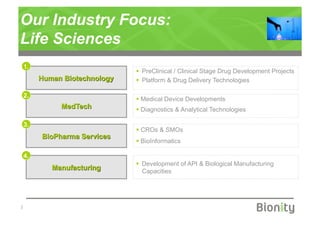

Bionity is an independent consulting firm located in Budapest, Hungary that focuses on providing valuation, financial, intellectual property, market analysis, and licensing services to biotech, pharma, medtech companies, investors, and academic institutions. It focuses on areas like drug development, medical devices, diagnostics, manufacturing, and bioinformatics. The managing director has over 15 years of experience in the life sciences sector in areas like corporate finance, investment promotion, and business development.