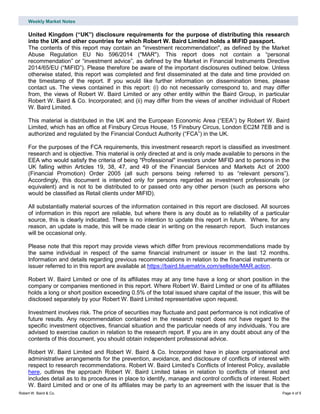

The Fed is expected to pause its tightening cycle and possibly reduce its balance sheet at a slower pace to support continued modest economic growth. Technically, short-term market breadth has improved but long-term breadth measures need to strengthen further for odds of a successful retest of December lows. Defensive sectors currently show strongest relative strength.