This document summarizes key aspects of individual income tax calculations in the United States, including:

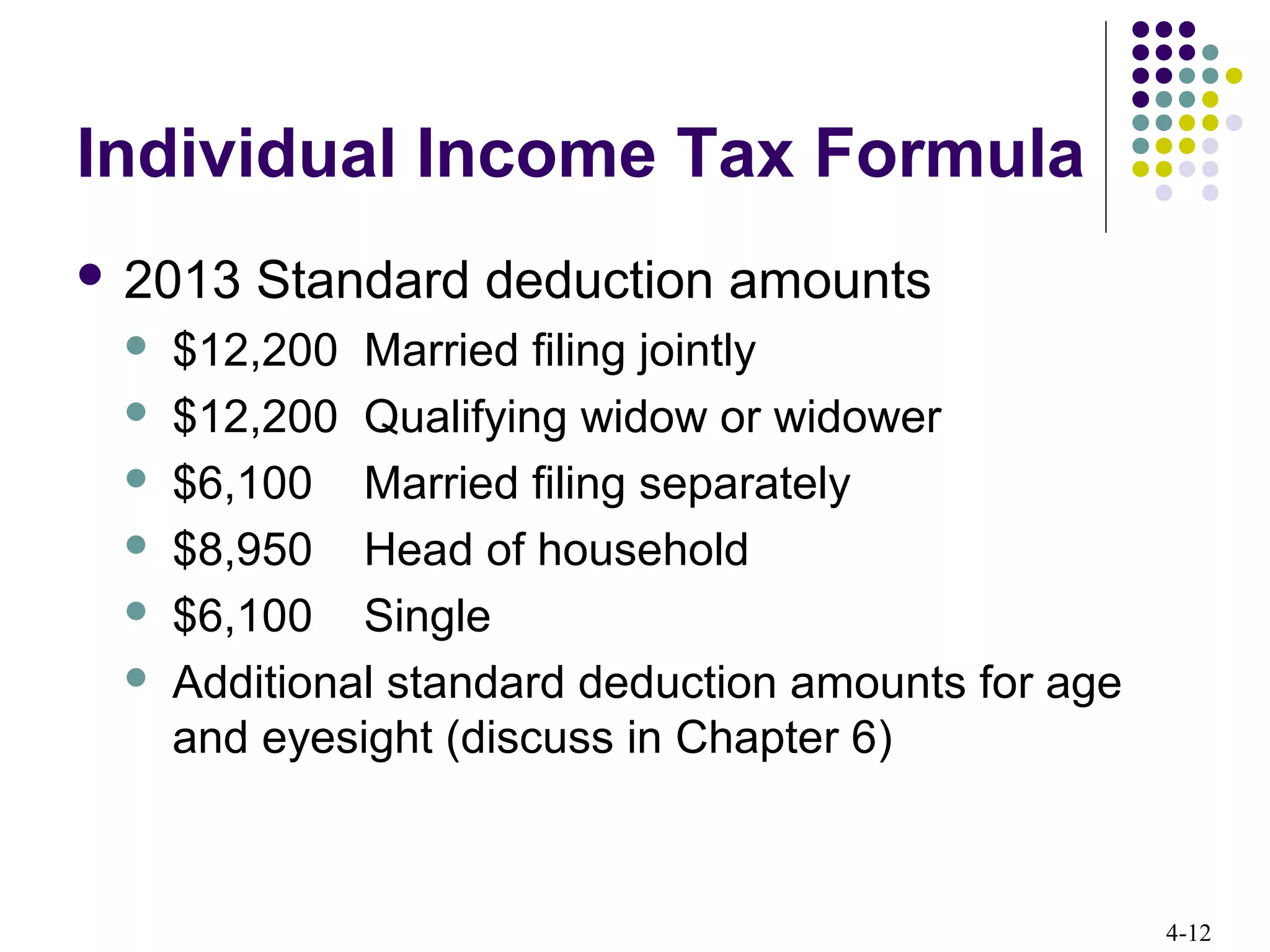

1) It outlines the basic formula for calculating individual tax liability, including components like gross income, deductions, exemptions, taxable income, tax rates, credits, and payments.

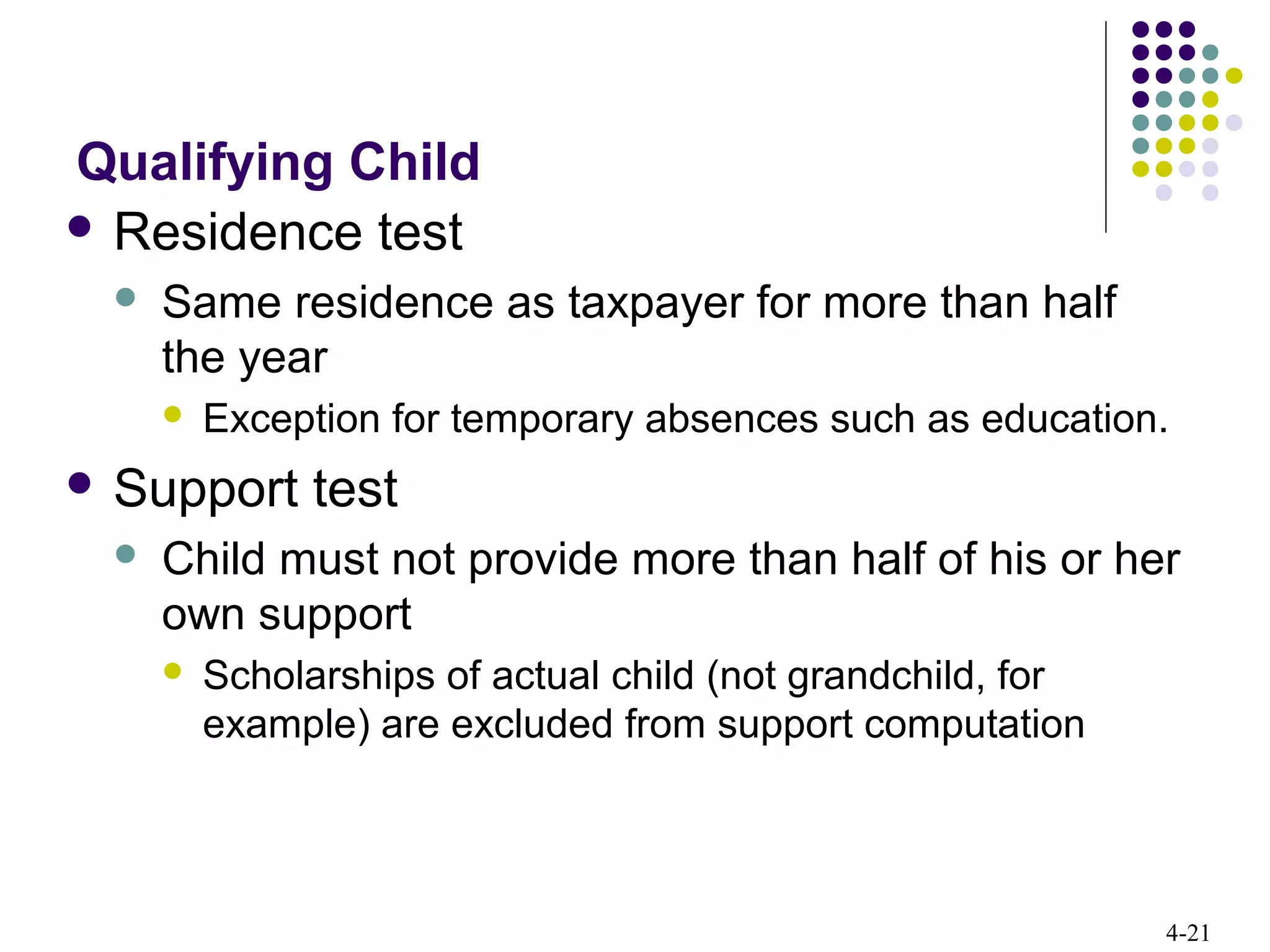

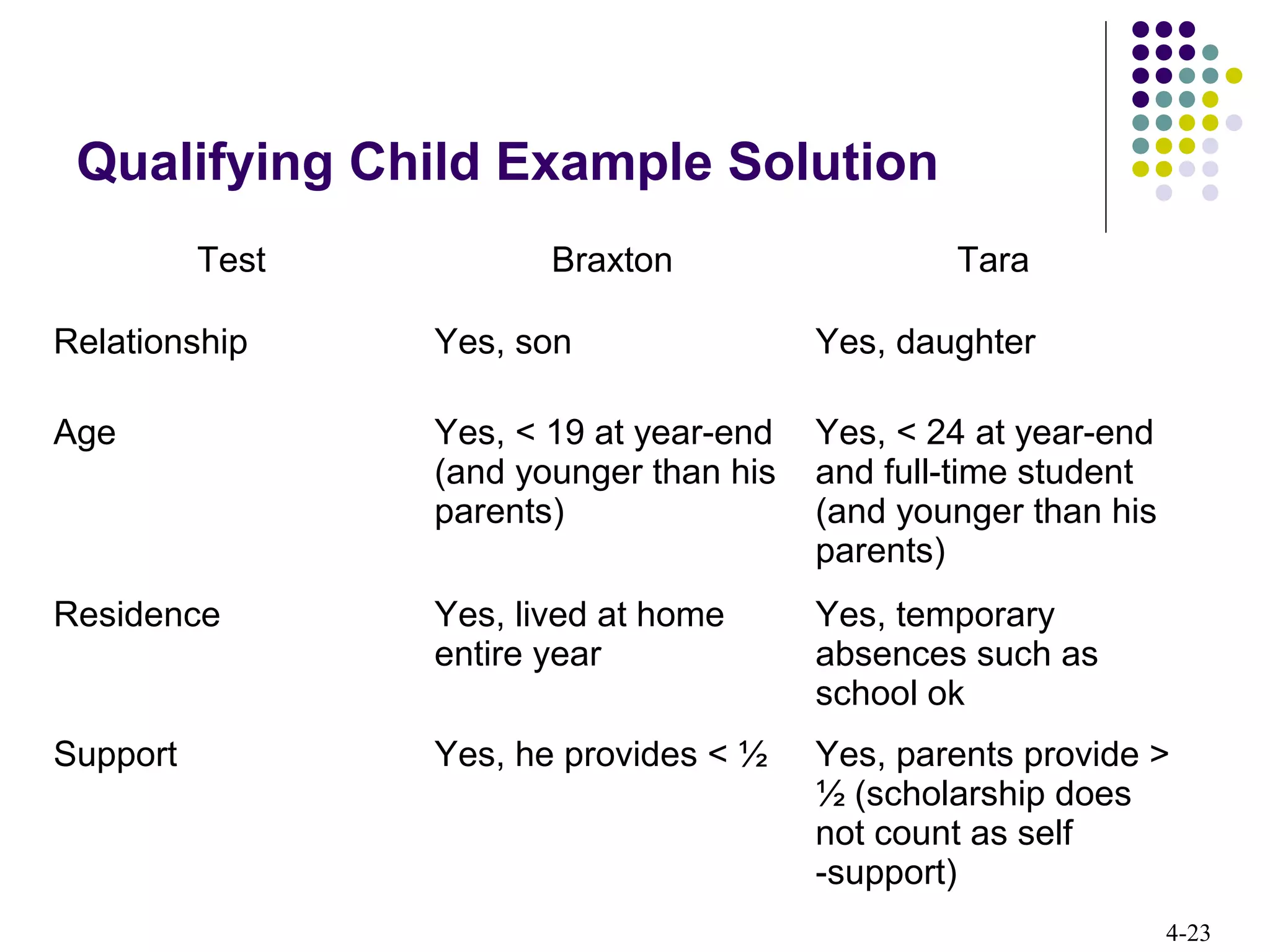

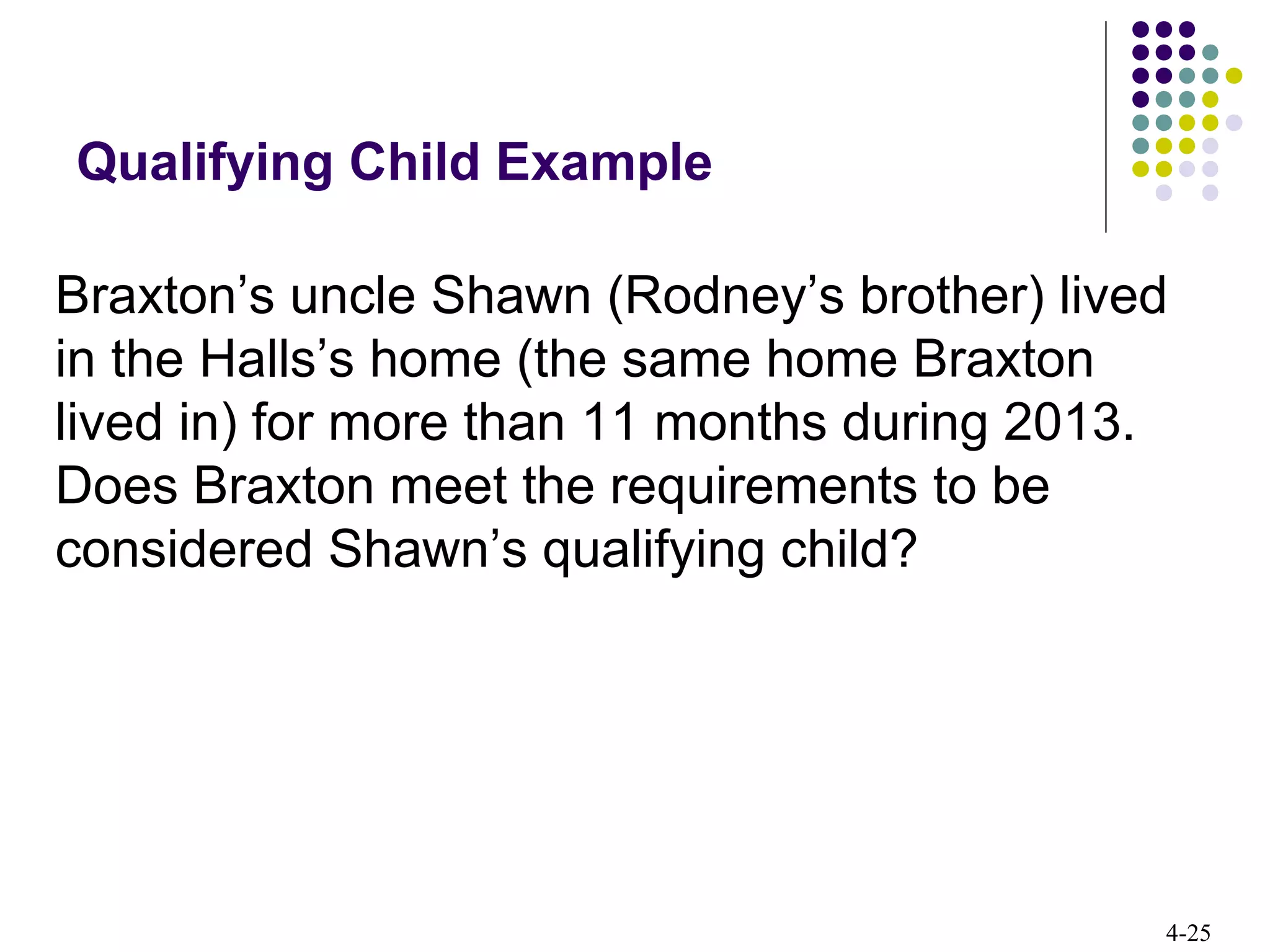

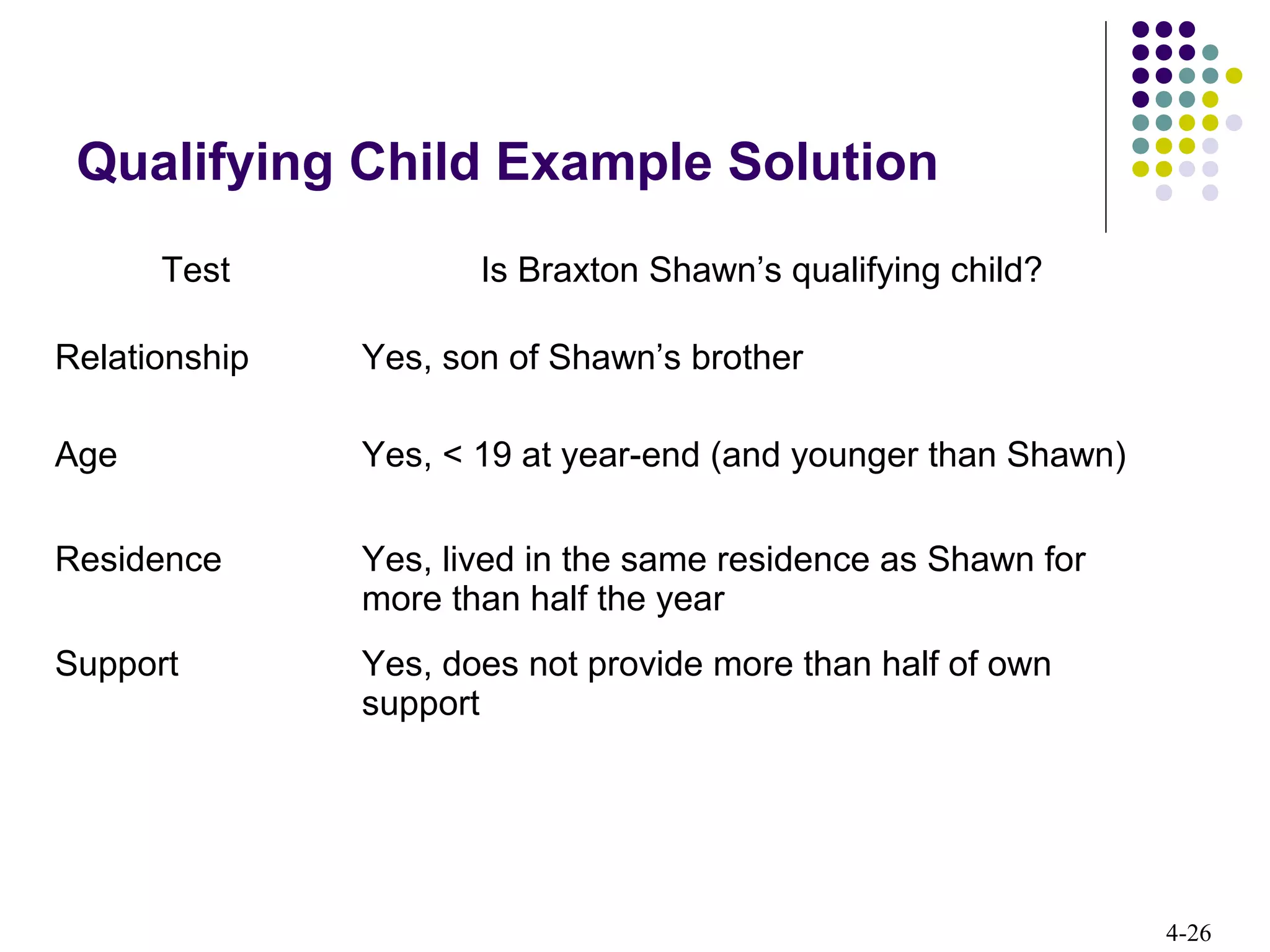

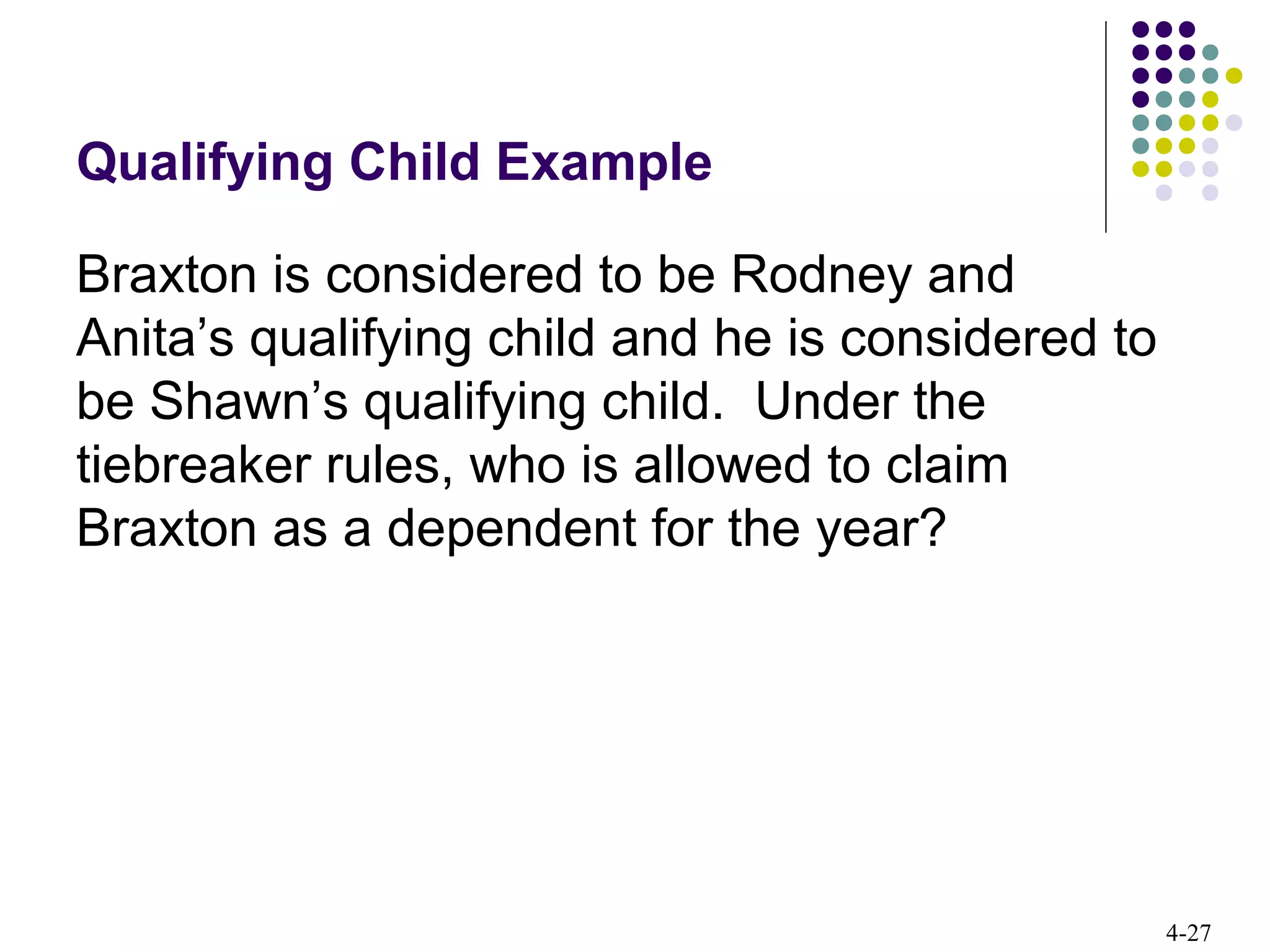

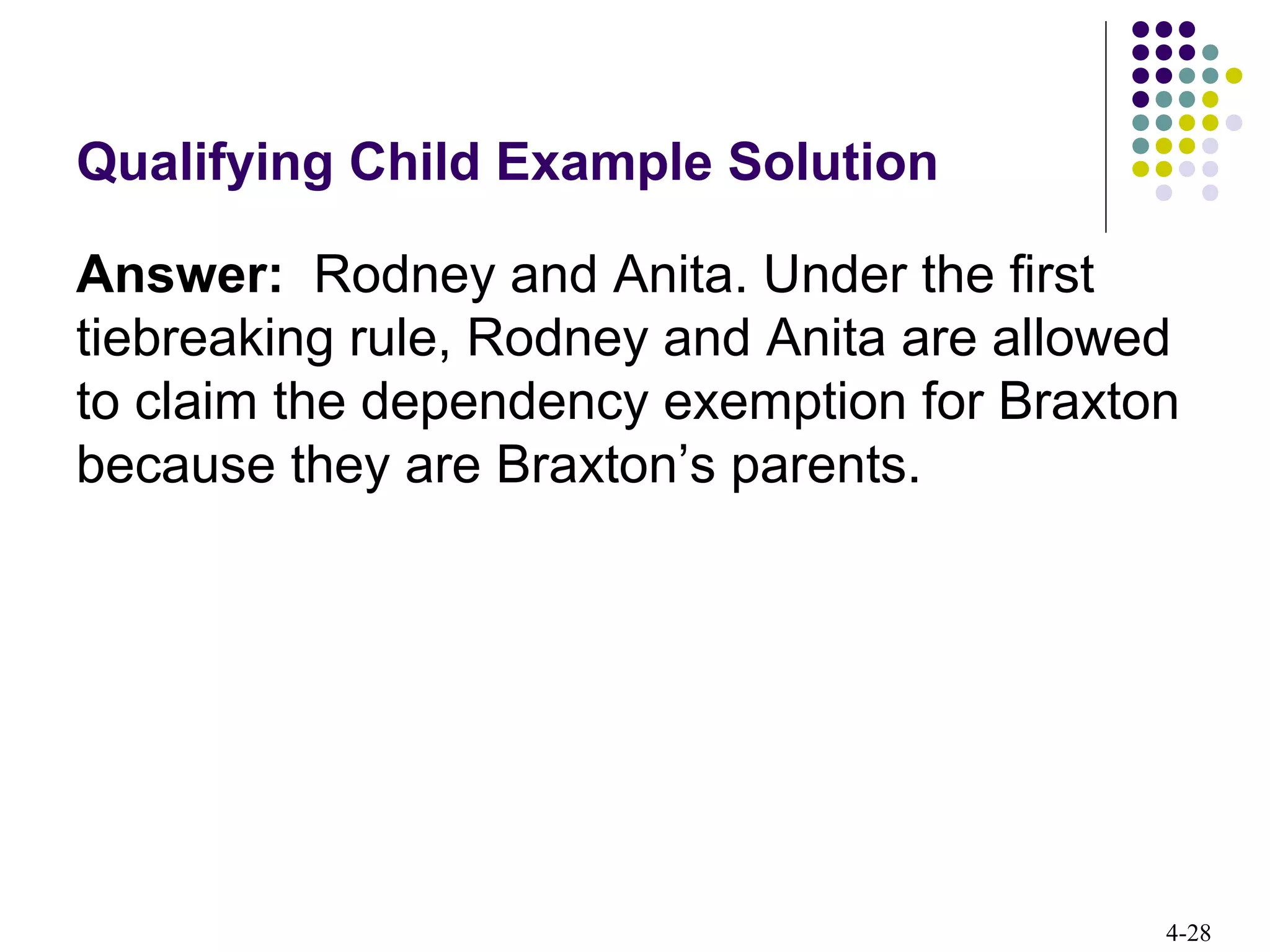

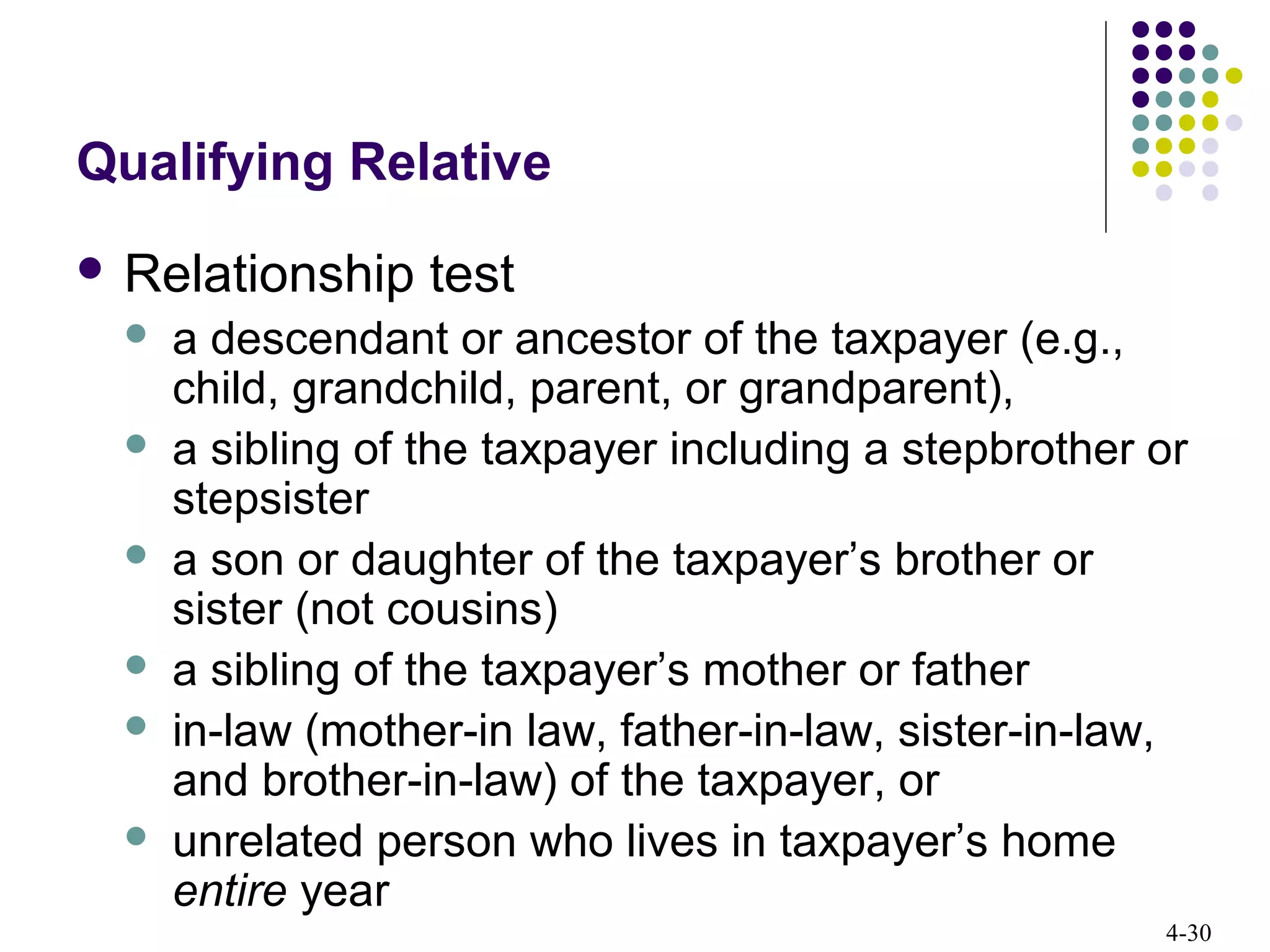

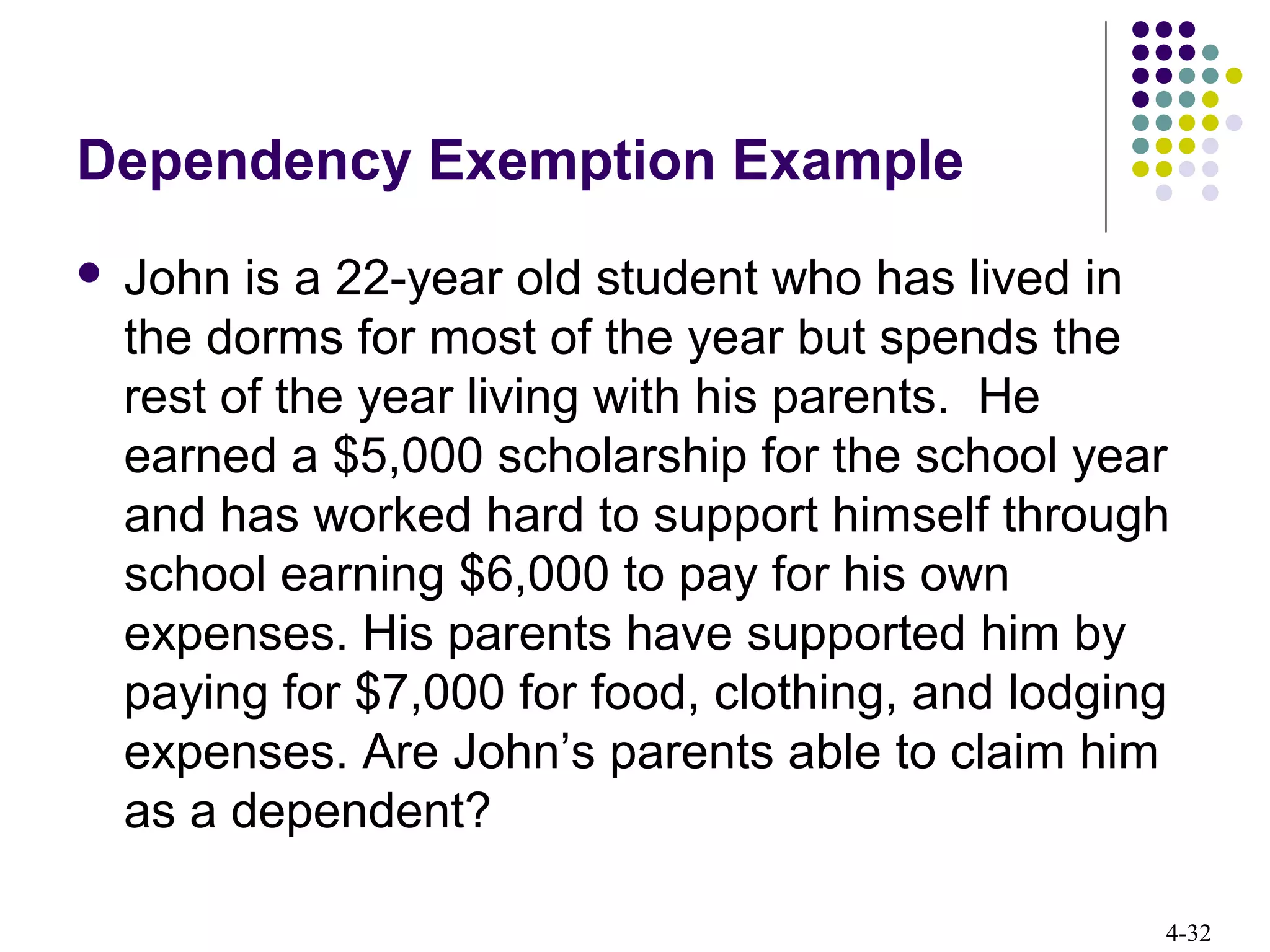

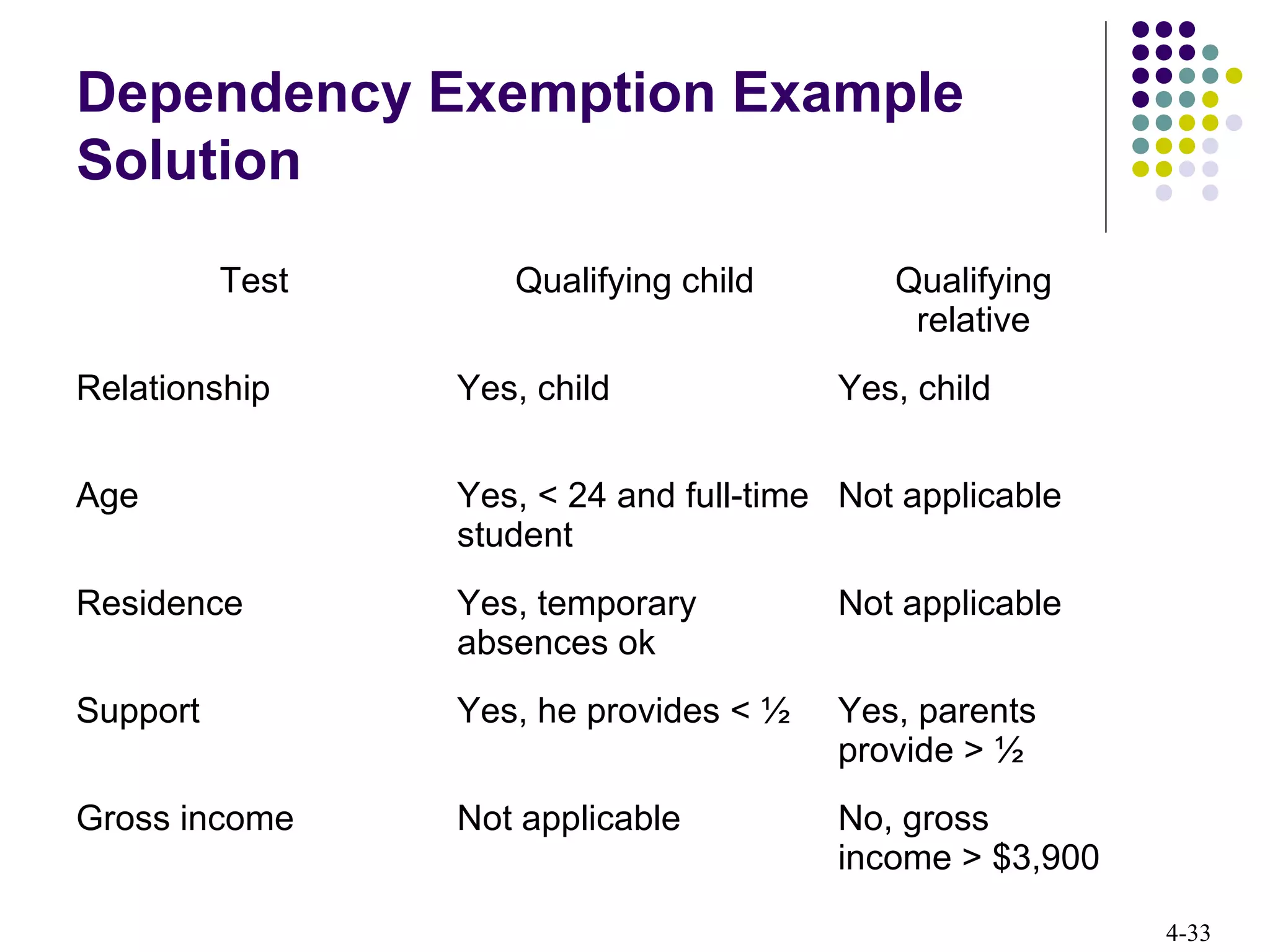

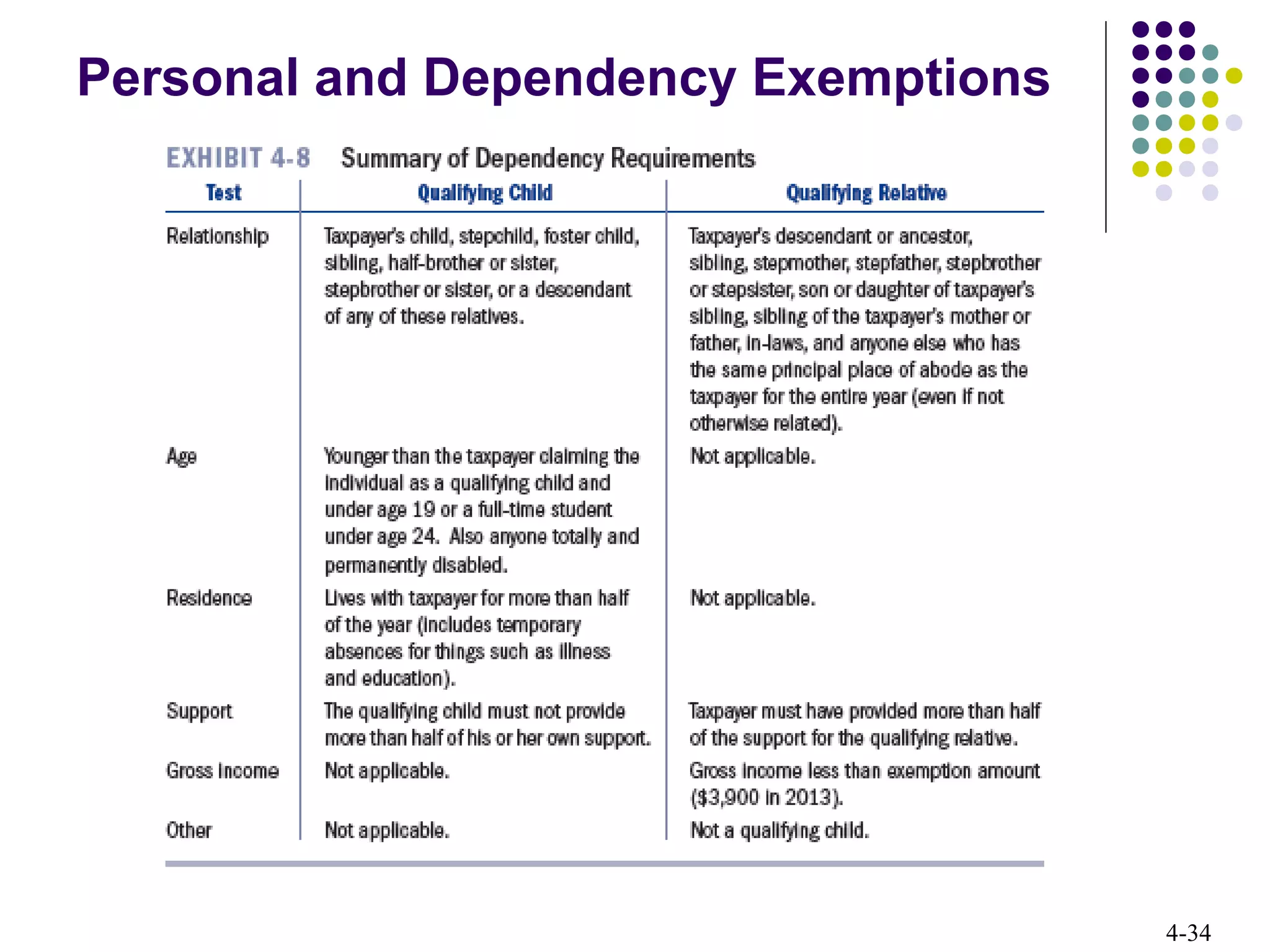

2) It describes the requirements for determining personal and dependency exemptions, including the definitions of a qualifying child and qualifying relative.

3) It explains the different filing statuses individuals can use, including married filing jointly, head of household, and qualifying widow. Examples are provided to illustrate how to determine the proper filing status.