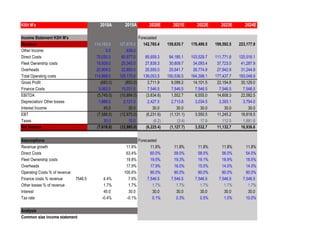

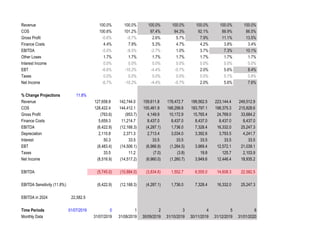

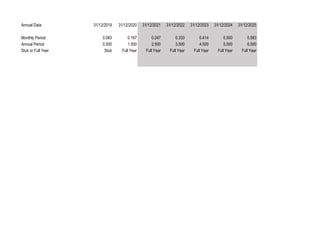

KSH M's forecasts its financial performance from 2018 to 2024. Revenue is projected to grow 11.8% annually while costs grow at slower rates. This leads to increasing gross and net profits over time. EBITDA is forecasted to increase from a loss of $10.9 million in 2018 to a profit of $22.6 million in 2024. Common size income statements show improving margins as costs decline as a percentage of revenue.