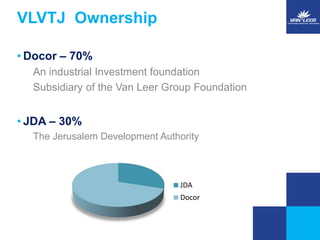

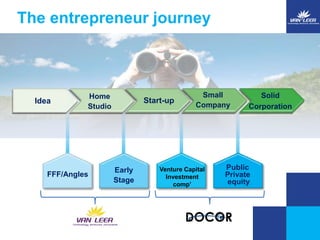

This document provides an overview of Van Leer Technology Ventures Jerusalem (VLTVJ), which implements high standards of business excellence and ethics to be a leading early stage investment center. VLTVJ's vision is to nurture ventures into successful companies that strengthen Israel's economy and position Jerusalem as a technology city. The organization focuses on investments in technology, industrial applications, advanced materials, biotechnology, and cleantech. It provides portfolio companies with mentoring, training, meeting spaces, and access to its network to help the companies grow and secure future funding.