- A joint venture is an arrangement where two or more businesses combine resources for a defined undertaking. Joint ventures can be equity-based or non-equity.

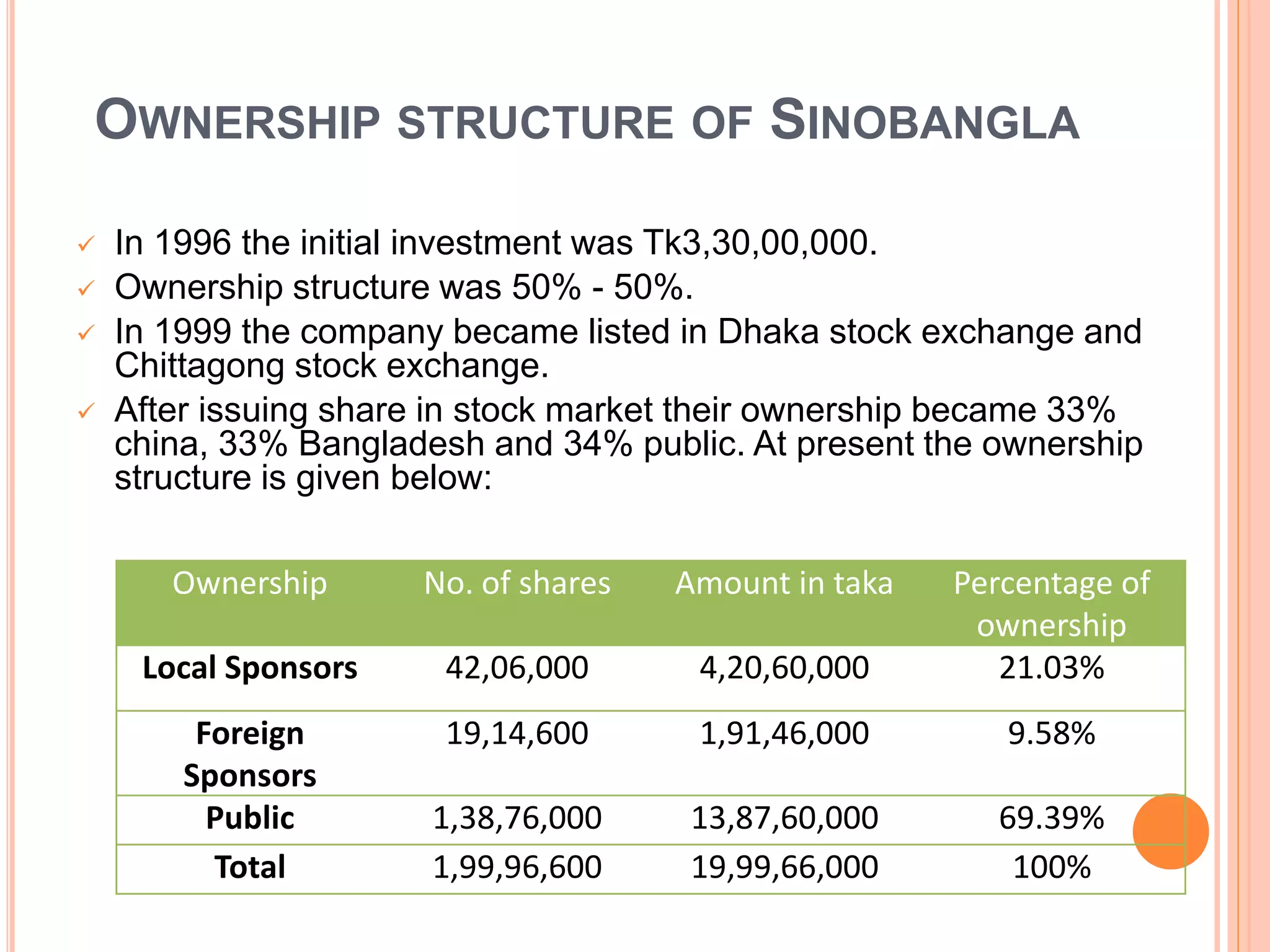

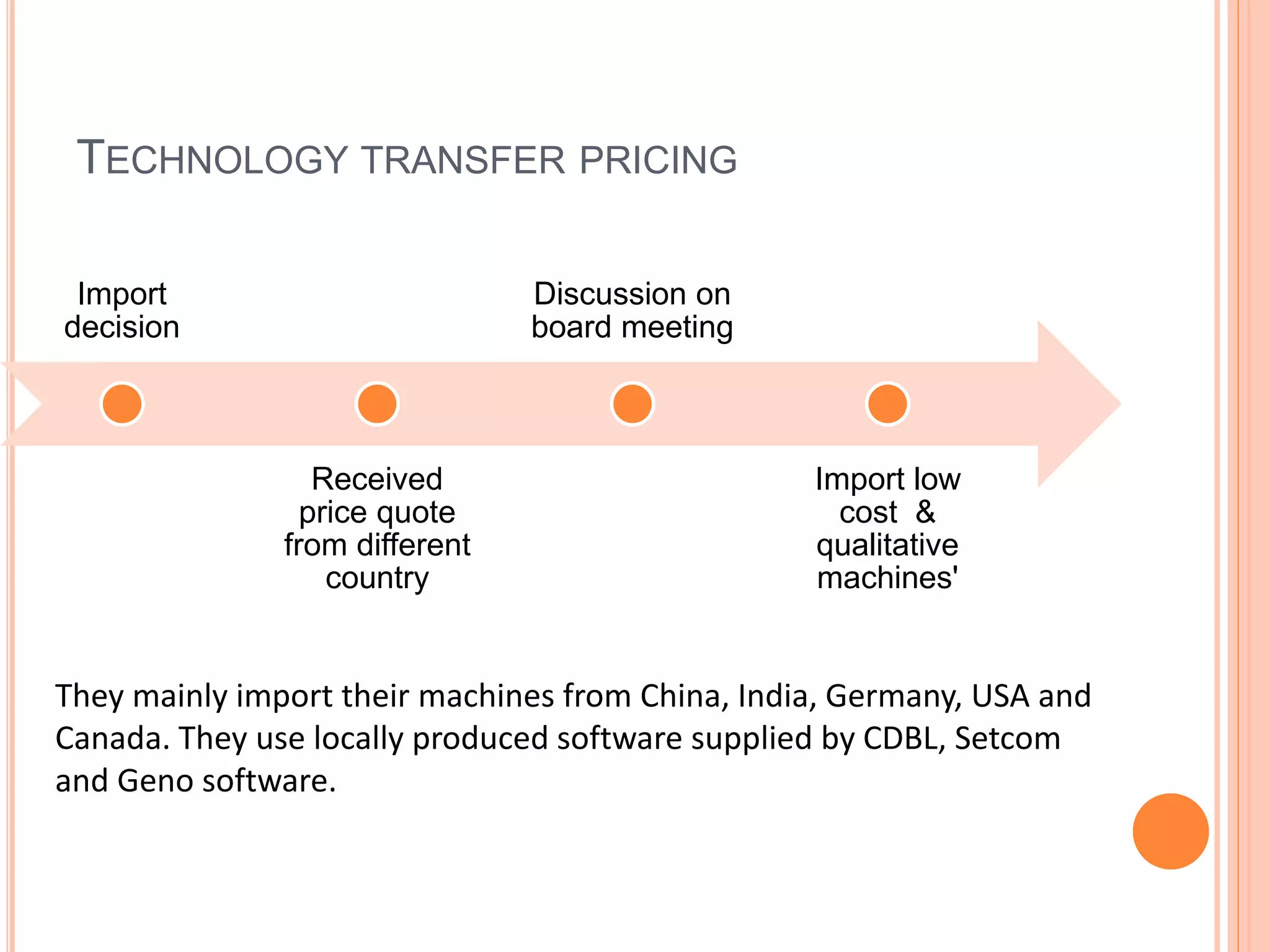

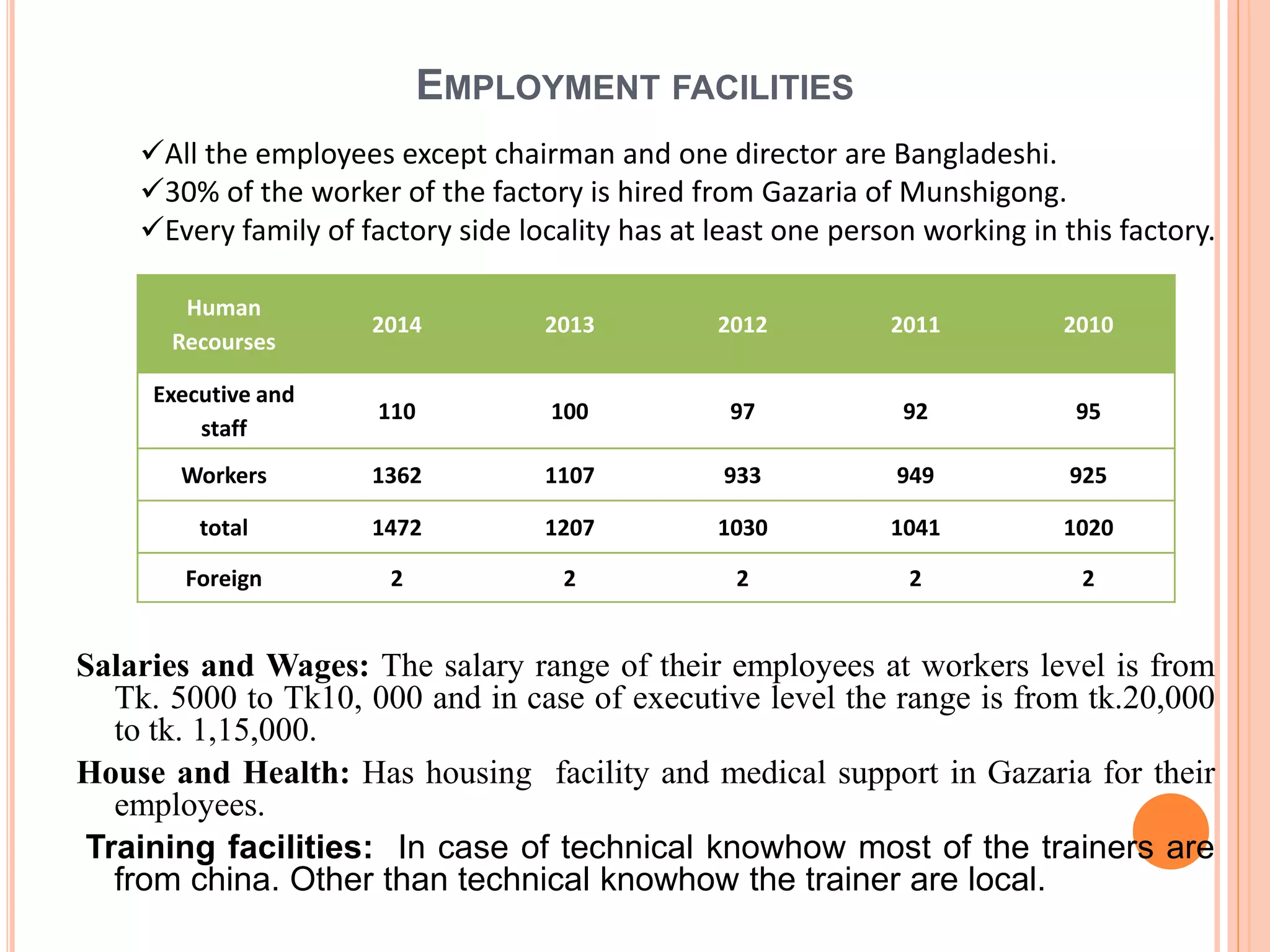

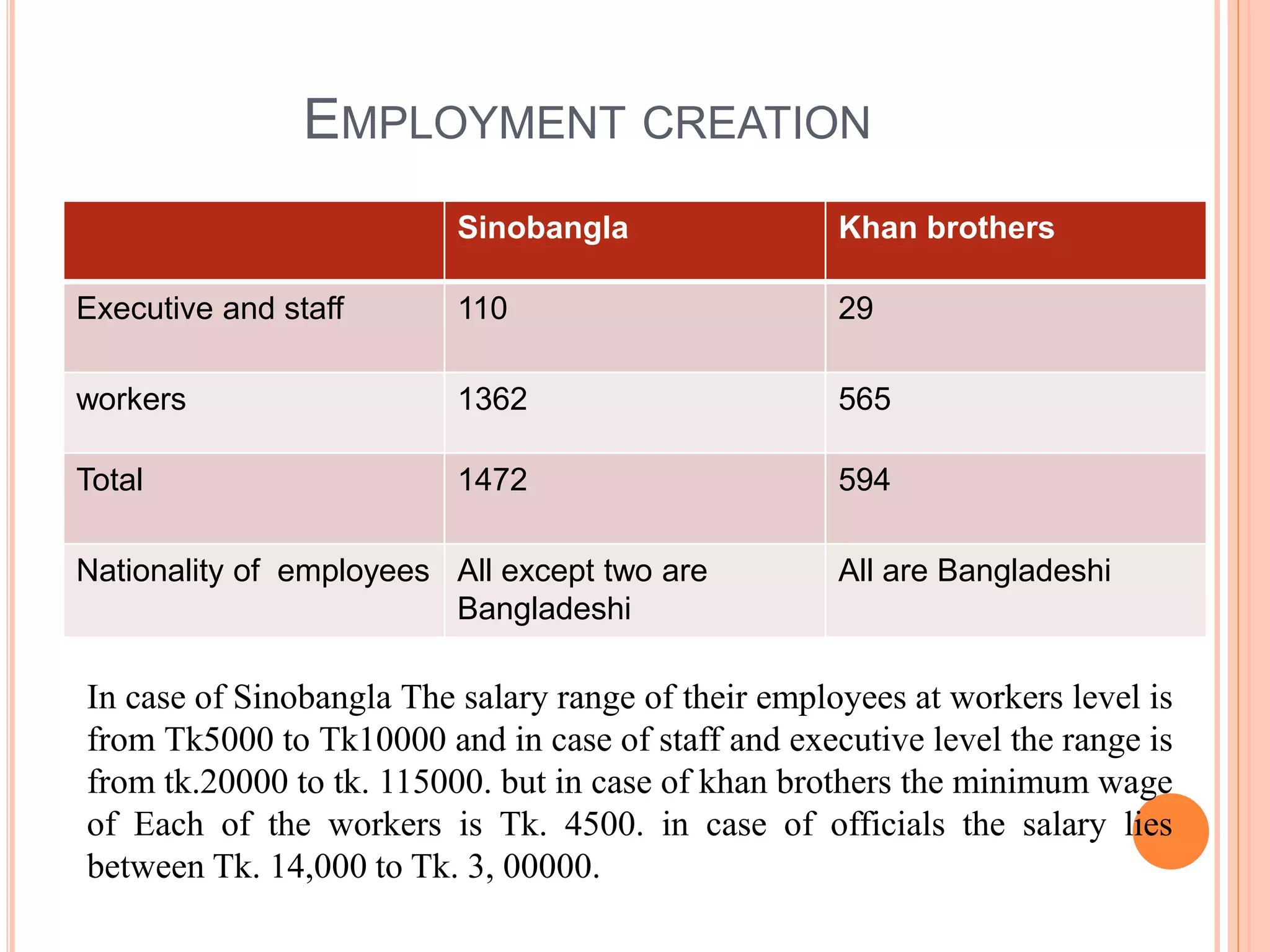

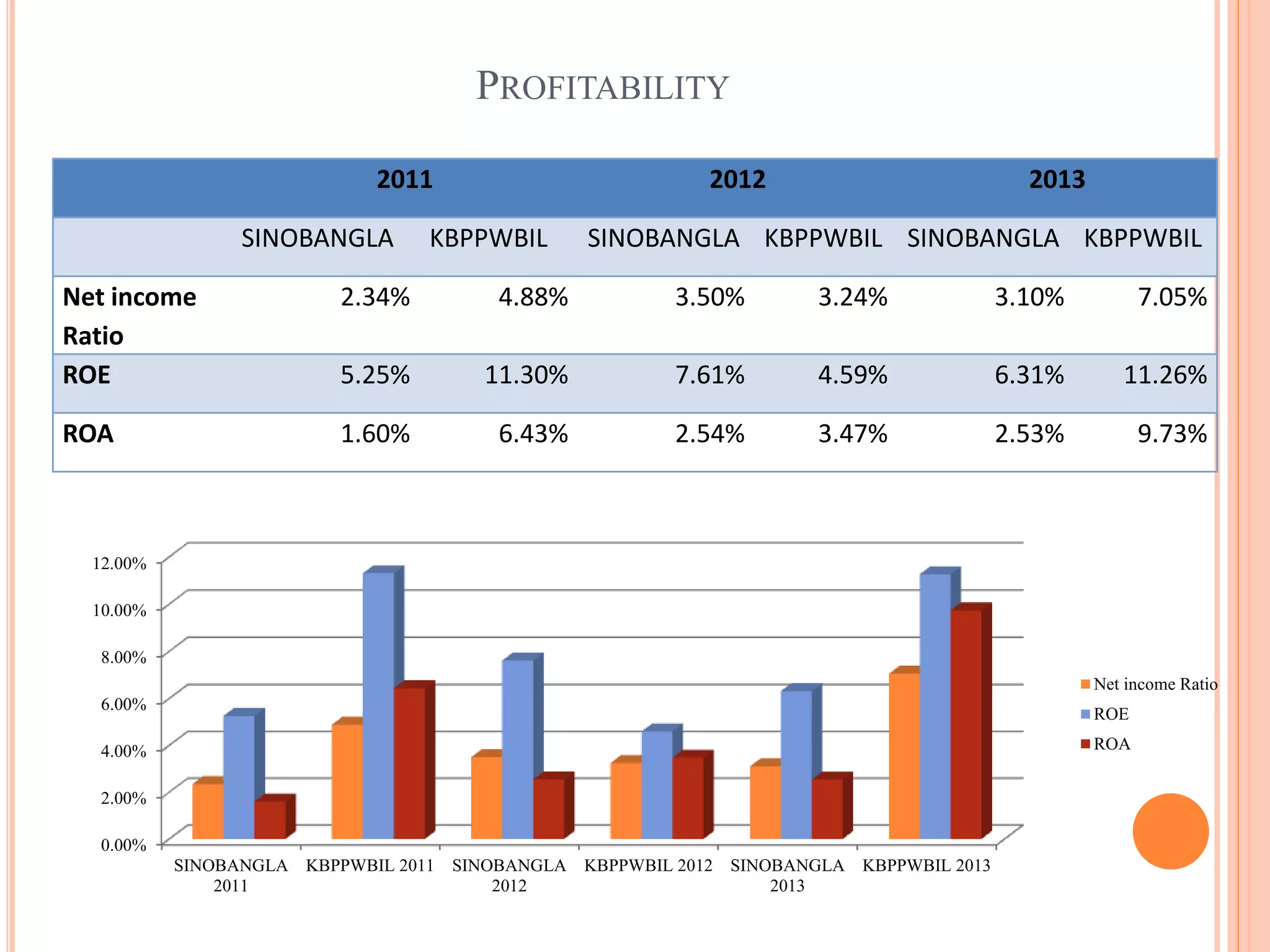

- Sinobangla is a China-Bangladesh joint venture established in 1996 to produce industrial bags. It imports machinery from China, India, Germany, USA and Canada.

- Khan Brothers PP Woven Bag Industries Ltd is a domestic Bangladeshi company established in 2006 that also produces industrial bags.