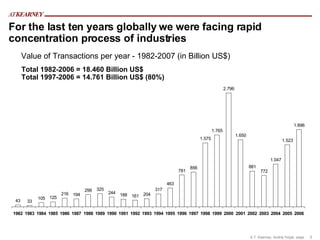

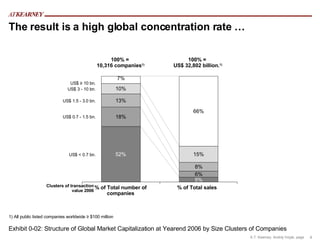

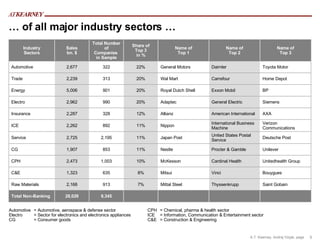

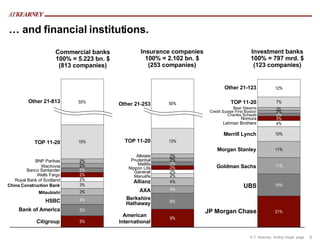

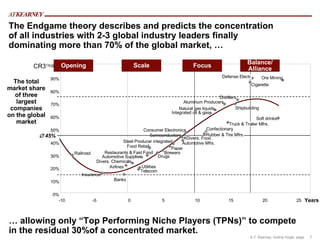

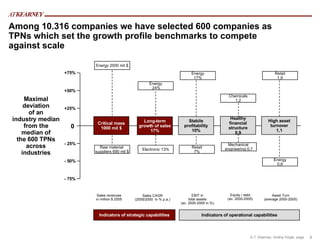

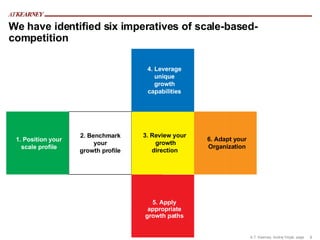

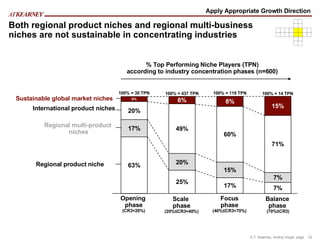

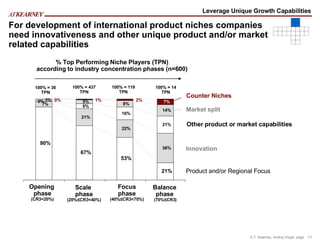

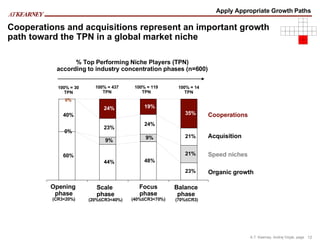

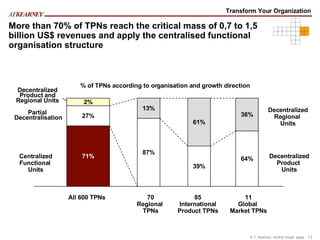

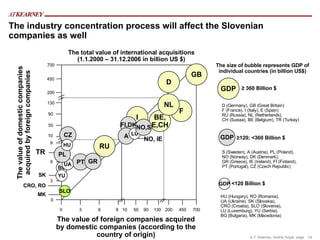

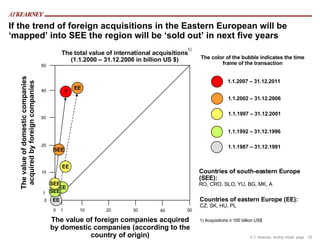

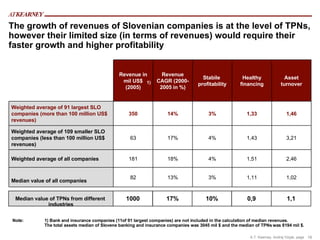

The document discusses the increasing concentration of industries globally, with the top 2-3 companies in each industry dominating over 70% of the market share. It analyzes 600 top performing niche players (TPNs) that have managed to carve out market share in the remaining 30% of concentrated markets. The key strategies used by TPNs include developing international product niches through innovation, pursuing organic growth and acquisitions, and centralizing organizational structures once reaching critical revenues of $0.7-1.5 billion. Slovenian companies are shown to have revenue growth comparable to TPNs but need to increase profitability and scale faster to effectively compete against global industry consolidation.