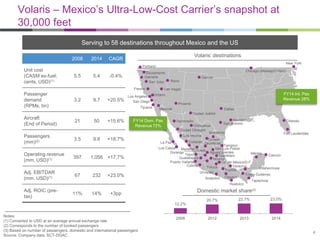

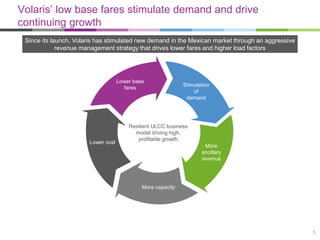

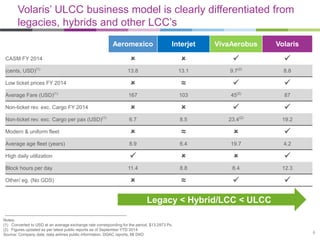

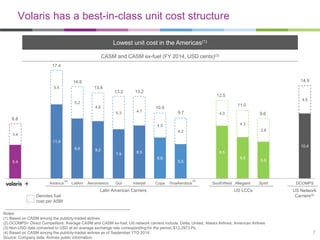

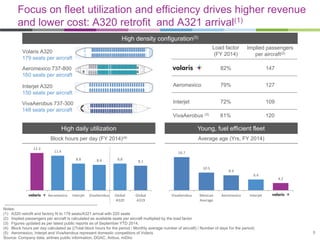

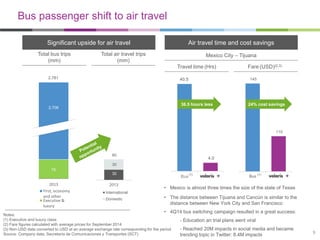

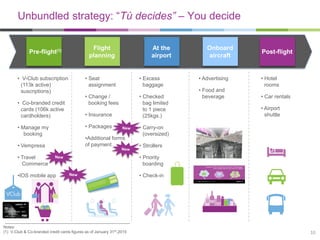

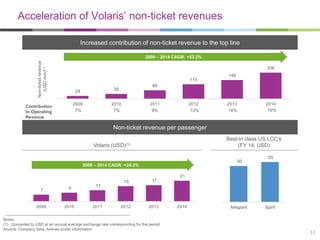

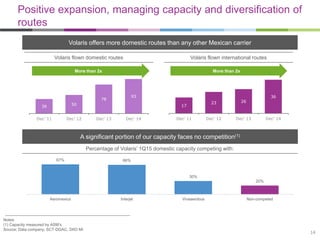

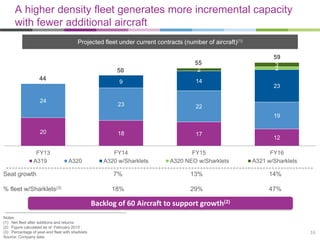

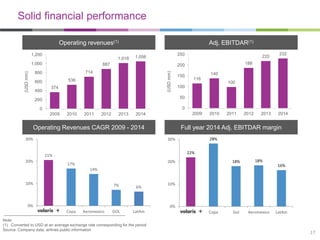

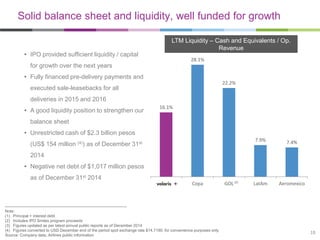

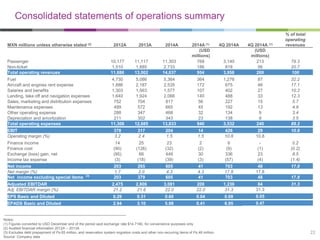

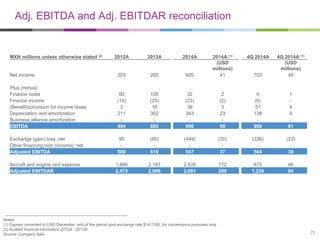

Volaris is the leading ultra-low-cost airline in Mexico and serves 58 destinations throughout Mexico and the US. In the fourth quarter of 2014, Volaris saw a 24% increase in total operating revenues and positive cash flow generation. Volaris maintains the lowest unit costs in the Americas through disciplined capacity management and a focus on increasing high-margin ancillary revenues, which grew 61% in the fourth quarter. Volaris has significant room for future growth in both its domestic and international networks.