Regression analysis is a predictive modeling technique used to investigate relationships between variables. It allows one to estimate the effects of independent variables on a dependent variable. Regression analysis can be used for forecasting, time series modeling, and determining causal relationships. There are different types of regression depending on the number of variables and the shape of the regression line. Linear regression models the linear relationship between two variables using an equation with parameters estimated to minimize error. Correlation and covariance measures the strength and direction of association between variables. Analysis of variance (ANOVA) compares the means of groups within data. Heteroskedasticity refers to unequal variability of a dependent variable across the range of independent variable values.

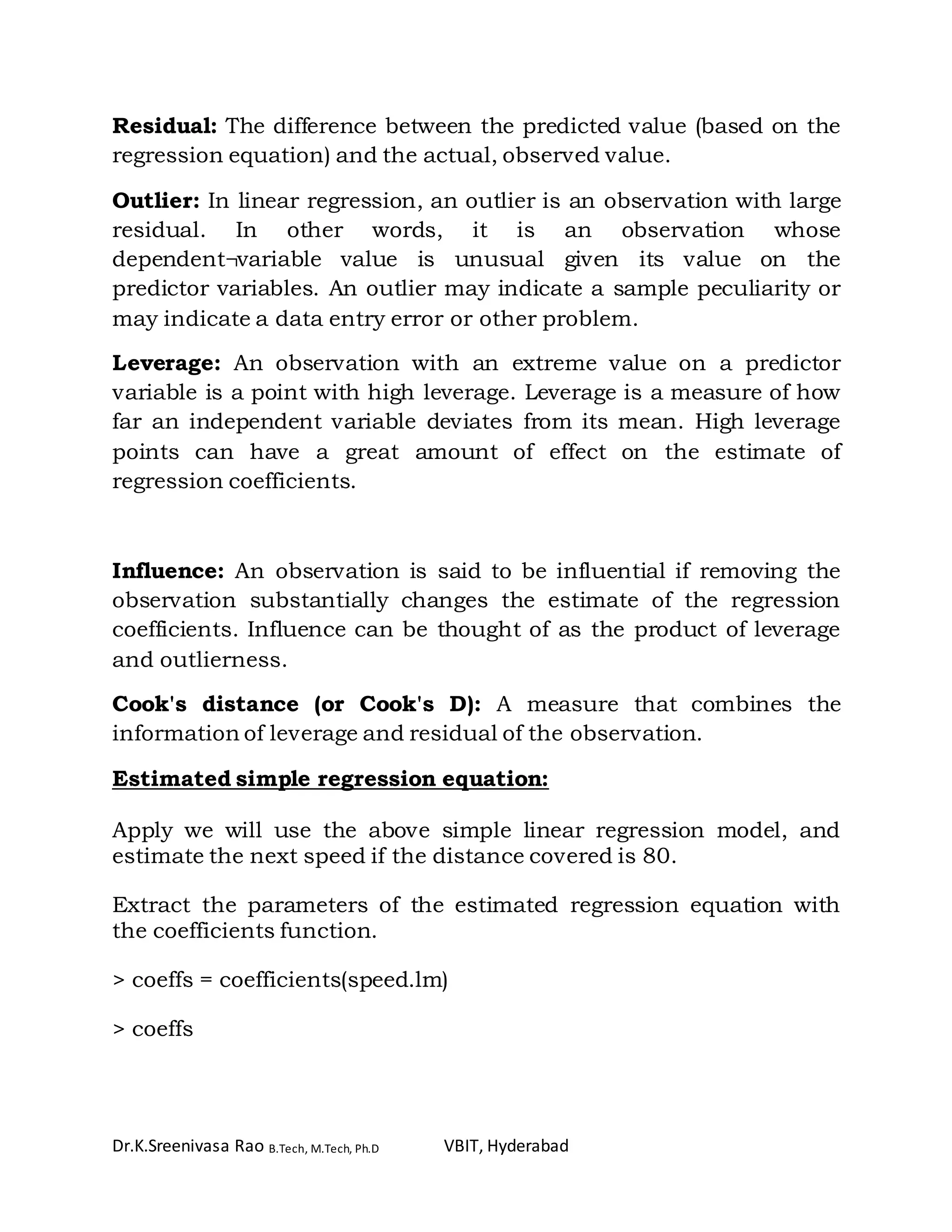

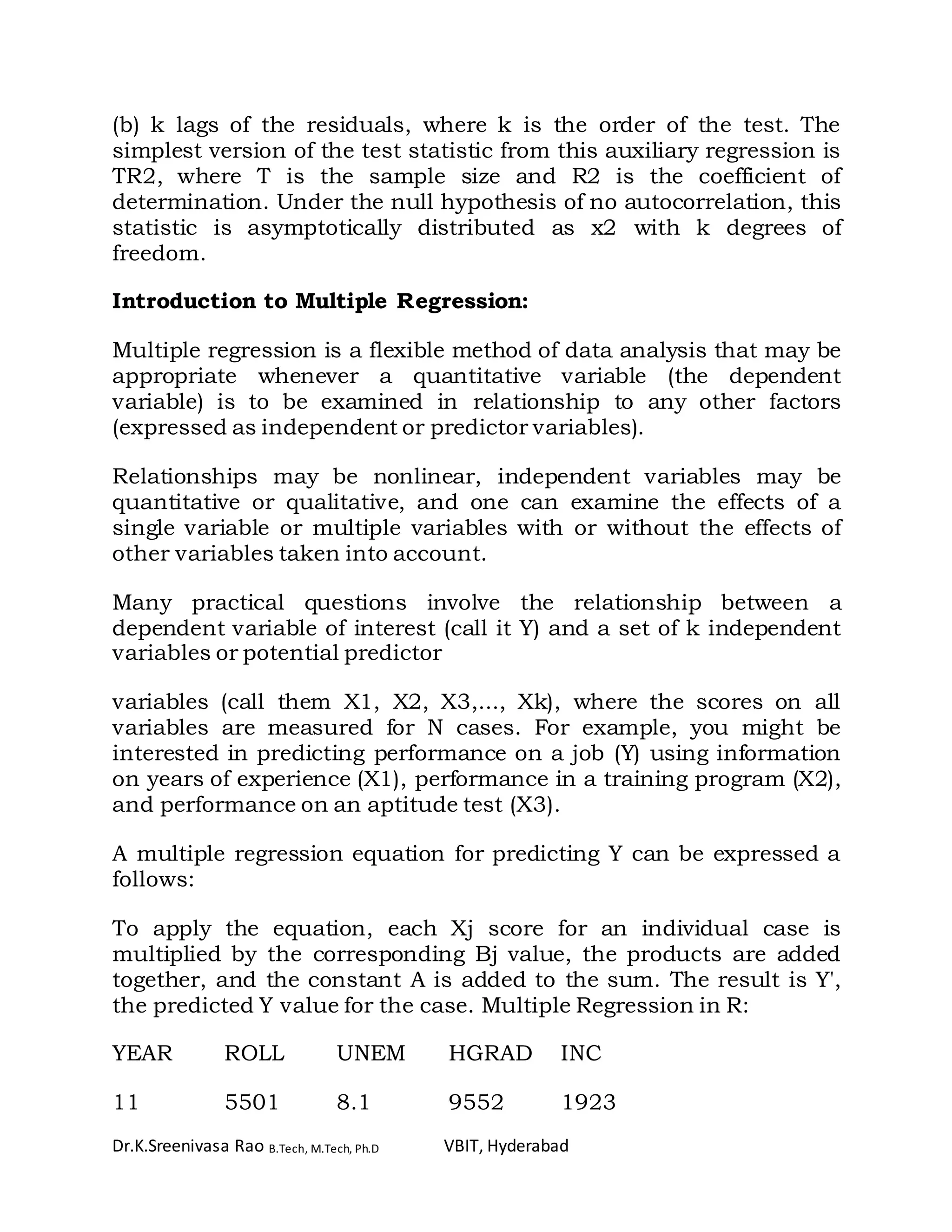

![Dr.K.Sreenivasa Rao B.Tech, M.Tech, Ph.D VBIT, Hyderabad

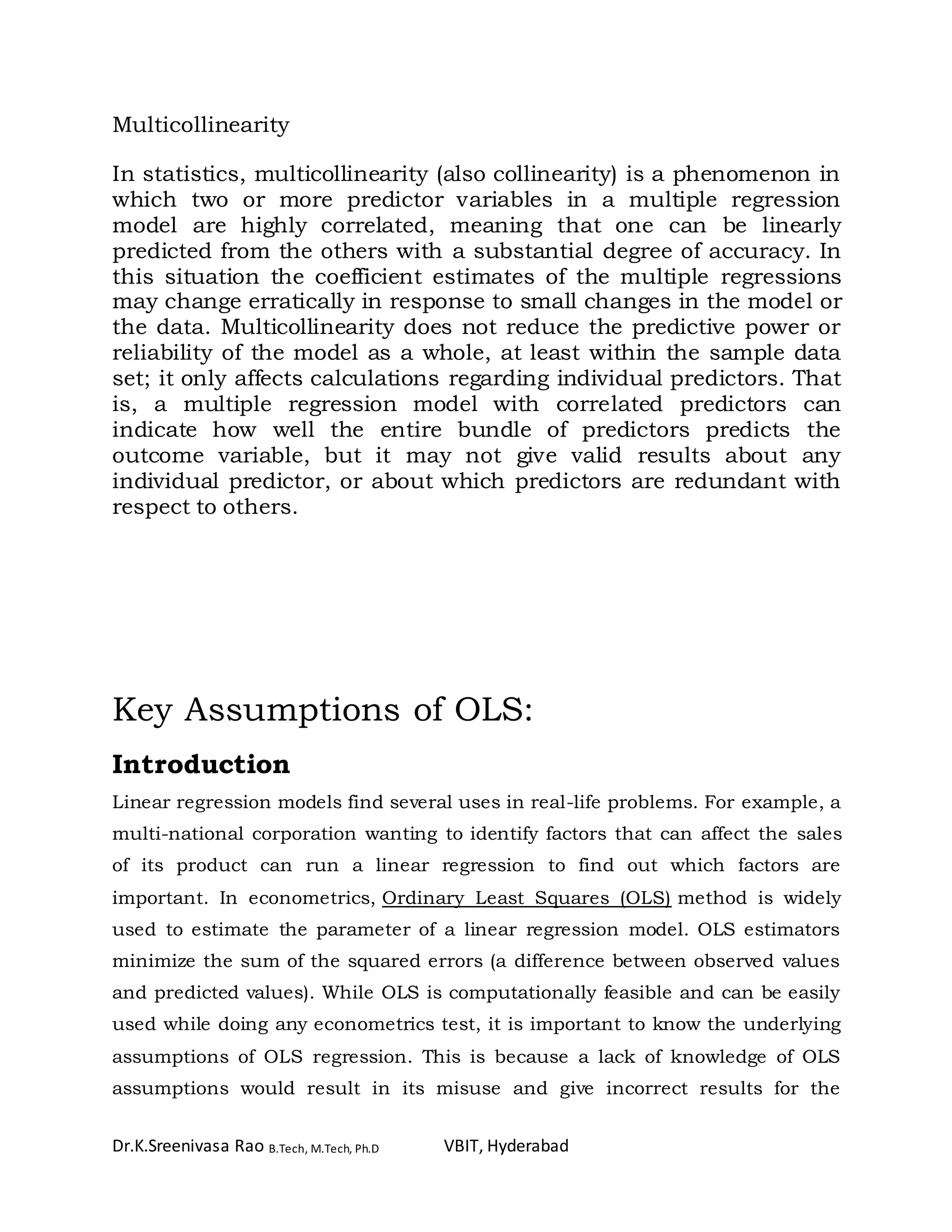

1 4 2

2 4 10

3 7 4

4 7 22

5 8 16

6 9 10

> attach(cars)

By using the attach( ) function the database is attached to the R

search path. This means that the database is searched by R when

evaluating a variable, so objects in the database can be accessed by

simply giving their names.

> speed

[1] 4 4 7 7 8 9 10 10 10 11 11 12 12 12 12 13 13 13 13 14 14 14 14

15 15 15 16

[28] 16 17 17 17 18 18 18 18 19 19 19 20 20 20 20 20 22 23 24 24

24 24 25

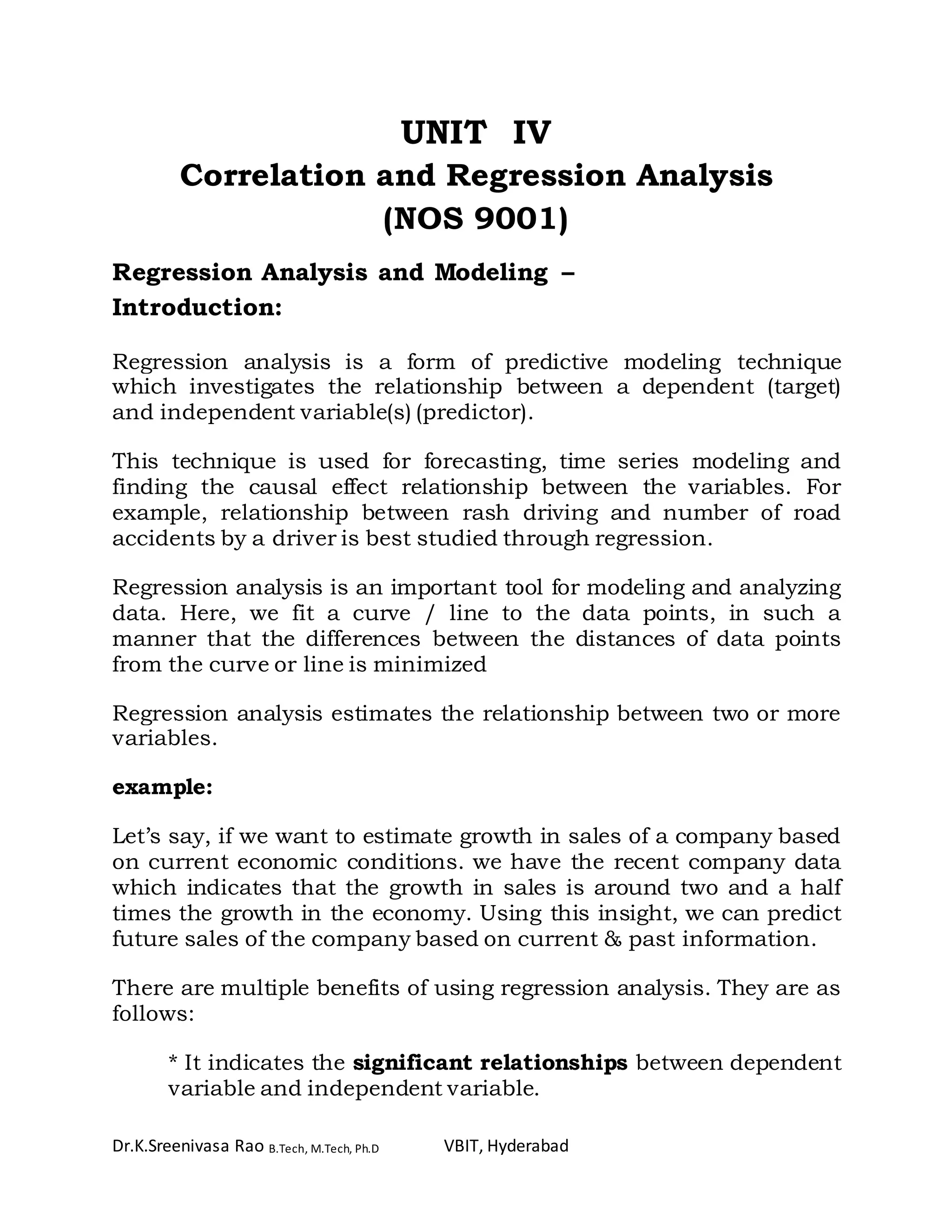

> plot(cars)

> plot(dist,speed)

The plot() function gives a scatterplot whenever we give two numeric

variables.

The first variable listed will be plotted on the horizontal axis.](https://image.slidesharecdn.com/correlationandregressioninr-170506080437/75/Correlation-and-regression-in-r-3-2048.jpg)

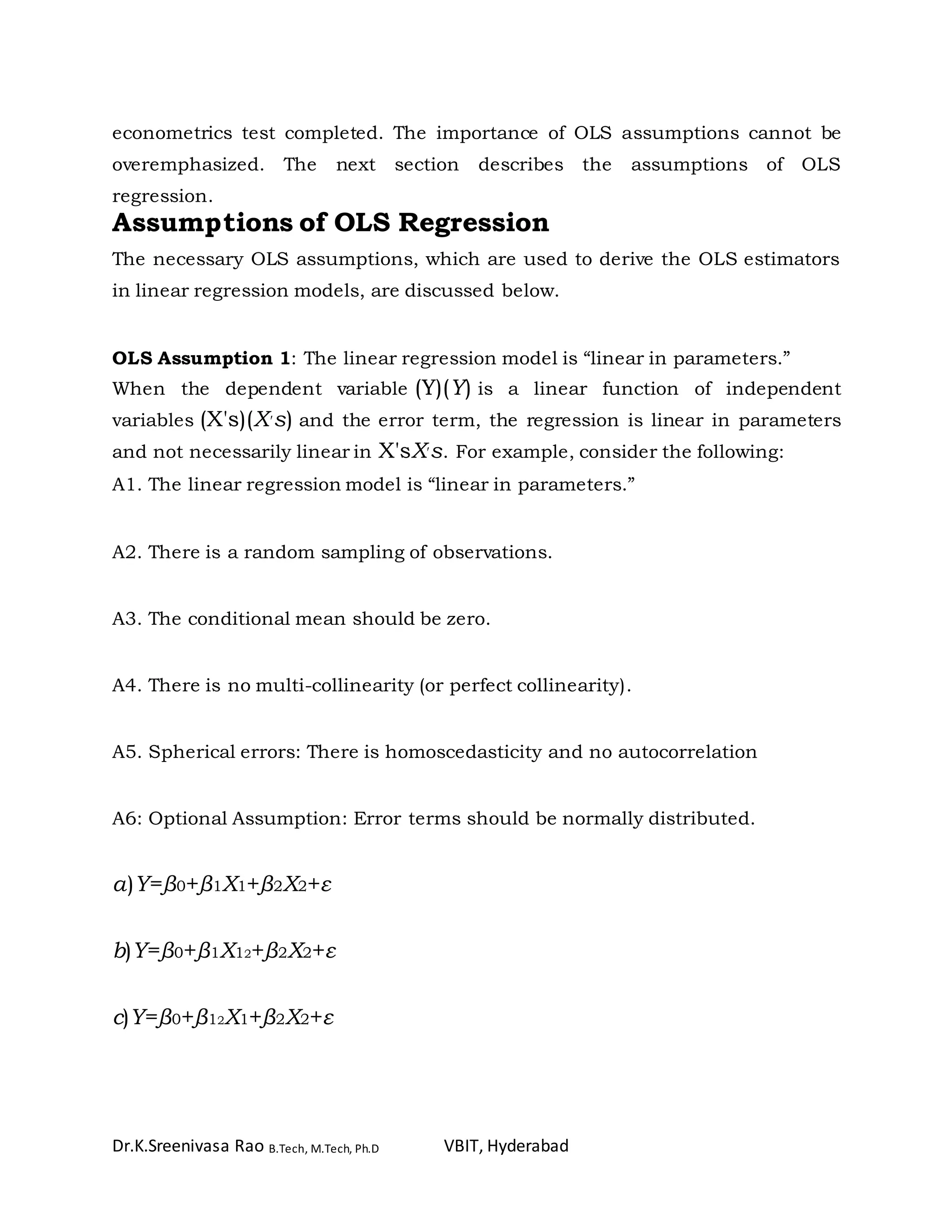

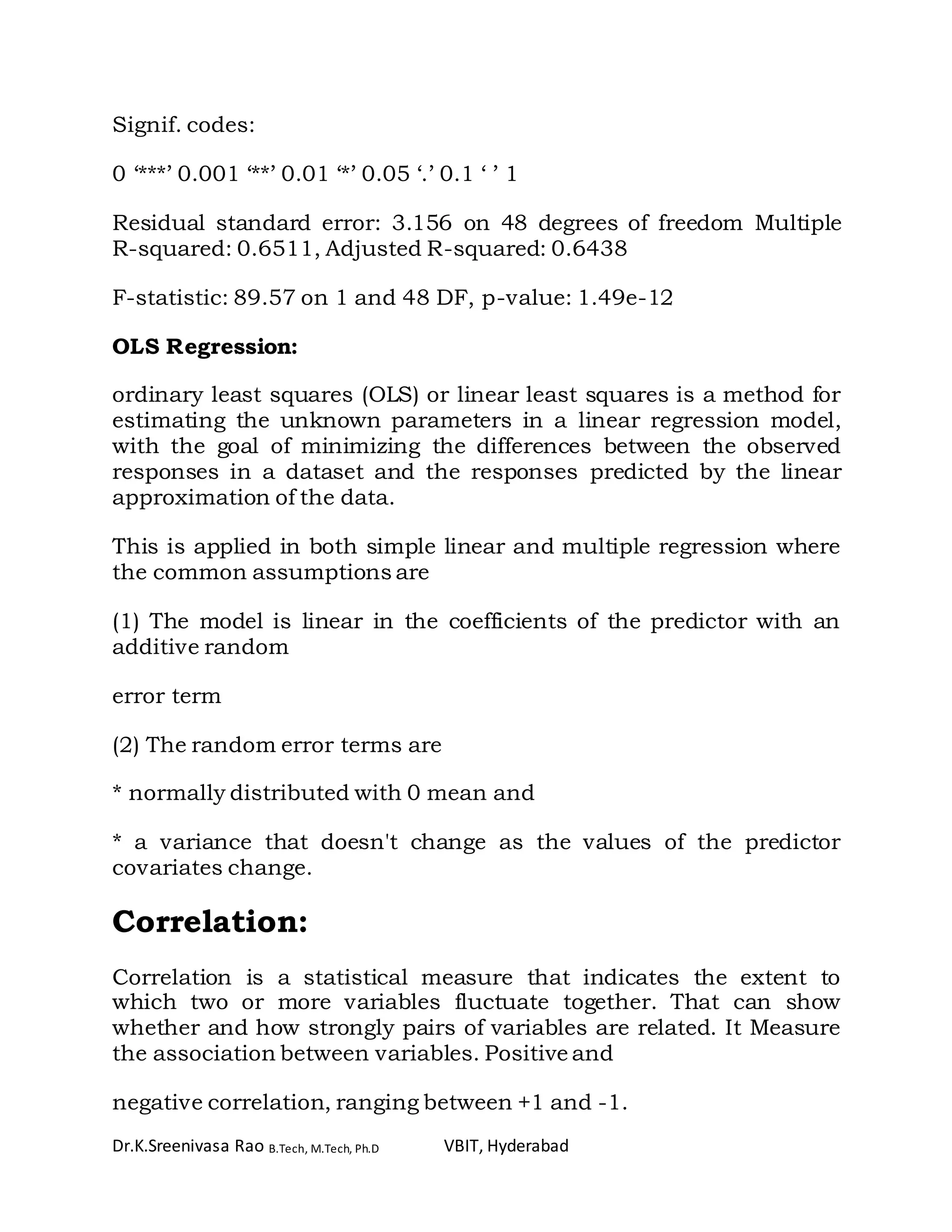

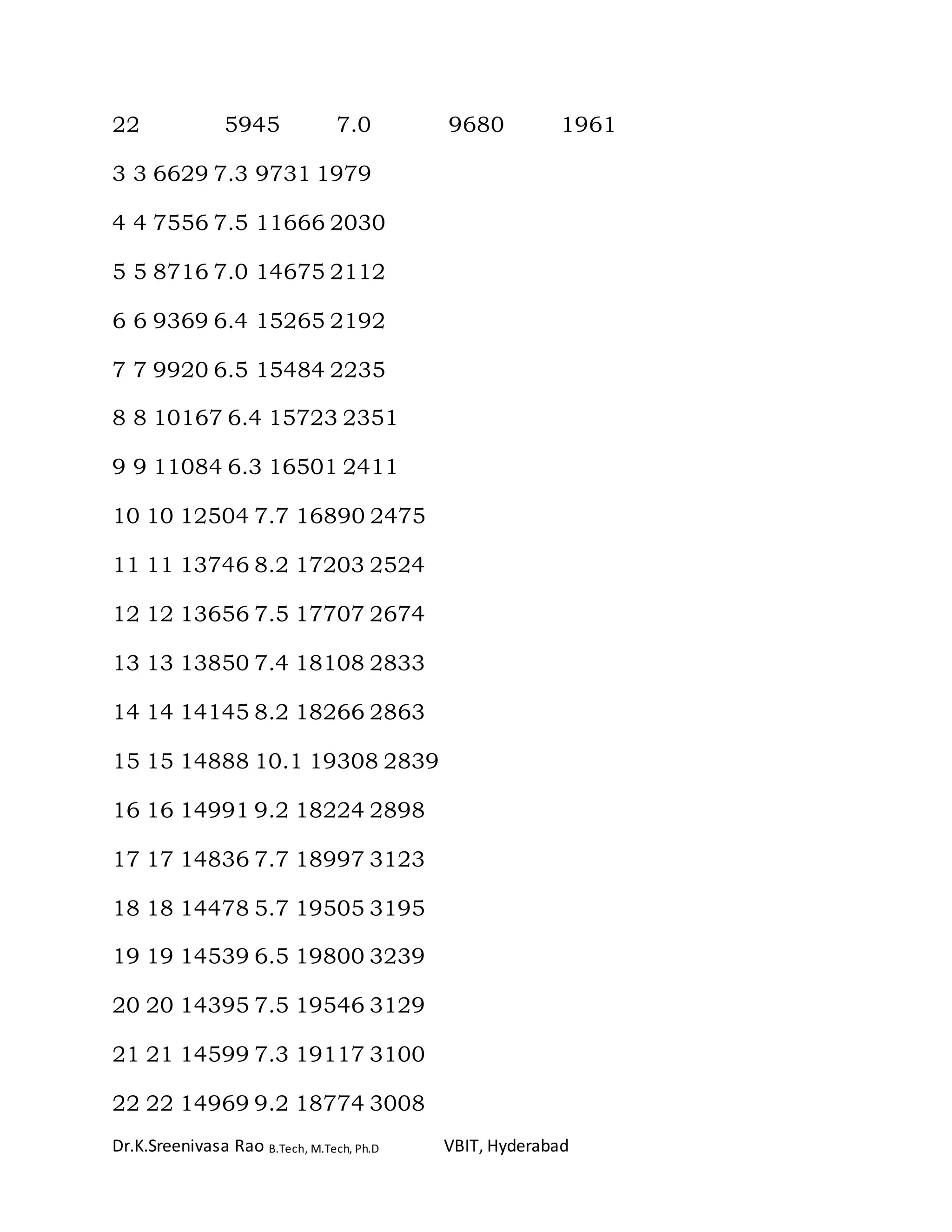

![Dr.K.Sreenivasa Rao B.Tech, M.Tech, Ph.D VBIT, Hyderabad

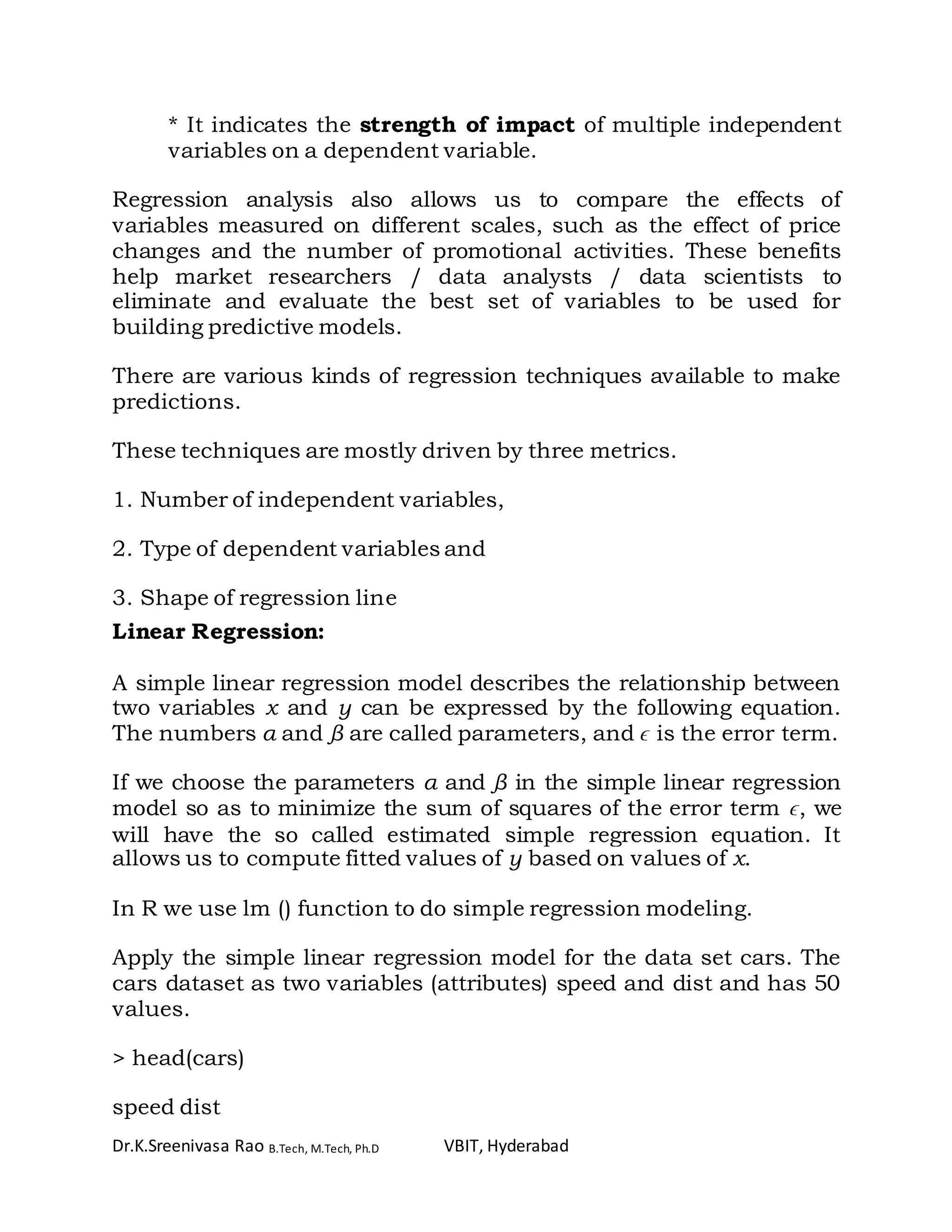

(Intercept) dist

8.2839056 0.1655676

Forecasting/Prediction:

We now fit the speed using the estimated regression equation.

> newdist = 80

> distance = coeffs[1] + coeffs[2]*newdist

> distance

(Intercept)

21.52931

To create a summary of the fitted model:

> summary (speed.lm)

Call:

lm(formula = speed ~ dist, data = cars)

Residuals:

Min 1Q Median 3Q Max

-7.5293 -2.1550 0.3615 2.4377 6.4179

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 8.28391 0.87438 9.474 1.44e-12 ***

dist 0.16557 0.01749 9.464 1.49e-12 ***

---](https://image.slidesharecdn.com/correlationandregressioninr-170506080437/75/Correlation-and-regression-in-r-11-2048.jpg)

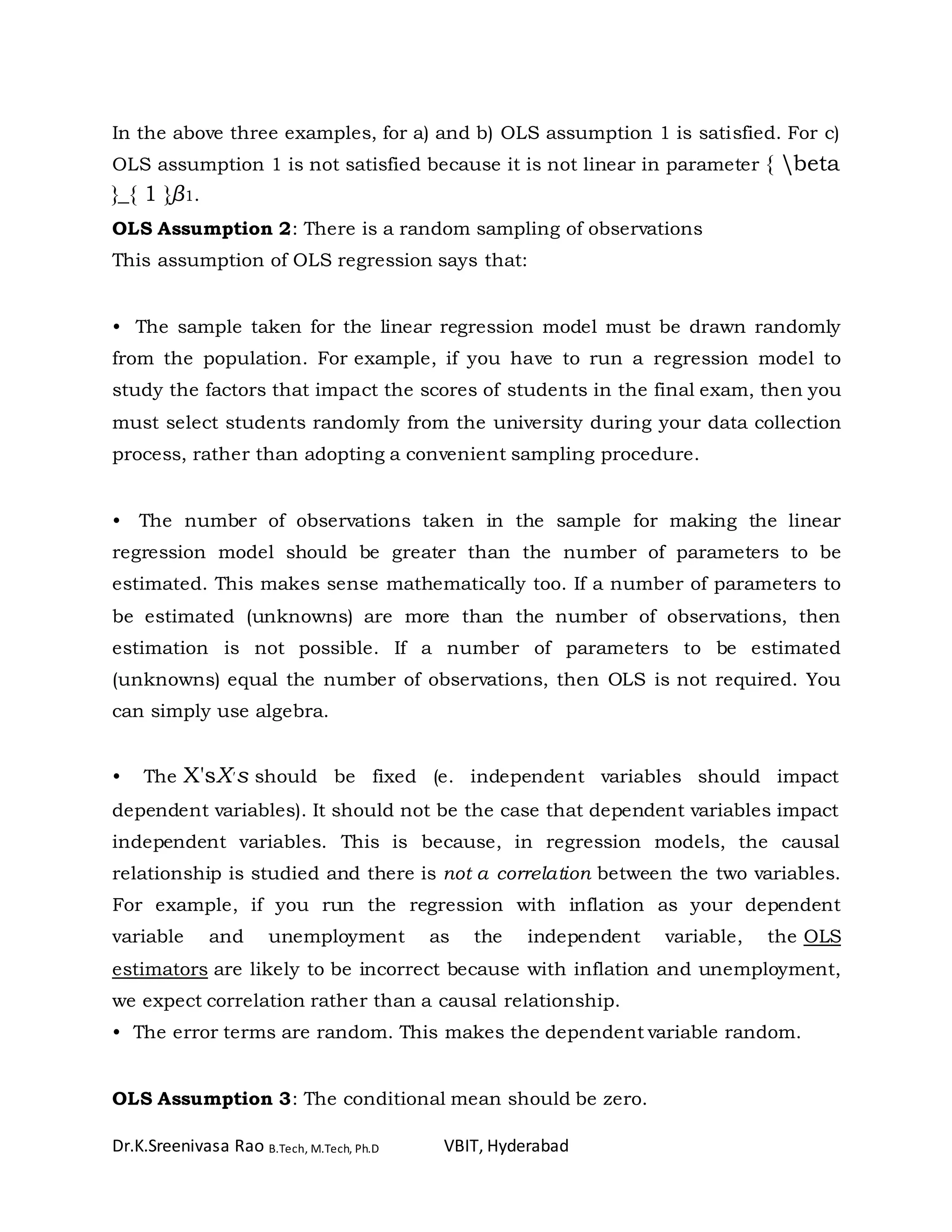

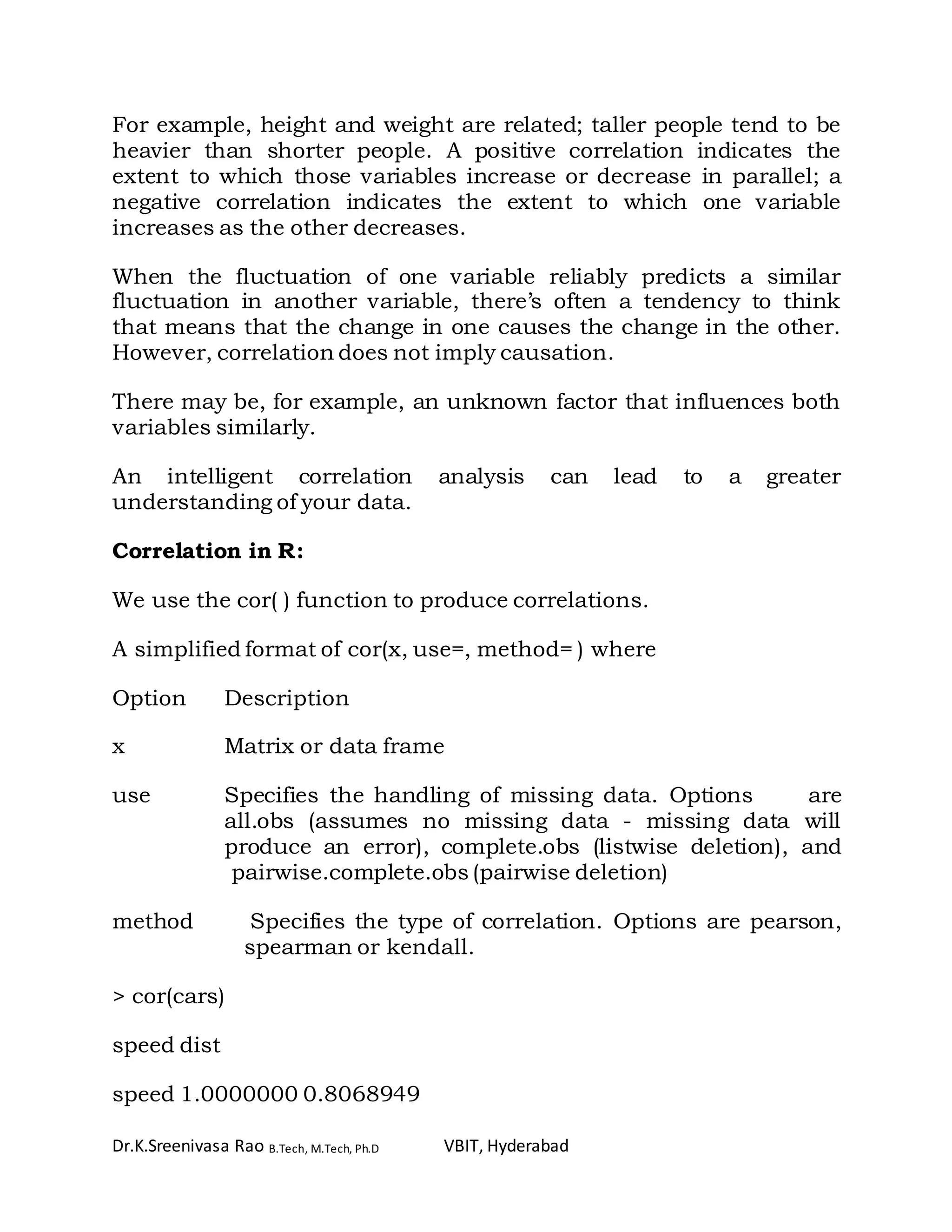

![Dr.K.Sreenivasa Rao B.Tech, M.Tech, Ph.D VBIT, Hyderabad

> duration = faithful$eruptions # the eruption durations

> waiting = faithful$waiting # the waiting period

> cov(duration, waiting) # apply the cov function

[1] 13.978

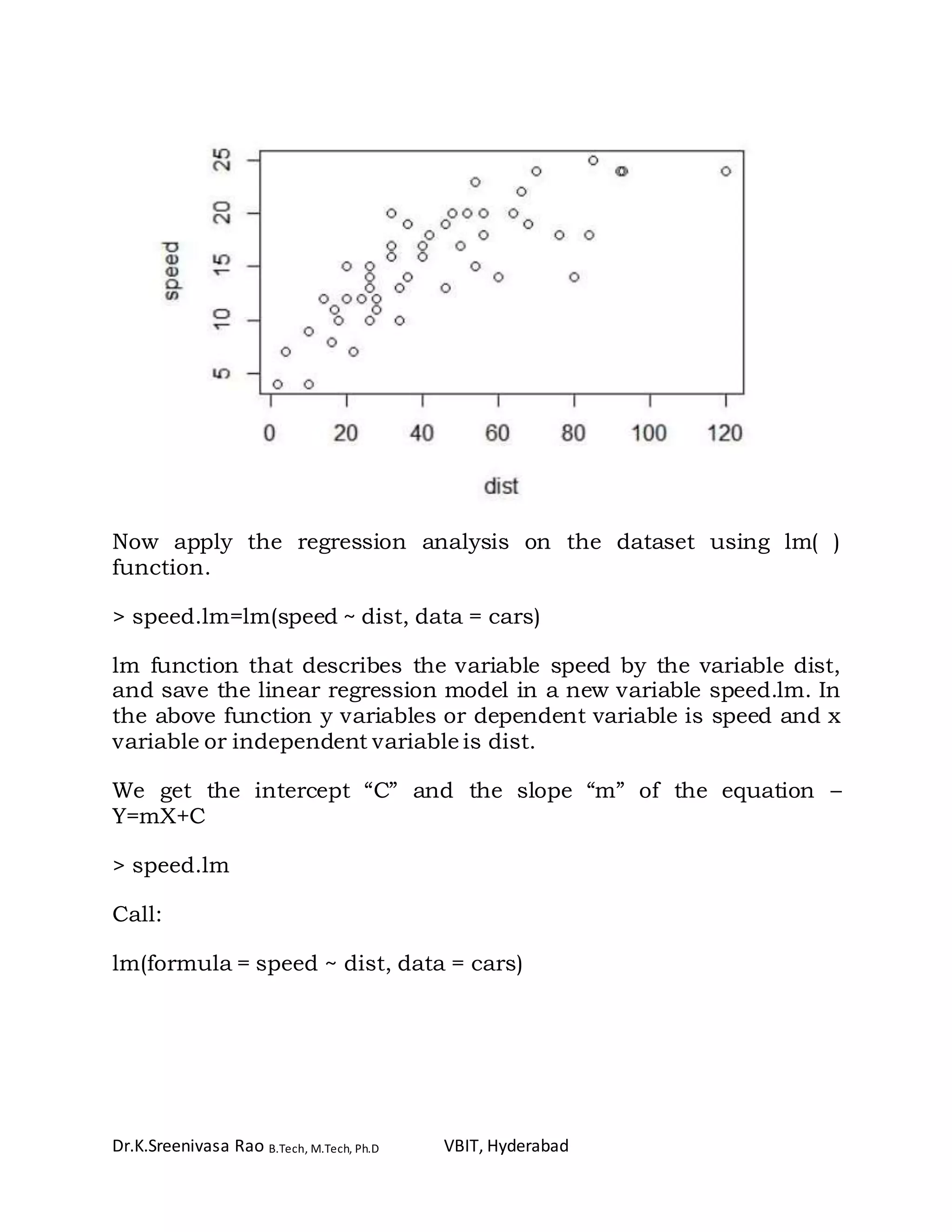

ANOVA:

Analysis of Variance (ANOVA) is a commonly used statistical

technique for investigating data by comparing the means of subsets

of the data. The base case is the one-way ANOVA which is an

extension of two-sample t test for independent groups covering

situations where there are more than two groups being compared.

In one-way ANOVA the data is sub-divided into groups based on a

single classification factor and the standard terminology used to

describe the set of factor levels is treatment even though this might

not always have meaning for the particular application. There is

variation in the measurements taken on the individual components

of the data set and ANOVA investigates whether this variation can

be explained by the grouping introduced by the classification factor.

To investigate these differences we fit the one-way ANOVA model

using the lm function and look at the parameter estimates and

standard errors for the treatment effects.

> anova(speed.lm)

Analysis of Variance Table

Response: speed

Df Sum Sq Mean Sq F value Pr(>F)

dist 1 891.98 891.98 89.567 1.49e-12 ***

Residuals 48 478.02 9.96](https://image.slidesharecdn.com/correlationandregressioninr-170506080437/75/Correlation-and-regression-in-r-16-2048.jpg)

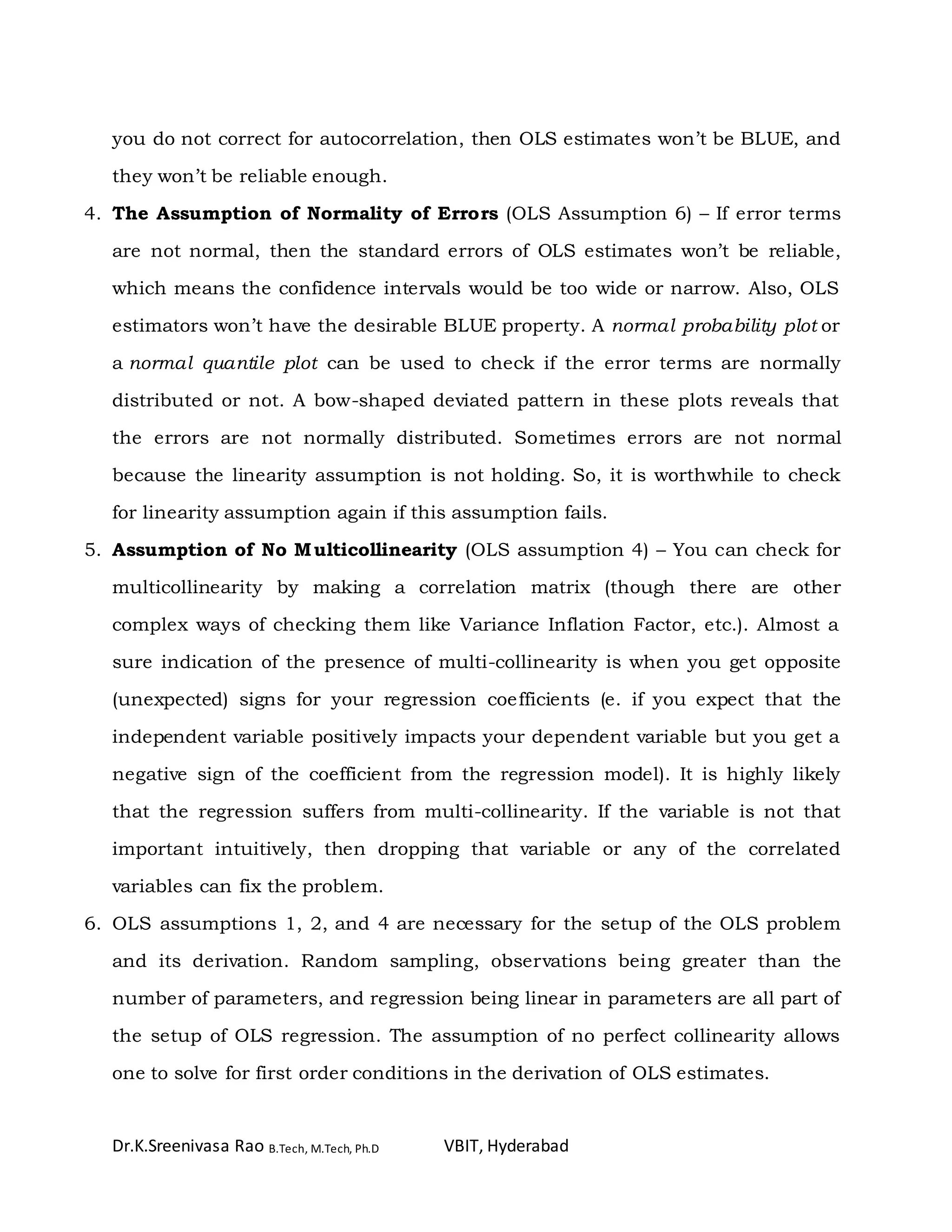

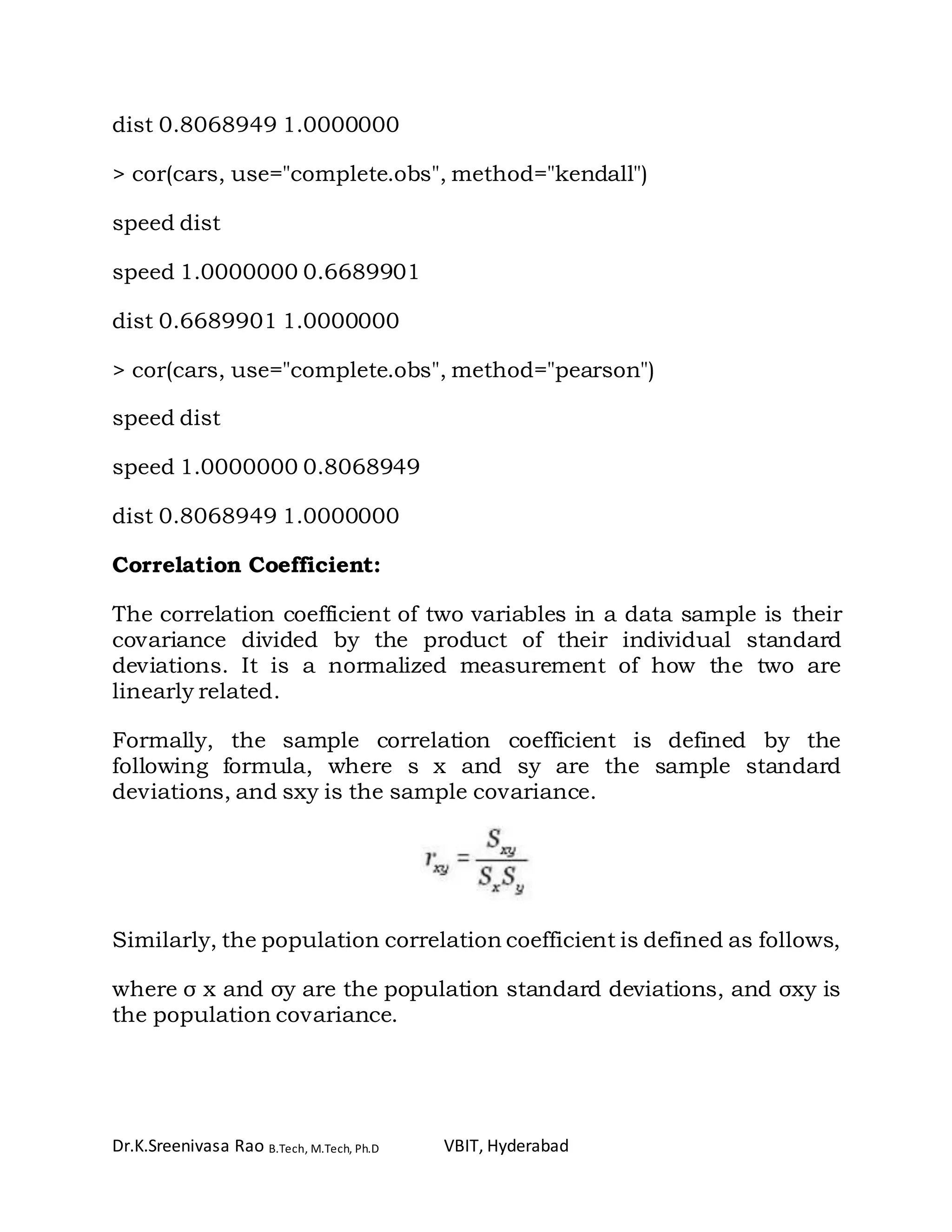

![Dr.K.Sreenivasa Rao B.Tech, M.Tech, Ph.D VBIT, Hyderabad

frequencies. It is often used in signal processing for analyzing

functions or series of values, such as time domain signals.

Autocorrelation is a mathematical representation of the degree of

similarity between a given time series and a lagged version of itself

over successive time intervals.

In statistics, the autocorrelation of a random process is

the correlation between values of the process at different times, as a

function of the two times or of the time lag. Let X be a stochastic

process, and t be any point in time. (t may be an integer for

a discrete-time process or a real number for a continuous-

time process.) Then Xt is the value (or realization) produced by a

given run of the process at time t. Suppose that the process

has mean μt and variance σt

2 at time t, for each t. Then the

definition of the autocorrelation between times s and t is

where "E" is the expected value operator. Note that this expression

is not well-defined for all-time series or processes, because the

mean may not exist, or the variance may be zero (for a constant

process) or infinite (for processes with distribution lacking well-

behaved moments, such as certain types of power law). If the

function R is well-defined, its value must lie in the range [−1, 1],

with 1 indicating perfect correlation and −1 indicating perfect anti-

correlation.](https://image.slidesharecdn.com/correlationandregressioninr-170506080437/75/Correlation-and-regression-in-r-22-2048.jpg)

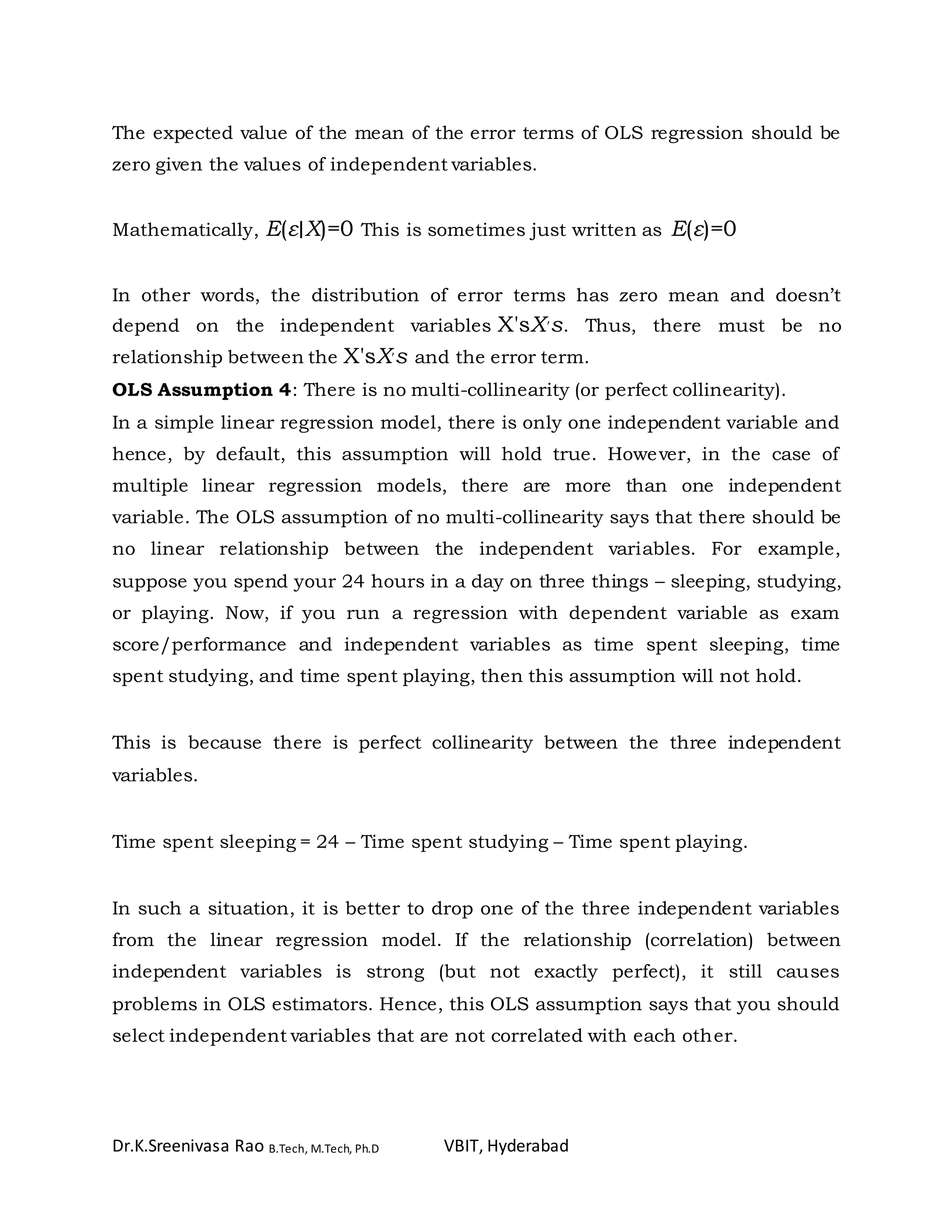

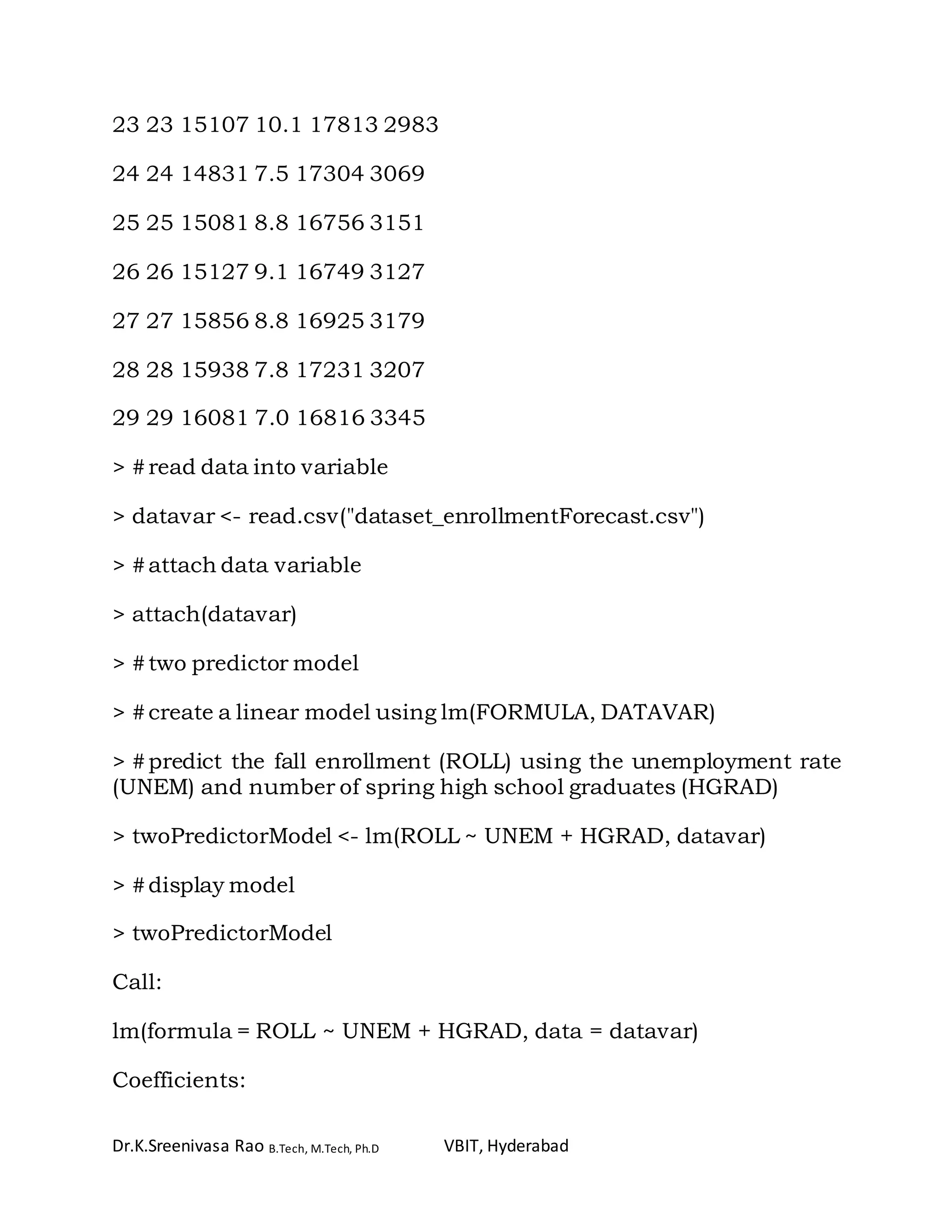

![Dr.K.Sreenivasa Rao B.Tech, M.Tech, Ph.D VBIT, Hyderabad

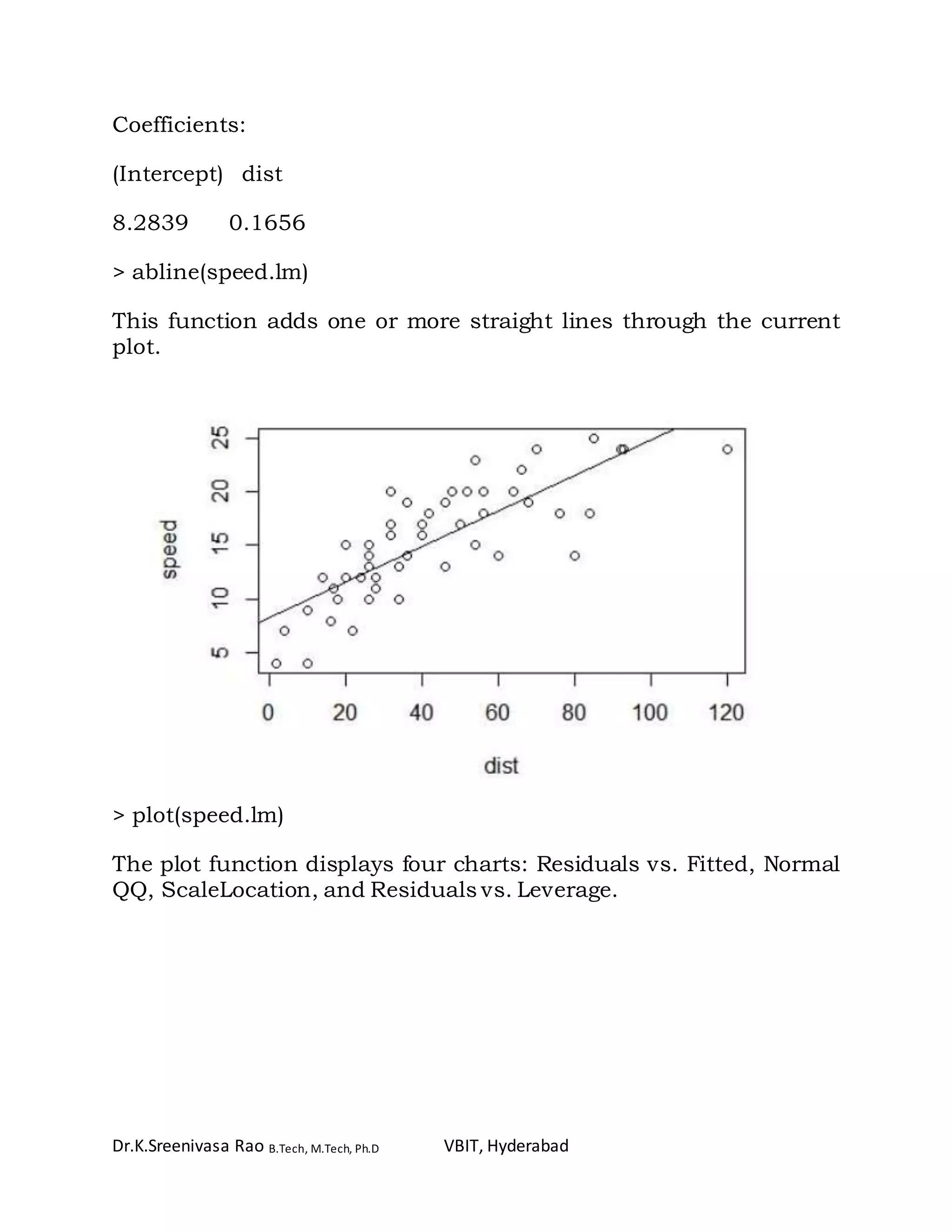

(Intercept) UNEM HGRAD

-8255.7511 698.2681 0.9423

> #what is the expected fall enrollment (ROLL) given this year's

unemployment rate (UNEM) of 9% and spring high school

graduating class (HGRAD) of 100,000

> -8255.8 + 698.2 * 9 + 0.9 * 100000

[1] 88028

> #the predicted fall enrollment, given a 9% unemployment rate and

100,000 student spring high school graduating class, is 88,028

students.

> #three predictor model

> #create a linear model using lm(FORMULA, DATAVAR)

> #predict the fall enrollment (ROLL) using the unemployment rate

(UNEM), number of spring high school graduates (HGRAD), and per

capita income (INC)

> threePredictorModel <- lm(ROLL ~ UNEM + HGRAD + INC,

datavar)

> #display model

> threePredictorModel

Call:

lm(formula = ROLL ~ UNEM + HGRAD + INC, data = datavar)

Coefficients:

(Intercept) UNEM HGRAD INC

-9153.2545 450.1245 0.4065 4.2749](https://image.slidesharecdn.com/correlationandregressioninr-170506080437/75/Correlation-and-regression-in-r-28-2048.jpg)