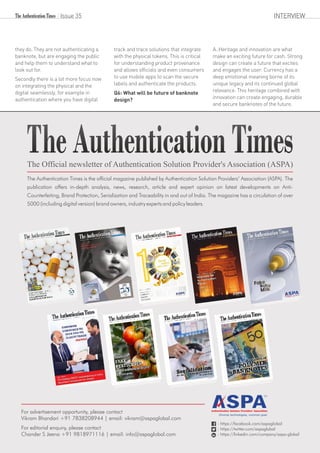

The November 2018 issue of 'The Authentication Times' highlights the significance of design in the authentication industry, particularly regarding banknotes and product security. It emphasizes the need for brand protection professionals to engage with users to create a positive consumer experience while navigating new technologies and design trends. Interviews with experts outline the importance of user-centered approaches in banknote design, addressing security features, aesthetic considerations, and future innovations.