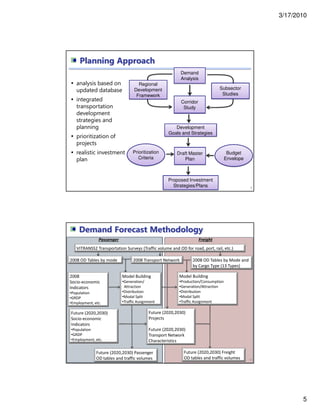

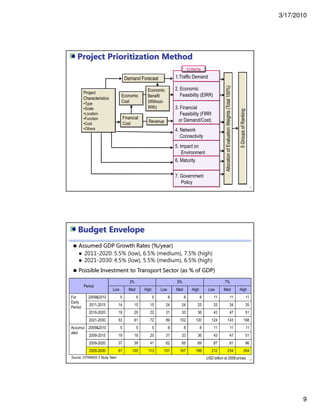

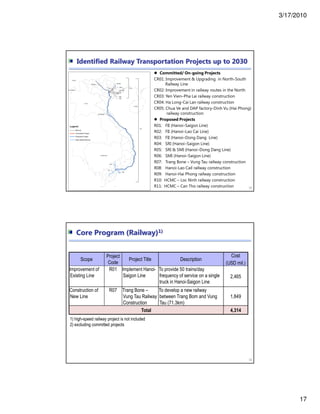

This document summarizes a study on transportation sector development strategies in Vietnam conducted by the Japan International Cooperation Agency (JICA) study team from 2007 to 2009. The study aimed to formulate long-term (to 2030), medium-term (to 2020), and short-term (2011-2015) strategies and plans. It involved developing demand forecasts, analyzing existing infrastructure and issues, and recommending priority projects. The document outlines the study process and findings on various transportation subsectors such as roads, railways, ports and aviation. It identifies infrastructure gaps and proposes strategies and a core investment program for transportation development in Vietnam.