Net Lease Drug Store Report

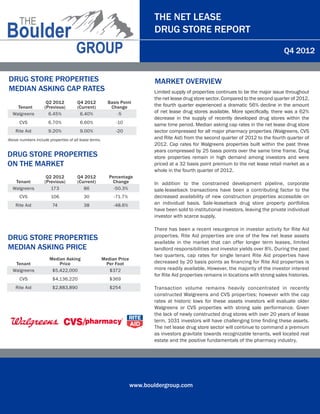

- 1. THE NET LEASE DRUG STORE REPORT Q4 2012 DRUG STORE PROPERTIES MARKET OVERVIEW MEDIAN ASKING CAP RATES Limited supply of properties continues to be the major issue throughout the net lease drug store sector. Compared to the second quarter of 2012, Q2 2012 Q4 2012 Basis Point Tenant (Previous) (Current) Change the fourth quarter experienced a dramatic 56% decline in the amount Walgreens 6.45% 6.40% -5 of net lease drug stores available. More specifically, there was a 62% decrease in the supply of recently developed drug stores within the CVS 6.70% 6.60% -10 same time period. Median asking cap rates in the net lease drug store Rite Aid 9.20% 9.00% -20 sector compressed for all major pharmacy properties (Walgreens, CVS Above numbers include properties of all lease terms. and Rite Aid) from the second quarter of 2012 to the fourth quarter of 2012. Cap rates for Walgreens properties built within the past three years compressed by 25 basis points over the same time frame. Drug DRUG STORE PROPERTIES store properties remain in high demand among investors and were ON THE MARKET priced at a 32 basis point premium to the net lease retail market as a whole in the fourth quarter of 2012. Q2 2012 Q4 2012 Percentage Tenant (Previous) (Current) Change In addition to the constrained development pipeline, corporate Walgreens 173 86 -50.3% sale-leaseback transactions have been a contributing factor to the CVS 106 30 -71.7% decreased availability of new construction properties accessible on Rite Aid 74 38 -48.6% an individual basis. Sale-leaseback drug store property portfolios have been sold to institutional investors, leaving the private individual investor with scarce supply. There has been a recent resurgence in investor activity for Rite Aid properties. Rite Aid properties are one of the few net lease assets DRUG STORE PROPERTIES available in the market that can offer longer term leases, limited MEDIAN ASKING PRICE landlord responsibilities and investor yields over 8%. During the past two quarters, cap rates for single tenant Rite Aid properties have Median Asking Median Price Tenant Price Per Foot decreased by 20 basis points as financing for Rite Aid properties is Walgreens $5,422,000 $372 more readily available. However, the majority of the investor interest for Rite Aid properties remains in locations with strong sales histories. CVS $4,136,220 $369 Rite Aid $2,883,890 $254 Transaction volume remains heavily concentrated in recently constructed Walgreens and CVS properties; however with the cap rates at historic lows for these assets investors will evaluate older Walgreens or CVS properties with strong sale performance. Given the lack of newly constructed drug stores with over 20 years of lease term, 1031 investors will have challenging time finding these assets. The net lease drug store sector will continue to command a premium as investors gravitate towards recognizable tenants, well located real estate and the positive fundamentals of the pharmacy industry. www.bouldergroup.com

- 2. THE NET LEASE DRUG STORE REPORT Q4 2012 MEDIAN ASKING CAP RATE BY BUILDING AGE Year Built Walgreens CVS Rite Aid 2010-2012 5.75% 6.00% 8.35% 2005-2009 6.08% 6.14% 8.50% 2000-2004 6.91% 7.25% 8.75% 1995-1999 7.45% 7.75% 10.12% Before 1994 8.10% 8.79% 10.45% MEDIAN ASKING CAP RATE BY PROPERTY TYPE Property Type Walgreens CVS Rite Aid Ground Lease 5.31% 5.50% 7.75% Fee Simple 6.50% 6.80% 9.00% MEDIAN NATIONAL ASKING VS. DRUG STORE VS. RETAIL NET LEASE CLOSED CAP RATE SPREAD MARKET CAP RATE Q2 2012 Q4 2012 Tenant Closed Asking Spread (bps) Tenant (Previous) (Current) Walgreens 6.28% 6.10% 18 Drug Store 7.00% 6.93% CVS 6.40% 6.12% 28 Retail Net Lease Market 7.50% 7.25% Rite Aid 9.35% 9.00% 32 Drug Store Premium (bps) 50 32 www.bouldergroup.com

- 3. THE NET LEASE DRUG STORE REPORT Q4 2012 COMPANY AND LEASE OVERVIEW Walgreens CVS Rite Aid Credit Rating BBB (Stable) BBB+ (Stable) B- (Stable) Market Cap $39 billion $64 billion $1 billion Revenue $70 billion $123 billion $26 billion 2013 Stores Planned 175 186 N/A (Company estimates) Number of Stores 8,516 7,458 4,633 Typical Lease Term 20 or 25 year primary term with 25 year primary term with six 20 year primary term with six fifty years of options 5-year options 5-year options Typical Rent Increases None None in primary 10% increases in Increases every 10 years of 10% option periods FOR MORE INFORMATION AUTHOR John Feeney | Research Director john@bouldergroup.com CONTRIBUTORS Randy Blankstein | President Jimmy Goodman | Partner Chad Gans | Research Analyst rblank@bouldergroup.com jimmy@bouldergroup.com chad@bouldergroup.com © 2013. The Boulder Group. Information herein has been obtained from databases owned and maintained by The Boulder Group as well as third party sources. We have not verified the information and we make no guarantee, warranty or representation about it. This information is provided for general illustrative purposes and not for any specific recommendation or purpose nor under any circumstances shall any of the above information be deemed legal advice or counsel. Reliance on this information is at the risk of the reader and The Boulder Group expressly disclaims any liability arising from the use of such information. This information is designed exclusively for use by The Boulder Group clients and cannot be reproduced, retransmitted or distributed without the express written consent of The Boulder Group. www.bouldergroup.com