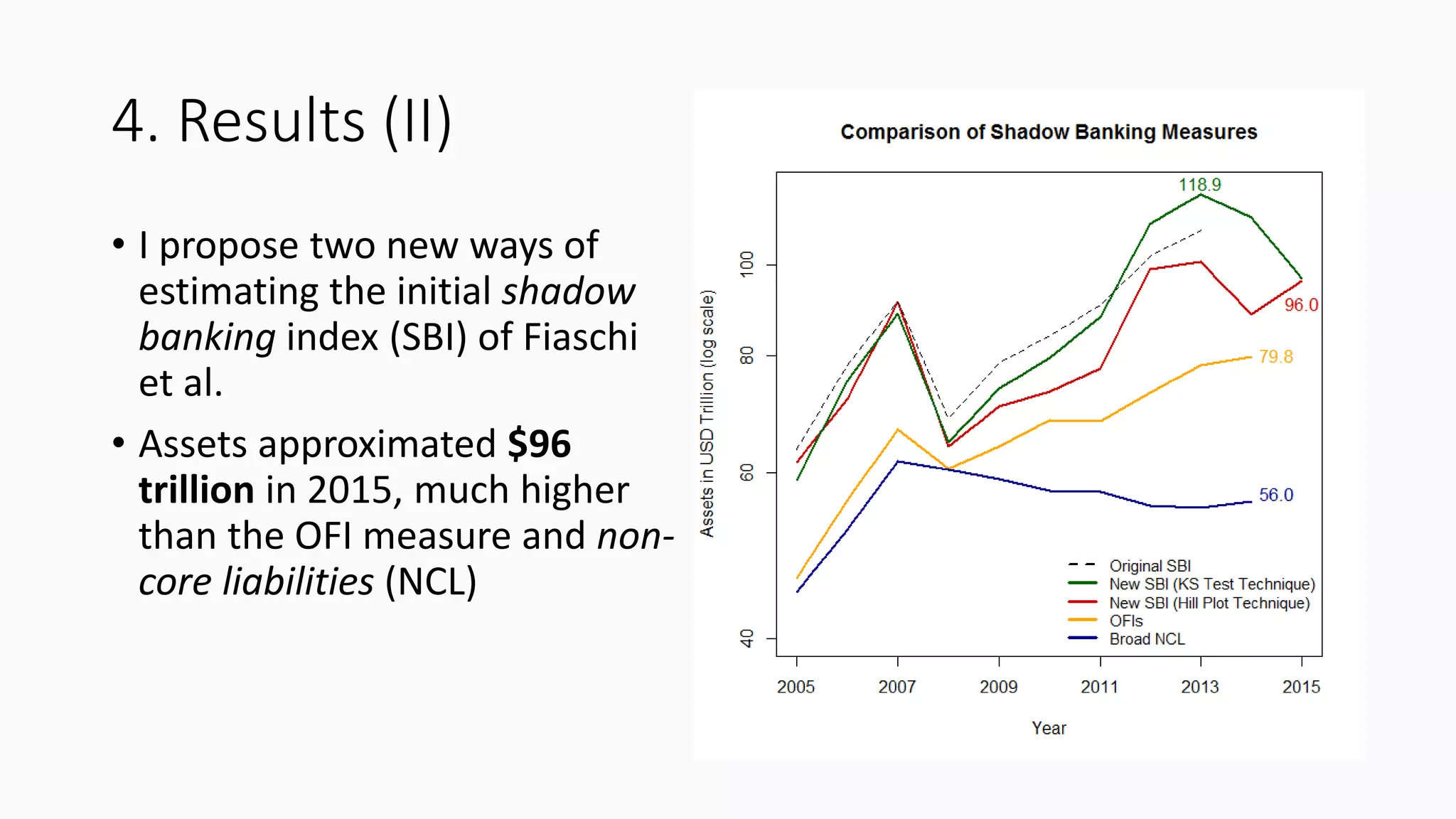

The document presents a master's thesis by Achim Braunsteffer on global shadow banking, which discusses the origins, definitions, and significance of a system that emerged in the 1970s and plays a key role in financial intermediation. It details methodologies for estimating the size of shadow banking, with findings suggesting assets approximated $96 trillion in 2015, indicating that its true scale is larger than previously thought. Additionally, it addresses the empirical approach to measuring shadow banking and the controversies around the validity of zipf's law in this context.