Embed presentation

Download to read offline

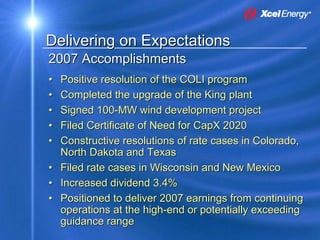

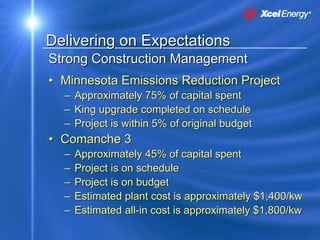

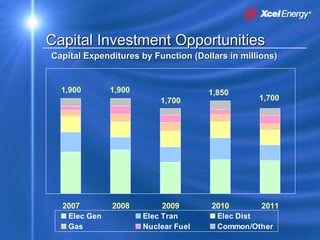

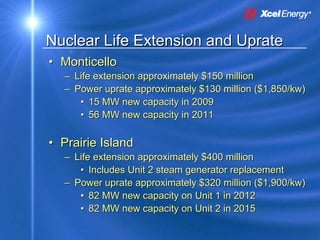

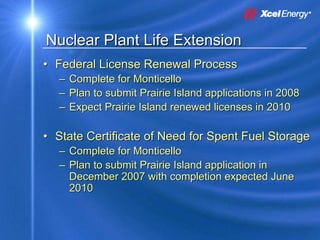

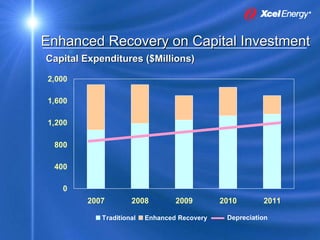

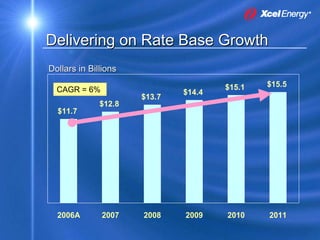

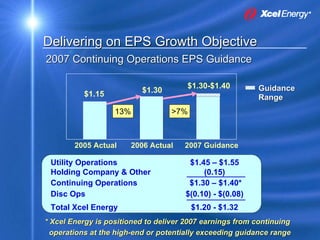

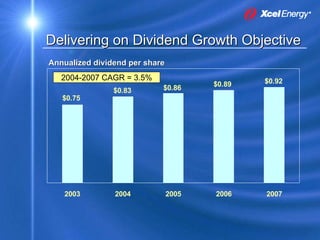

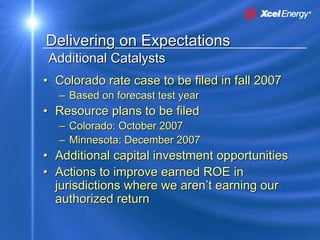

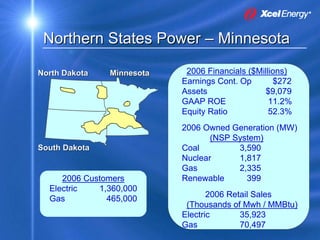

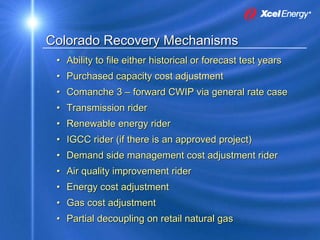

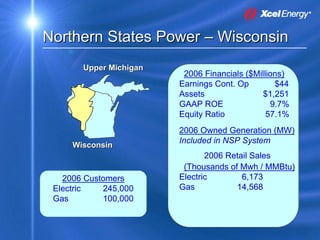

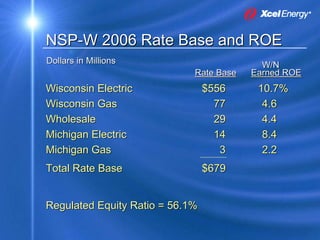

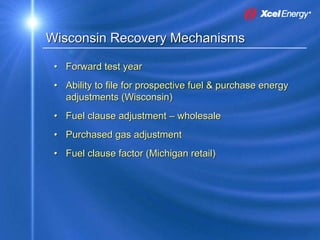

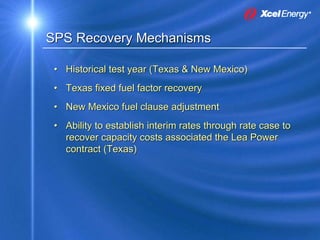

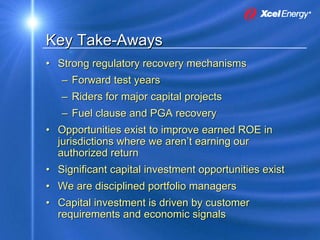

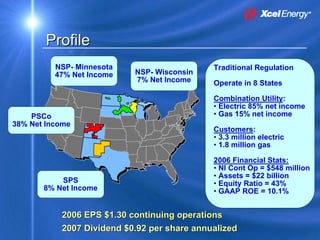

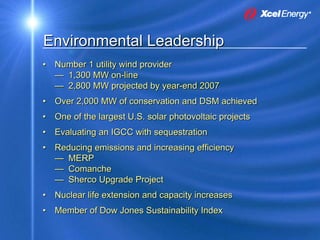

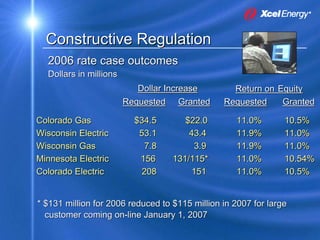

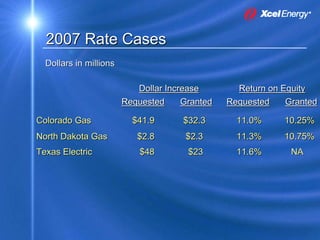

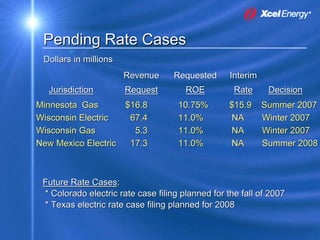

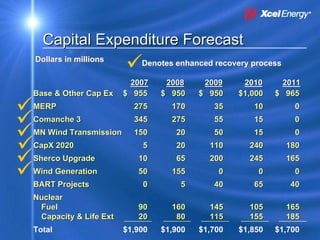

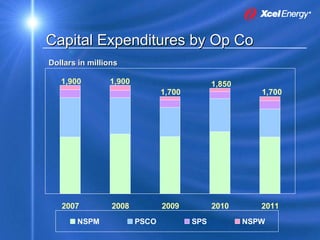

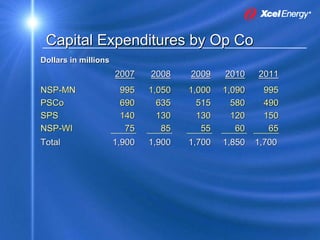

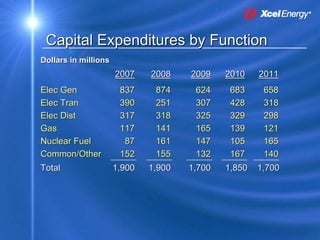

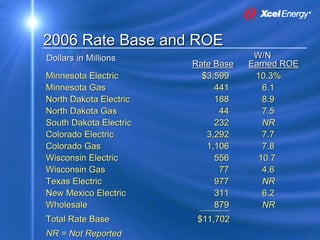

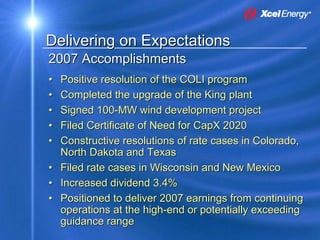

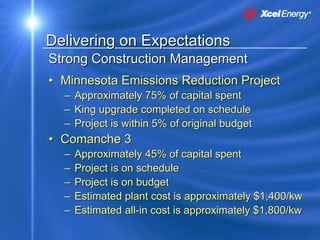

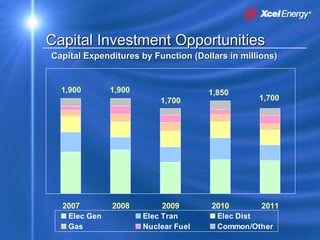

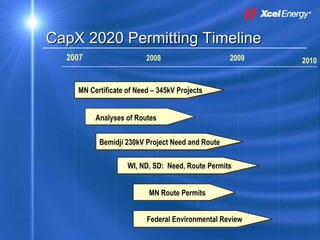

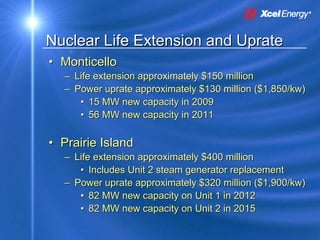

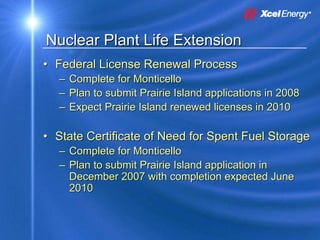

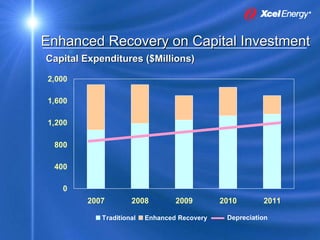

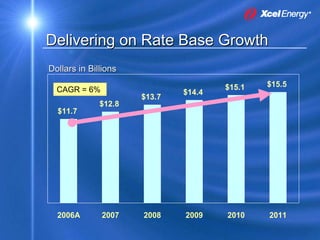

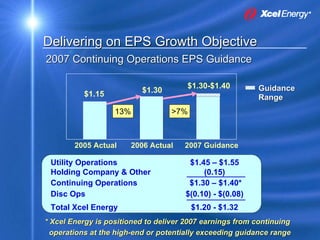

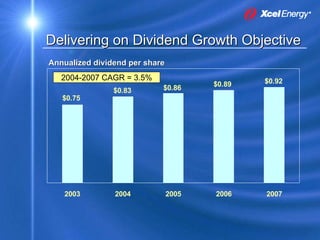

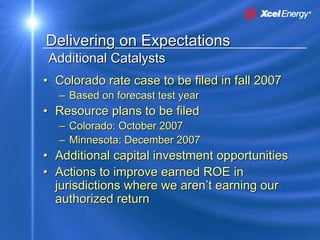

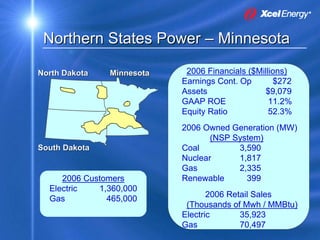

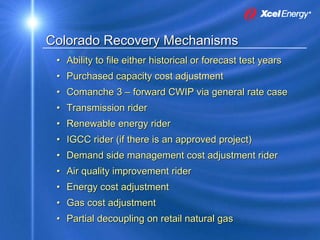

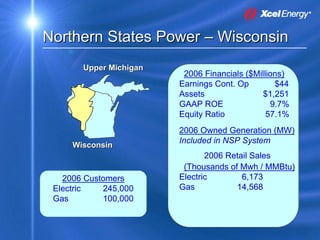

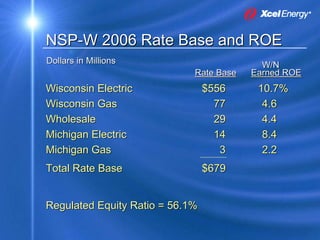

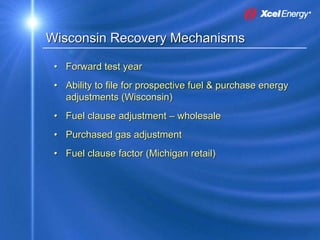

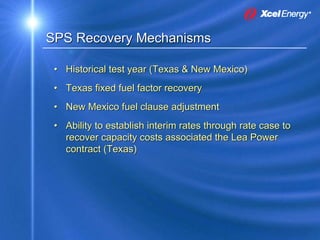

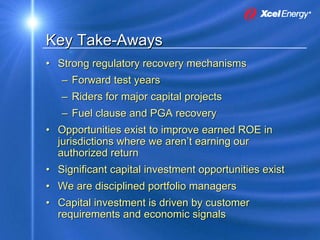

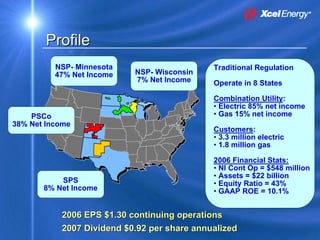

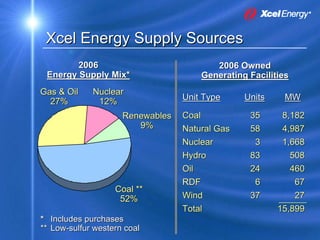

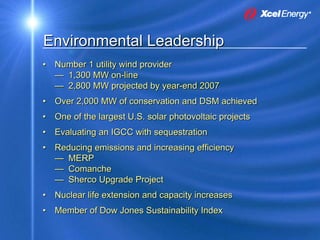

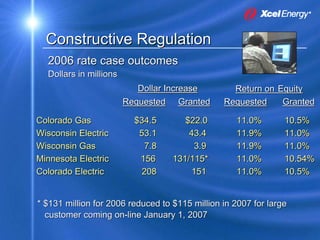

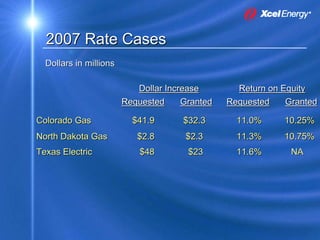

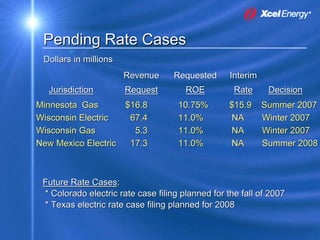

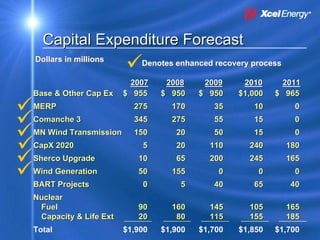

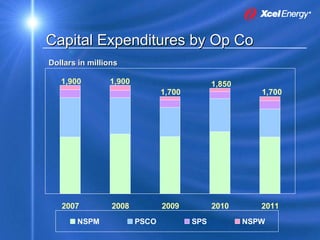

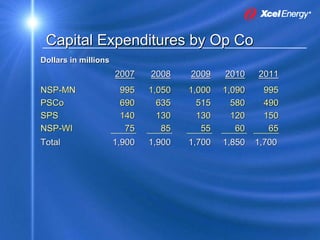

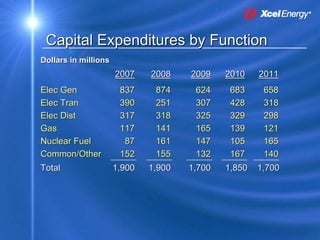

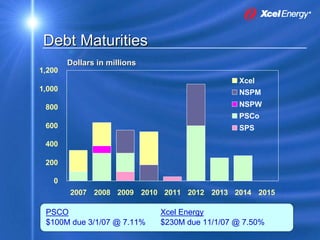

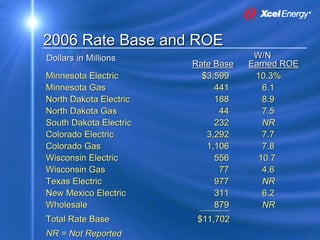

Xcel Energy delivered positive results in 2007 and positioned itself for continued growth. Key accomplishments included resolving legal issues, completing generation projects on time and budget, and receiving constructive regulatory resolutions. The company expects to meet or exceed 2007 earnings guidance. Xcel outlined capital investment opportunities through 2011 focused on generation, transmission and distribution. Recovery mechanisms provide stability, and opportunities exist to improve returns in some jurisdictions.