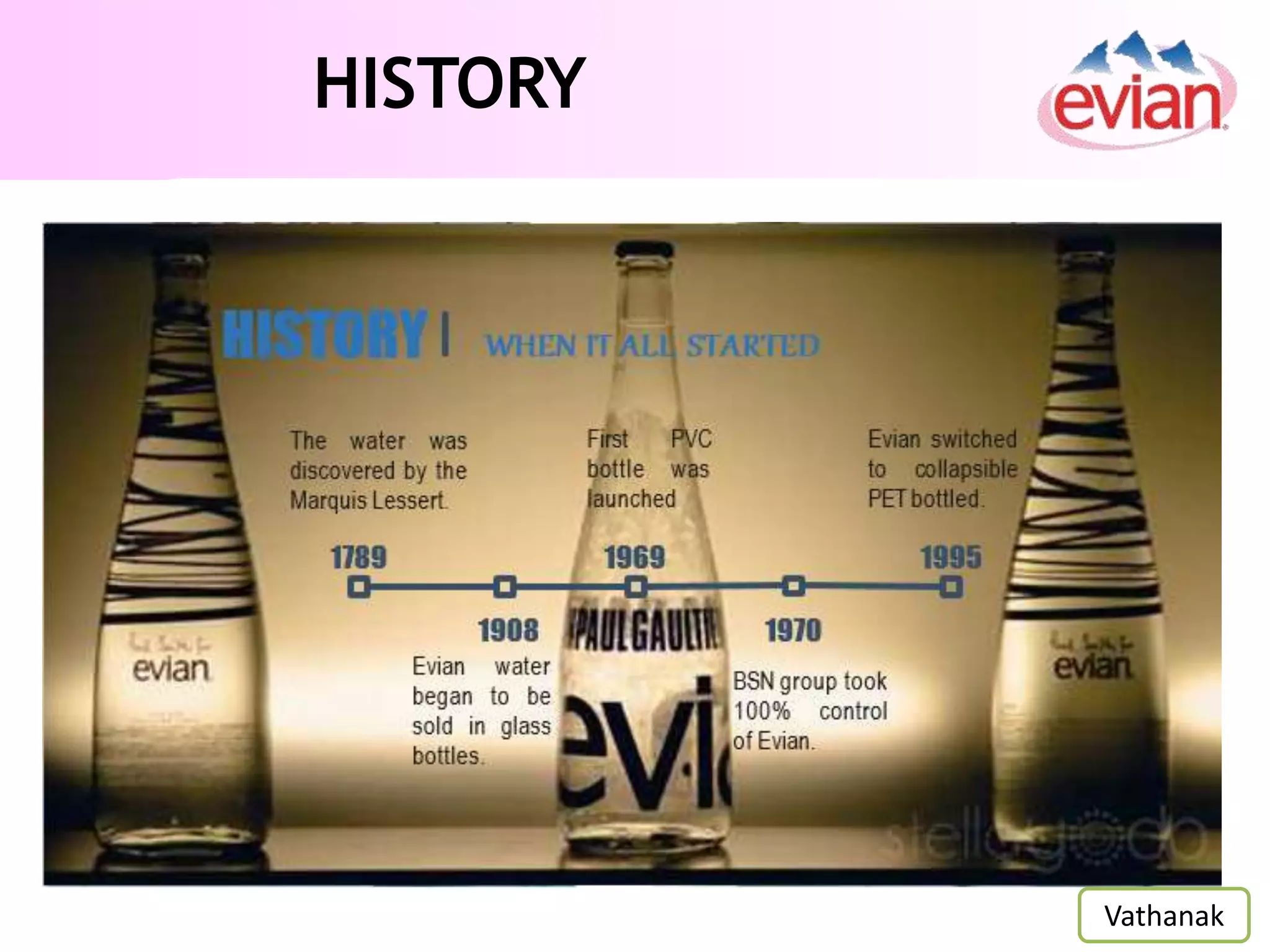

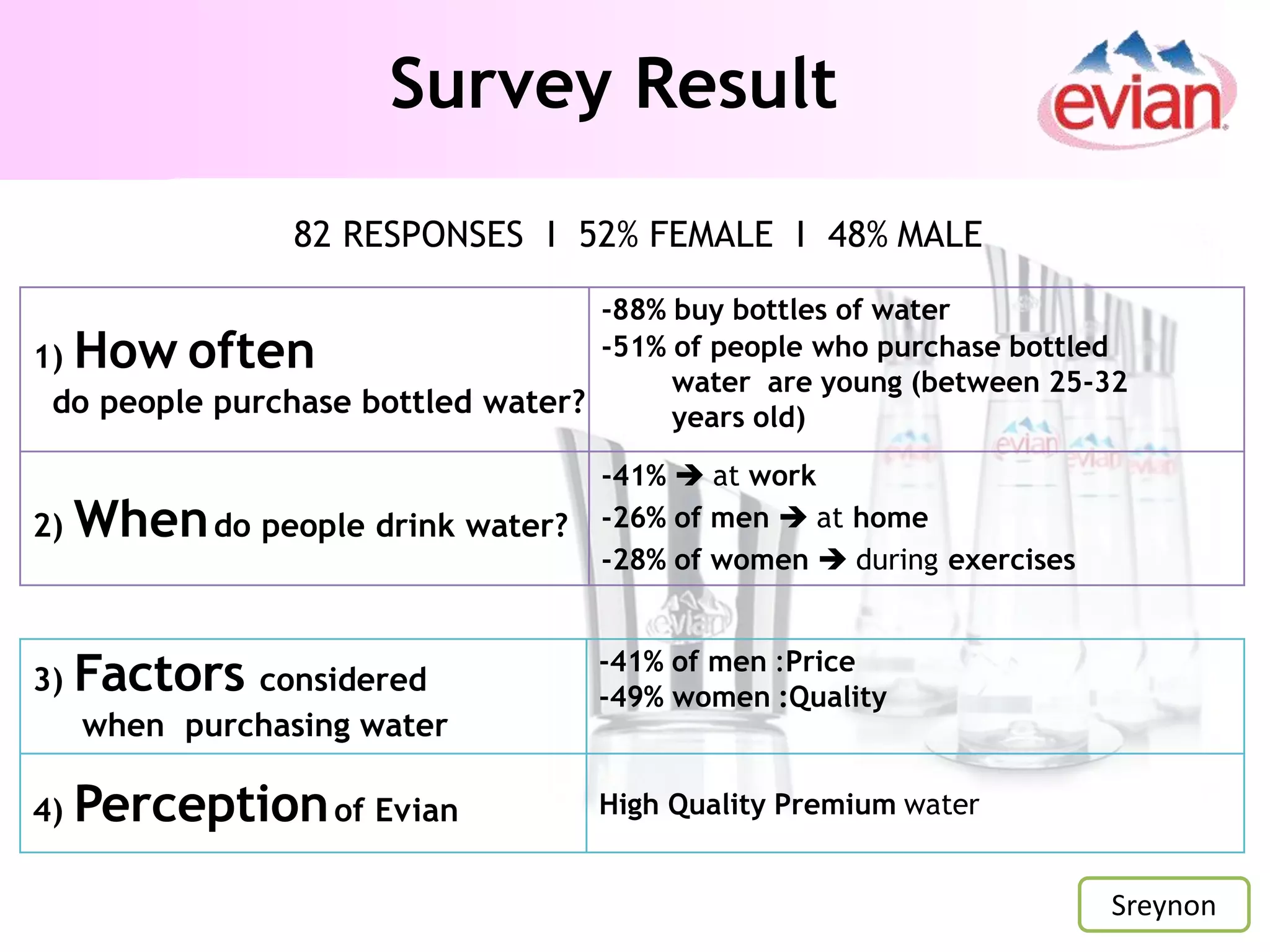

The document presents an in-depth market analysis of Evian mineral water in Cambodia, focusing on its company history, market situation, pricing strategies, and consumer behavior. It highlights the competitive landscape, market demand projections, and a SWOT analysis, showcasing Evian's strengths as a high-quality product against the backdrop of local and international competitors. The conclusion emphasizes Evian's premium brand status and strong recognition within both the Cambodian and global markets.