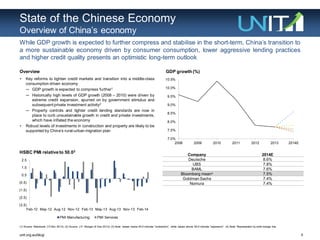

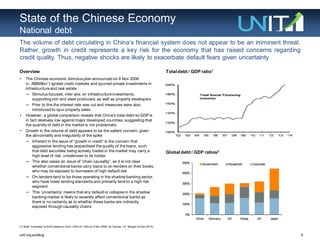

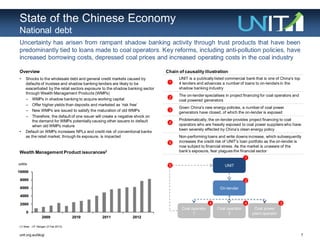

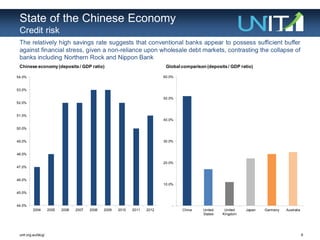

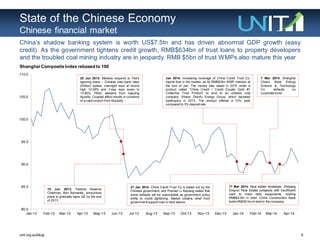

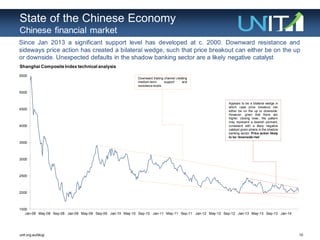

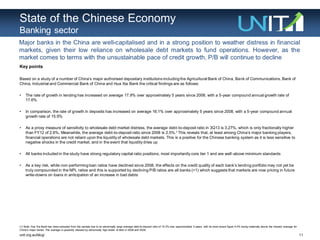

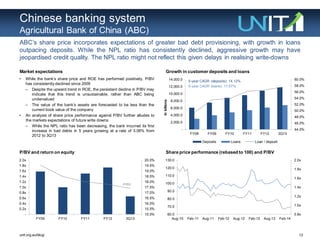

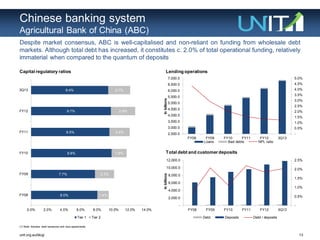

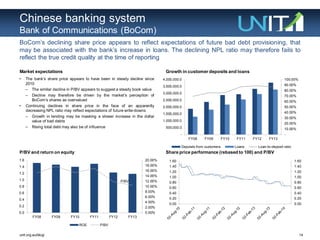

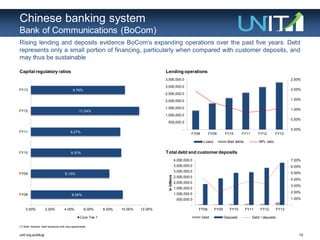

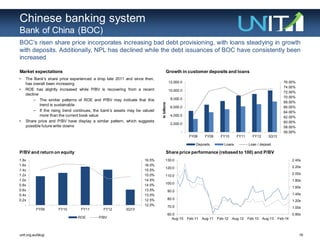

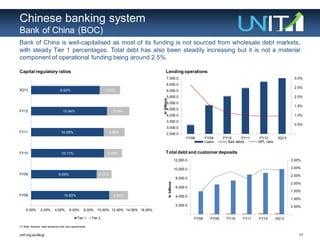

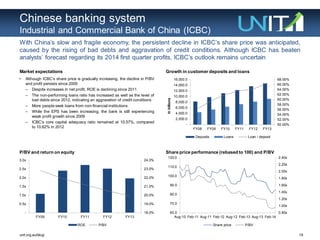

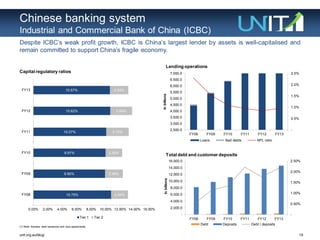

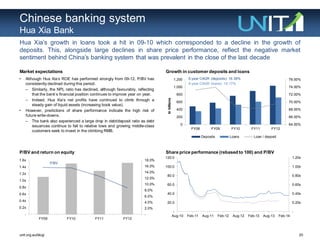

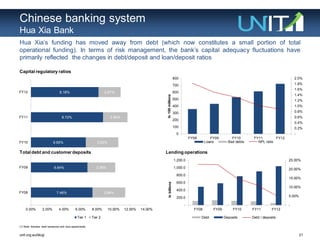

The document discusses the state of the Chinese economy and banking system. It provides an overview of China's economy, noting that GDP growth is expected to further slow as the country transitions to a more consumption-driven model with tighter credit. It also summarizes China's national debt levels and financial markets, highlighting concerns about the large shadow banking sector and potential defaults. The document concludes with studies on several major Chinese banks and observations about credit quality risks.