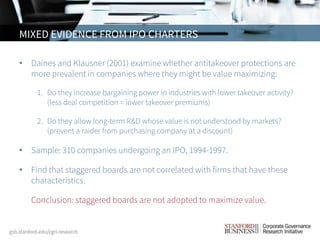

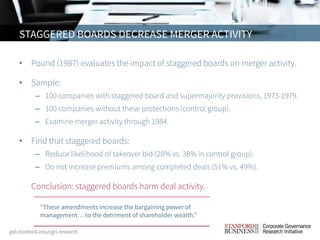

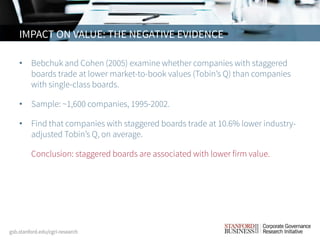

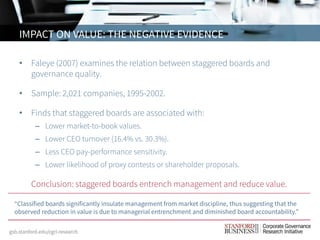

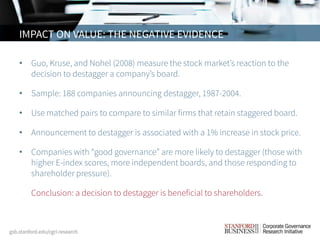

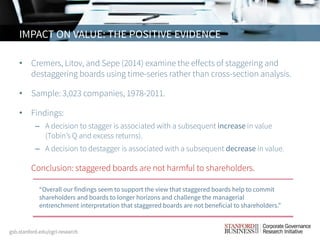

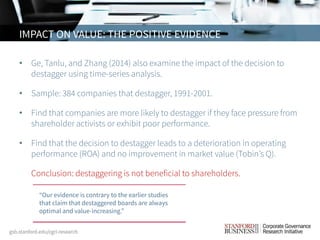

The document discusses staggered boards in corporate governance, which are seen as an antitakeover measure that can protect management but may harm shareholder value. It presents mixed empirical evidence regarding their impact, suggesting they can decrease merger activity and be associated with lower firm value, while potentially benefiting long-term commitments. Ultimately, the effects of staggered boards appear to depend on company-specific situations and the context in which they operate.

![• Larcker, Ormazabal, and Taylor (2011) examine the market reaction to

proposed regulations that would bar staggered boards.

• Sample:

– 3,451 companies, 2007-2009.

– 18 proposed legislative rules / amendments in the years preceding Dodd-Frank.

• Firms with staggered boards exhibit negative excess returns in response to

proposals that include provisions to eliminate staggered boards.

• Conclusion: restrictions on board structure are not value enhancing.

IMPACT ON VALUE: THE POSITIVE EVIDENCE

“The evidence suggests the market reaction [to regulation] is increasingly

negative for firms with staggered boards. This is consistent with the notion that

the presence of a staggered board is a value-maximizing governance choice.”](https://image.slidesharecdn.com/qg-staggeredboards-150917233723-lva1-app6891/85/Staggered-Boards-13-320.jpg)