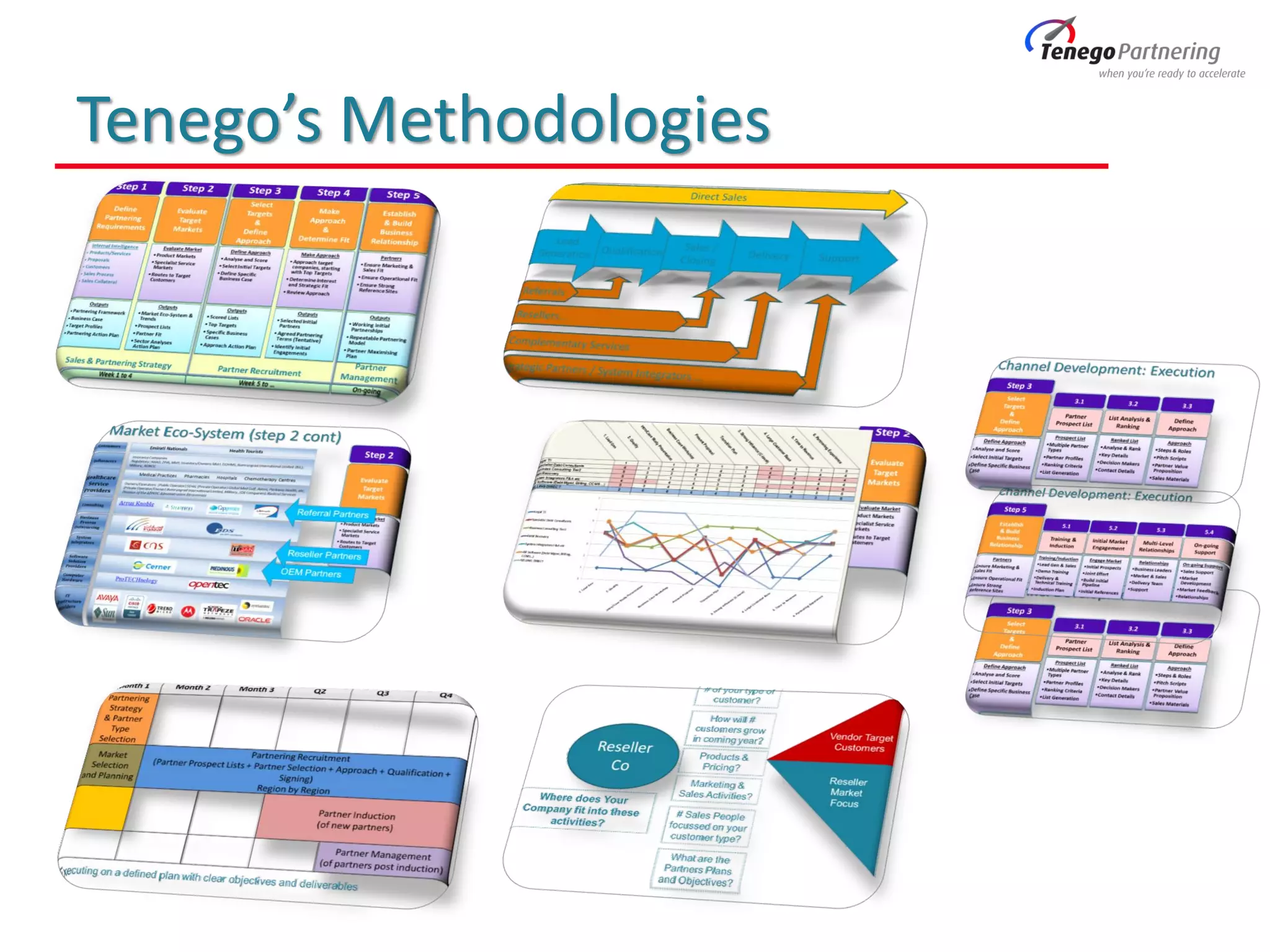

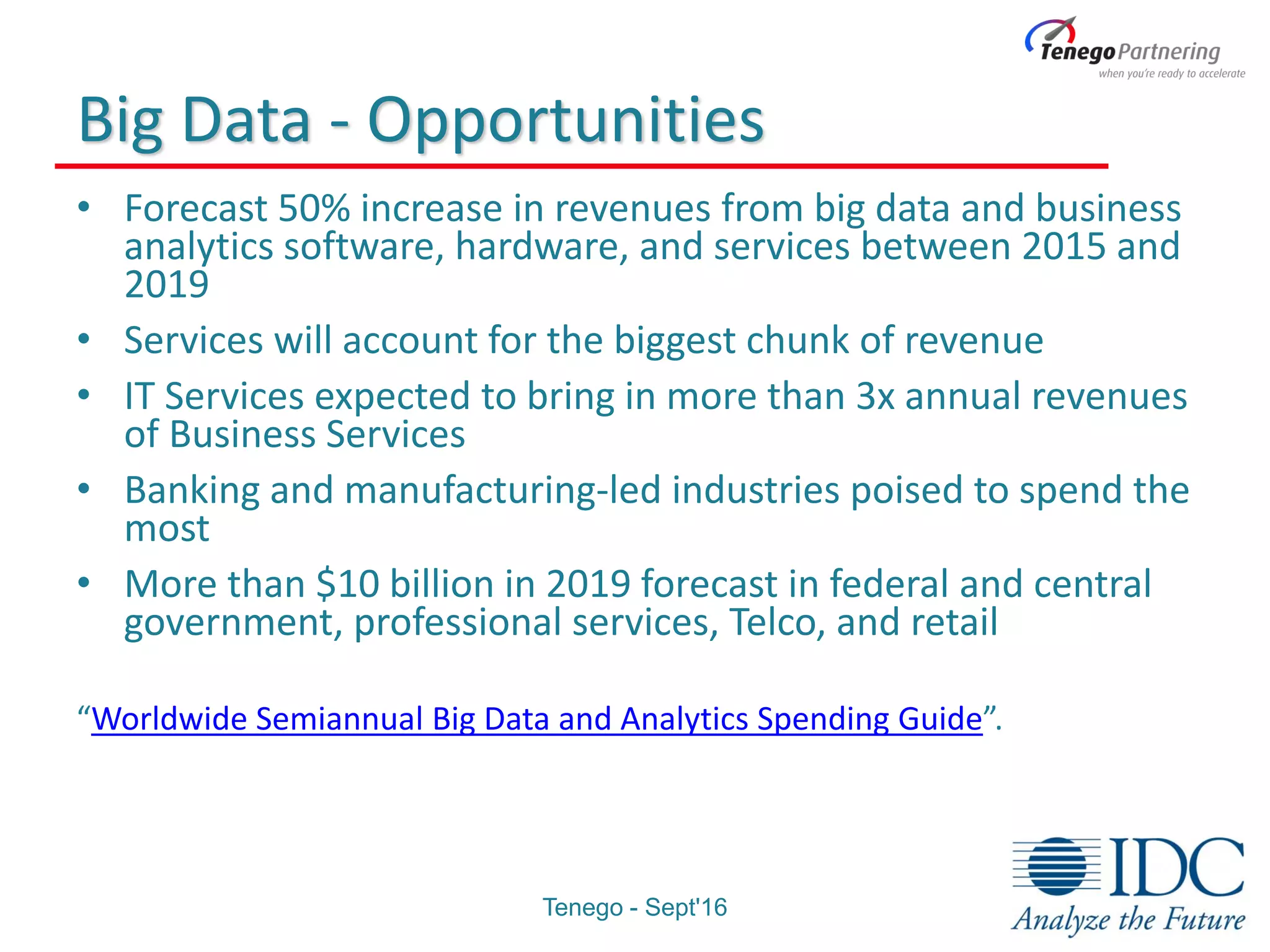

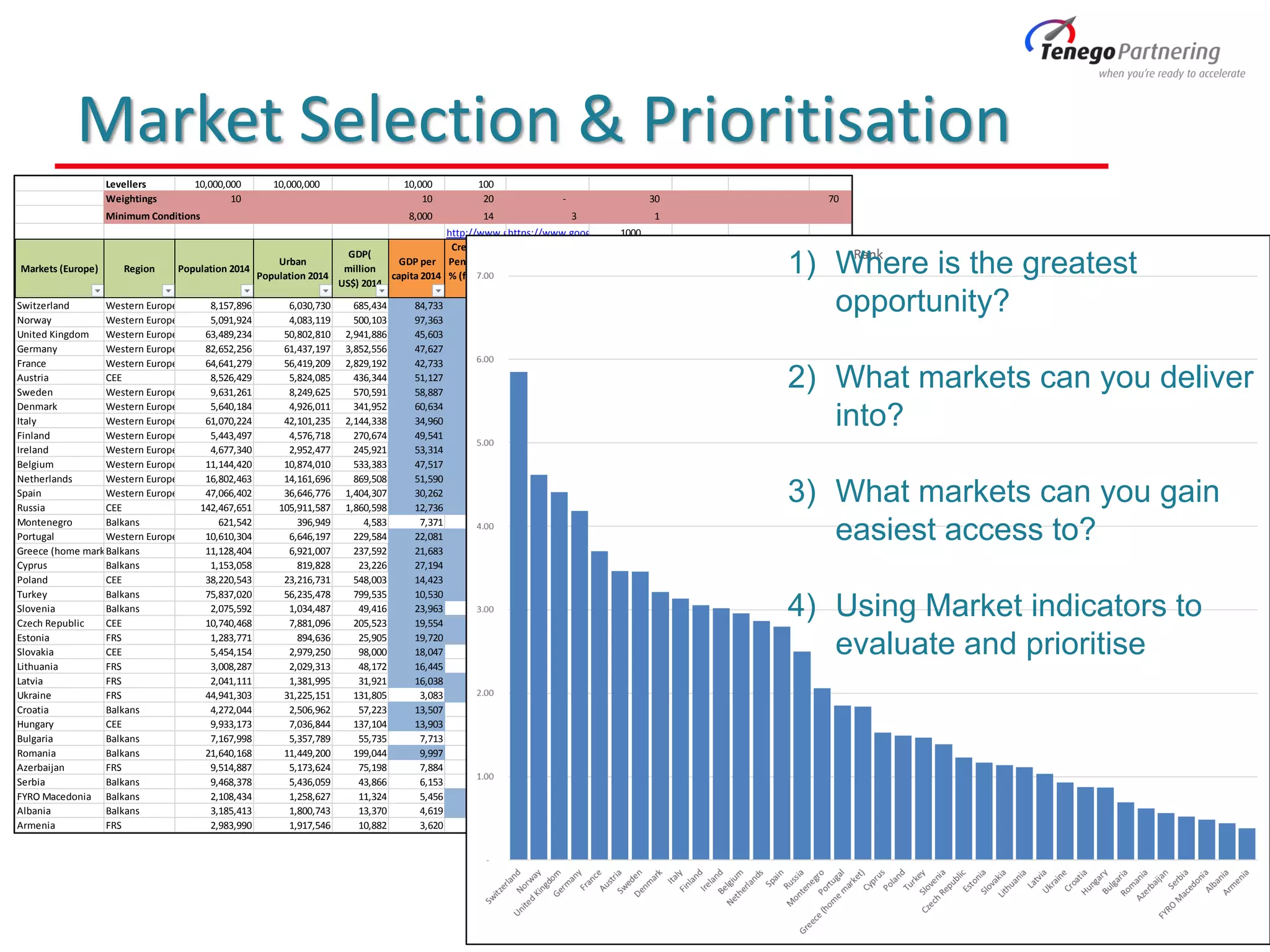

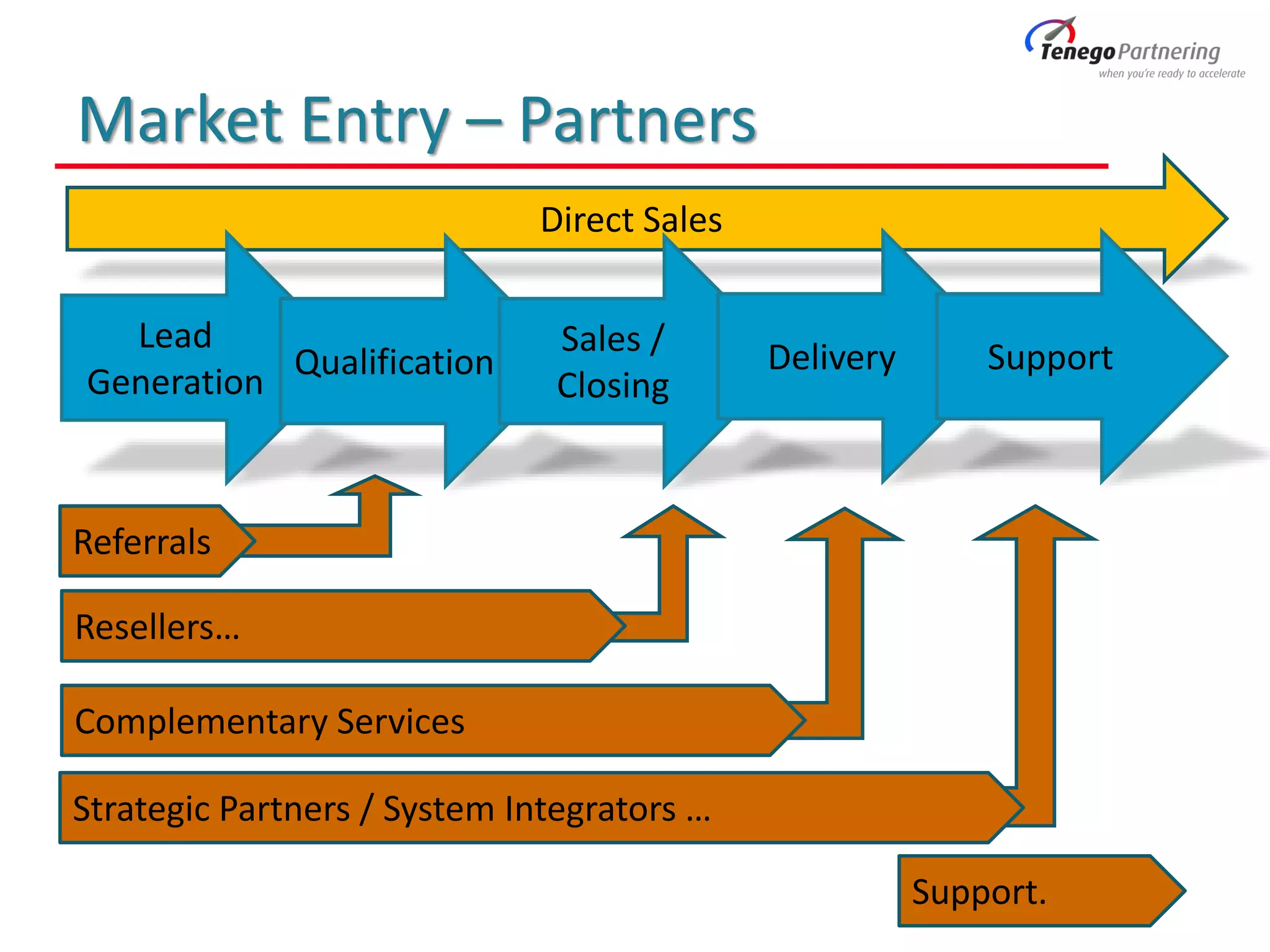

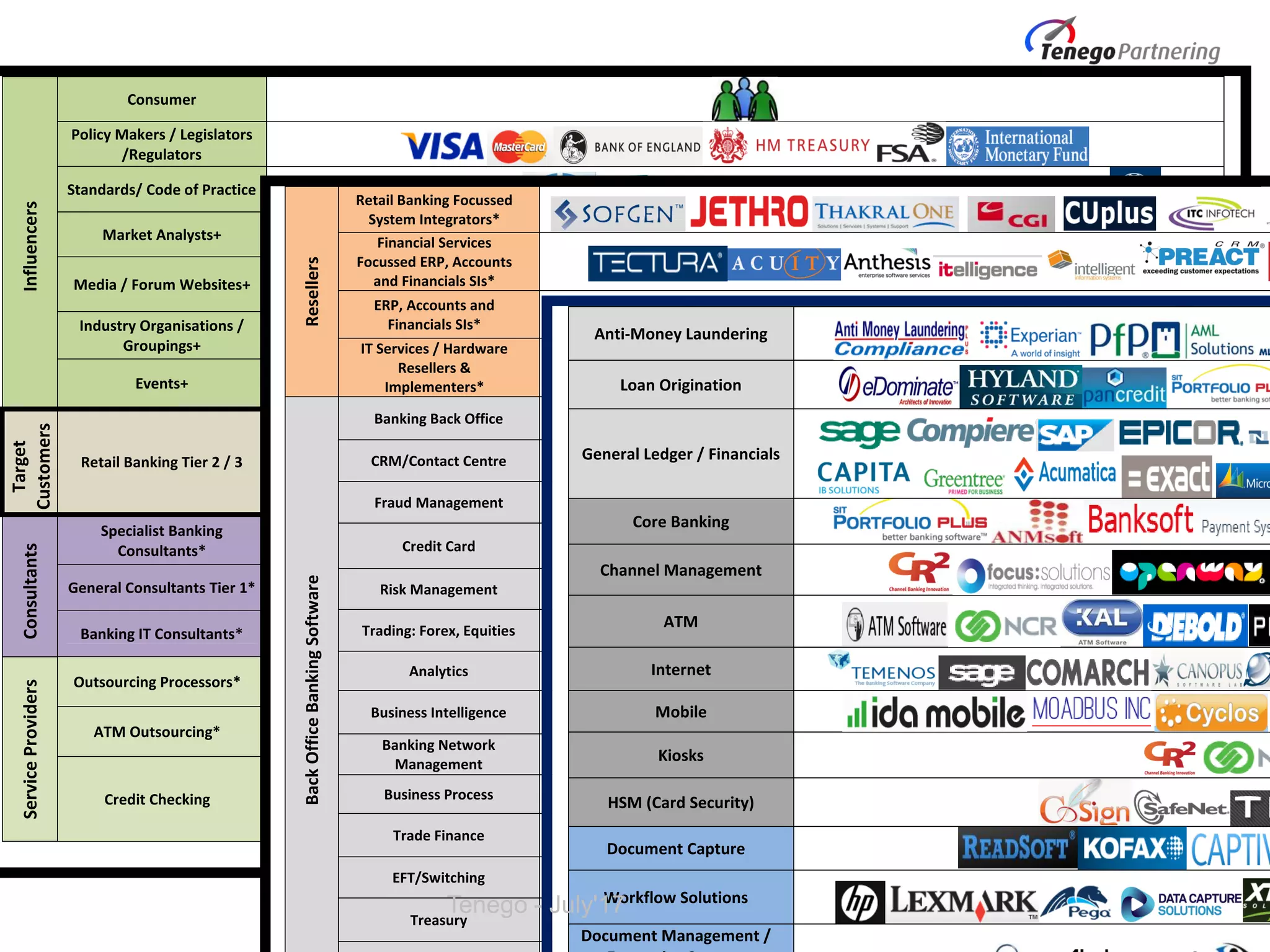

The document discusses the opportunities and challenges in the big data and analytics market, highlighting the expected growth in revenue and the importance of identifying target sectors and routes to market. Various industries, including financial services and retail, are poised for significant investment in big data solutions, with emerging trends in IoT presenting both opportunities and security challenges. The importance of building effective sales channels and strategic partnerships for market entry and growth is also emphasized.