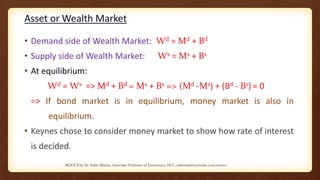

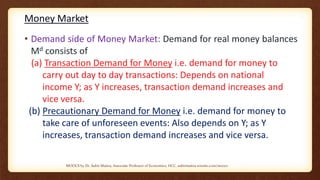

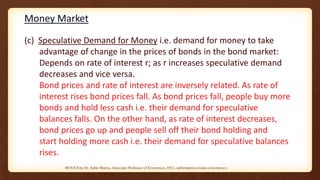

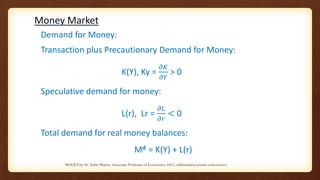

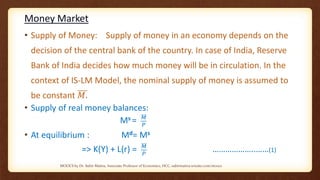

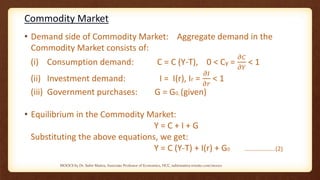

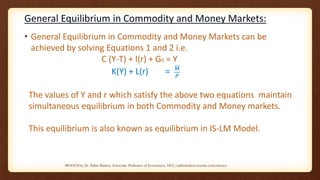

This document discusses the IS-LM model, which jointly determines the equilibrium interest rate and level of income in the goods/commodity market and the money market. It describes the demand and supply factors in each market. The commodity market equilibrium depends on consumption, investment, and government spending functions. The money market equilibrium depends on the transactions, precautionary, and speculative demand for real money balances, given the money supply. General equilibrium is reached where the commodity market and money market equations are simultaneously satisfied.