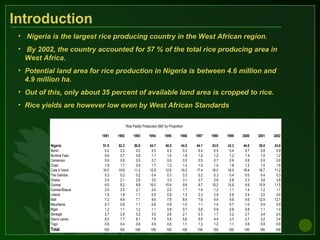

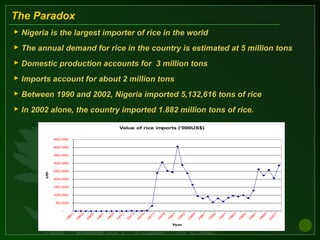

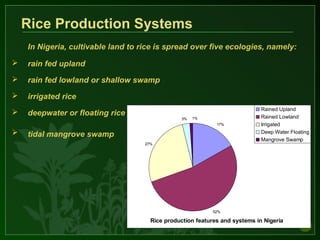

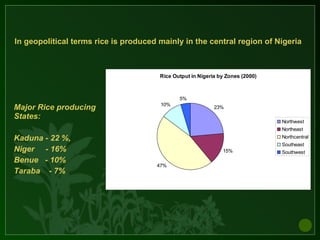

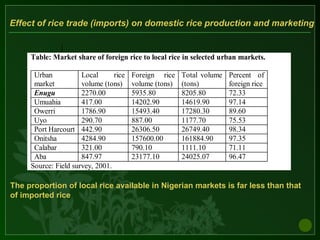

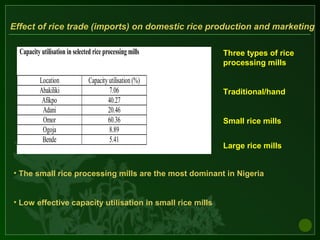

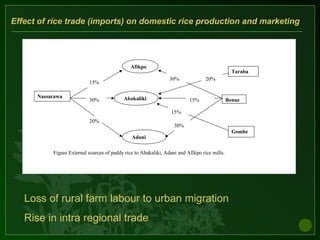

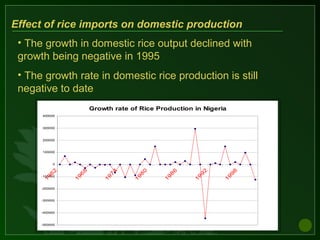

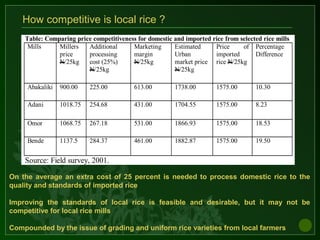

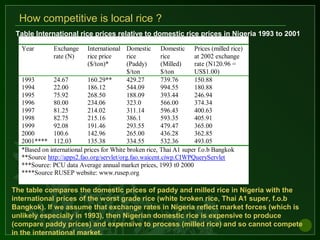

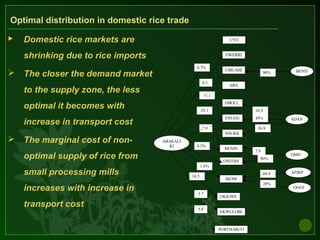

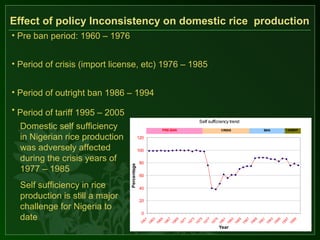

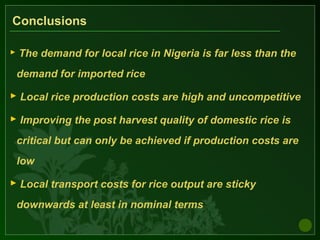

This document analyzes the impact of rice imports on domestic rice production in Nigeria. It finds that Nigeria accounts for over 50% of rice production in West Africa but still relies heavily on rice imports to meet domestic demand. Domestic rice production costs are high, making local rice uncompetitive with imported rice. While government policies have aimed to promote self-sufficiency, rice imports continue to dominate the market and outcompete local producers. Improving yields, quality standards, processing efficiency and reducing costs will be needed for domestic rice to become competitive.