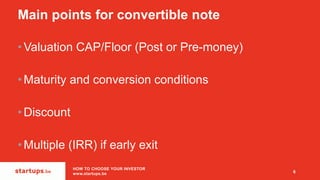

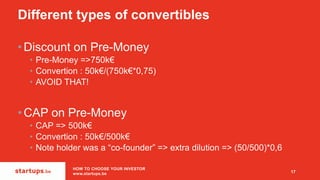

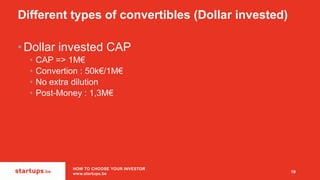

The document outlines the differences between equity rounds and convertible notes in startup financing. It covers key considerations for each type, including valuation methods, types of shares, conditions for conversion, and investor expectations. Important factors such as maturity, caps, and discounts are highlighted as crucial elements in deciding between these financing options.