Etude PwC Autofacts Chine (fév. 2014)

•

0 likes•700 views

http://pwc.to/1cg6eTA La Chine a décidé de lutter contre la pollution et les embouteillages de ses villes en restreignant les immatriculations d'automobiles. Découvrez le dernier rapport de PwC Autofacts spécial Chine en ligne. (in English)

Report

Share

Report

Share

Recommended

Recommended

B2B decision-maker preferences and behaviors have shifted dramatically since the onset of COVID. The GTM revolution is here and B2B sales is forever changed.McKinsey Survey: Brazilian B2B decision maker response to COVID-19 crisis

McKinsey Survey: Brazilian B2B decision maker response to COVID-19 crisisMcKinsey on Marketing & Sales

More Related Content

What's hot

B2B decision-maker preferences and behaviors have shifted dramatically since the onset of COVID. The GTM revolution is here and B2B sales is forever changed.McKinsey Survey: Brazilian B2B decision maker response to COVID-19 crisis

McKinsey Survey: Brazilian B2B decision maker response to COVID-19 crisisMcKinsey on Marketing & Sales

What's hot (20)

Impact of COVID-19 on Global Consumers and Emerging Opportunities

Impact of COVID-19 on Global Consumers and Emerging Opportunities

Covid-19 đã ảnh hưởng đến các nền tảng ứng dụng di động như thế nào?

Covid-19 đã ảnh hưởng đến các nền tảng ứng dụng di động như thế nào?

E marketer the_us_cpg_and_consumer_products_industry_2013-digital_ad_spending...

E marketer the_us_cpg_and_consumer_products_industry_2013-digital_ad_spending...

Bcg true luxury global cons insight 2017 - presentata

Bcg true luxury global cons insight 2017 - presentata

Futuro Digital LATAM 2014 - La Revisión Anual Sobre el Entorno Digital en Amé...

Futuro Digital LATAM 2014 - La Revisión Anual Sobre el Entorno Digital en Amé...

Commencis Covid-19 Playbook for Financial Services

Commencis Covid-19 Playbook for Financial Services

The CMO Survey - Highlights and Insights Report - August 2021

The CMO Survey - Highlights and Insights Report - August 2021

Digital Consumers, Emerging Markets, and the $4 Trillion Future

Digital Consumers, Emerging Markets, and the $4 Trillion Future

E marketer the_us_retail_industry_2013-digital_ad_spending_forecast_and_key_t...

E marketer the_us_retail_industry_2013-digital_ad_spending_forecast_and_key_t...

McKinsey Survey: Brazilian B2B decision maker response to COVID-19 crisis

McKinsey Survey: Brazilian B2B decision maker response to COVID-19 crisis

Similar to Etude PwC Autofacts Chine (fév. 2014)

Similar to Etude PwC Autofacts Chine (fév. 2014) (20)

Chinain2025andimplicationsforautomakersvfjan2015 150112052522-conversion-gate02

Chinain2025andimplicationsforautomakersvfjan2015 150112052522-conversion-gate02

China in 2025 and implications for automakers Jan 2015

China in 2025 and implications for automakers Jan 2015

Disruptive Trends That Will Transform The Automotive Industry

Disruptive Trends That Will Transform The Automotive Industry

Allianz Risk Pulse: The Future of Individual Mobility

Allianz Risk Pulse: The Future of Individual Mobility

Future of mobility for external author lucio ribeiro

Future of mobility for external author lucio ribeiro

The Future of the Automotive Dealership Whitepaper

The Future of the Automotive Dealership Whitepaper

Dealing with Urban Mobility Challenges - What can we learn from China?

Dealing with Urban Mobility Challenges - What can we learn from China?

Study HERE SBD - How autonomous vehicles could relieve or worsen traffic cong...

Study HERE SBD - How autonomous vehicles could relieve or worsen traffic cong...

Philippine Automotive Industry Insights | AutoDeal | Q3 2018

Philippine Automotive Industry Insights | AutoDeal | Q3 2018

More from PwC France

More from PwC France (20)

Etude PwC "20ème édition de la CEO Survey" - Janvier 2017

Etude PwC "20ème édition de la CEO Survey" - Janvier 2017

Etude PwC : La transition énergétique pour la croissance verte (nov 2015)

Etude PwC : La transition énergétique pour la croissance verte (nov 2015)

Etude PwC "Total Retail 2015" Sur quoi miser aujourd’hui pour réenchanter la ...

Etude PwC "Total Retail 2015" Sur quoi miser aujourd’hui pour réenchanter la ...

GEMO 2016 : un digital de plus en plus cannibale ?

GEMO 2016 : un digital de plus en plus cannibale ?

Infographie PwC GEMO 2016 sur l'industrie Médias et Loisirs (juin 2015)

Infographie PwC GEMO 2016 sur l'industrie Médias et Loisirs (juin 2015)

Etude FCD, ESSEC et PwC sur la distribution responsable (août 2015)

Etude FCD, ESSEC et PwC sur la distribution responsable (août 2015)

Etude PwC CEO Survey Talent "People Strategy for the Digital Age" (juillet 2015)

Etude PwC CEO Survey Talent "People Strategy for the Digital Age" (juillet 2015)

Etude PwC et Essec "Grande consommation 1985 - 2015 - 2045"

Etude PwC et Essec "Grande consommation 1985 - 2015 - 2045"

Etude PwC sur le Top 100 des entreprises les mieux valorisées au monde en 201...

Etude PwC sur le Top 100 des entreprises les mieux valorisées au monde en 201...

Etude PwC "Point of View: Enterprise Portfolio & Program Management" (mai 2015)

Etude PwC "Point of View: Enterprise Portfolio & Program Management" (mai 2015)

Etude PwC "Bridging the gap" sur les investisseurs institutionnels (mai 2015)

Etude PwC "Bridging the gap" sur les investisseurs institutionnels (mai 2015)

Etude PwC sur l'intérêt des investisseurs pour l’Afrique (avril 2015)

Etude PwC sur l'intérêt des investisseurs pour l’Afrique (avril 2015)

Recently uploaded

Recently uploaded (8)

Core technology of Hyundai Motor Group's EV platform 'E-GMP'

Core technology of Hyundai Motor Group's EV platform 'E-GMP'

The Future of Autonomous Vehicles | civilthings.com | Detailed information

The Future of Autonomous Vehicles | civilthings.com | Detailed information

Advanced Technology for Auto Part Industry Inventory Solutions

Advanced Technology for Auto Part Industry Inventory Solutions

gtyccccccccccccccccccccccccccccccccccccccccccccccccccccccc

gtyccccccccccccccccccccccccccccccccccccccccccccccccccccccc

What Should You Do If Your Jaguar XF Bluetooth Isn't Working

What Should You Do If Your Jaguar XF Bluetooth Isn't Working

Etude PwC Autofacts Chine (fév. 2014)

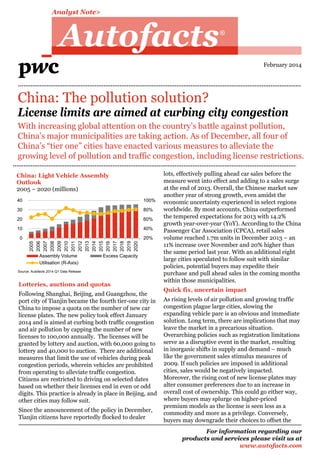

- 1. Analyst Note> Autofacts R February 2014 China: The pollution solution? License limits are aimed at curbing city congestion With increasing global attention on the country’s battle against pollution, China’s major municipalities are taking action. As of December, all four of China’s “tier one” cities have enacted various measures to alleviate the growing level of pollution and traffic congestion, including license restrictions. China: Light Vehicle Assembly Outlook 2005 – 2020 (millions) 100% 30 80% 20 60% 10 40% 0 20% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 40 Assembly Volume Utilisation (R-Axis) Excess Capacity Source: Autofacts 2014 Q1 Data Release Lotteries, auctions and quotas Following Shanghai, Beijing, and Guangzhou, the port city of Tianjin became the fourth tier-one city in China to impose a quota on the number of new car license plates. The new policy took effect January 2014 and is aimed at curbing both traffic congestion and air pollution by capping the number of new licenses to 100,000 annually. The licenses will be granted by lottery and auction, with 60,000 going to lottery and 40,000 to auction. There are additional measures that limit the use of vehicles during peak congestion periods, wherein vehicles are prohibited from operating to alleviate traffic congestion. Citizens are restricted to driving on selected dates based on whether their licenses end in even or odd digits. This practice is already in place in Beijing, and other cities may follow suit. Since the announcement of the policy in December, Tianjin citizens have reportedly flocked to dealer lots, effectively pulling ahead car sales before the measure went into effect and adding to a sales surge at the end of 2013. Overall, the Chinese market saw another year of strong growth, even amidst the economic uncertainty experienced in select regions worldwide. By most accounts, China outperformed the tempered expectations for 2013 with 14.2% growth year-over-year (YoY). According to the China Passenger Car Association (CPCA), retail sales volume reached 1.7m units in December 2013 – an 11% increase over November and 20% higher than the same period last year. With an additional eight large cities speculated to follow suit with similar policies, potential buyers may expedite their purchase and pull ahead sales in the coming months within those municipalities. Quick fix, uncertain impact As rising levels of air pollution and growing traffic congestion plague large cities, slowing the expanding vehicle parc is an obvious and immediate solution. Long term, there are implications that may leave the market in a precarious situation. Overarching policies such as registration limitations serve as a disruptive event in the market, resulting in inorganic shifts in supply and demand – much like the government sales stimulus measures of 2009. If such policies are imposed in additional cities, sales would be negatively impacted. Moreover, the rising cost of new license plates may alter consumer preferences due to an increase in overall cost of ownership. This could go either way, where buyers may splurge on higher-priced premium models as the license is seen less as a commodity and more as a privilege. Conversely, buyers may downgrade their choices to offset the For information regarding our products and services please visit us at www.autofacts.com

- 2. increased financial burden. Either way, the growth of entry level vehicles in this scenario is expected to slow given the market’s propensity towards perceived luxury. There is little doubt that the rapid rise in vehicle ownership and related traffic congestion has contributed to the pollution crisis in the four biggest cities in China, but to what extent is still up for debate. Commercial vehicles, manufacturing byproducts, and power production are also primary sources of pollution within China’s metropolitan centers. It should be noted though, that the problems facing growing Chinese cities is not unlike the growing pains experienced in other expanding large cities in recent history. Tokyo faced a similar situation in the 1960’s as vehicle penetration grew from under 500k units in 1965 to 1.2m units by 1970. Tokyo’s rapid urbanization eventually led to a stronger public transportation network, and what was once a city riddled with air pollution and traffic congestion is now one of the more efficient megacities globally. China is now in a similar predicament, with automakers and local municipalities alike struggling with how to handle the social and environmental impact of expanding vehicle ownership. There is no silver bullet to address the multifaceted issues of the rapidly growing cities in China and the corresponding impact on the automotive sector. Despite these looming concerns, Autofacts remains optimistic in our forecast for China. Municipalities and OEMs can use this opportunity to develop a more eco-minded approach of balancing the needs for mobility amidst burgeoning population growth. China: Vehicle parc statistics 2003 – 2012 (thousands) 16.0% 19.2% 18.0% 109m 17.0% 17.8% 20.6% CAGR (2003-2012) Over 10,000 5,000 - 10,000 3,000 - 5,000 China’s total parc volume as of 2012 – over triple the volume of 2003 China’s 2003 – 2012 compounded annual growth rate (CAGR) of vehicle parc 0.08 1,000 - 3,000 Under 1,000 18.4% China’s parc per capita as of 2012 (vehicles per inhabitant) Source: China 2013 Statistical Yearbook Parc volume by city 2012 (approximate) Shanghai 2,128,000 Guangzhou Beijing 4,957,000 Tianjin Guangzhou adopts a combination of both lottery and auction systems for license allocation 2,014,000 2,211,000 Shanghai first introduces the auctioning of new licenses 1994 Beijing implements the lottery system of allocating new licenses 2011 Tianjin also adopts both the lottery and auction systems to issue licenses 2012 2014 Source: China 2013 Statistical Yearbook © 2014 PricewaterhouseCoopers LLP, a Delaware limited liability partnership. All rights reserved. PwC refers to the US member firm, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. For information regarding our products and services please visit us at www.autofacts.com