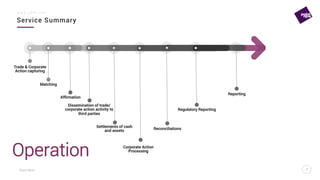

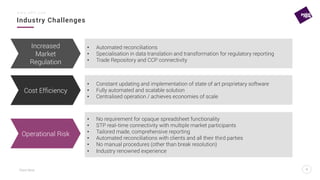

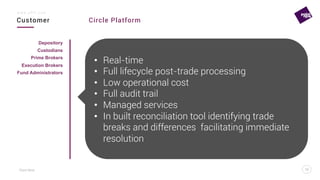

Point Nine is a post-trade execution firm founded in 2002 that helps financial and corporate clients meet challenges in post-trade processing. It offers Circle, a proprietary real-time technology that provides automated trade capturing, matching, settlements, reconciliations and reporting across multiple asset classes. Circle connects with custodians, brokers, funds and other market participants to streamline the post-trade lifecycle and reduce costs and risks for clients.