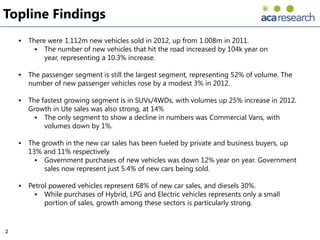

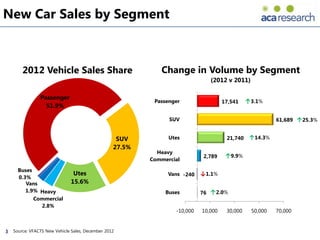

1) New car sales in Australia increased 10.3% in 2012, with SUV sales growing the fastest at 25%. Passenger vehicles remained the largest segment at 52% of sales.

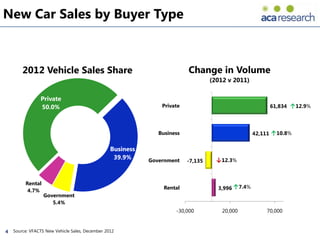

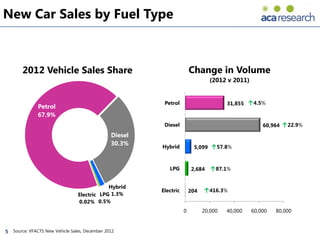

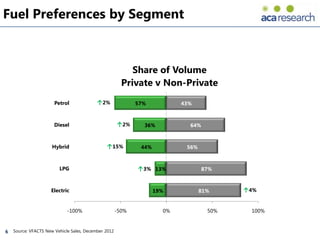

2) Private and business buyers fueled growth, increasing purchases by 13% and 11% respectively, while government purchases fell 12%. Petrol vehicles represented 68% of sales.

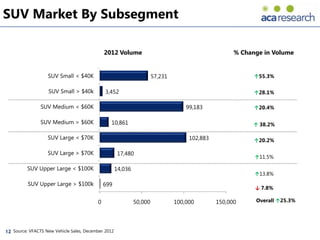

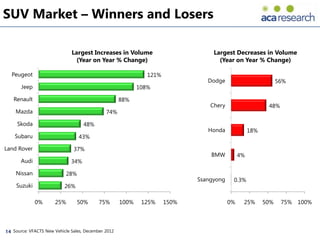

3) The SUV market saw a 25.3% rise in sales volumes. Toyota led sales in this segment followed by Nissan, Subaru, and Mitsubishi, all of which increased volumes. Small SUVs under $40K saw a 55.3% jump.