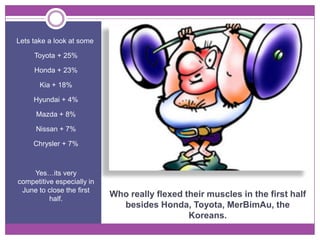

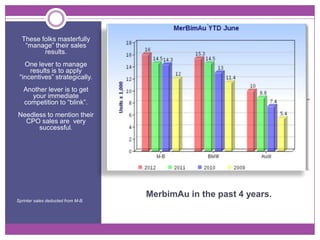

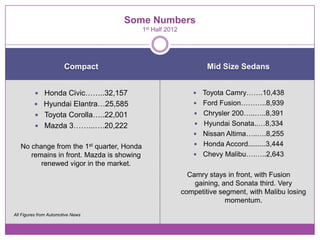

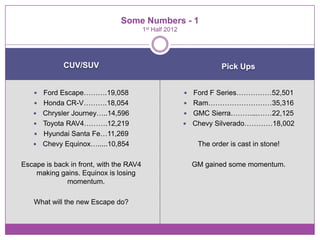

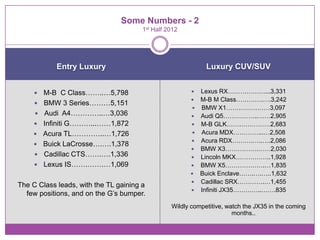

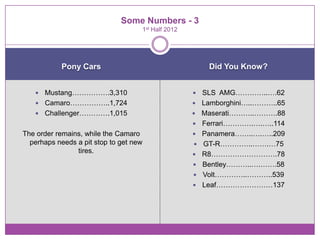

The Canadian auto sales in the first half of 2012 were 7% ahead of the previous year, with an impressive overall performance. Honda and Toyota emerged as big winners after recovering from disruptions, growing sales by 23% and 25% respectively. GM struggled, with sales down 6% year-to-date while the overall market grew 7%. The report analyzed sales trends across various vehicle segments and manufacturers, noting strong competition especially in June as the first half came to a close. It predicted continued battles for market share in the coming third quarter.