Global Automakers Monthly Market Report for March 2013

The report summarizes vehicle sales trends in March 2013:

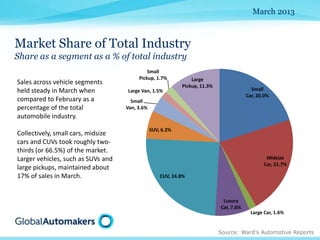

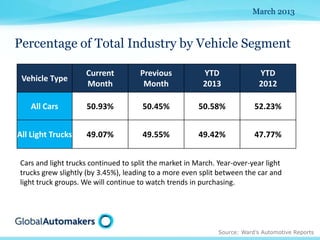

1) Cars and light trucks split the market almost evenly in March, continuing a trend seen over the past year of light trucks gaining share.

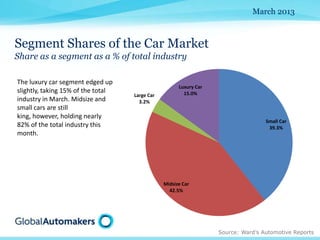

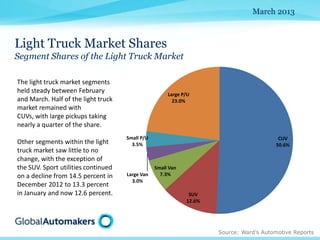

2) Midsize and small cars made up over 80% of car sales, while light trucks were led by CUVs at 50% and large pickups at 23% of sales.

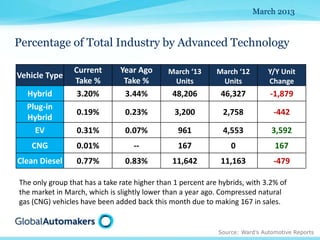

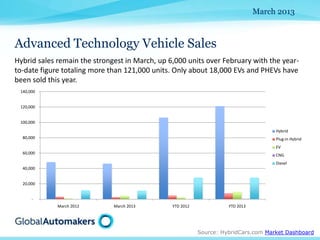

3) Advanced technology vehicles like hybrids, plug-in hybrids, and electric vehicles made up under 5% of total sales in March, with hybrids being the dominant category at 3.2% of sales.