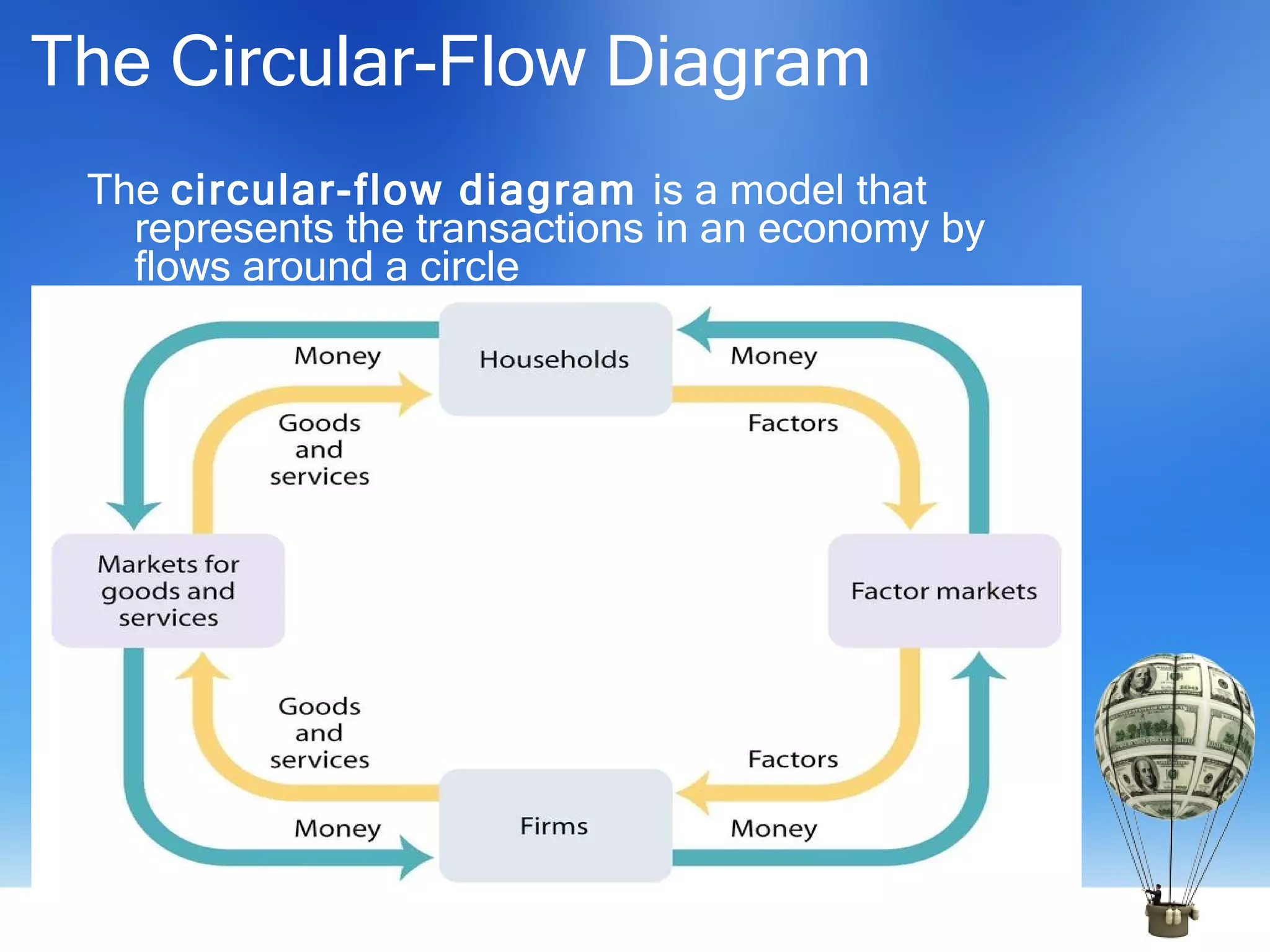

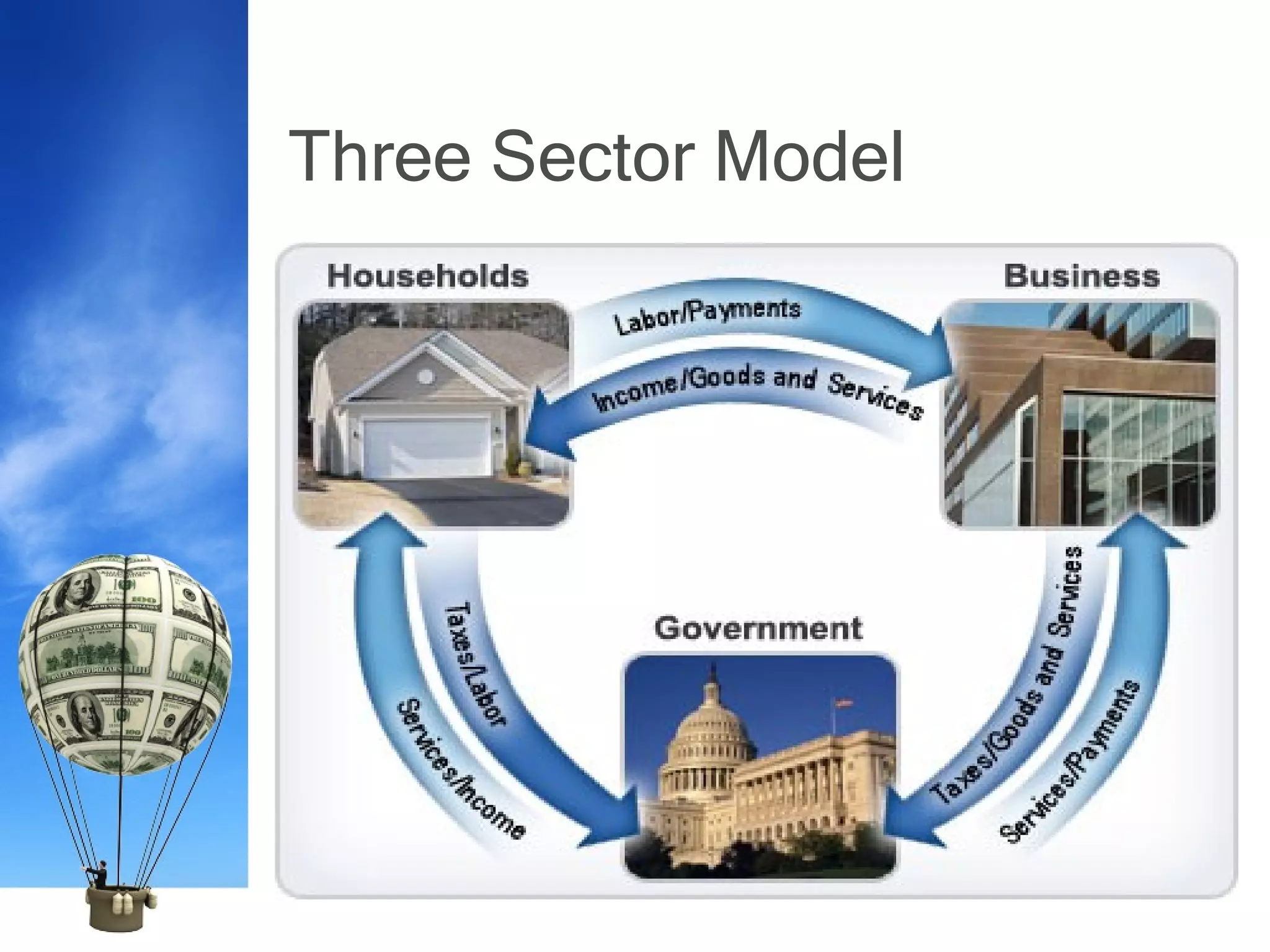

The three sector model shows the circular flow of income and expenditure between households, firms, and the government. Households receive income from firms and purchase goods and services. Firms produce goods/services and purchase inputs from households. The government collects taxes from households and firms, and spends on goods/services. Leakages like savings and taxes reduce household/firm income, while injections like investment and government spending add income into the circular flow. The economy is stable if injections equal leakages, contracting if leakages exceed injections, and expanding if injections exceed leakages. The government can impact the economy through taxing and spending policies.