- The stock market broke a two-week winning streak last week, declining nearly 2%, as concerns remain about rising interest rates, trade issues, and slowing global growth.

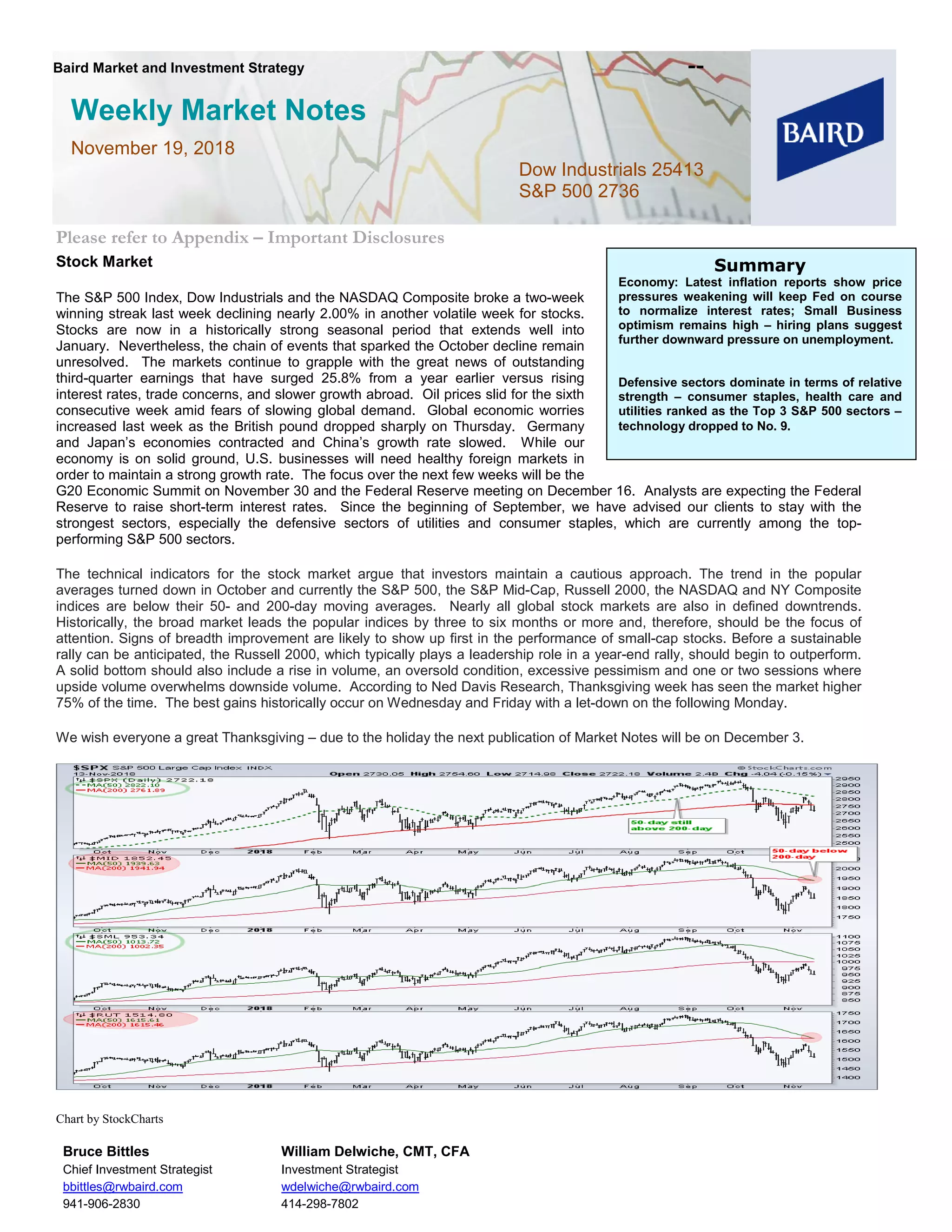

- Defensive sectors like utilities and consumer staples have outperformed recently. Analysts recommend maintaining a cautious approach given technical indicators showing market downtrends.

- The document provides an overview of recent market performance and factors, along with recommendations to remain cautious given ongoing uncertainties.