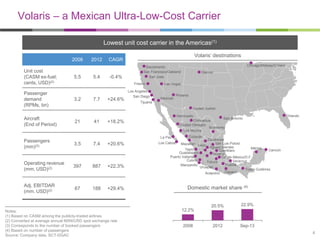

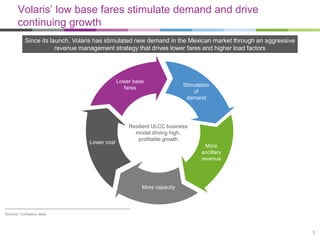

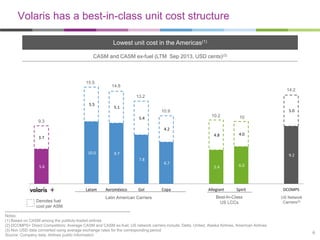

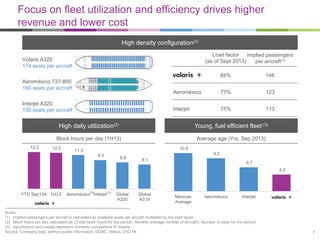

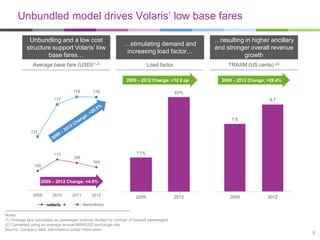

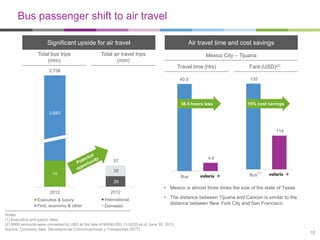

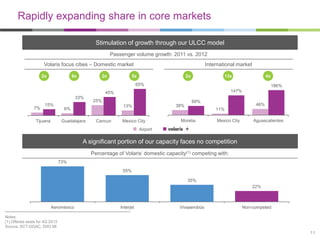

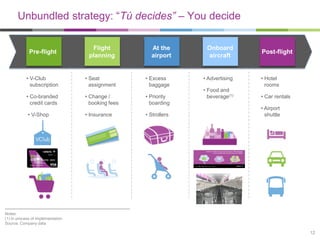

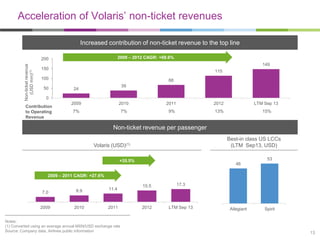

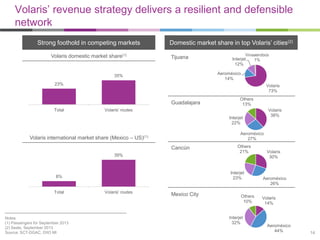

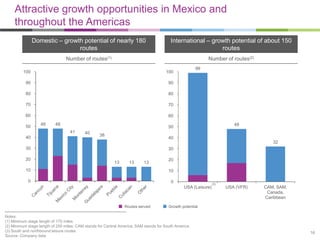

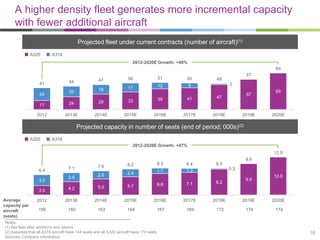

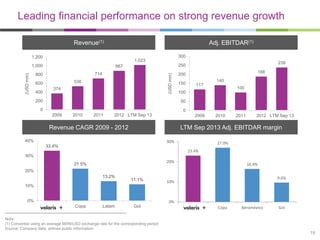

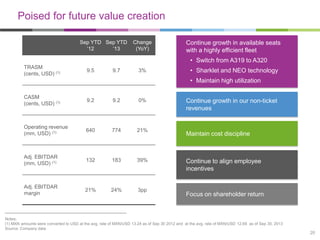

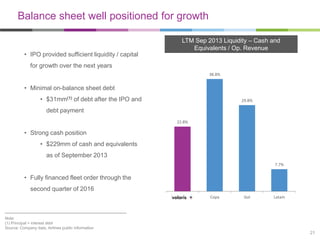

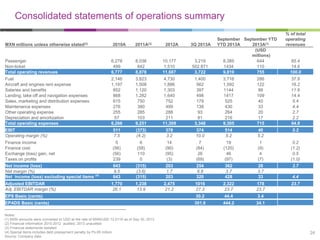

This corporate presentation by Volaris, a Mexican ultra-low-cost carrier, highlights the company's recent growth and opportunities. Key points include: Volaris had record load factors of 87.5% in the third quarter of 2013 and the lowest unit costs in the Americas. The company aims to stimulate demand through low base fares while increasing ancillary revenues. Volaris also sees potential to capture passenger traffic shifting from bus to air travel and has opportunities to expand its route network both domestically in Mexico and internationally.