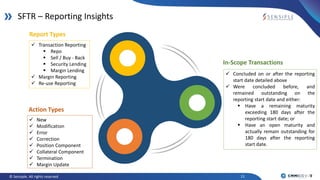

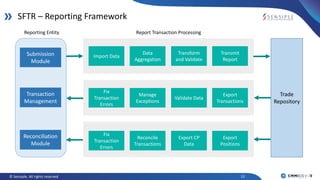

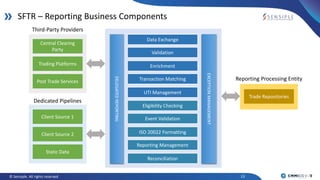

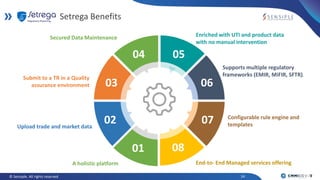

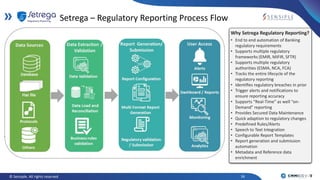

The document outlines a webinar on the Securities Financing Transactions Regulation (SFTR), focusing on its implementation, challenges, and impacts. It features insights from industry experts and highlights the Setrega platform's capabilities for regulatory reporting, including automation and compliance with multiple frameworks. Key topics include the complexities of SFTR, reporting obligations, and the importance of data management in financial institutions.