This document discusses a study on changes in board characteristics before and after the 2007-2008 financial crisis.

The study finds that average board size increased marginally after the crisis, rising from 9.66 members before to 9.8 members after. This suggests shareholders attempted to gain more control by increasing board influence. The study also found boards had more financial expertise after the crisis.

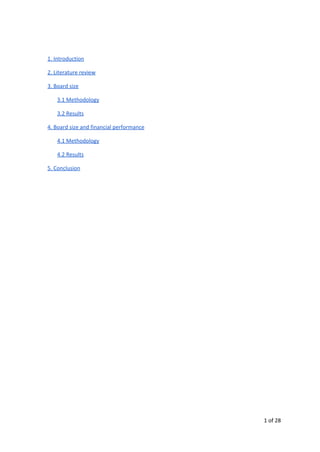

The document then examines the relationship between pre-crisis board size and firm performance during the crisis. It uses Tobin's Q and return on assets to measure performance for 2007-2008. This will help determine if larger or smaller boards beforehand correlated with better financial outcomes when the crisis hit.

![that came to light during and post crisis was that the boards did not monitoring accordingly

(Cameira, 2003), therefore directors were not able to prevent the company from damaging

itself before the consequences were irreversible. In order to increase the monitoring role of

the board an increase in the amount of independent directors was enforced post crisis. The

positives involved with an addition of independent directors include increase in specialist

skills, diversity of board and a clear separation of ownership and control leading to a more

efficient governance and monitoring system.

Before the crisis (2002-2006) mean board size (reflected in the DIRECTOR variable) is 9.66

and the average board consist of 75% independent members. After the crisis (2010-2014)

the average board size has grown to 9.8 (2.04 standard deviation), while the composition

has remained the same.

The information acquired during this t-test is similar to that from a Moody’s survey. Which

found that there was a 14% increase in outside directors post crisis. Most of these outside

directors had financial background, they hoped that this would enable them to realize poor

internal and external environments before the consequences were irreversible. (Reuters :

Bank boards' financial expertise improves -Moody's, 2010)

4. Board size and financial performance

4.1 Methodology

In order to test the relationship between board size prior to the financial crisis and the firm

performance during the crisis, we calculate a mean board size per company for the period

from 2002 until 2006. We combine this data with performance indicators, namely Tobin’s Q

[TQ] and Return on Assets [ROA], for the period during the crisis. In regards to the time

frame of the crisis we select the period from 2007 to 2008. This differs from our assumptions

for the previous question due to the nature of the data we are using. Here we assume that

board size changes are slower and are reflected over a further period of time (2007-2009),

while performance data is taken into account faster. In relation to this the crisis period can

be delimited to two years.

5 of 28](https://image.slidesharecdn.com/081c83e2-77cb-4929-849f-769ada7357b4-160102180159/85/WriteUp-docx-6-320.jpg)

![Companies utilize key performance indicators in an attempt to accurately measure firm

performance. The proxies used to regress board size with performance are Tobin’s Q and

Return on Assets [ROA].

Return on Assets is an accounting calculation which analyses a firm's profitability compared

to the total assets. This gives an indication into the efficiency of the management team, and

their ability to generate earnings-returns to ordinary shareholders given the total assets of

the firm.

Tobin’s Q is a valuation ratio, its main benefit is the incorporation of current market

expectations. (Chan-Lee, 1986) In the last 50 years it has been the essential key in the

theory of investments. Recently, it has been applied in financial economics in an attempt to

capture the anticipated return, and therefore represents the measure of risk. (Richard Roll

and J. Fred Weston December 3, 2008).

Our main hypothesis is that companies with larger boards perform worse during periods of

sharp downturn. Our sample consists of publicly traded U.S. companies with available data

for the years between 2002 and 2014. We exclude financial services companies, due to the

disproportionate effect of the exogenous shock on their performance. We perform and

Ordinary Least Squares (OLS) regression to test for the relationship between the average TQ

and average ROA, and the average board size. In our first regression regression we use our

entire sample of companies with available board size and financial data. For our regression

we focus only on S&P 500 companies, due to their similarities in size and performance.

Tobin’s Q = (Total Market Value Fiscal year + Total Liabilities) / Total Assets

ROA = Net Income / Total Assets

Furthermore, we use board composition characteristics and board member characteristics to

attempt to explain the difference in TQ and ROA.

6 of 28](https://image.slidesharecdn.com/081c83e2-77cb-4929-849f-769ada7357b4-160102180159/85/WriteUp-docx-7-320.jpg)

![use c

format %20s county

format %20s conm

ren fyear year

gen cusip2=substr(cusip,1,6)

replace cusip=cusip2

drop cusip2

save f

merge m:m cusip year using g, force

save h1

use h1

so cusip year at

keep if _merge==3

encode cusip, gen(cusip2)

drop cusip

ren cusip2 cusip

keep if cusip>0

so cusip year

by cusip year: gen id=[_n]

egen CUSIPYEAR = concat(cusip year), decode p("")

encode CUSIPYEAR, gen(CUSIPYEAR2)

drop CUSIPYEAR

21 of 28](https://image.slidesharecdn.com/081c83e2-77cb-4929-849f-769ada7357b4-160102180159/85/WriteUp-docx-22-320.jpg)

![ren CUSIPYEAR2 CUSIPYEAR

by cusip year: gen DIRECTOR=[_N]

keep if id==1

drop id

keep if cusip != .

save h3

import excel "C:UsersWildHostageGoogle DriveESESeminar ACFGassignment

3stataregression1.xlsx", sheet("Sheet1") firstrow clear

save extra

use extra

encode CUSIPYEAR, gen(CUSIPYEAR2)

drop CUSIPYEAR

ren CUSIPYEAR2 CUSIPYEAR

save extra, replace

use h3

gen CRISIS = (year>=2007)

ttest DIRECTOR, by(CRISIS)

drop if year==2007

drop if year==2008

drop if year==2009

ttest DIRECTOR, by(CRISIS)

22 of 28](https://image.slidesharecdn.com/081c83e2-77cb-4929-849f-769ada7357b4-160102180159/85/WriteUp-docx-23-320.jpg)

![drop _merge

merge m:m CUSIPYEAR using extra, force

keep if _merge==3

so cusip

by cusip: gen id=[_N]

drop if id<10

ttest DIRECTOR, by(CRISIS)

save reg1

use reg1

encode sic, gen(sic2)

drop sic

ren sic2 sic

so sic

drop if sic in 4001/4690

ttest DIRECTOR, by(CRISIS)

save reg1a

use h3

gen CRISIS = (year>=2007)

drop _merge

merge m:m CUSIPYEAR using extra2, force

keep if _merge==3

23 of 28](https://image.slidesharecdn.com/081c83e2-77cb-4929-849f-769ada7357b4-160102180159/85/WriteUp-docx-24-320.jpg)

![drop if year>2009

gen ROA= ni/ at

gen TQ=( mkvalt+ lt)/ at

keep if TQ>=0

keep if at!=.

keep if TQ!=.

keep if ROA!=.

save reg3, replace

encode sic, gen(sic2)

drop sic

ren sic2 sic

so sic

drop if sic in 6559/7063

ttest DIRECTOR, by(CRISIS)

save reg3a

so cusip

so cusip year

so cusip

by cusip: gen id=[_N]

drop if id<8

drop id

save reg3b

24 of 28](https://image.slidesharecdn.com/081c83e2-77cb-4929-849f-769ada7357b4-160102180159/85/WriteUp-docx-25-320.jpg)

![egen meanteq = mean(teq), by (cusip CRISIS)

egen meanava = mean(ava), by (cusip CRISIS)

egen meanpci = mean(pci), by (cusip CRISIS)

egen meanpce = mean(pce), by (cusip CRISIS)

egen meanpcl = mean(pcl), by (cusip CRISIS)

egen meantq = mean(TQ), by (cusip CRISIS)

egen meand = mean(DIRECTOR), by (cusip CRISIS)

egen meanroa = mean(ROA), by (cusip CRISIS)

egen meanmvl = mean(mkvalt), by (cusip CRISIS)

egen meanat = mean(at), by (cusip CRISIS)

gen logmeanat=log(meanat)

gen logmeanmvl=log(meanmvl)

gen meanPCI=meanpci*100

gen meanPCE=meanpce*100

gen meanPCL=meanpcl*100

so cusip CRISIS

by cusip CRISIS: gen id=[_n]

keep if id==1

drop id

save reg3d

use reg3d

drop if CRISIS==1

25 of 28](https://image.slidesharecdn.com/081c83e2-77cb-4929-849f-769ada7357b4-160102180159/85/WriteUp-docx-26-320.jpg)