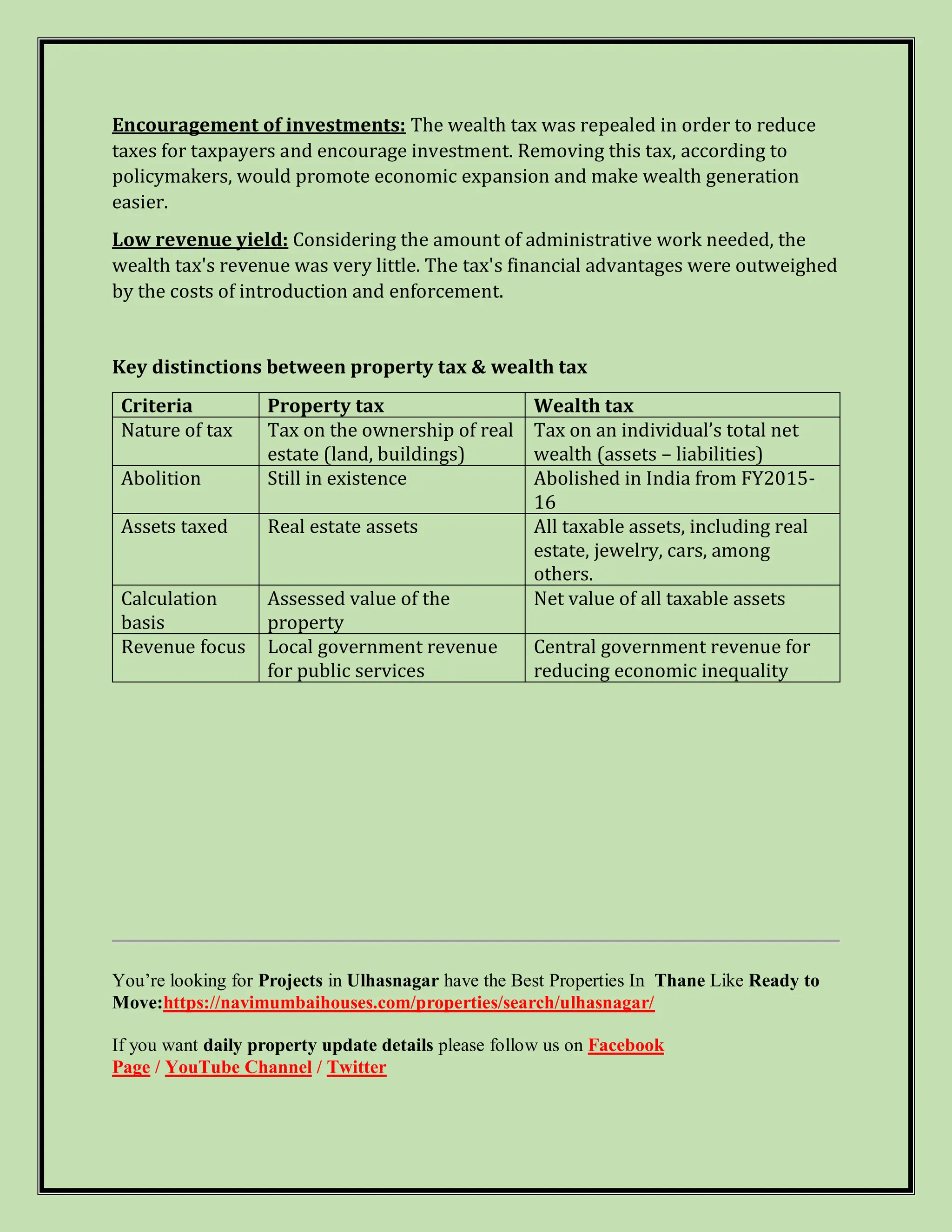

The document explains the differences between property tax and wealth tax in India, with property tax being levied on real estate by local authorities for community services, while wealth tax, a direct tax on total net wealth, was abolished in 2015 due to administrative challenges and low revenue yield. Property tax is calculated based on the assessed value of properties using various methods, while wealth tax applied to individuals with net wealth exceeding Rs 30 lakh. The article also outlines reasons for abolishing the wealth tax, such as encouraging investments and simplifying the tax system.