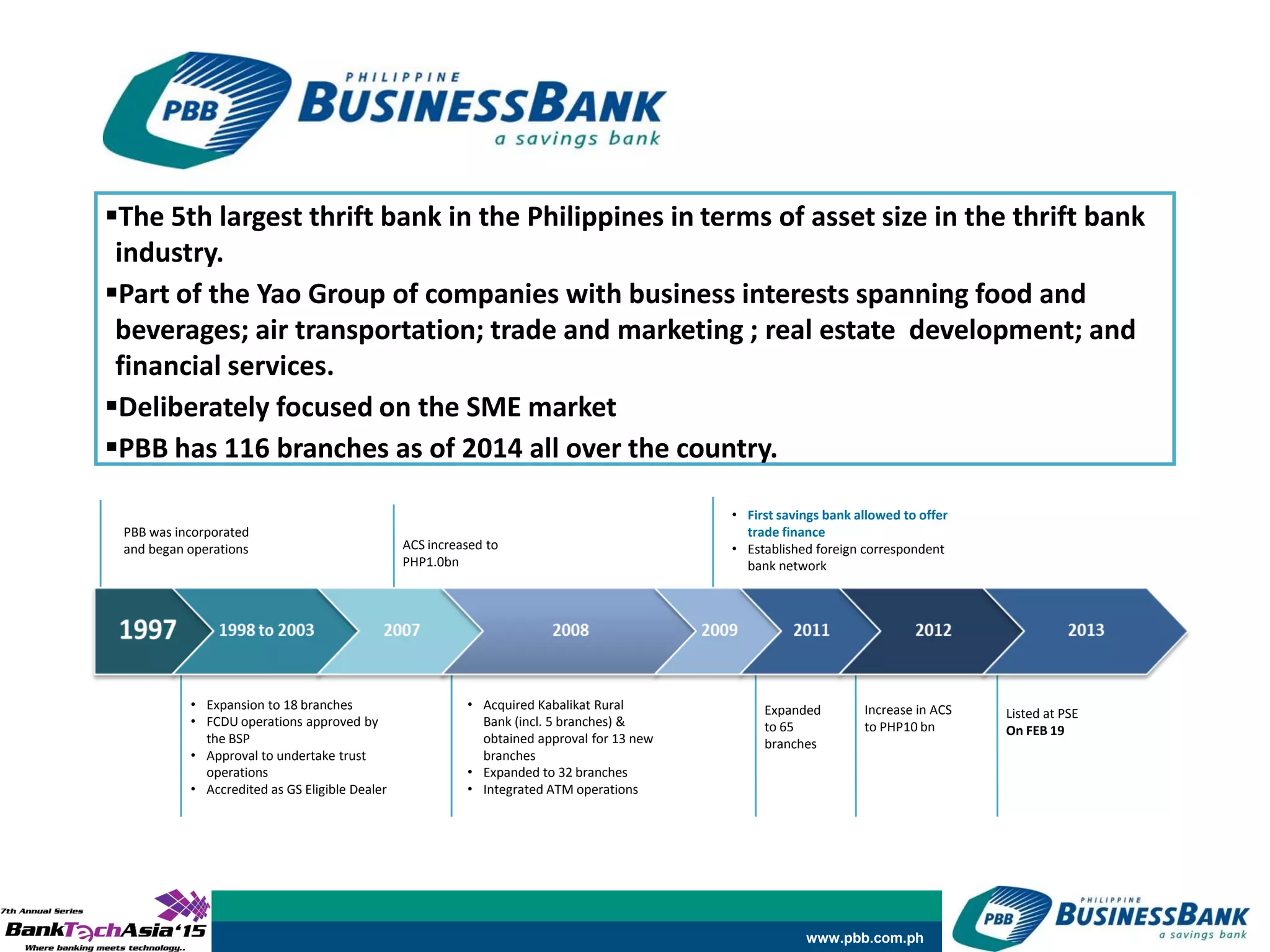

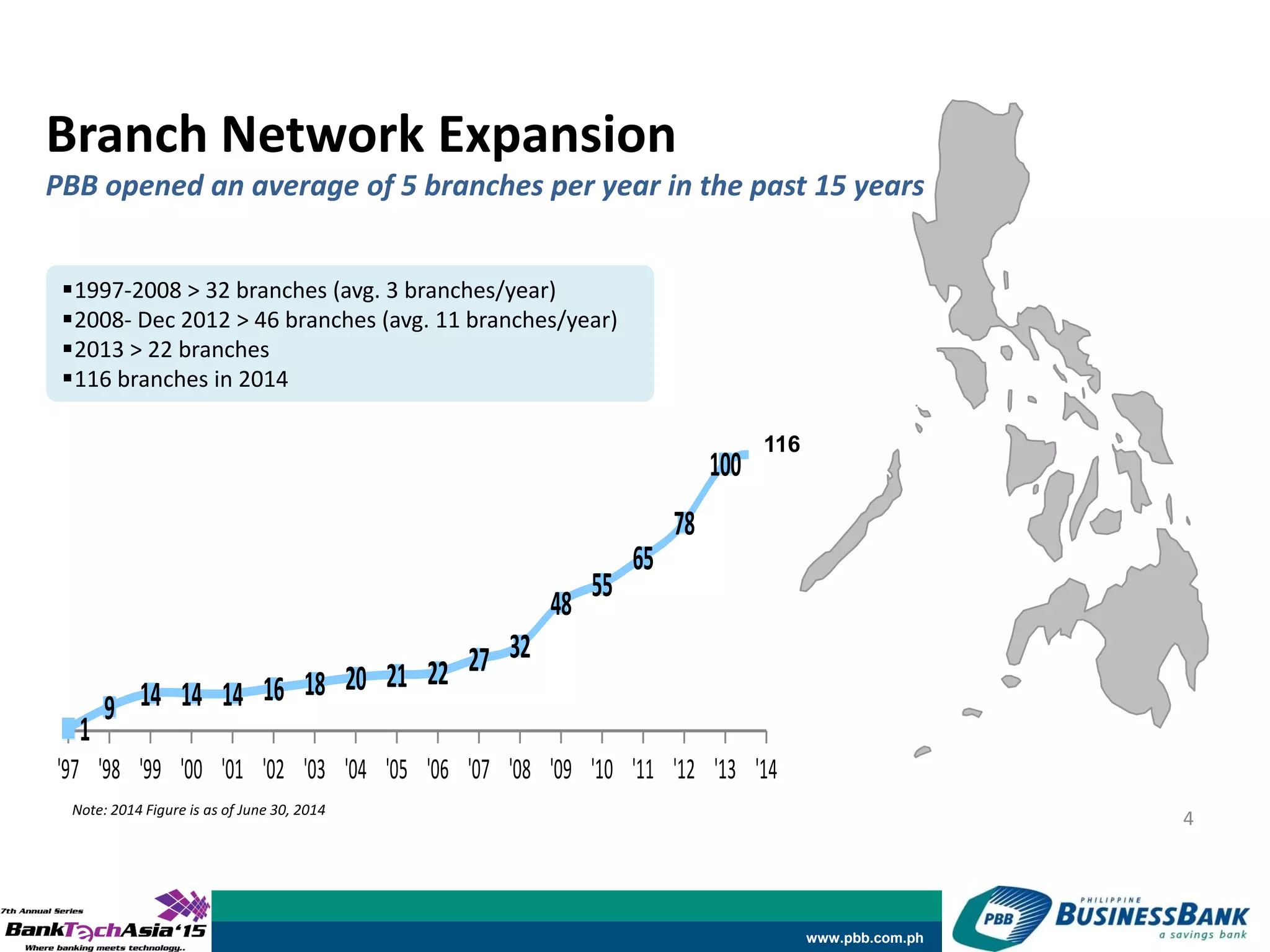

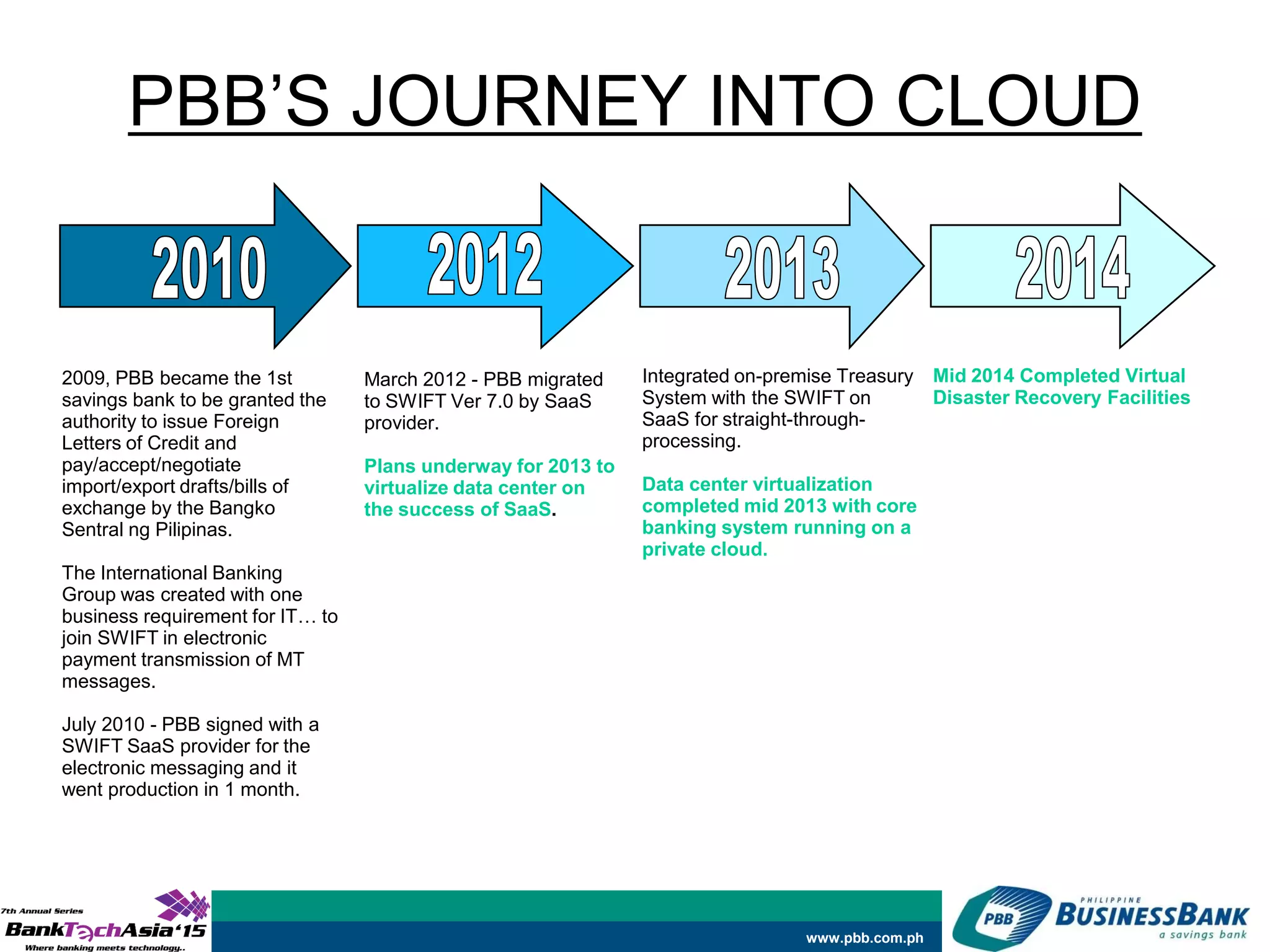

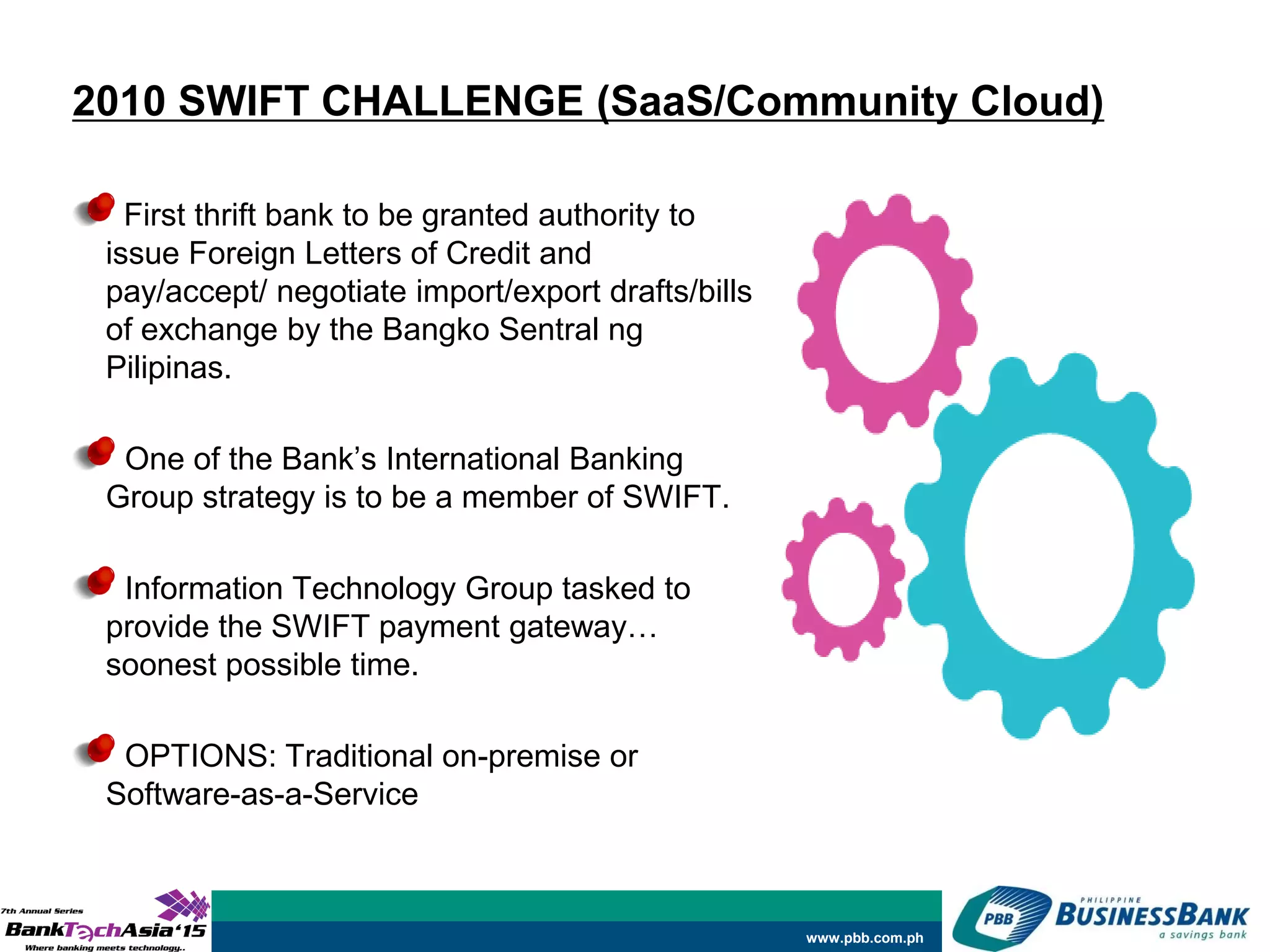

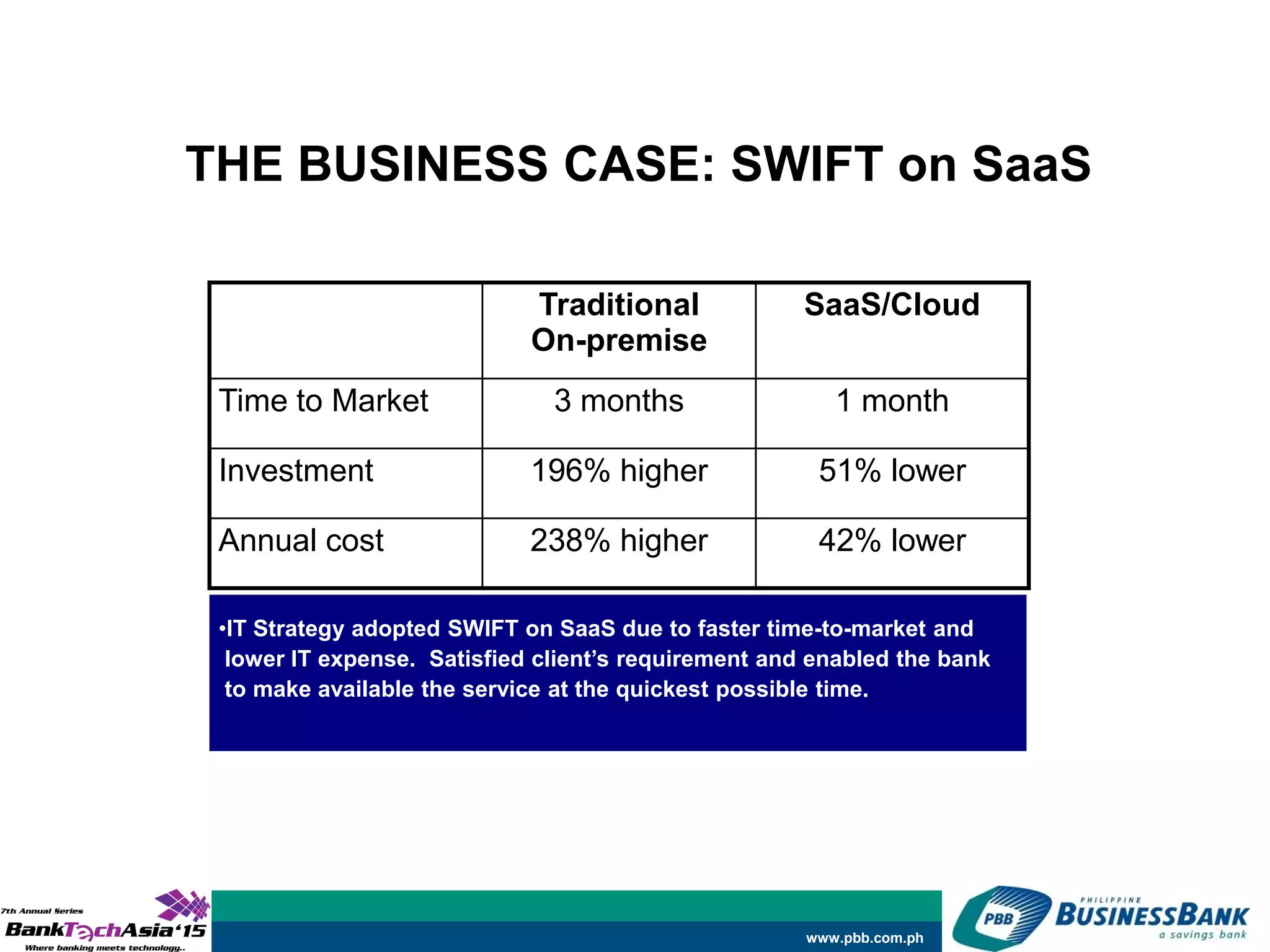

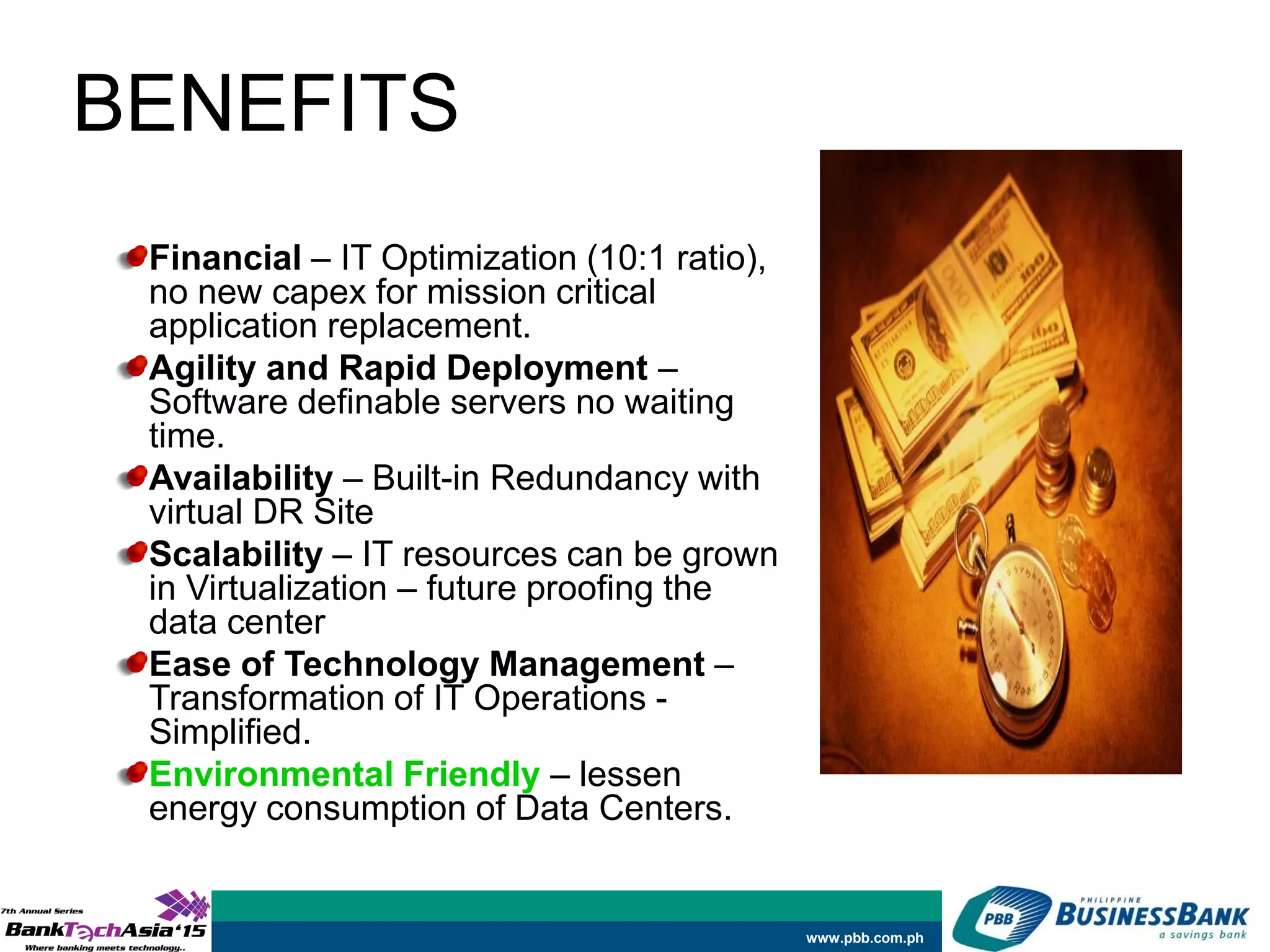

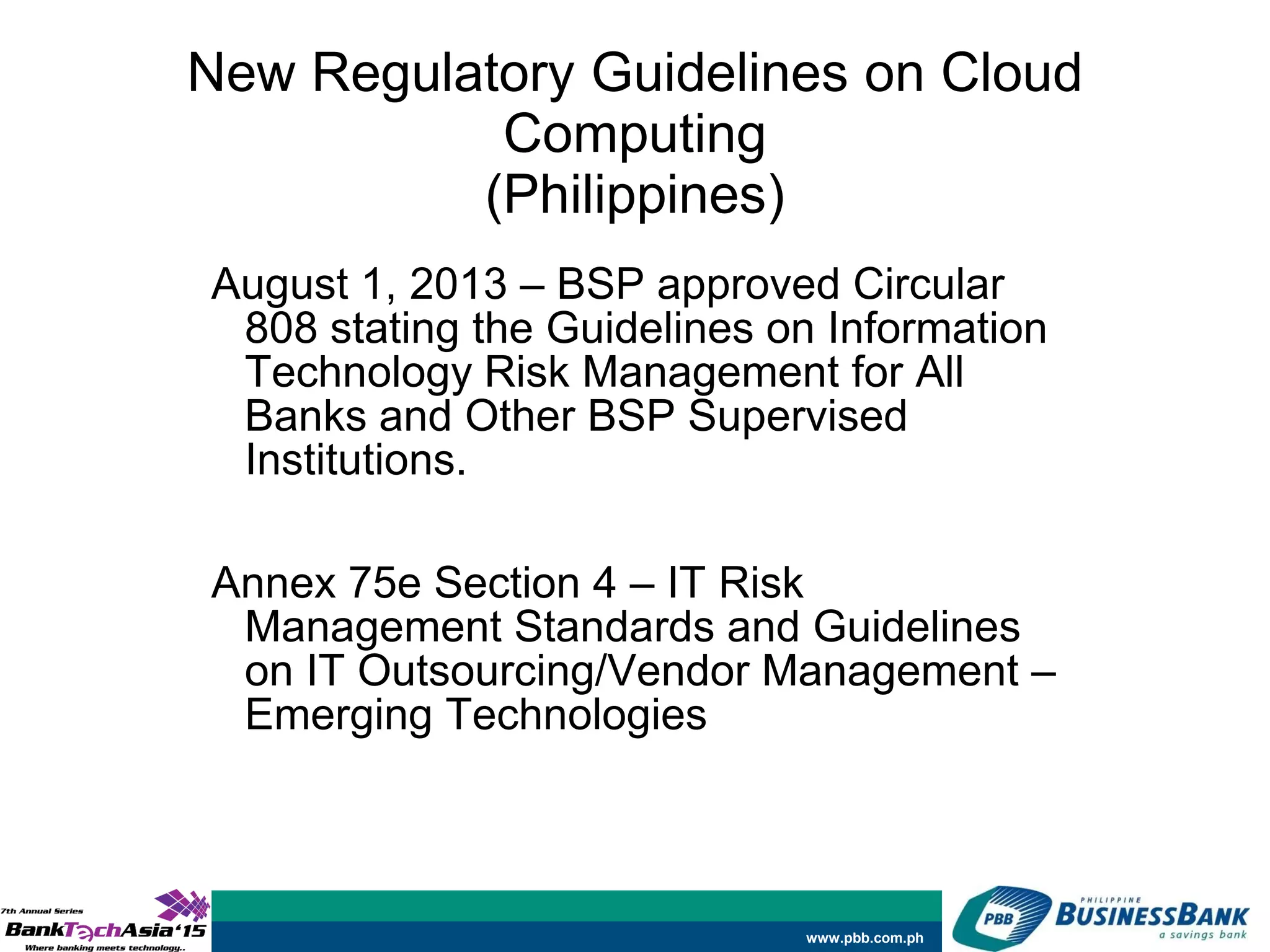

Philippine Business Bank (PBB) adopted cloud computing models to modernize its IT infrastructure and gain efficiencies. It first implemented a Software-as-a-Service model for its SWIFT payment system, which allowed for faster deployment at lower cost compared to an on-premise system. PBB then virtualized its data center using a private cloud model, transforming operations without disruption while future-proofing the infrastructure. PBB's experiences highlight how cloud computing can optimize costs, increase agility, and scale infrastructure to meet business needs.

![www.pbb.com.ph

Recipient of the following Awards:

• 2014 – “Best Banking Technology, Philippines”,

Global Banking and Finance Review, London.

• 2014 – “Philippine Domestic Technology and Operations of the Year”,

Asia Banking and Finance, Singapore

• 2013 – “Philippine Domestic Technology and Operations of the Year”,

Asia Banking and Finance, Singapore

IDC Financial Insights Innovation Awards: Cited among the top 30 Financial Technology Initiatives in the

Asia/Pacific regions.

• 2014 - “Future Proofing with Enterprise Data Center-Virtualization” (The only Philippine based bank on the list.)

• 2012 – “SWIFT on SaaS”

• 2011 – “SWIFT on SaaS”

IDC Asia/Pacific Published Case Study:

• March 2014, “Philippine Business Bank: Data Center Transformation to Meet Future Business Demands” by the

International Data Corporation (IDC) Asia/Pacific Headquarters, Singapore. [IDC #AP246107]

Awards, Citations and Case Studies on

PBB’s Technology Initiatives](https://image.slidesharecdn.com/keithchan-150304032334-conversion-gate01/75/Evaluating-Cloud-Computing-Risk-Recounting-PBB-s-Journey-into-the-Cloud-Keith-S-Chan-23-2048.jpg)