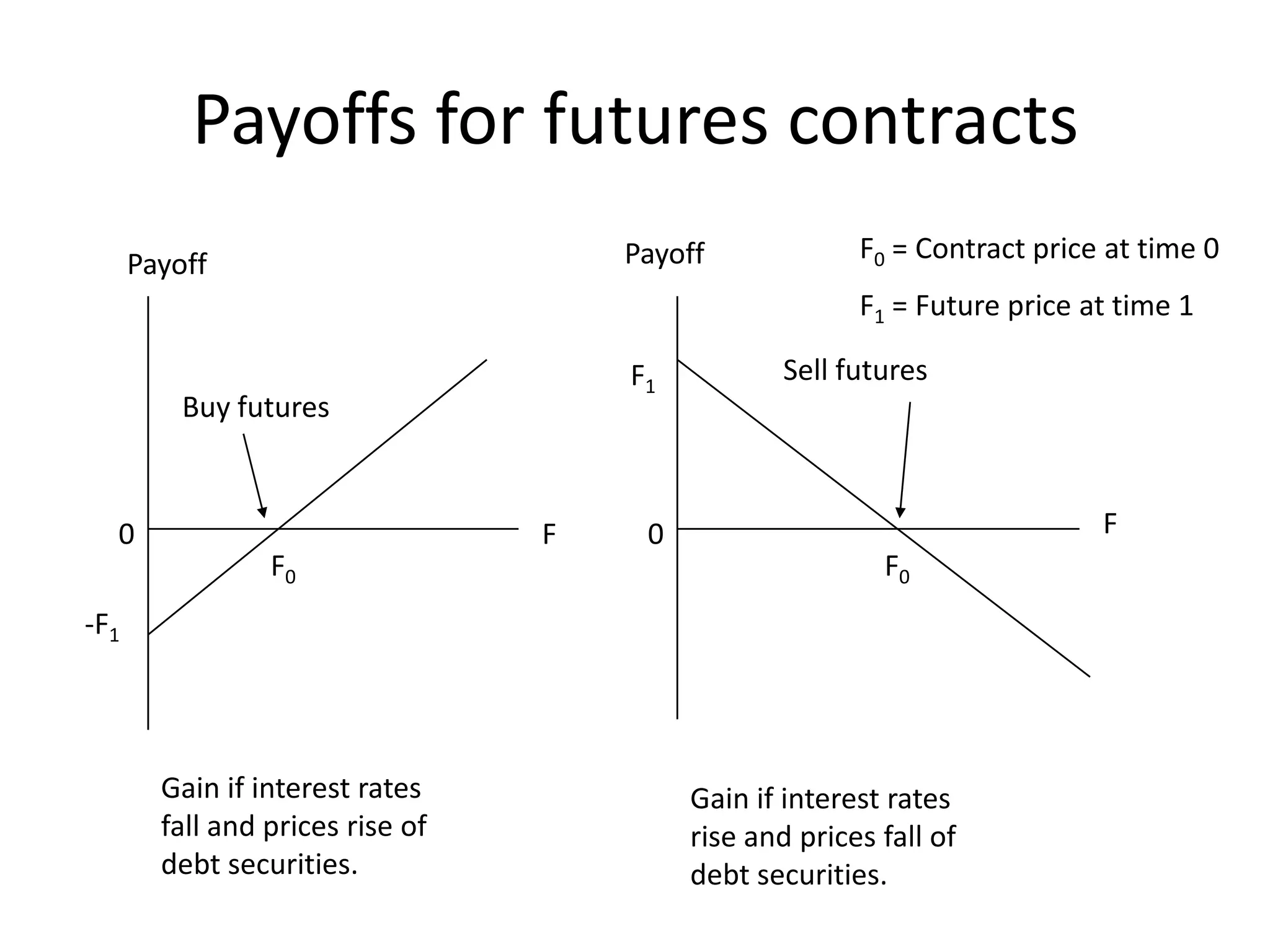

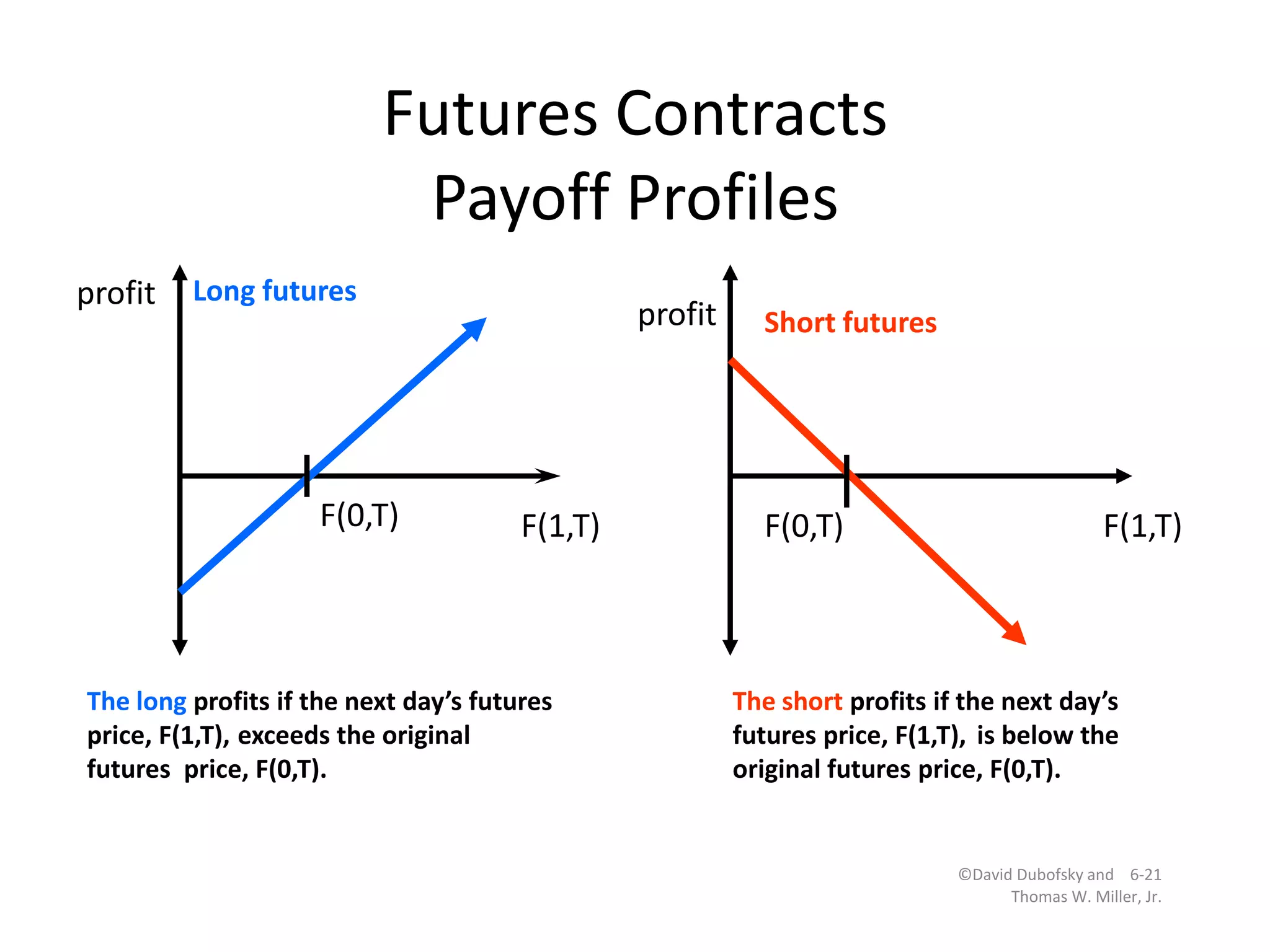

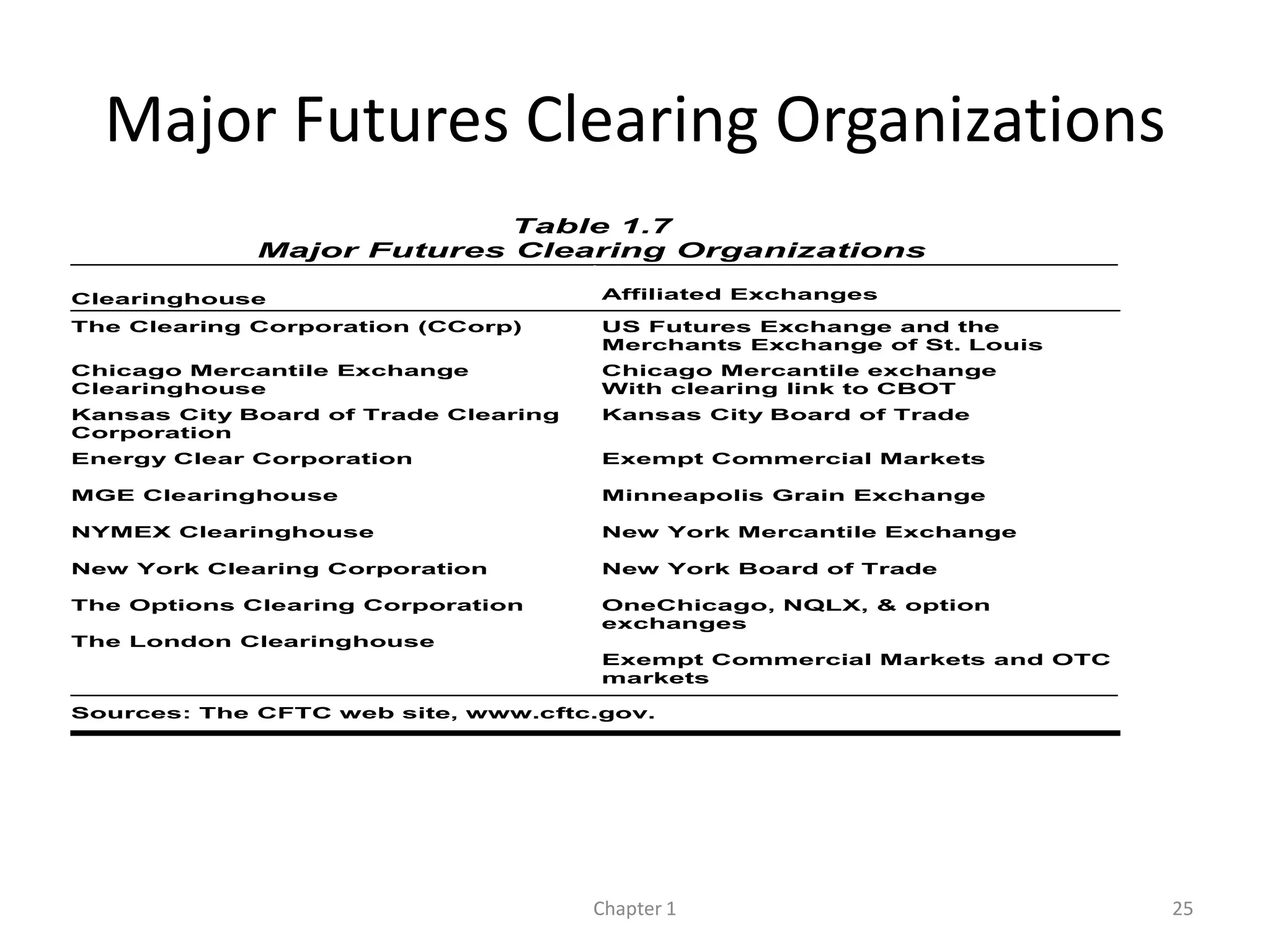

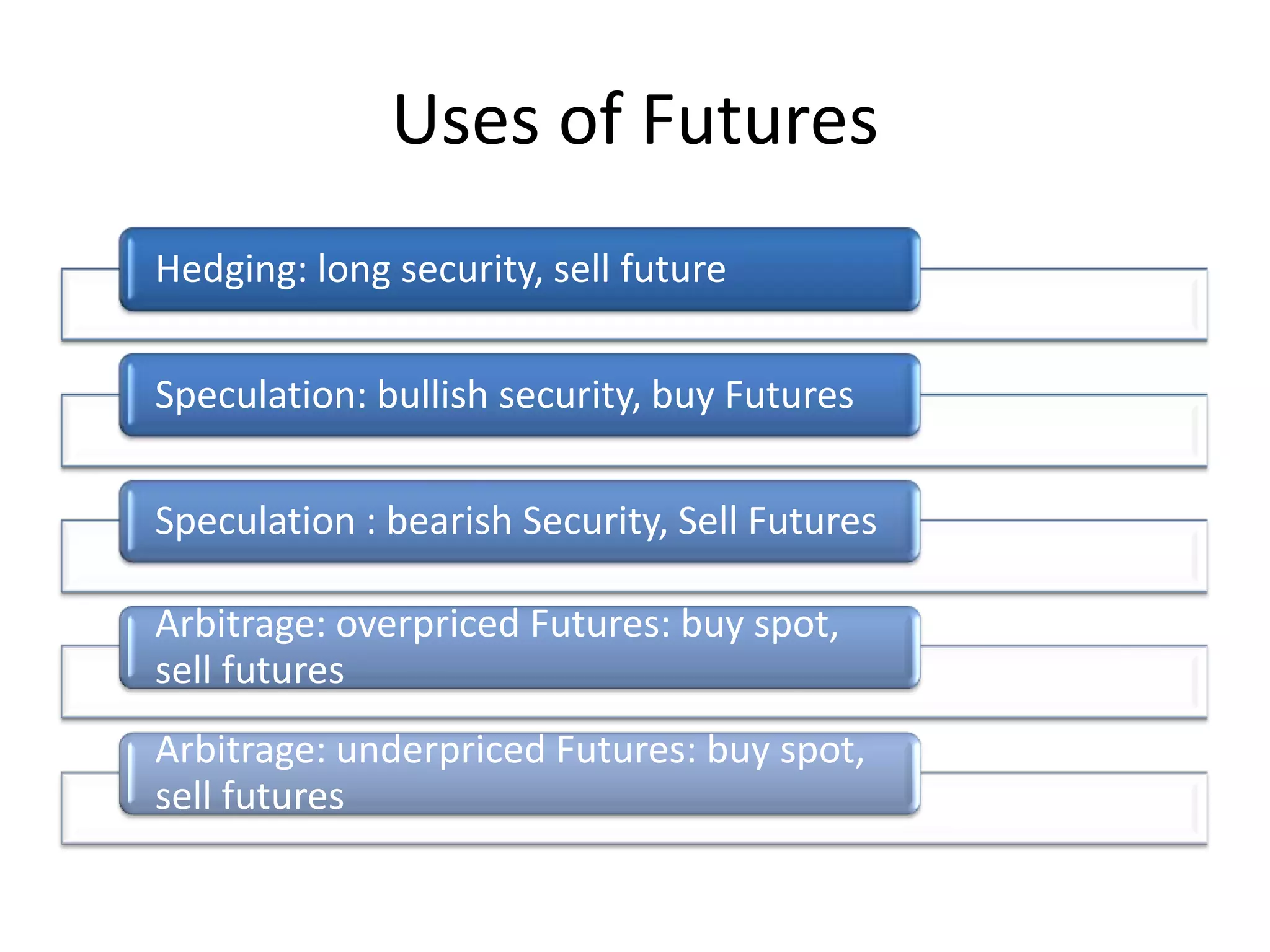

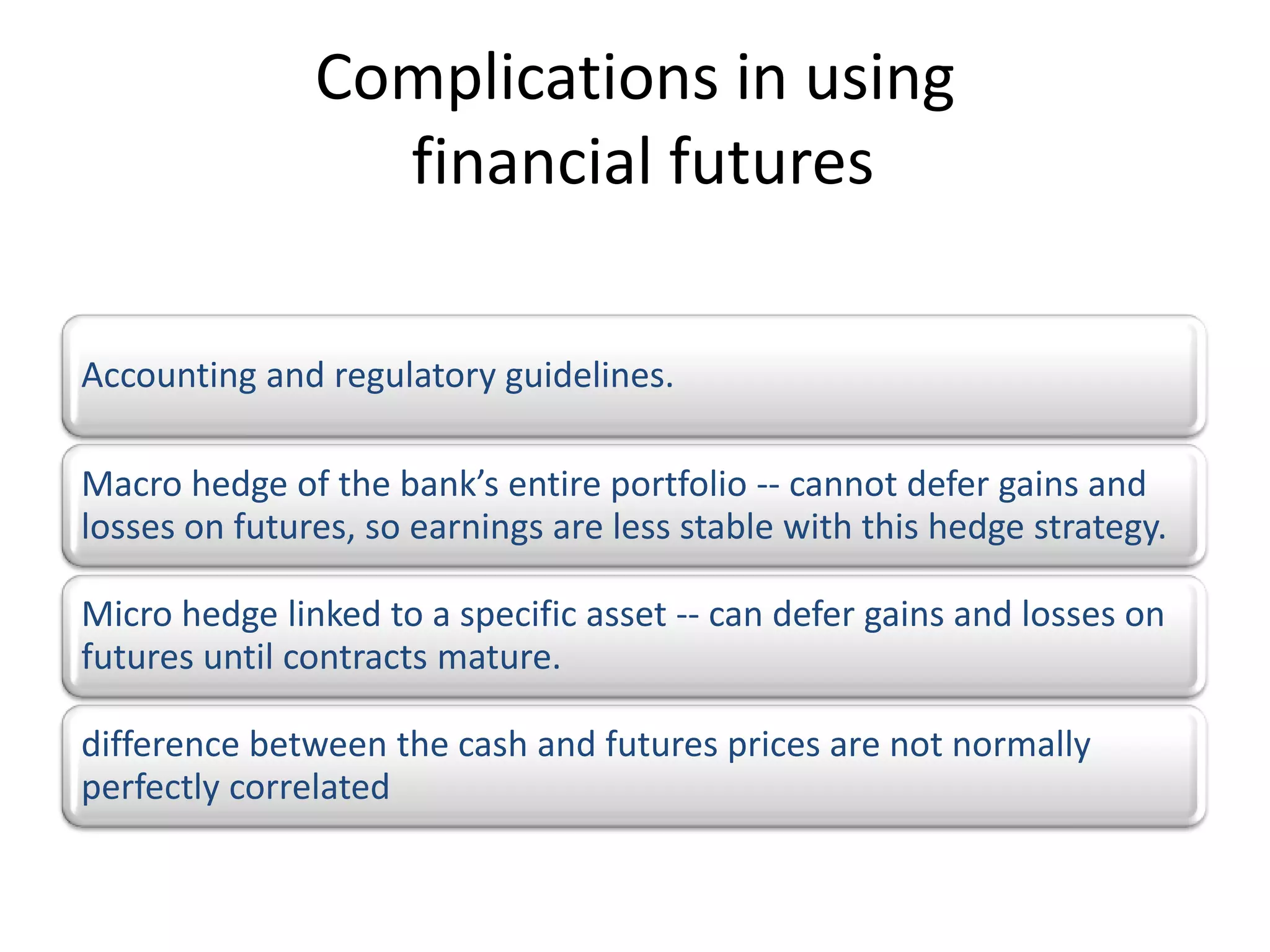

Futures and swaps allow parties to manage risks associated with price fluctuations in underlying assets. A futures contract is a standardized agreement to buy or sell an asset at a predetermined price at a specified future date. Key elements of futures contracts include the underlying asset, settlement/delivery date, and futures price. Futures are traded on organized exchanges and involve clearinghouses that guarantee contracts. Futures can be used for hedging, speculation, or arbitrage. Swaps allow parties to exchange cash flows of one party's financial instrument for those of the other party.