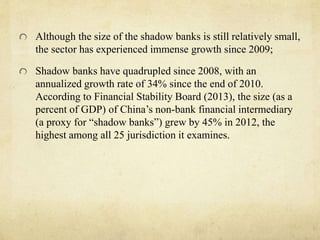

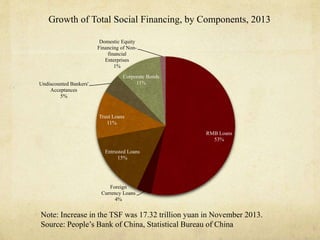

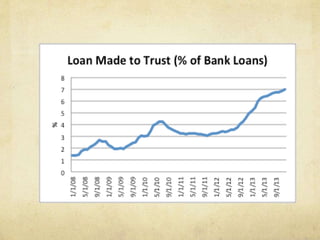

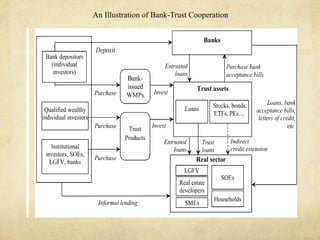

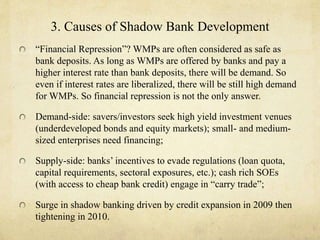

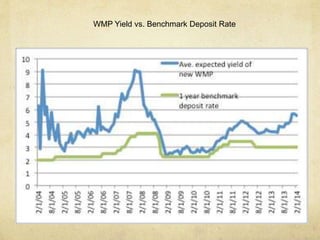

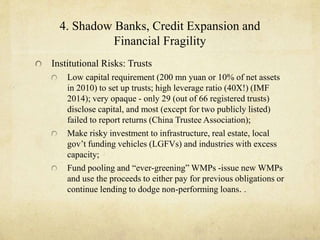

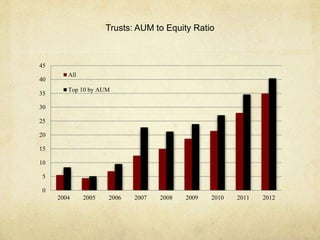

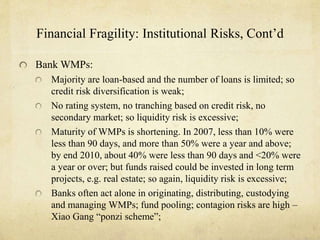

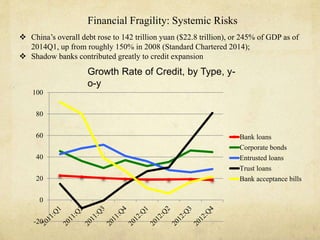

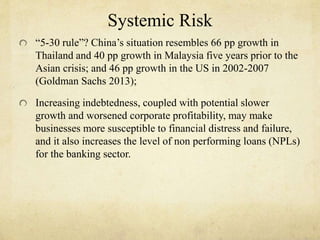

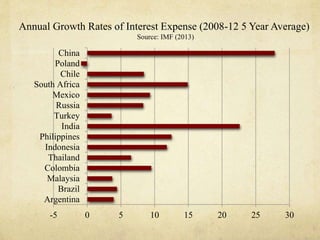

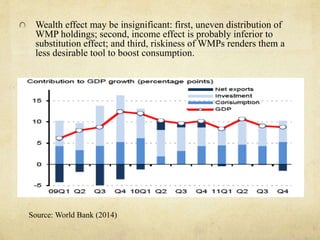

Shadow banking in China has grown rapidly in recent years, increasing financial stability risks. Major shadow banking institutions include trusts, wealth management products, and off-balance sheet bank activities. This rapid growth was driven by regulatory arbitrage as banks sought to expand credit outside of regulatory constraints. However, shadow banking also contributes to high leverage, liquidity and maturity transformation risks, exacerbating China's credit and economic imbalances. More research is needed to understand these systemic risks and appropriate regulatory responses.