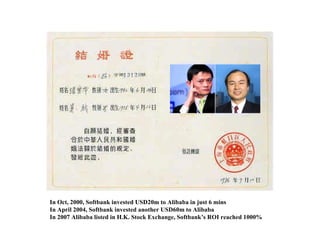

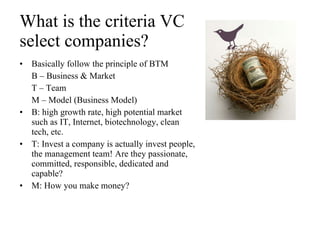

Venture capital firms provide funding for startup companies and manage large funds from institutions and wealthy investors. They look for companies in high-growth industries like technology and assess them based on their business model, market potential, and management team. While most VC investments fail to return a profit, successful ones can provide high returns through events like a company's IPO or acquisition. Some well-known Chinese VC firms include Softbank, which earned a 1000% return on its investment in Alibaba, demonstrating the potential rewards of venture capital.