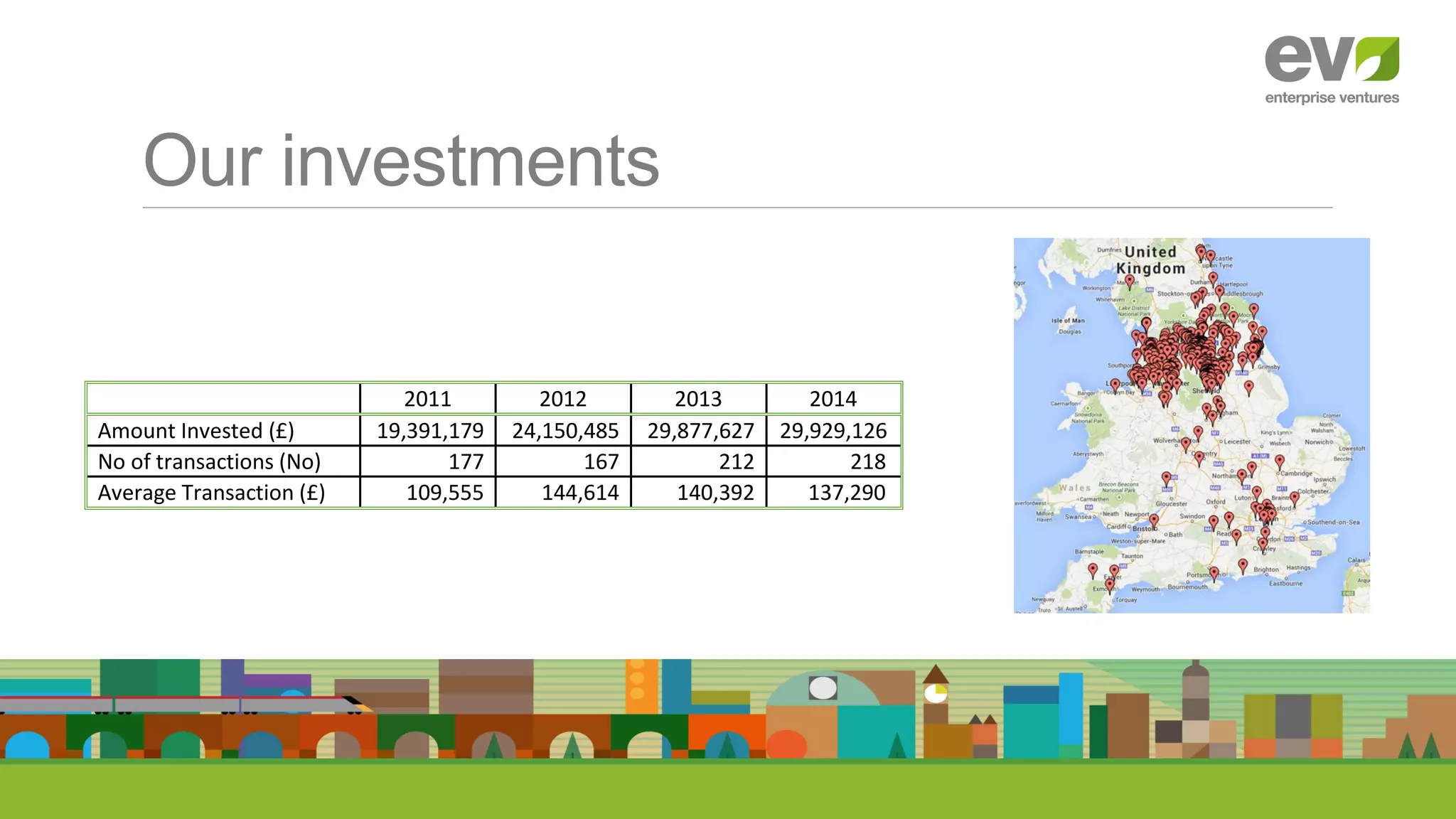

The document discusses Enterprise Ventures, which has been operating for 30 years and manages £160m in funds, focusing on SME funding, with significant investment statistics over the years. It outlines the challenges SMEs face in accessing funding, particularly for growth, and highlights the importance of management structure and track record in securing financial support. It emphasizes the need for public sector intervention to help small businesses grow and achieve maturity.