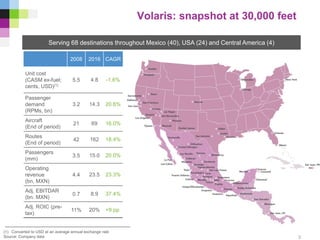

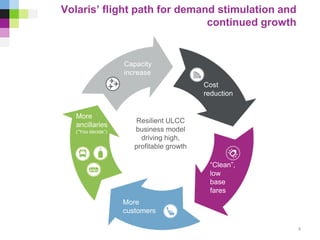

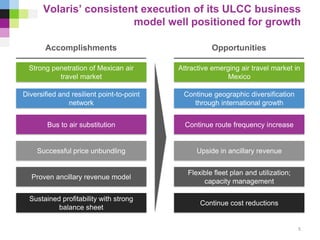

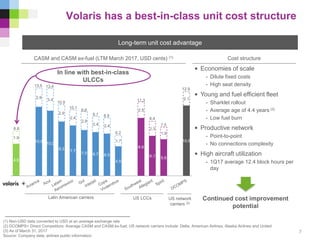

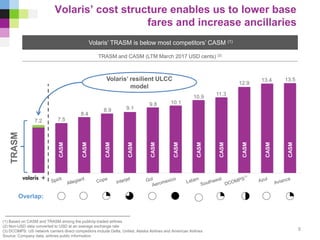

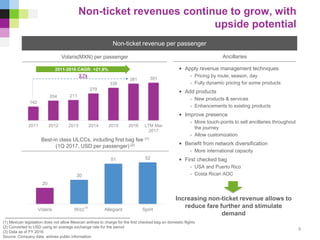

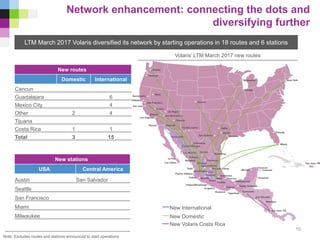

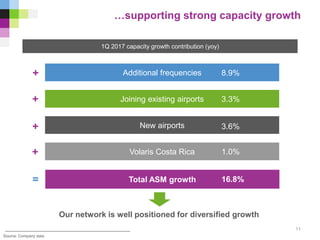

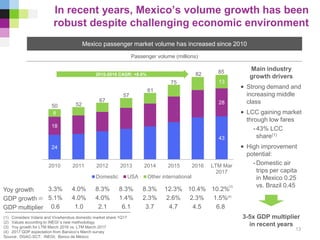

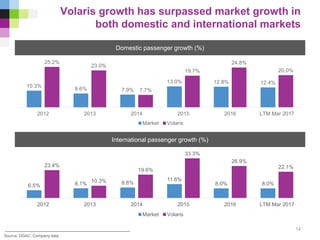

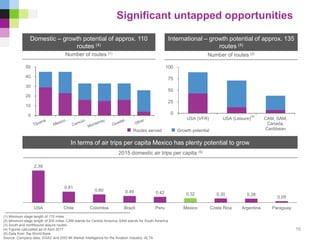

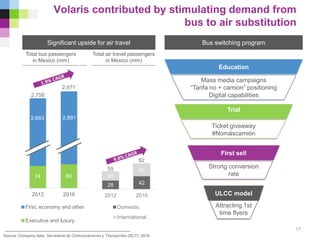

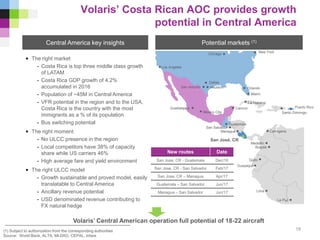

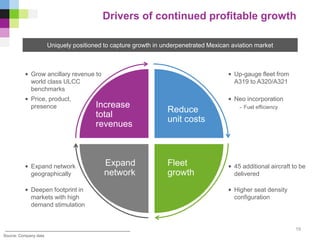

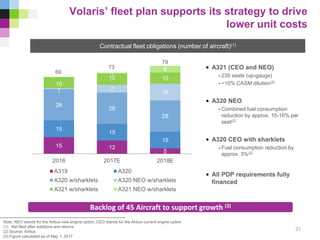

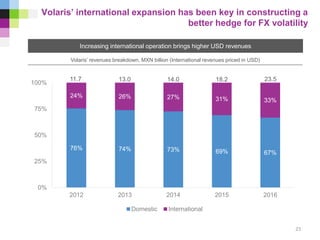

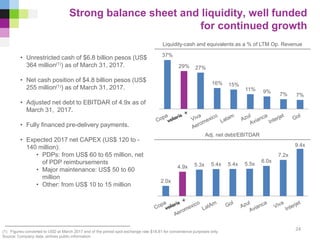

Volaris is an ultra-low-cost airline serving Mexico, the United States, and Central America. It has experienced strong growth rates in recent years, significantly outpacing overall market growth. Volaris has expanded its network through new routes and airports, increased flight frequencies, and started operations in Costa Rica. This network growth has supported a 16.8% increase in available seat miles in the first quarter of 2017. Volaris aims to continue its domestic and international expansion through fleet upgrades, high aircraft utilization, and stimulating additional demand through low fares.