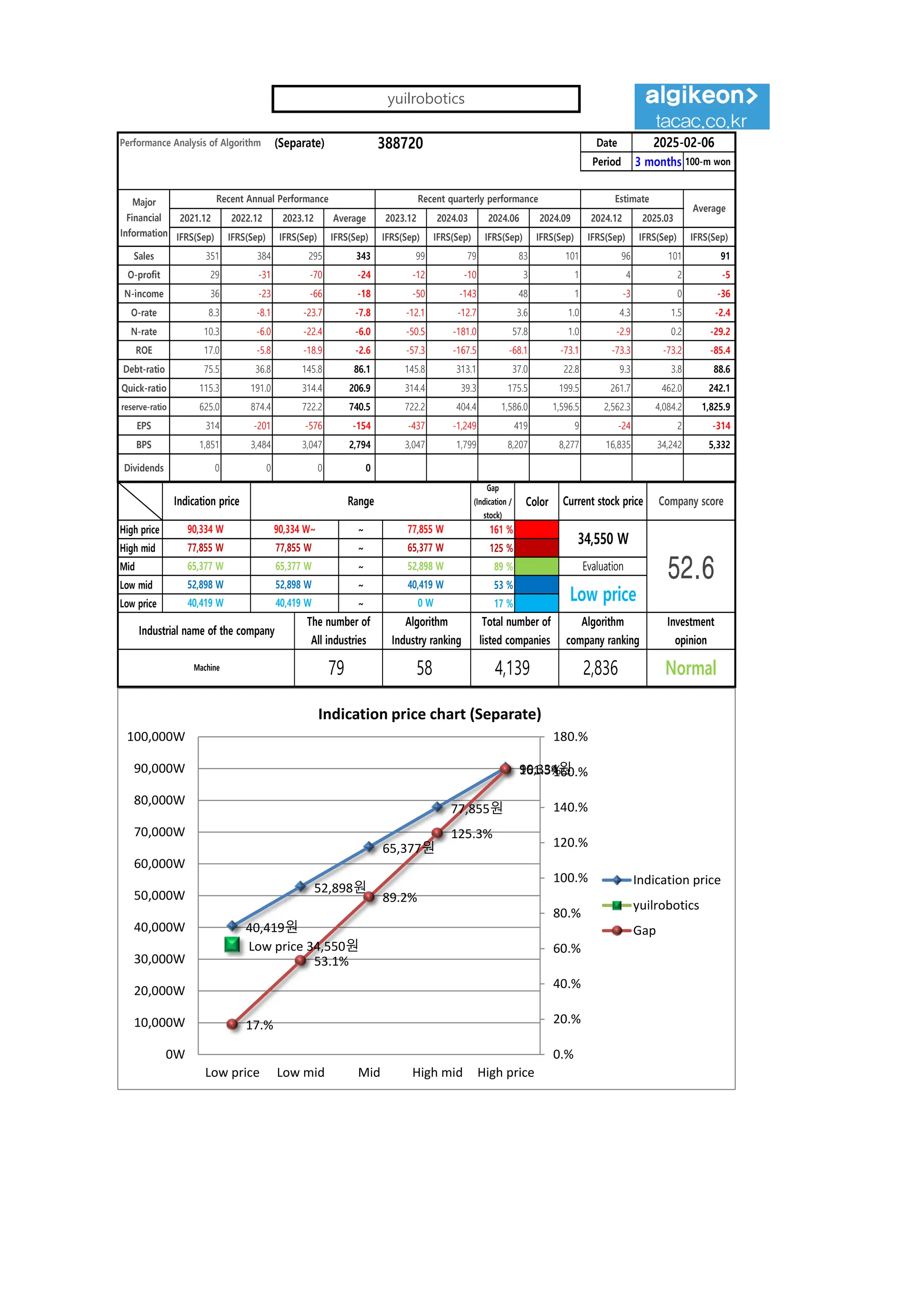

The document presents a performance analysis of an algorithm over a three-month reporting period, detailing financial metrics such as sales, operating profit, net income, return on equity, and various ratios for 2021 to 2025. It includes projections of stock prices, evaluation metrics, investment opinions, and past performance metrics across different sectors. Additionally, it provides disclaimers regarding the accuracy of the provided data and the responsibility of users when making investment decisions.

![[Price for scheduled purchasing]

Arbitrarily made

Algorithm stocks Trading Strategies (Separate) 388720 Date

Period

Gap

(Indication /

stock)

Color

low price 40,419 W 40,419 W ~ 0 W 17 % -616,596 W -15

Low mid 52,898 W 52,898 W ~ 40,419 W 53 % -1,927,541 W -36

Mid 65,377 W 65,377 W ~ 52,898 W 89 % -3,238,486 W -50

High mid 77,855 W 77,855 W ~ 65,377 W 125 % -4,549,430 W All selling

Suggested Purchase

Amount 3,629,641 W

Number of stocks

purchased 105

Indication price Range Buying / Selling Buying / Selling [Stocks]

High price 90,334 W 90,334 W~ ~ 77,855 W 161 % -5,860,375 W All selling

2025-02-06

3 months

Current stock price Evaluation

Stock price rise

probability score

Investment opinion Prospective purchase amount

34,550 W Low price 49.0 Normal 10,000,000 W

Stock price rise

probability score

A Sector 53.3 47.2 48.6 48.4 50.5 48.7

49.0

B Sector 28.8 52.5 48.4 48.4 21.3 38.3

Total average 41.0 49.8 34.1 44.6 35.9 43.5

2024.09.02 2024.10.07 2024.11.05 2024.12.03 2025.01.03 2025.02.06

2024.11.05 2024.12.03 2025.01.03 2025.02.06

Total of

increase rate

Total score

A Sector -13 % 3 % -0 % 4 % -4 %

-2 % 48.0

B Sector 45 % -168 % 60 % -128 % 45 %

Total average 18 % -46 % 24 % -24 % 18 %

2024.10.07

-13%

3% -0% 4% -4%

45%

-168%

60%

-128%

45%

18%

-46%

24%

-24%

18%

-200%

-150%

-100%

-50%

0%

50%

100%

2024.10.07 2024.11.05 2024.12.03 2025.01.03 2025.02.06

Increase rate of stock price rise

A sector

B sector

Total average

yuilrobotics

53

47 49 48 51 49

29

53

20

48

21

38

41

50

34

45

36

44

0

10

20

30

40

50

60

2024.09.02 2024.10.07 2024.11.05 2024.12.03 2025.01.03 2025.02.06

Stock price rise probability score

A sector

B sector

Total average](https://image.slidesharecdn.com/yuilrobotics388720algorithminvestmentreport-250206125914-6cb090bf/85/yuilrobotics-388720-Algorithm-Investment-Report-2-320.jpg)